by Russell Noga | Updated May 22, 2023

Do you want to enroll in a Medigap plan? You might be wondering how to apply for Medigap insurance and the coverage you get with these policies.

This guide gives you everything you need to know about Medigap plans and how to enroll.

What Is Medigap & How Does It Work?

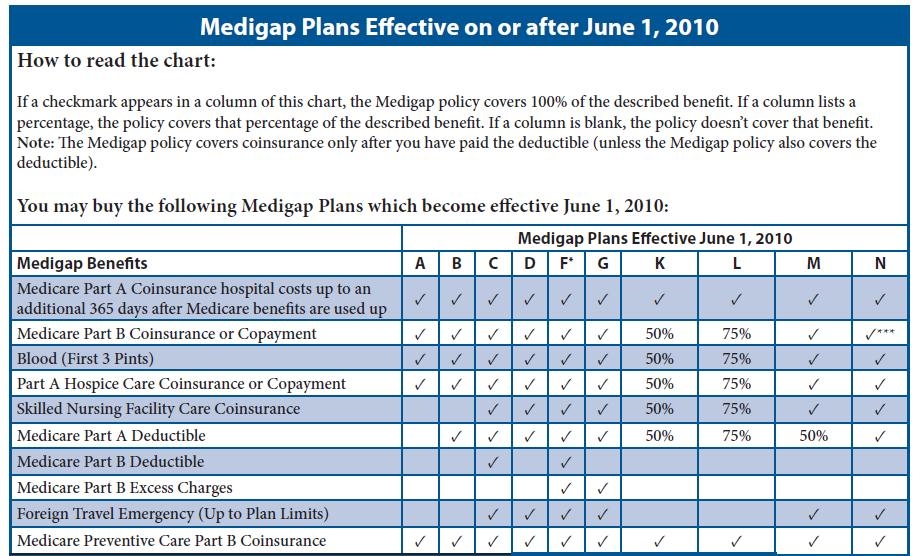

Medigap plans come in ten options. Each plan offers different coverage levels in exchange for a monthly premium. There’s a Medigap plan to suit your healthcare needs and your budget.

The most comprehensive plans are F and G. These policies cover you for all out-of-pocket expenses involved with Medicare Parts A & B. Plans A, B, C, & D have limited coverage, focusing mainly on Medicare Part A expenses.

Plans K & L offer cost-sharing options with low monthly premiums. Plan N also offers low monthly premiums, but you get excellent coverage of Part A & B costs. However, Medicare Plan N requires copayments for visiting the doctor and emergency room.

Plans F & G are also available in “high-deductible” options. These High-Deductible plans offer all the same benefits as the original Medigap Plans F & G, but with a higher annual Part A deductible, increasing from $1,600 to $2,700.

In exchange, you get a low monthly premium that’s around a quarter of the cost of the standardized version.

The plan you choose must align with your healthcare requirements as well as your budget. Understanding the benefits they offer is critical to ensuring you don’t end up under or over-insured.

Medigap Plans Chart

What Coverage Does a Medigap Plan Provide for Medicare Parts A & B?

Medigap plans help assist Medicare beneficiaries with Part A & B policies and cover the out-of-pocket costs associated with inpatient and outpatient care services and treatments.

The Federal government standardizes the Medigap industry, ensuring that all providers offer the same basic Part A & B benefits in their plans.

As a result, you get a consistent offering across the industry. All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F*, G, and N offer additional Medicare Parts A & B benefits. These are currently the most popular Medigap plans.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F is no longer available to seniors qualifying for Original Medicare after January 1, 2020. If you’re eligible after this cut-off date, your best option is Plan G. The only thing Plan G doesn’t cover that Plan F does is the Part B deductible of $226 for 2023.

Compare Medicare Plans & Rates in Your Area

Where Do You Buy a Medigap Plan?

While Medicare is a Federally-funded program, Medigap is different. Private insurers like Mutual of Omaha and Blue Cross Blue Shield sell Medigap plans. You can buy a Medigap plan easily through an independent agency such as Medisupps.com. We can assist you with choosing the right plan.

Going through an agent is the best option. They’ll help you find the most affordable insurer in your state for any plan you want. Licensed agents advise you to ensure you don’t buy a plan offering too little or too much coverage. They’ll also source the best rate to help you save money on your monthly premiums.

When Should You Enroll in a Medigap Plan?

You can sign up for Medigap plans during the six months after your 65th birthday. This 6-month Medigap Open Enrollment period guarantees you a Medigap plan, even if you have pre-existing health conditions. The insurer can’t refuse your application to enroll.

If you are changing Medigap plans and applying with a new company during the year, the process involves answering a questionnaire about your health. If you have pre-existing conditions, the insurer will assess your situation. They could charge you above-average rates on your premiums to cover their risk of insuring you, or they might deny your application depending on the company’s own guidelines.

