by Russell Noga | Updated October 3rd, 2024

Navigating the world of Medicare Supplement plans in 2025 can be overwhelming, especially considering the numerous options available for Iowa residents.

Navigating the world of Medicare Supplement plans in 2025 can be overwhelming, especially considering the numerous options available for Iowa residents.

It’s essential to find a plan that best suits your healthcare needs and budget without sacrificing essential coverage.

This article will guide you through the process of understanding, comparing, and choosing the right Medicare Supplement plans Iowa has to offer.

We’ll discuss the top available plans, the factors affecting costs, and tips for finding the best rates.

Let’s dive in and make this decision-making process a breeze!

Key Takeaways

- Medigap plans in Iowa offer financial protection for out-of-pocket expenses not covered by Original Medicare.

- Plans F, G, and N are the best options to consider when selecting a plan that meets healthcare needs and budget.

- Assessing healthcare needs, evaluating provider options & seeking professional assistance can help choose the right Medigap plan in Iowa.

Understanding Medicare Supplement Plans in Iowa

Medicare Supplement plans, also known as Medigap, are private insurance policies designed to fill the gaps left by Original Medicare (Part A and B) coverage.

They assist in covering the out-of-pocket expenses associated with deductibles, copays, and coinsurance. In some cases, they provide additional coverage for excess charges and foreign travel health emergencies.

The Role of Medigap in Iowa

In Iowa, Medigap plans play a crucial role in mitigating the financial burden of healthcare expenses not covered by Original Medicare. Such expenses include deductibles, coinsurance, and copayments.

It’s important to note that Medigap plans are distinct from Medicare Advantage plans, which serve as an alternative to Original Medicare, rather than a supplement.

One key advantage of Medigap policies is their ability to provide coverage for out-of-pocket costs that Original Medicare does not have an out-of-pocket maximum for.

This financial safety net can be particularly beneficial for those with chronic health issues or frequent healthcare needs.

Standardized Medigap Plans

Medigap plans are standardized by letter, meaning they provide the same benefits regardless of the insurance company providing the policy.

Medigap plans are standardized by letter, meaning they provide the same benefits regardless of the insurance company providing the policy.

There are ten standardized Medigap plans, each offering different levels of coverage. Among these, Plan F and Plan G are the most sought-after options in Iowa.

The primary distinction between Plans F and G lies in the coverage of the yearly Part B deductible. Plan F covers this deductible, while Plan G does not.

Understanding these differences is crucial in determining the most suitable plan for your healthcare needs and financial situation.

The Best Medicare Supplement Plans in Iowa

Now that we grasp the basics of Medicare Supplement plans, let’s delve into the top three Medigap plans available in Iowa: Plan F, Plan G, and Plan N. Each of these plans offers unique coverage options and benefits, catering to a range of healthcare needs and budgets.

By examining the specifics of each plan, you can make an informed decision on the most suitable option for your individual healthcare requirements.

Keep in mind that the best plan for you may not be the best plan for someone else, as everyone’s healthcare and financial needs differ.

Find 2025 Rates Now

Enter Zip Code

Plan F: Comprehensive Coverage

Plan F is often considered the most comprehensive Medigap plan available, as it covers all gaps in Original Medicare coverage. This includes the Part B deductible, which sets it apart from Plan G.

Some insurance companies may even offer additional benefits in Plan F, such as coverage for emergency travel expenses.

However, it’s important to note that Plan F is no longer available to those who became eligible for Medicare on or after January 1, 2020.

If you were eligible for Medicare prior to this date, Plan F could be an excellent choice for comprehensive coverage.

Plan G: Maximum Coverage with Savings

Plan G is another popular Medigap option in Iowa, offering maximum coverage with savings. It covers all gaps in Original Medicare, except for the Part B deductible.

By choosing Plan G, you can enjoy extensive coverage while saving on monthly premiums compared to Plan F.

With Plan G’s affordability and extensive coverage, it’s no surprise that this plan has become increasingly popular among Medicare beneficiaries in Iowa.

Plan N: Affordable Option for Healthy Individuals

Plan N is an affordable option for healthy individuals, covering most medical expenses but not Part B excess charges or deductibles. This plan provides comprehensive inpatient coverage for hospital stays and covers the majority of medical care expenses.

It has become increasingly popular among Iowa seniors due to its lower cost and comprehensive coverage.

However, it’s important to note that Plan N includes nominal copayments for certain doctor office visits and emergency room visits unless you’re admitted as an inpatient.

Despite these small out-of-pocket costs, Plan N remains an attractive option for those seeking affordable yet comprehensive coverage.

Comparing Costs of Medigap Plans in Iowa

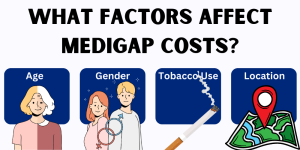

Understanding the costs of different Medigap plans is crucial in making an informed decision. Factors such as age, gender, tobacco use, and location can all significantly impact the cost of your Medigap plan.

