by Russell Noga | Updated October 3rd, 2024

If you’re a senior living in North Dakota, you probably have Medicare Parts A & B to help you deal with your annual medical and hospital expenses. These policies only cover 80% of Part A & B, leaving you with the balance to pay out-of-pocket.

If you’re a senior living in North Dakota, you probably have Medicare Parts A & B to help you deal with your annual medical and hospital expenses. These policies only cover 80% of Part A & B, leaving you with the balance to pay out-of-pocket.

A Medigap plan covers the remaining 20%, reducing your annual healthcare costs. These plans come in ten versions, each offering different levels of coverage.

The average cost for Medicare supplement plans is $120 per month across all insurers and policies.

The most popular options for Medigap are plans F, G, & N. These plans have average monthly premiums dependent on personal factors such as your location, age, gender, and more.

This article provides information on the best Medicare supplement plans North Dakota offers. We’ll list the top-rated providers in The Peace Garden State and the best rates available for each of the plans.

Use Us to Find the Best Medicare Supplement Plans in North Dakota

Contact our team of fully licensed Medigap agents at 1-888-891-0229.

Contact our team of fully licensed Medigap agents at 1-888-891-0229.

We’ll give you a free consultation to help you find the best plan for 2025 for your healthcare requirements and a free quote on the best rate available.

Leave us your details if you can talk right now, and we’ll get an agent to call you back. Or take your due diligence into your own hands and use the tool on our site to get a free automated quote on the plan you want.

Discover 2025 Rates

Enter Zip Code

The Most Popular Providers for Medicare Supplement Plan G North Dakota

31 insurers offer Plan G in North Dakota, with the market average pricing across all providers being $169.50.

State Farm offers the best deal on premiums, charging $122.90 per month. UnitedHealthcare is the most expensive provider, with an average of $152.90 monthly.

Going with State Farm over UnitedHealthcare can save you up to $30 monthly premiums.

Here are the average premium costs across the top providers in the state. Prices are based on a 65-year-old nonsmoking woman.

- State Farm: $123

- Blue Cross Blue Shield of North Dakota: $137

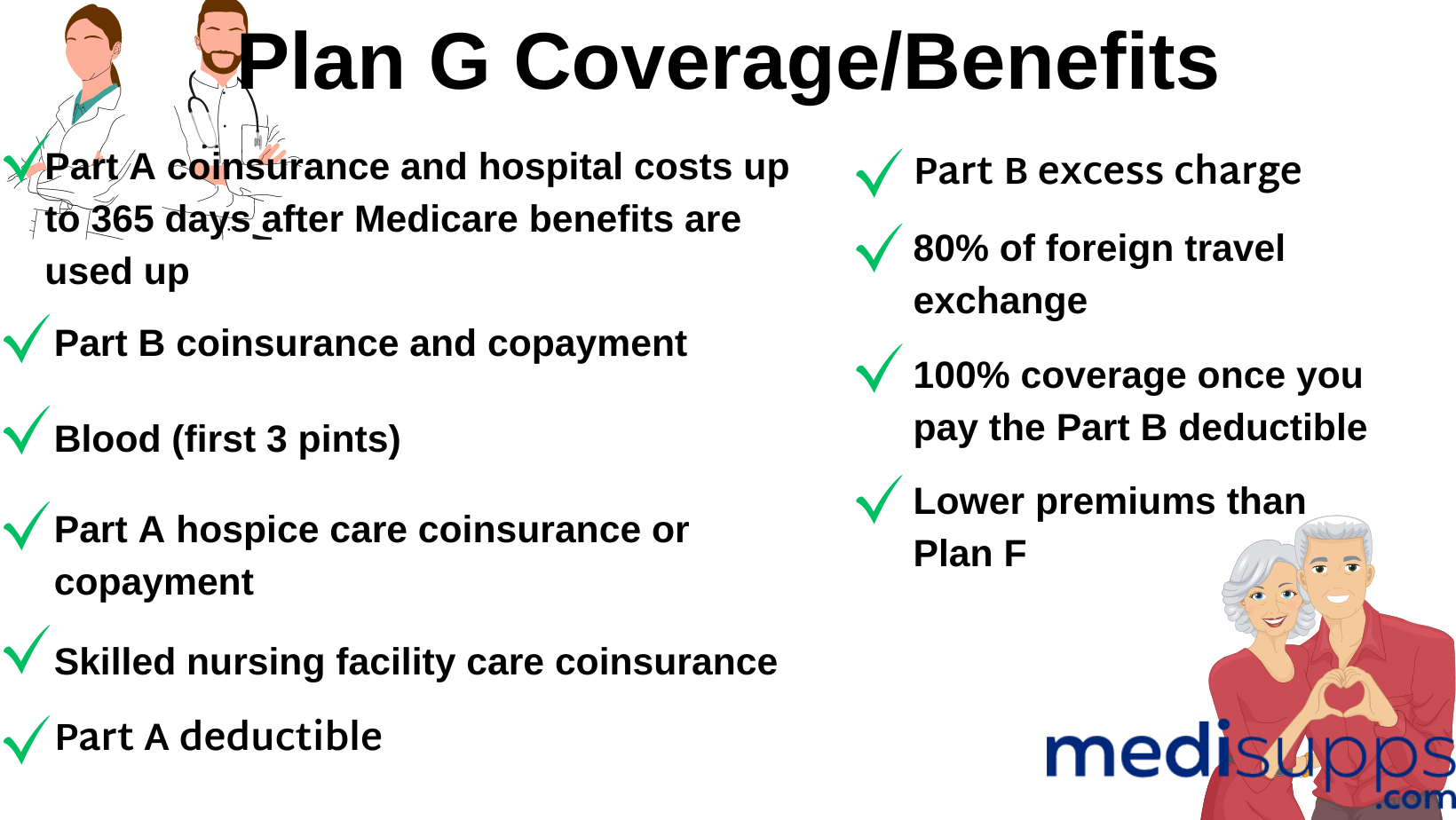

What Does Plan G Cover?

