by Russell Noga | Updated October 2, 2024

Medicare supplement plans (Medigap) assist Original Medicare beneficiaries with partially or fully paying the out-of-pocket costs associated with Medicare Part A & B services. Every Medigap plan offers a different level of coverage, with Medigap plans F, G, & N being the most popular options. This post looks at the Medigap offering from Western United Life.

Medicare supplement plans (Medigap) assist Original Medicare beneficiaries with partially or fully paying the out-of-pocket costs associated with Medicare Part A & B services. Every Medigap plan offers a different level of coverage, with Medigap plans F, G, & N being the most popular options. This post looks at the Medigap offering from Western United Life.

Western United Life Medicare Supplement Plans at a Glance

- Western United Life is a subsidiary of the Manhattan Life Group.

- The company offers Medigap plans in 26 states.

- The company offers competitive premiums and good discounts. However, there’s no option for extra perks covering vision, dental, and hearing services.

Compare 2025 Plans & Rates

Enter Zip Code

Who Is Western United Life?

Western United Life is a subsidiary and affiliate of Manhattan Life. Founded in 1850, Manhattan Life is one of the first insurance companies in the country. Western United Life has 25 years in the Medigap industry and offers Medigap plans in 26 states.

What Medicare Supplement Plans Does Western United Life Offer?

Western United Life has a niche offering of Medigap plans. The company focuses on the more popular options, with Plan A, C, F, G, and N policies available.

Plan A – This policy offers basic Medicare Part A benefits. All providers must offer Plan A as part of their Medigap range per CMS regulations. Medigap Plan A provides coverage for the Medicare Part B coinsurance or copayment but doesn’t cover the Medicare Part A deductible.

Plan C*– Near-comprehensive coverage, but no benefits from Part B excess charges.

Plan F – This policy offers the most comprehensive coverage in the Medigap range, including a benefit for the Medicare Part B deductible.

Plan G – You get near-comprehensive coverage for Medicare Part A & B expenses. It’s similar to Plan F but doesn’t cover the Part B deductible.

Plan N* – The low premiums make this policy attractive. There are copayment responsibilities when visiting the emergency room and seeing the doctor. It doesn’t cover Medicare Part B excess charges.

*Plans C & N don’t cover Medicare Part B excess charges. Doctors in the Medicare network can charge up to 15% above Medicare-approved rates (Medicare Assignment) for their services. The additional fees above the Medicare Assignment rate are “excess charges.” However, you can avoid excess charges by visiting practitioners in the Medicare network charging Medicare Assignment.

Compare Medicare Plans & Rates in Your Area

Western United Life Medicare Supplement Plans – Benefits & Coverage

Western United Life complies with regulations set by the CMS on the standardized benefits offered in Medigap plans. Therefore, your coverage with any of their Medigap policies is identical to all other national insurers offering Medigap policies.

All Medigap plans offer the following benefits for Original Medicare Parts A & B.

- Part A coinsurance and hospital costs for up to 365 days after using Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans C*, F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plans C & N don’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plans C & F cover the Medicare Part B deductible. However, these policies are unavailable to seniors eligible for Medicare after January 1, 2020. The MACRA Act of 2015 prevents Medigap policies from providing coverage for the Medicare Part B deductible for new Medicare members enrolling after the cut-off date.

Plan G offers the same benefits as Plan F but doesn’t cover the Medicare Part B deductible. However, Plan G premiums are $10 to $40 cheaper than Plan F premiums. Therefore, you can usually account for the cost of the Medicare Part B deductible in the savings you make on Plan G premiums over Plan F.

What Western United Life Medicare Supplement Plans Don't Cover

Medigap plans only offer coverage for Original Medicare Part A & B expenses. Medicare doesn’t cover it, then Medigap won’t cover it either. So, you don’t have coverage for preventative treatments, such as chiropractic, acupuncture, or physiotherapy.

In some instances, Medicare may approve preventative care services if deemed medically necessary by a doctor. An example would be chiropractic care when recovering from back surgery covered by Medicare Part A.

