by Russell Noga | Updated October 20th, 2023

Medicare Supplement plans, also known as Medigap plans, play a pivotal role in ensuring comprehensive healthcare coverage for Alabama residents.

Medicare Supplement plans, also known as Medigap plans, play a pivotal role in ensuring comprehensive healthcare coverage for Alabama residents.

With a myriad of options and varying levels of coverage, it can become overwhelming to identify the Medicare Supplement plans in Alabama that best suit your needs.

This article delves into the complexities surrounding Medicare Supplement plans in Alabama, focusing on popular selections such as Plan G, Plan F, and Plan N, to help you make an informed decision about your healthcare coverage.

Key Takeaways

- Medicare Supplement Plans in Alabama are designed to cover expenses not covered by Medicare Parts A and B.

- Popular plans for 2024 include Plan G, F & N which offer varying benefits and coverage tailored to individual healthcare needs.

- Factors such as location, age, and gender can affect monthly premiums. Research resources should be consulted when selecting a plan.

Understanding Medicare Supplement Plans in Alabama

Medicare Supplement plans in Alabama, or Medigap, are health insurance policies designed to supplement Original Medicare coverage, providing coverage for certain costs associated with Original Medicare.

Medicare Supplement insurance plans in Alabama, also known as Medicare supplemental insurance, cover expenses not covered by Medicare Part A and Part B, such as:

- Copayments

- Coinsurance

- Deductibles

- And more

Working with one of our licensed insurance agents can be beneficial in finding the most suitable Medicare Supplement plan as we can access all available options from leading carriers in your area.

The Role of Medigap in Alabama

Medigap insurance in Alabama serves to help cover the out-of-pocket costs associated with Medicare Parts A and B. Individuals enrolled in both Medicare Part A and Medicare Part B, commonly referred to as Original Medicare, are eligible for a Medigap policy.

For disabled beneficiaries under 65, additional options like Medicare Advantage plans and Medicaid are available.

During open enrollment, the approximate expense of Medigap plans F, G, or N in Alabama ranges from $100 to $343 per month. Grasping the role of Medigap in Alabama is key in choosing a plan that best covers your healthcare needs.

Standardized Medigap Plans in Alabama

In Alabama, standardized Medicare Supplement plans are identified by a letter ranging from A to N. These plans offer various advantages, such as coverage for hospitalization, medical expenses, and other benefits.

Medicare Supplement Plan N, for instance, provides a suitable balance between coverage and affordability, accompanied by copayments and excess charges. The mean premium for Medicare Supplement Plan N in Alabama is approximately $98 per month.

Certain plans can provide extra coverage for expenses beyond Part B. This includes emergency medical costs accrued while traveling abroad. A thorough understanding of the standardized Medigap plans available in Alabama can aid in making an informed decision about the plan that best addresses your healthcare needs.

Compare Medigap Plans & Rates

Enter Zip Code

Top Medicare Supplement Plans in Alabama

The most commonly chosen Medicare Supplement plans in Alabama are Plan G, Plan F, and Plan N. These plans provide comprehensive coverage, encompassing hospitalization, medical expenses, and other benefits.

To find the most advantageous rates for Medicare Supplement plans, Alabama residents can engage with Medigap providers or utilize online forms to contrast policies, considering the Medicare Supplement plans cost.

Being fully aware of the eligibility requirements, enrollment periods, and factors influencing Medigap plan costs in Alabama is crucial. Eligibility requires enrollment in Parts A and B of Medicare, being at least 65 years old, and residing in Alabama.

The enrollment periods and timing for Medigap plans in Alabama are contingent upon the plan and the provider. Factors influencing Medigap plan costs in Alabama include age, provider, and discounts.

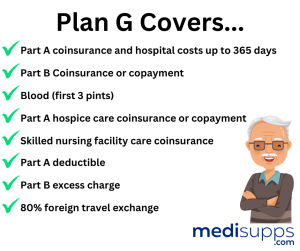

Medicare Plan G

Medicare Plan G is a popular choice among Alabama residents due to its comprehensive coverage, with the exception of the Medicare Part B deductible. UnitedHealthcare’s Renew Active is an example of a unique benefit included in certain Medigap Plan G policies.

Plan G encompasses all standardized benefits apart from the Part B deductible and provides 80% coverage of foreign travel exchange within plan limits.

During the open enrollment period, the monthly premiums for Medicare Plan G in Alabama can range from $100 to $343. The average monthly premium for Medicare Supplement Plan G in Alabama is estimated to be $134.20.

Understanding Plan G’s coverage can help you determine if it aligns with your healthcare needs.

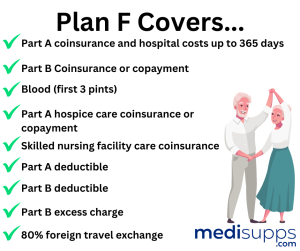

Medicare Plan F

Medicare Plan F provides the most extensive coverage but is only available to those enrolled in Medicare Part A before January 1, 2020. Plan F offers coverage for:

- Part A co-insurance and hospital costs for an additional year after Medicare benefits have been utilized

- Part B co-insurance or copayments

- The first three pints of blood

- Part A hospice care co-insurance or copayments

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B deductible

- Foreign travel exchange (up to plan limits)

Paragraph 2: Plan F offers the most comprehensive coverage. The plan provides coverage of up to 80% of foreign travel exchange. This is within the predetermined limits of the plan..