What are Guaranteed Issue Rights?

Other examples of guaranteed or special issue rights where the insurer has to sell you a policy are the following.

- If you leave a Medicare Advantage plan in the first year of your policy subscription.

- If you leave an employer or union health plan.

Speak to our consultants about your situation, and we’ll tell you if you qualify for a special or guaranteed issue right.

Can I Join Medigap If I Have a Medicare Advantage Plan?

No. Unfortunately, you can’t have both Medicare Advantage and Medigap plans. Medicare Advantage (also known as Medicare Part C) replaces Medicare Parts A & B. You’ll have to leave your Medicare Advantage plan provider, apply to join Original Medicare Parts A & B, and then apply for a Medigap plan with a provider during the Annual Enrollment Period which runs from October 15th – December 7th each year.

What Do You Pay for Medigap Plans?

The cost of plans varies, depending on which plan you choose and the personal factors insurers use to create your risk profile. Factors affecting your risk profile and the price of your premiums include your age, gender, location, and smoking status.

Men pay more for Medigap plans than women, smokers pay more than non-smokers, and age can be issue-related, community-rated, or age-rated. Your location also plays a big role in the cost of your premiums.

For instance, people in Los Angeles can expect to pay more for Medigap plans than those in Texas. Insurers can charge more in one state for a plan and less in another. The cost of premiums also varies between providers. Some companies are cheaper in one state but more expensive in another.

To check rates in your area simply enter your zip code below.

Compare Plans & Rates

Enter Zip Code

Frequently Asked Questions

How and when should I apply for Medigap coverage?

When it comes to applying for Medigap coverage, the best time is during your Medigap Open Enrollment Period. This period begins on the first day of the month you turn 65 and are enrolled in Medicare Part B. Applying during this time ensures you have guaranteed issue rights, meaning insurance companies cannot deny you coverage or charge higher premiums due to pre-existing conditions.

What is the Medigap Open Enrollment Period?

The Medigap Open Enrollment Period is a six-month period that begins when you are 65 and enrolled in Medicare Part B. During this time, insurance companies must offer you any Medigap policy they sell, regardless of your health condition. This is the ideal time to apply for Medigap coverage.

Can I apply for Medigap outside the Open Enrollment Period?

Yes, you can apply for Medigap outside the Open Enrollment Period. However, if you apply after this period, insurance companies may subject you to medical underwriting, which means they can consider your health status and may charge higher premiums or deny coverage based on pre-existing conditions.

What is a Special Enrollment Period for Medigap?

A Special Enrollment Period for Medigap is a specific period during which you have guaranteed issue rights to apply for Medigap coverage outside of the Open Enrollment Period. Examples of situations that may trigger a Special Enrollment Period include losing employer coverage, moving out of your plan’s service area, or losing other coverage, such as Medicaid.

Can I be denied Medigap coverage if I have pre-existing conditions?

During your Medigap Open Enrollment Period or a Special Enrollment Period, insurance companies cannot deny you Medigap coverage or charge higher premiums based on pre-existing conditions. However, if you apply outside of these periods, medical underwriting may be used, and coverage denial or higher premiums based on pre-existing conditions could occur.

Can I switch Medigap plans at any time?

You can generally switch Medigap plans at any time. However, if you apply outside of your Medigap Open Enrollment Period or a Special Enrollment Period, you may be subject to medical underwriting, which could impact your ability to switch plans or result in higher premiums.

Is there an annual enrollment period for Medigap?

Unlike Medicare Advantage or Part D plans, Medigap does not have an annual enrollment period. You can apply for or switch Medigap plans at any time, but it’s important to consider the potential implications of medical underwriting if you apply outside of the designated enrollment periods.

Can I have both Medicare Advantage and Medigap coverage?

No, you cannot have both Medicare Advantage and Medigap coverage simultaneously. You must choose one or the other. It’s important to carefully compare the benefits and costs of each option to determine which one best suits your healthcare needs.

What is the difference between Medigap and Medicare Supplement insurance?

Medigap and Medicare Supplement insurance are essentially the same things. Medigap is the commonly used term, while Medicare Supplement insurance is the official name. Both terms refer to private insurance policies that help fill the gaps in Original Medicare coverage.

Should I consult with an expert before applying for Medigap coverage?

It is highly recommended to consult with a Medicare expert or insurance agent before applying for Medigap coverage. They can provide personalized guidance based on your specific circumstances, helping you understand enrollment periods, compare plan options, and make informed decisions to ensure you get coverage that meets your needs.

Call Our Team, and We'll Get You Enrolled in a Medigap Plan

If you need help enrolling in a Medigap plan, call our fully licensed Medigap agents at 1-888-891-0229. Our agents are experts in matching our clients with the right Medigap policy to suit their individual healthcare requirements.

We offer free consultations on plans and will get you a complimentary free quote on any plans with the best rates from leading providers in your state.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.