Medicare Insurance

the Easy Way

We help make Medicare easy

for you every year!

View Rates in Your Area Now

Watch to learn more

Compare Medicare plans below

How we can help

Our service is FREE

FREE Online Quote Analyzer

5-Star Reviews!

Meet Us!

Here at Medisupps.com, we’ve been helping people for 14 years now learn about Medicare, and Medicare supplement plans.

Our website is one of the only sites online that offer online quotes from the top carriers. Unlike most sites, we actually show you the rates!

In fact, all of our services are always 100% FREE, and we’ll help you pay the least amount possible for your Medicare insurance now, and for years to come.

Turning 65 and New to Medicare?

Start with the video above!

Start with the video above!

Thousands of people have commented how this one video was the easiest way they ever found to understand Medicare!

After this short video, you’ll have a thorough understanding of exactly how Medicare works.

You’ll learn the basics of Medicare and Medicare plans.

Already have a Medigap or a Medicare Advantage Plan?

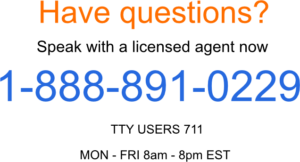

Well, the easiest way to get started is to give us a call at 1-888-891-0229.

You can talk to one of our licensed insurance agents and within minutes of our call, we’ll look up the lowest Medigap premiums from all the top companies to see who you qualify with and how much you can save.

Or just fill out the form to the right to view rates instantly online!

But here’s what’s really great…

When you become one of our clients, we’ll be contacting YOU next year before your rate increase and we’ll shop the rates so you’re ready to go and never overpay.

How to Get Started

Whether you’re new to Medicare or just changing plans, we can help!

We make it easy and do the work for you each and every year. Our clients love our service and you will too.

Call us today to get started. We’ll answer all of your questions and help educate you on Medicare , Medigap, and Medicare Advantage plans for 2025 to see which fits your needs best.

What the CMS 2026 Rate Announcement Means for You

CMS recently released its final payment policy for 2026, approving a 5.06% increase for Medicare Advantage plan reimbursements. While this doesn’t change Medigap (Medicare Supplement) plans directly, it may shift how Advantage plans are marketed — especially in terms of added perks like $0 premiums or supplemental benefits. These changes could affect how seniors compare Advantage and Supplement options in 2026. We break down the full details in our Medicare payment update explainer.