Plan G covers all out-of-pocket medical and hospital expenses associated with Medicare Parts A & B. The only thing it doesn’t cover is the Part B deductible.

However, you get a lower rate than Plan F, and the savings you make annually account for the cost of the deductible.

- Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits expire.

- Part B coinsurance or copayments.

- Blood (first 3 pints).

- Part A hospice care coinsurance or copayments.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Part B excess charges.

- 80% of foreign travel exchange (up to plan limits).

The Most Popular Providers for Medicare Supplement Plan F North Dakota

31 insurers offer Plan F in North Dakota. The market average pricing across all providers is $288.30.

The most expensive provider is Humana, with an average monthly premium of $313.20. Prices are based on a 65-year-old nonsmoking female.

What Does Plan F Cover?

Plan F offers the highest level of coverage in the Medigap range, but it’s not available for people eligible for Medicare after January 1, 2020.

It’s the only plan offering overage for the Part B deductible..

- Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits expire.

- Part B coinsurance or copayments.

- Blood (first 3 pints).

- Part A hospice care coinsurance or copayments.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Part B deductible.

- Part B excess charges.

- 80% of foreign travel exchange (up to plan limits).

Popular Provider for Medicare Supplement Plan N North Dakota

29 insurers offer Plan N in North Dakota. The average market pricing across all companies is $136 monthly, with State Farm being the most affordable option at $95 per month.

Blue Cross Blue Shield of North Dakota is the most expensive option, with average monthly premiums of $122.90.

You could save up to $27.90 monthly by going with State Farm over Blue Cross Blue Shield of North Dakota.

Here is the top providers’ average monthly pricing for Plan N, based on a 65-year-old nonsmoking female.

State Farm: $95

State Farm: $95- Blue Cross Blue Shield of North Dakota: $123

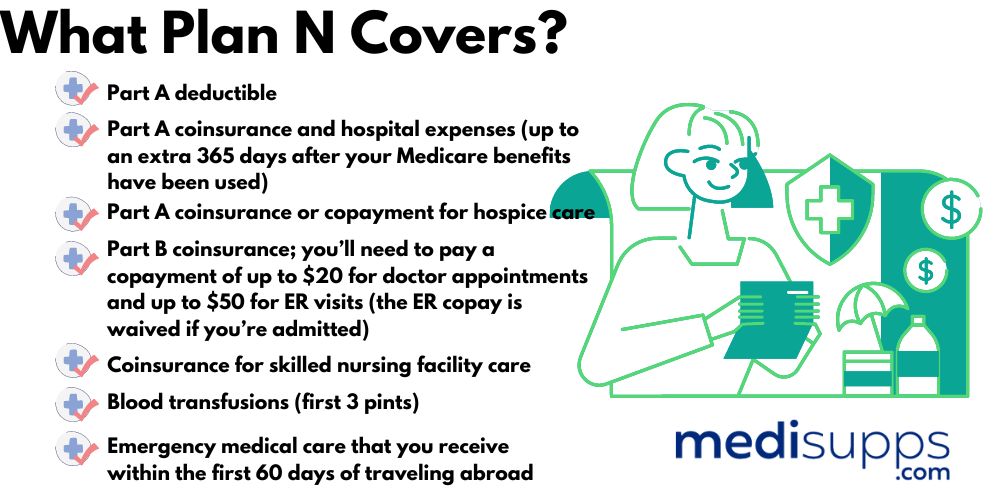

What Does Plan N Cover?

Plan N offers you low premiums in exchange for copayments at the doctor’s office ($20) and the emergency room ($50). There’s no copayment if admitted into the hospital for treatment.

- Part A coinsurance and hospital costs up to an additional year after Medicare benefits expire.

- Blood (first 3 pints).

- Part A hospice care coinsurance or copayments.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- 80% of foreign travel exchange (up to plan limits).

Plan N doesn’t cover excess charges associated with seeing doctors and specialists charging more than the Medicare Assignment rate. It also doesn’t cover the Part B deductible.

What Do Plans F, G, & N Not Cover?

While Original Medicare and Medigap cover your hospital and medical expenses, they don’t cover the cost of prescriptions or preventative treatments. That means there’s no coverage for visits to the physiotherapist, chiropractor, or acupuncture therapist.

Some Medigap providers offer coverage for vision, dental, and hearing services if you pay an extra fee on top of your monthly premium.

Others offer discounted rates at these service providers as a perk to beneficiaries, provided you use the service providers in their network.

Compare Medicare Plans & Rates in Your Area

What are the Best Alternate Medicare Supplement Plans in North Dakota?

What are the Best Alternate Medicare Supplement Plans in North Dakota?

The other Medigap plans don’t offer the same level of comprehensive coverage as Plans N, F, & G.

However, they’re good choices for affordable coverage, especially for seniors living on fixed incomes.

Our research shows Blue Cross Blue Shield of North Dakota has the best deals on Plans A & L, while State Farm has the best rates on Plan D.

Here are the average premium costs for these providers based on a 65-year-old female nonsmoker.

- Plan A – Blue Cross Blue Shield of North Dakota: $86.90

- Plan D – State Farm: $122.57

- Plan L – Blue Cross Blue Shield of North Dakota: $114.20

Compare 2025 Plans & Rates

Enter Zip Code

Find the Right Medicare Plan for You

Finding the ideal Medicare plan for you doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!