by Russell Noga | Updated August 10th, 2023

Medicare supplement plans, known as “Medigap,” assist seniors enrolled in Original Medicare Parts A & B with coping with the out-of-pocket expenses associated with Medicare Parts A (hospital) & B (Medical) services.

Medicare supplement plans, known as “Medigap,” assist seniors enrolled in Original Medicare Parts A & B with coping with the out-of-pocket expenses associated with Medicare Parts A (hospital) & B (Medical) services.

These plans are available from private healthcare companies, such as:

- Mutual of Omaha

- Aetna

- Cigna

- Allstate

- Blue Cross

- Humana

And many more.

You can sign up for a Medicare supplement plan in the six months after your 65th birthday, known as the “Open Enrollment” period. Open Enrollment guarantees you a Medigap policy from the provider of your choice. The company can’t deny coverage or prevent you from joining its Medigap scheme.

This post examines the Medigap options available from Heartland National. We’ll look at the plans, benefits, premiums, and perks available to new beneficiaries.

Heartland National Medicare Supplement Plans at a Glance

- A small range of popular Medigap plans is available.

- 7% household discount.

- Mid-range pricing for plans.

- No perks like discounted gym memberships or discounts on wellness services and products.

Who Is Heartland National?

Founded in 1994, Heartland National is a leading health insurance provider and life insurance distributor in the United States. With headquarters in Salt Lake City, the company offers Medigap policies in all 50 states.

What Medicare Supplement Plans Does Heartland National Offer?

Heartland focuses on offering the most popular Medigap plans, F, G, and N. They also sell Plan A, as per CMS regulations. Here’s a breakdown of the coverage in each plan.

Plan A – Basic benefits with coverage for Medicare Part B coinsurance and copayments, but no cover for the Medicare Part A deductible.

Plan A – Basic benefits with coverage for Medicare Part B coinsurance and copayments, but no cover for the Medicare Part A deductible.

Plan F – The most comprehensive plan available, with first-dollar coverage, including a Medicare Part B deductible benefit.

Plan G – Similar coverage to Plan F, but with no benefit for the Medicare Part B deductible. It’s the best choice for seniors who don’t qualify for Plan F.

Plan N – No coverage for the Part B deductible or excess charges. Beneficiaries must make copayments when visiting the doctor ($20) and emergency room ($50 when not admitted).

Compare Medicare Plans & Rates in Your Area

Heartland National Medicare Supplement Plans – Benefits & Coverage

The CMS, a federal agency, standardizes the benefits of Medigap schemes. You get the same benefits in Heartland National Medicare supplement policies as with any other healthcare provider offering these plans.

All Medigap plans offer the following benefits for Original Medicare Parts A & B.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F is the only Medigap plan covering the Medicare Part B deductible. The CMS is phasing out this policy due to this benefit, and Plan F is no longer available for seniors qualifying for Medicare after January 1, 2020. However, if you’re eligible for Medicare before this date, Heartland National must honor your application for a Plan F policy.

*Plan F is the only Medigap plan covering the Medicare Part B deductible. The CMS is phasing out this policy due to this benefit, and Plan F is no longer available for seniors qualifying for Medicare after January 1, 2020. However, if you’re eligible for Medicare before this date, Heartland National must honor your application for a Plan F policy.

However, you may have to undergo medical underwriting when applying. If you have pre-existing conditions, Heartland National may charge you a higher-than-market-average premium for your policy or deny your application. In some cases, you might qualify for a guaranteed issue right with your application, allowing you to avoid underwriting. Call us to find out if this applies to your situation.

What Heartland National Medicare Supplement Plans Don't Cover

Medigap plans cover out-of-pocket expenses relating to Original Medicare Parts A & B. If Medicare doesn’t cover a service, Medigap won’t cover it either. As a result, Medigap plans don’t provide coverage for preventative services and cosmetic procedures.

You don’t have coverage for podiatrists, physiotherapists, acupuncturists, or chiropractor visits. Medicare will cover these services if your doctor deems them necessary after hospitalization or surgery. In that case, Medigap would cover the out-of-pocket costs of these services.

Medigap plans don’t cover private duty nursing or stays at unskilled nursing homes. You don’t have any coverage for dental, vision, and hearing services or devices.