Understanding the costs of different Medigap plans is crucial in making an informed decision. Factors such as age, gender, tobacco use, and location can all significantly impact the cost of your Medigap plan.

In addition, the insurance company and specific plan type you choose will also play a role in determining your monthly premiums.

To find the best rates for your Medigap plan, it’s essential to compare prices from different providers and make use of resources such as rate quote services.

This will help you identify the most cost-effective option that aligns with your healthcare needs and financial situation.

Factors Affecting Medigap Costs

Several factors can affect the cost of your Medigap plan in Iowa. Age is a significant determinant, as the cost of Medigap plans generally increases with age.

Gender can also play a role, with some states charging higher premiums for women than men. Tobacco usage may result in higher costs for users compared to non-users, depending on the state.

Lastly, your location can impact your Medigap costs, varying prices between states.

Knowing these factors will help you anticipate potential changes in your Medigap plan costs and budget accordingly.

Tips for Finding the Best Rates

One of the most effective ways to find the best rates for Medigap plans in Iowa is to compare prices from various insurance companies such as Mutual of Omaha, Allstate, or Aetna.

You can utilize a FREE quote engine on this page to identify the lowest prices and discounts available in your area.

This tool will assist you in comparing rates from different providers, helping you find the most suitable plan for your needs and budget.

Another valuable tip is to explore any available discounts, which may help reduce your premium.

By staying informed and utilizing available resources, you’ll be well-equipped to secure the best rates for your Medigap plan in Iowa.

Choosing the Right Medicare Supplement Plan in Iowa

Choosing the right Medicare Supplement insurance in Iowa is a critical decision that requires careful consideration of your healthcare needs, available provider options, and professional assistance.

By assessing your healthcare needs, evaluating provider options, and seeking the help of licensed insurance agents or other professional resources, you can ensure that you select the most suitable plan for your individual circumstances.

In the following subsections, we’ll discuss these steps in greater detail, helping you make an informed decision when it comes to your Medicare Supplement plan in Iowa.

Assessing Your Healthcare Needs

When selecting a Medigap plan, it’s crucial to assess your healthcare needs. Consider factors such as chronic health issues, emergency care, supplies, and durable medical equipment.

By understanding your healthcare requirements, you can better determine which Medigap plan will offer the most appropriate coverage for your needs.

Additionally, consider the out-of-pocket expenses that Original Medicare does not cover, such as deductibles, copays, and coinsurance.

This will help you identify a Medigap plan that provides the financial protection you need in the face of these costs.

Evaluating Provider Options

Once you have a clear understanding of your healthcare needs, it’s time to evaluate your provider options. Research customer reviews, AM Best ratings, and rate increase history for various insurance companies.

Once you have a clear understanding of your healthcare needs, it’s time to evaluate your provider options. Research customer reviews, AM Best ratings, and rate increase history for various insurance companies.

This information will help you gauge the reliability and financial stability of each provider, ensuring you choose a reputable company for your Medigap plan.

Additionally, compare the costs and benefits of different plans from various providers. This will help you identify the most cost-effective option that meets your healthcare needs and budget.

Seeking Professional Assistance

Seeking professional assistance when choosing a Medigap plan can offer valuable insights and guidance in navigating the selection process. Licensed insurance agents, HealthCompare, and Iowa’s SHIP are excellent resources for professional assistance.

By enlisting the help of professionals, you’ll receive personalized advice and support in comparing plans and selecting the most suitable option for your healthcare needs and financial situation.

This added support can make all the difference in ensuring you make an informed decision when it comes to your Medicare Supplement plan in Iowa.

Compare Medicare Plans & Rates in Your Area

Medicare Supplement Plan Eligibility and Enrollment in Iowa

To enroll in a Medigap plan in Iowa, you must be enrolled in both Medicare Part A and Part B. Enrolling in a Medicare Supplement plan during your Medigap Open Enrollment Period is the best time.

This period begins when you turn 65 and are enrolled in Medicare Part B and lasts for six months. Enrolling during this period ensures that insurance companies cannot use medical underwriting to accept or alter the price of your application.

In this section, we’ll discuss the eligibility and enrollment process for Medigap plans in Iowa, including the open enrollment period and guaranteed issue rights.

Medigap Open Enrollment Period

The Medigap Open Enrollment Period is a critical time for enrolling in a Medicare Supplement plan in Iowa. This period begins on the first day of the month when you turn 65 and are enrolled in both Parts A and B, and lasts for six months.

During this time, insurance companies are required to accept your Medicare Supplement plan application without using medical underwriting to accept or alter the price of your plan.

It’s important to enroll in a Medigap plan during your open enrollment period, as obtaining Medicare supplemental insurance after this period can be more challenging and may result in higher premiums or declined applications due to medical history.