Medigap policies don’t cover the cost of your prescription medications. They also don’t cover cosmetic procedures, private-duty nursing, or stays at unskilled nursing homes.

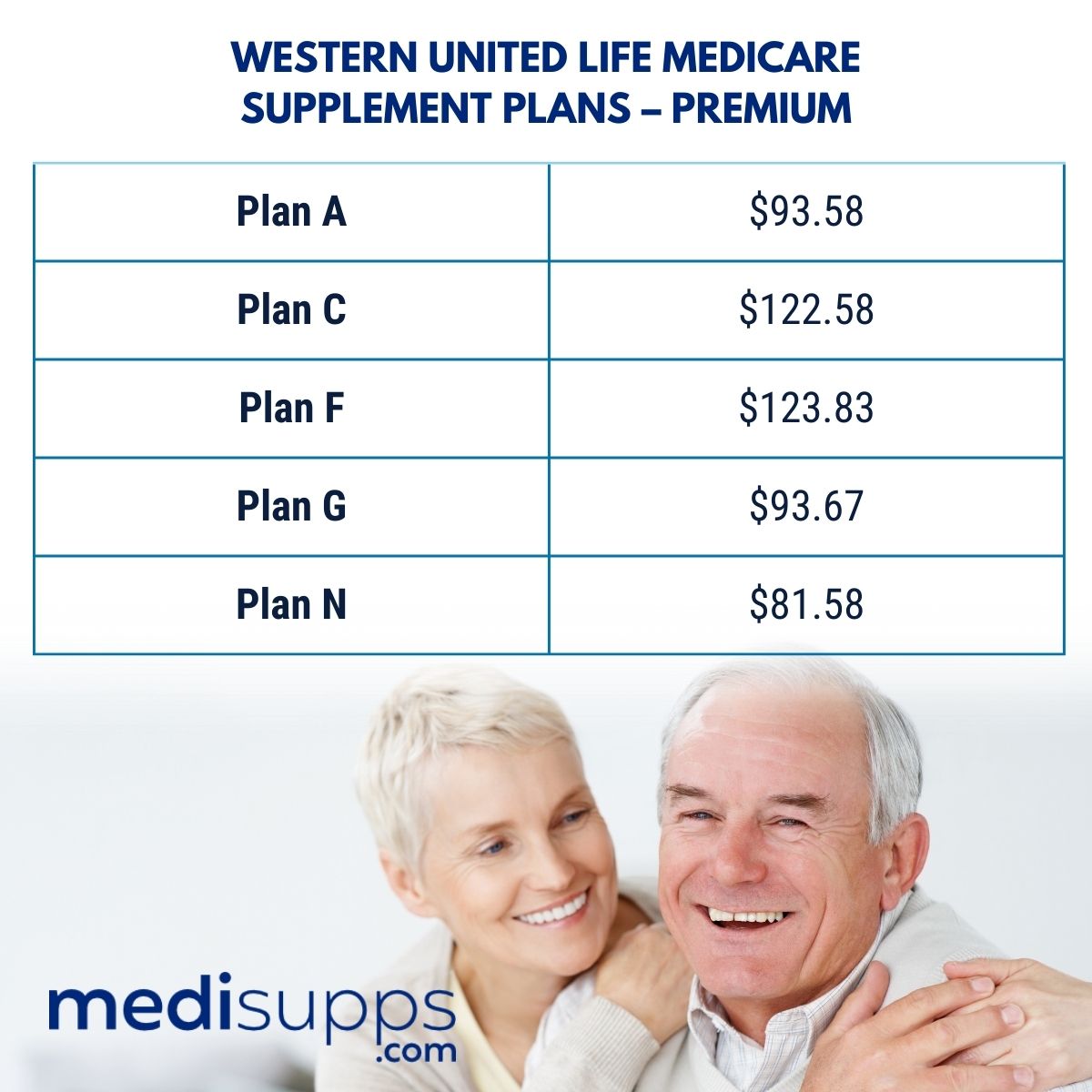

Western United Life Medicare Supplement Plans – Premiums

Western United Life creates a risk profile on you when applying for a policy. The risk profile determines the rate charged for your monthly premiums. Factors used in assessing you include your age, gender, smoking status, and location in the United States.