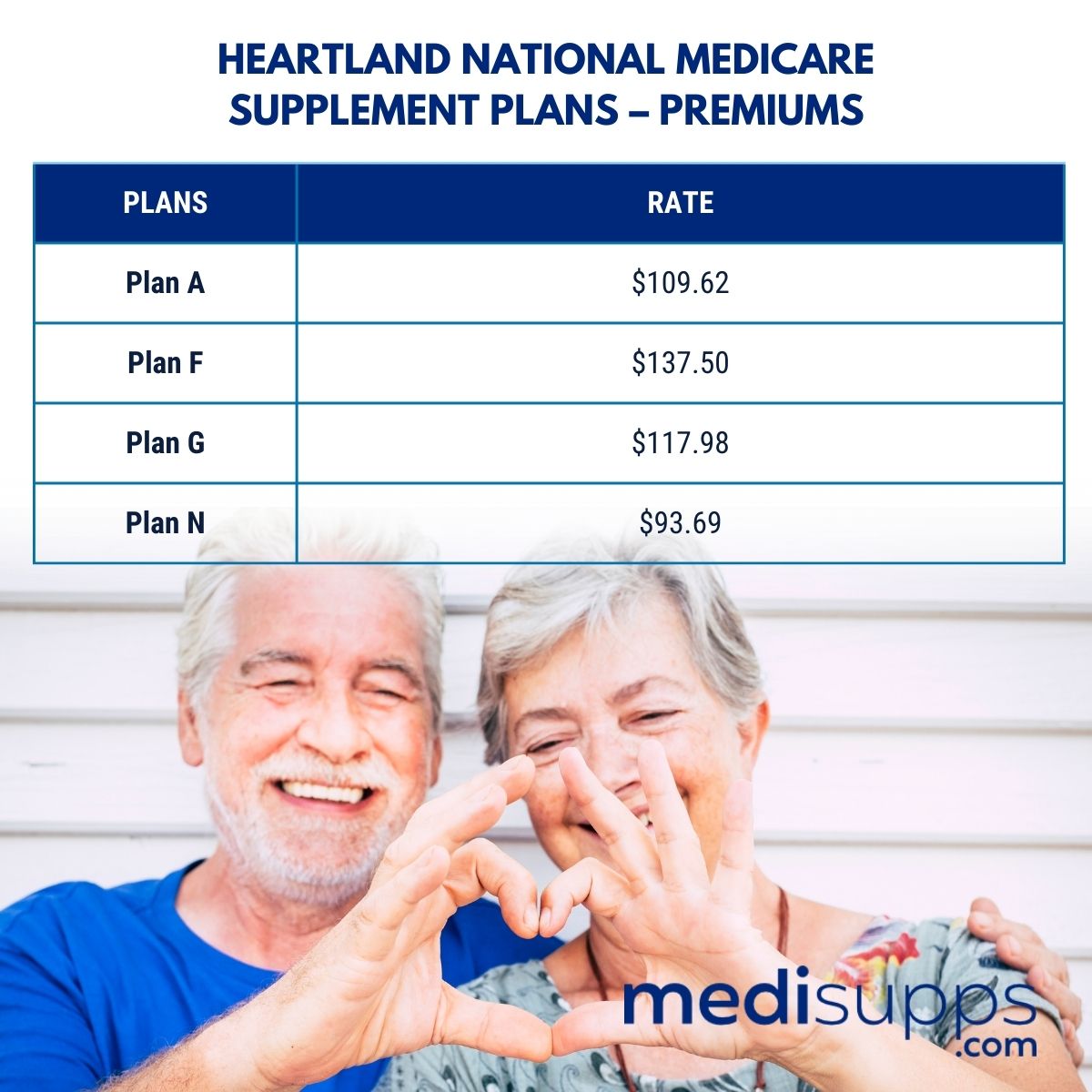

Heartland National Medicare Supplement Plans – Premiums

When applying for a Medigap plan with Heartland National, they create a risk profile based on your age, location in the United States, gender, and smoking status. This profile determines what the company charges for your monthly plan premium.

The cost of premiums can vary widely depending on your risk profile. Here are the average premiums for a Heartland National Medigap plan based on the risk profile of a 65-year-old female nonsmoker.

*Your premiums may vary depending on your unique risk profile.

*Your premiums may vary depending on your unique risk profile.

Heartland National Medicare Supplement Plans – Additional Benefits & Discounts

Heartland National offers a 7% household discount and simplified underwriting compared to other Medigap providers. You get fast application processing, and claims are usually settled within five days of submission. The company also has a free E-app for filing claims and managing your account.

Heartland National offers no perks covering vision, dental, or hearing services. There’s no access to SilverSneakers or related gym discount programs. There’s no option for discounts on healthcare products or services.

Heartland National Medicare Supplement Plans – Third-Party Ratings & Reviews

Heartland National has an A+ rating from AM Best for financial strength and an A+ rating with the Better Business Bureau.

Compare Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Heartland National Medicare Supplement Plans?

Call Us for More Information on Heartland National Medicare Supplement Plans

For more information on Heartland National Medigap plans, call our team at 1-888-891-0229. Our fully licensed agents offer free consultations and quotes on any Medigap plan. We’ll advise you on the right plan for your needs and secure the best rates on premiums in your state.

If you can’t call us now, leave your details on our contact form, and we’ll get a Medigap agent to reach out to you. Or use the tool on our website to get a free automated quote on any Medigap plan.