Paragraph 3:

- Plan F furnishes the most comprehensive coverage

- Plan F is only accessible to those enrolled in Medicare Part A prior to January 1, 2020

- Plan G offers comprehensive coverage, except for the Medicare Part B deductible

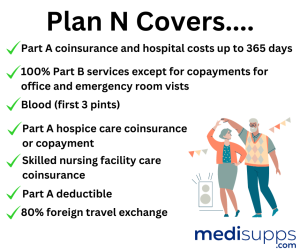

Medicare Plan N

Medicare Supplement Plan N in Alabama provides the following benefits:

- Payment of the Medicare Part B deductible

- Copayments are up to $20 for doctor’s visits and $50 if you visit the emergency room and you’re not admitted

- Medicare Part B Excess charges when applicable in the state in which care is received

Medigap Plan N provides a compromise between coverage and cost-effectiveness, with certain copayments and additional charges.

The average cost of Medicare Plan N in Alabama is $122.20 per month. Aetna and Cigna offer the least costly Plan N in Alabama at $97.90 per month, while Humana is the most expensive at $112 per month. Plan N’s estimated average monthly cost for 65-year-olds is $104. For 75-year-olds, it costs an average of $140 per month.

Aetna’s Plan N in Alabama offers coverage in case of a Foreign Travel Emergency. It provides the necessary medical assistance to ensure the traveler’s well-being.

Benefits and Coverage of Popular Plans

When comparing the coverage offered by Plans G, F, and N, it’s important to consider your healthcare needs and financial constraints. Plan F is the only plan that covers the Medicare Part B deductible.

Plans G and N do not cover this cost. Plan N covers Part A co-insurance and hospital costs up to an additional year after Medicare benefits have been exhausted, Part B co-insurance or copayments, the first three pints of blood, Part A hospice care co-insurance or copayments, skilled nursing facility care coinsurance, Part A deductible, and foreign travel exchange (subject to plan limits). It does not cover the annual Medicare Part B deductible or Medicare Part B excess charges.

Individuals who qualify for Medicare are eligible for Plans C and F. This applies to those who were eligible prior to January 1, 2020. Once the out-of-pocket yearly limit and the yearly Part B deductible have been reached, Medigap plans can cover 100% of covered services for the remainder of the calendar year.

Comparing Costs and Providers

Alabama residents looking for the best plan tailored to their needs and budget can obtain competitive rates for Medicare Supplement plans by:

- Call us today at 1-888-891-0229

- Using this website to view rates in your area for Medigap plans

- Comparing the cost of Medicare supplement plans in Alabama is determined by factors such as age, provider discounts, other medical underwriting, and the insurer selected

The premiums of various Medicare supplement plans in Alabama may vary based on the plan and the insurance provider. Notable plans in Alabama include Plan N, Plan G, and Plan F, with an average monthly premium of approximately $98 for Plan N and $160.32 for Plan G.

It is advisable to compare the benefits and costs of different plans to identify the most suitable option for individual needs and budget.

Eligibility Criteria for Medicare Supplement Plans in Alabama

To be eligible for Medicare Supplement plans in Alabama, beneficiaries must fulfill the eligibility criteria for Medicare Part A and Medicare Part B, generally attained at 65 years of age with a work history of at least ten years (40 tax credits) and contributions to the Medicare system through taxes.

Exceptions to being eligible for Medicare at 65 include having end-stage renal disease (ESRD), ALS (also known as Lou Gehrig’s disease), or receiving Social Security Disability Insurance (SSDI) for two years or more while on disability.

To apply for Medicare in Alabama, it is necessary to register with Social Security either online, over the phone, or in person. Navigating the eligibility criteria for Medicare Supplement plans in Alabama ensures that you receive the coverage you need to maintain your health and well-being.

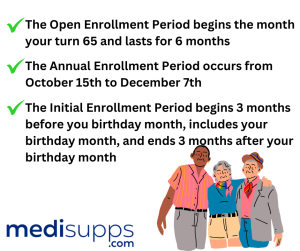

Enrollment Periods and Timing for Medigap Plans in Alabama

The Open Enrollment Period for a Medicare Supplement plan is when an individual first turns 65 or within a six-month period following the registration for Medicare Part B.

Enrolling during the initial enrollment period grants one the guaranteed issue rights and avoids the necessity of medical underwriting. If the Open Enrollment Period is missed, you may still apply for a Medigap plan but may have to go through medical underwriting.

Being cognizant of the enrollment periods and timing for Medigap plans in Alabama is vital, as enrolling during the initial period ensures the best coverage and rates. This period is an essential window of opportunity to secure comprehensive healthcare coverage without encountering obstacles due to pre-existing conditions or other factors.