Guaranteed Issue Rights

In certain circumstances, such as when switching from Medicare Advantage to Medigap, you may be eligible for guaranteed issue rights.

These rights allow you to acquire a Medigap policy even if you’re outside of your open enrollment period.

If you have guaranteed issue rights, insurance companies are obligated to sell you a policy and cannot use medical underwriting to accept or alter the price of your application.

Understanding your eligibility for guaranteed issue rights can help ensure you have access to the coverage you need, regardless of your current healthcare situation.

Additional Benefits and Coverage Options

While Medigap plans to provide essential coverage for out-of-pocket costs not covered by Original Medicare, there are additional benefits and coverage options to consider.

These include prescription drug coverage and dental, vision, and hearing benefits.

In the following subsections, we’ll discuss these additional benefits and how they can complement your Medigap plan.

Prescription Drug Coverage

Medigap plans do not include prescription drug coverage, so you may want to consider purchasing a separate Medicare Part D prescription drug plan to cover these costs.

In Iowa, prescription drug plans are easy to come by. Many of these plans cost less than $20 per month.

By supplementing your Medigap plan with a Part D prescription drug plan, you can ensure comprehensive coverage for your healthcare needs, including the cost of necessary medications.

Dental, Vision, and Hearing Benefits

Unfortunately, dental, vision, and hearing benefits are not covered by Original Medicare or Medigap plans in Iowa.

However, you may be able to acquire an additional plan for these benefits or explore Medicare Advantage plans that offer coverage for routine dental, vision, and hearing services.

By considering these additional benefits and coverage options, you can create a comprehensive healthcare plan that meets all of your needs and provides peace of mind.

Summary

In conclusion, choosing the right Medicare Supplement plan in Iowa requires careful consideration of your healthcare needs, available provider options, and professional assistance.

By understanding the basics of Medigap plans, evaluating the top options in Iowa, and comparing costs, you can make an informed decision that best suits your individual needs and budget.

Remember that the best plan for you may not be the best plan for someone else, as everyone’s healthcare and financial needs differ.

By taking the time to assess your options and seek professional assistance, you can ensure that you select the most suitable Medicare Supplement plan for your unique situation, allowing you to enjoy peace of mind and comprehensive healthcare coverage.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Medicare Supplement plans, and how do they work in Iowa?

Medicare Supplement plans, also known as Medigap plans, are private health insurance policies that help cover the gaps in Original Medicare. In Iowa, these plans work alongside Medicare Part A and B to provide additional coverage for out-of-pocket expenses.

Which are the popular Medicare Supplement plans in Iowa?

Popular Medicare Supplement plans in Iowa include Plan F, Plan G, and Plan N. These plans offer different levels of coverage for medical costs.

What benefits do Medicare Supplement plans in Iowa typically cover?

Medicare Supplement plans in Iowa can cover expenses such as deductibles, coinsurance, and copayments associated with Medicare Part A and B. Some plans may also provide coverage for skilled nursing facility care and foreign travel emergencies.

When is the best time to enroll in a Medicare Supplement plan in Iowa?

The best time to enroll in a Medicare Supplement plan in Iowa is during the six-month Medigap Open Enrollment Period, which starts when you turn 65 and are enrolled in Medicare Part B. This period provides guaranteed issue rights and allows you to enroll without medical underwriting.

Can I switch Medicare Supplement plans in Iowa?

Yes, you can switch Medicare Supplement plans in Iowa. However, depending on the insurance company, you may be subject to medical underwriting, which could affect eligibility and premiums.

Are Medicare Supplement plans standardized in Iowa?

Yes, Medicare Supplement plans are standardized in Iowa. This means that the benefits offered by a particular plan, such as Plan F, will be the same regardless of the insurance company. However, pricing may vary.

Do Medicare Supplement plans in Iowa cover prescription drugs?

No, Medicare Supplement plans in Iowa do not include prescription drug coverage. To obtain coverage for prescription drugs, you need to enroll in a standalone Medicare Part D plan.

Are there any specific restrictions on Medicare Supplement plans in Iowa?

In Iowa, there are no specific restrictions on Medicare Supplement plans. However, insurance companies may have their own rules and requirements, so it’s important to review the policies and choose one that suits your needs.

How can I find the best Medicare Supplement plan in Iowa?

To find the best Medicare Supplement plan in Iowa, compare the plans offered by different insurance companies. Consider your healthcare needs, budget, and factors such as premiums, benefits, and customer reviews.

Are there any financial assistance programs available for Medicare Supplement plans in Iowa?

No, there are no specific financial assistance programs for Medicare Supplement plans in Iowa. However, you may be eligible for other assistance programs like Medicaid, which can help cover Medicare-related costs.

Find the Right Medicare Plan for You

Finding the perfect Medicare plan for you doesn’t have to be confusing. Whether it’s a Medigap plan or you have questions about Medicare Advantage or Medicare Part D, we can help.

Reach out today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!