Premiums may be higher in some states than others. Here are the average monthly premiums Western United Life charges a 65-year-old nonsmoking woman in Texas.

*Your rates may vary depending on your risk profile.

Western United Life charges a $25 policy fee in some states.

Western United Life Medicare Supplement Plans – Additional Benefits

Western United Life offers a 7% household discount in some states. You get a Fast and user-friendly electronic application with near-instant approval of policies. Beneficiaries can manage their account and claim through a dedicated app.

Western United Life Medicare Supplement Plans – Third-Party Ratings & Reviews

Western United Life has excellent customer service and claims support reviews. The company has a B+ financial strength rating with AM Best and an A+ rating with the Better Business Bureau.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What Medicare Supplement plans does Western United Life offer?

Western United Life offers a range of Medicare Supplement plans, including Plan G, Plan N, and other standardized plans. These plans provide additional coverage to supplement Original Medicare.

Who is eligible to enroll in Western United Life Medicare Supplement plans?

Eligibility to enroll in Western United Life Medicare Supplement plans typically requires being enrolled in Medicare Part A and Part B. Enrollment is generally open to individuals who are 65 years or older, or those under 65 with certain disabilities.

What are the key features of Western United Life Medicare Supplement Plan G?

Western United Life Medicare Supplement Plan G offers comprehensive coverage, including coverage for Medicare Part A and B coinsurance, Part A deductible, Part B excess charges, and skilled nursing facility coinsurance.

What are the key features of Western United Life Medicare Supplement Plan N?

Western United Life Medicare Supplement Plan N provides coverage for Medicare Part A and B coinsurance, Part A deductible, and skilled nursing facility coinsurance. However, it does have cost-sharing in the form of copayments for certain services.

What is the difference between Western United Life Medicare Supplement Plan G and Plan N?

The main difference between Western United Life Medicare Supplement Plan G and Plan N is that Plan G offers more comprehensive coverage, including coverage for Part B excess charges, while Plan N has cost-sharing in the form of copayments for certain services.

What coverage and benefits do Western United Life Medicare Supplement plans offer?

Western United Life Medicare Supplement plans typically provide coverage for Medicare Part A and B coinsurance, hospital costs, and may include additional benefits such as coverage for skilled nursing facility care, foreign travel emergencies, and more. Coverage details may vary based on the specific plan.

Are there any additional benefits or perks offered by Western United Life Medicare Supplement plans?

While additional benefits and perks may vary, some Western United Life Medicare Supplement plans may offer benefits such as coverage for prescription drugs, vision and dental care, fitness programs, and telehealth services. It’s important to review the details of each plan to understand the specific benefits included.

How can I enroll in Western United Life Medicare Supplement plans?

To enroll in Western United Life Medicare Supplement plans, you can contact Western United Life directly or work with licensed insurance agents who represent Western United Life. These agents can assist you in the enrollment process and help you compare plan options.

What factors should I consider when comparing Western United Life Medicare Supplement plans?

When comparing Western United Life Medicare Supplement plans, important factors to consider include the specific coverage offered, premium rates, company reputation, customer service quality, financial stability, and any additional benefits or perks that align with your healthcare needs.

Where can I get more information about Western United Life Medicare Supplement plans?

To obtain more information about Western United Life Medicare Supplement plans, you can visit their official website or contact them directly. Additionally, licensed insurance agents who represent Western United Life can provide personalized guidance and assistance in understanding the plan options.

Call Us for More Information on Western United Life Medicare Supplement Plans

Reach out to our team at 1-888-891-0229 for more information on Medicare supplement plans. Our licensed agents offer free consultations and quotes on any Medigap plan from any provider. We’ll secure you the best rates on monthly premiums in any state.

If you can’t call us right now, leave your details on our contact form, and we’ll call you back. Our tool on our site offers free automated quotes on any Medigap plan in your region.