Factors Affecting Medigap Plan Costs in Alabama

The monthly premium for Medicare Supplement plans in Alabama is determined by factors such as:

- Location

- Age

- Gender

- Tobacco-use status

For instance, males will generally incur a higher cost for coverage than females, and plans with more extensive benefit levels will be more expensive than plans with fewer benefits. The majority of individuals in Alabama can anticipate paying between $115 and $175 monthly for a Medigap plan.

The average monthly premium costs for a 65-year-old male and female, as well as a 75-year-old male and female in the same Alabama zip code who do not use tobacco, can be found in the source section. This cost comparison provides an insight into the differences between ages and genders.

Comprehending the factors that influence Medigap plan costs in Alabama can guide you to make an informed decision on the best plan for your needs and budget.

Additional Medicare Coverage Options in Alabama

Additional Medicare Coverage Options in Alabama

In addition to Medigap plans, Alabama residents have other Medicare coverage options available, such as Medicare Part D plans, Medicare Advantage plans, and ancillary plans for hearing, dental, and vision benefits.

Medicare Advantage plans (Part C) are a component of Medicare, provided by private insurers, which combine Medicare Part A and Part B and often include prescription drug coverage.

Ancillary plans refer to plans that are available to assist with covering the expenses of hearing, dental, and vision benefits.

Exploring all available Medicare coverage options in Alabama is crucial to ensure comprehensive coverage tailored to your individual healthcare needs.

Navigating Medigap Plan Ratings and Protections in Alabama

Medigap plans in Alabama are rated based on factors such as customer satisfaction, the financial stability of the insurance company, and the benefits offered by the plan. Highly-rated Medigap plan carriers in Alabama include Mutual of Omaha, Aetna, and Allstate. Medicare Plan G for people new to Medicare is a very popular choice due to its comprehensive coverage, with one small out-of-pocket cost being having to pay the annual Medicare Part B deductible.

Compare Medicare Plans & Rates in Your Area

Tips for Choosing the Right Medicare Supplement Plan in Alabama

To choose the right Medicare Supplement plan in Alabama, follow these steps:

- Evaluate your current healthcare needs.

- Review your Medicare coverage.

- Consider your budget.

- Compare Medicare Supplement plans.

- Seek professional guidance.

- Utilize resources such as MoneyGeek, Fair Square Medicare, MedicarePlans.com, Medicare.gov, and MedicareFAQ to compare costs for Medicare Supplement plans in Alabama.

The reputation of the provider is also an essential factor when selecting a Medicare Supplement plan in Alabama. A reliable provider guarantees access to an expansive network of healthcare providers, granting you the freedom to choose the physicians and specialists you prefer.

This can give you assurance in knowing that your healthcare requirements will be suitably addressed.

Summary

Navigating the world of Medicare Supplement plans in Alabama can be overwhelming, but understanding the various options and factors that impact coverage and costs is crucial in making an informed decision.

By exploring the popular plans such as Plan G, Plan F, and Plan N, considering factors that affect plan costs, and evaluating your individual healthcare needs, you can choose the best Medicare Supplement plan to ensure comprehensive healthcare coverage for your golden years in Alabama.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Medicare Supplement Plans in Alabama?

Medicare Supplement Plans in Alabama, also known as Medigap plans, are private insurance policies designed to help cover the out-of-pocket costs that Original Medicare doesn’t pay for.

How many types of Medicare Supplement Plans are available in Alabama?

In Alabama, there are ten standardized Medicare Supplement Plans, each labeled with letters (A, B, C, D, F, G, K, L, M, and N), offering different levels of coverage.

Do the benefits of each Medicare Supplement Plan in Alabama remain the same across different insurance companies?

Yes, the benefits for each standardized Medigap plan are the same, regardless of the insurance company. However, prices and availability can vary among insurers.

Can I purchase a Medicare Supplement Plan in Alabama if I have a Medicare Advantage plan?

You cannot have both a Medicare Supplement Plan and a Medicare Advantage plan simultaneously. You must choose one or the other.

Is there an open enrollment period for Medicare Supplement Plans in Alabama?

Yes, there is a six-month open enrollment period when you first enroll in Medicare Part B. During this period, insurers are generally required to offer you any Medigap plan without medical underwriting.

What are the costs associated with Medicare Supplement Plans in Alabama?

The cost of Medigap plans can vary based on factors such as your age, location in Alabama, and the insurance company. Premiums are in addition to your Original Medicare premiums.

Do Medicare Supplement Plans in Alabama include prescription drug coverage?

No, Medigap plans do not cover prescription drugs. You’ll need to enroll in a Medicare Part D plan for prescription drug coverage.

Can I use my Medicare Supplement Plan anywhere in Alabama and the U.S.?

Yes, Medicare Supplement Plans provide nationwide coverage, so you can use them anywhere in Alabama or the United States where Medicare is accepted.

Do Medigap plans in Alabama offer coverage for preventive services like dental and vision?

Generally, Medicare Supplement Plans do not cover routine dental and vision care. Separate dental or vision insurance may be necessary for such coverage.

Can I switch between different Medicare Supplement Plans in Alabama?

You can change your Medigap plan at any time, but outside the open enrollment period, you may need to go through medical underwriting. It’s important to consider this before making changes to your coverage.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be pleased to help you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.