An Accendo Medicare Supplement can provide outstanding coverage, low monthly premiums, and a generous household discount. Keep reading to learn more about Accendo Insurance company and their options when it comes to Medicare Supplement plans.

Accendo Insurance Company

Accendo Insurance Company, a subsidiary of CVS Health, is a prominent provider of insurance products and services in the United States. As a part of the CVS Health family, Accendo offers various insurance solutions, including Medicare Supplement Plans that help fill the gaps in Original Medicare coverage.

These plans assist in managing out-of-pocket costs such as copayments, coinsurance, and deductibles, ensuring that policyholders receive comprehensive coverage.

Accendo Insurance Company and Aetna

Accendo Insurance Company works closely with Aetna, a renowned health insurance provider. Aetna is a subsidiary of CVS Health, which also owns Accendo.

Together, they offer Medicare Supplement Plans that cater to the specific needs of individuals seeking additional coverage to supplement their Original Medicare.

Accendo Medicare Supplement Plans

Accendo Medicare Supplement Plans, also known as Medigap plans, are designed to supplement Original Medicare (Part A and Part B) by providing additional benefits and covering expenses not fully addressed by Medicare.

These plans help beneficiaries minimize the financial burden of healthcare costs while ensuring access to quality healthcare services.

What are the Best Accendo Medicare Supplement Plans?

Accendo offers several Medicare Supplement Plans, each designed to cater to varying coverage needs and preferences.

The most popular plans are Plan F, Plan G, and Plan N, which provide a comprehensive range of benefits to policyholders. To learn what the best Medicare Supplement plan is for you, you’ll need to compare the benefits of each individual plan as well as consider your own personal budget.

Below is a summary of the benefits of Medicare Plan F, G, and N. An important factor to keep in mind is that Medicare Supplement Plans are standardized. This means that each company offers identical coverage within each plan letter.

Though they might all offer the same coverage, every insurance company charges different rates for the same coverage. Here on our website, you can compare the cost of each plan from top insurance companies in your area. Our service is entirely FREE and helps you save money with your Medigap coverage each year.

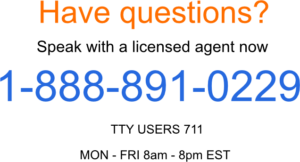

Also, our licensed insurance agents are available to help with any questions you might have. Call us today at 1-888-891-0229.

Accendo Medicare Supplement Plan F

Accendo Medicare Supplement Plan F is known for offering the most comprehensive coverage among Medigap plans. It covers 100% of the gaps in Original Medicare, including:

- Part A hospital deductible

- Part A coinsurance and additional hospital costs up to 365 days after Medicare benefits are exhausted

- Part B coinsurance or copayments

- Part A hospice care coinsurance or copayments

- Skilled nursing facility care coinsurance

- First three pints of blood used in a medical procedure

- Part B excess charges

- Part B deductible

- Foreign travel emergency coverage (up to plan limits)

However, Plan F is no longer available to new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. For those who were eligible before this date, Plan F remains a viable option.

Accendo Medicare Supplement Plan G

Accendo Medicare Supplement Plan G is an attractive alternative to Plan F, offering similar coverage with one key exception – it does not cover the Medicare Part B deductible.

Medigap Plan G covers:

- Part A hospital deductible

- Part A coinsurance and additional hospital costs up to 365 days after Medicare benefits are exhausted

- Part B coinsurance or copayments

- Part A hospice care coinsurance or copayments

- Skilled nursing facility care coinsurance

- First three pints of blood used in a medical procedure

- Part B excess charges

- Foreign travel emergency coverage (up to plan limits)

With comprehensive coverage and typically lower premiums than Plan F, Plan G is an increasingly popular choice among Medicare beneficiaries.

Accendo Medicare Supplement Plan N

Accendo Medicare Supplement Plan N provides a balance between comprehensive coverage and lower premiums. While it does not cover the Medicare Part B deductible or excess charges, it provides coverage for:

- Part A hospital deductible

- Part A coinsurance and additional hospital costs up to 365 days after Medicare benefits are exhausted

- Part B coinsurance (except for a copayment of up to $20 for some office visits and up to $50 for emergency room visits that do not result in inpatient admission)

- Part A hospice care coinsurance or copayments

- Skilled nursing facility care coinsurance

- First three pints of blood are used in a medical procedure.

- Foreign travel emergency coverage (up to plan limits)

Plan N offers a more affordable option for those who are comfortable with some out-of-pocket expenses in exchange for lower premiums.

Frequently Asked Questions About Accendo Medicare Supplement Plans

Q: How do Accendo Medicare Supplement Plan premiums compare to other providers?

A: Premiums for Accendo Medicare Supplement Plans are competitive and may vary based on factors such as age, gender, location, and the specific plan is chosen. To get an accurate quote, it is essential to contact Accendo or a licensed insurance agent.

Q: Can I switch from another Medicare Supplement plan to an Accendo Medicare Supplement plan?

A: Yes, you can switch plans, but you may be subject to medical underwriting, which could affect your eligibility and premium rates. It is recommended to switch during your Medigap Open Enrollment Period or a Special Enrollment Period to avoid medical underwriting.

Q: Are prescription drug costs covered under Accendo Medicare Supplement plans?

A: No, prescription drug costs are not covered under Accendo Medicare Supplement plans. To receive prescription drug coverage, consider enrolling in a separate Medicare Part D plan.

Q: Can I use any doctor or hospital with an Accendo Medicare Supplement plan?

A: Yes, as long as the provider accepts Medicare patients, you can use any doctor or hospital in the United States.

Q: Are dental and vision care covered under Accendo Medicare Supplement plans?

A: No, dental and vision care are not covered under Accendo Medicare Supplement plans. You may consider purchasing separate dental and vision insurance plans to cover these expenses.

How to Enroll in an Accendo Medicare Supplement

Accendo Medicare Supplement Plans offer a range of options for those seeking additional coverage to supplement their Original Medicare benefits. By understanding the unique features of Plans F, G, and N, you can make an informed decision about the best plan to meet your healthcare needs and budget.

It is crucial to compare rates and benefits across different providers to ensure you choose the plan that offers the best value for your specific circumstances.

You can view Accendo Medicare Supplement rates here on our website for free by entering your zip code above.

Or, if you have questions and would like to speak with one of our licensed insurance agents, just give us a call now.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.