We get asked frequently, “Can I change my Medicare supplement plans anytime?”

The answer is YES, however changing Medicare supplement plans depends on whether or not you can get approved into the new plan.

To Change Medicare Supplement Plans anytime:

- You’ll need to first apply for the new plan

- Answer medical questions on the new application

- Go through medical underwriting and possible phone interview

- Once the new policy is issued, you can then cancel your old plan

View the Plans

Medicare Open Enrollment Period

Now, most people know that there is an initial enrollment period when you first sign up to Medicare.

And what that gives you is six months time, also called an Open Enrollment Period, that you can enroll in a Medicare supplement plan with no medical questions asked.

During that time of course, you’ll want to allow us to help out and shop the rates for you, and make sure you enroll with the best company.

Once you are outside the initial six months of when you take Part B Medicare if you want to change your Medicare supplement plan you may do so at any time during the year.

However, you will have to go through medical underwriting with the new company that you’re applying with which means answering their medical questions on the application.

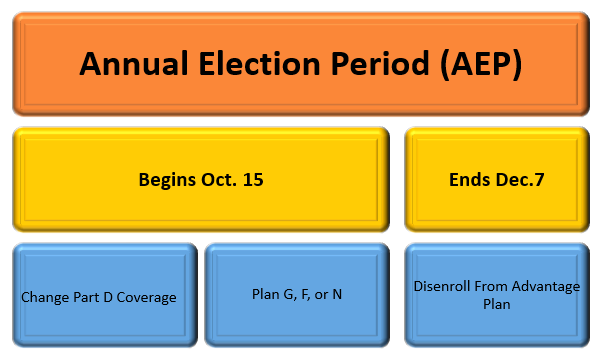

Medicare Annual Election Period (AEP)

From October 15 through December 7, called the Annual Election Period or AEP. This is the time period where you change your prescription Part D drug plan only.

Now, any changes you make to your drug plan from October 15 on to December 7, will go into effect January 1 of the following year.

So you really only have one time to change your drug plan, but unlimited chances to change your supplement plan.

Your Medicare supplement plan may be changed at any time during the year!

Medicare Open Enrollment Period

That period, that enrollment period, which happens in October, only applies to your drug plan if you are on a Medicare supplement plan.

It also applies to people who want to disenroll from a Medicare Advantage plan, come back to original Medicare and get on a Medicare supplement plan.

If you have a Medicare Advantage plan and you’re looking to move back to the original Medicare and a Medigap plan, by all means, let us know regardless of what time of year it is.

We can show you all the options that are currently available and get you ready to move when the time comes.

Recap of How Annual Election Period Works

From October 15 through December 7, called the Annual Election Period or AEP. This is the time period where you change your prescription Part D drug plan only.

Now, any changes you make to your drug plan from October 15 on to December 7, will go into effect January 1 of the following year.

So you really only have one time to change your drug plan, but unlimited chances to change your supplement plan.

Your Medicare supplement plan may be changed at any time during the year!

View the Plans

What is Medigap?

First and foremost, you should know what Medigap plans are. Private insurance providers only offer these plans.

So you can only purchase them through companies like AARP, Mutual of Omaha, Aetna, and more. However, these plans were designed to work alongside the plans sold by Medicare.

You have to turn 65 years to be eligible for the plans sold by Medicare unless you are on disability. But you may not be aware that as soon as you turn 65, you are also eligible for Medigap plans, and these plans can provide you extra coverage for the medical expenses left out by your primary coverage plan.

Medigap plans are useless without a standard Medicare plan because they were specifically designed to supplement the basic plan.

When you purchase both plans, you will see that they fit together like two puzzle pieces.

These two plans do not overlap; therefore, they provide extensive coverage for a wide selection of common and rare healthcare expenses.

There are a lot of choices for Medigap plans.

There are low coverage plans, and there are high coverage plans. If you require only a bit of extra coverage, you can opt for low coverage plans, but there are high coverage plans for you if you require extensive coverage.

Either way, choose carefully, so you have ample protection.

Medicare Supplement Rate Increases

When we get you with a company on a Medicare Supplement Plan, there’s typically a one-year lock-in on your rate.

As the end of that year approaches, you will get a letter in the mail stating if there’s going to be a rate increase or not.

There probably is going to be. We help people choose the right company to help avoid those high rate increases.

We contact you well ahead of time so we can prepare to make a change if it’s best for you and we can save you money?

So how great is that?

For NO cost to you, we look out for your rates for years to come!

By shopping the rates for our clients every year we make sure they’re always paying the least amount possible for their coverage.

And there’s never a cost for our service.

Or I should say ” HOW IMPORTANT IS THAT?”

Well, just recently I had a Woman call me and she had gone direct to a company a few years ago to sign up for her supplement.

Three years of rate increases went by and of course, the company never told her to go shopping for another rate.

Why would they?

We ended up saving her over $40 per month on her premium, simply by changing companies.

The entire process took about 15 minutes and got her nearly $540 back in her pocket. I’d rather see you keep the money than give it to an insurance company.

View the Plans

Medical Underwriting - Will I Get Approved?

What does “Medical underwriting” mean exactly?

That well it just means you’ll have to answer some medical questions on their application. This is extremely common and all companies require it if you’re outside your initial open enrollment period for Medicare.

Is it hard to get approved?

This is a very common question, and believe me, we meet talk to people all across this country who have various medical conditions.

It’s not quite as strict as you might think, in fact, we switch people all day long!

Below are some examples of what might get you declined:

- Any major heart issues within the last 2 to 3 years

- Any cancer with the last 2 to 3 years including any treatments

- Any major lung or respiratory disorders combined with some other various conditions

- Waiting on pending test results from previous treatment

- You have a scheduled doctor’s visit or follow-up visit for something that was diagnosed previously

Don’t let this alarm you!

If your last check-up for a major illness was two years or beyond many companies will take you the very next day after year anniversary of that treatment.

Each company is different as some go back 3, and even 5 years.

There are a lot of options available and each company has different underwriting guidelines.

And you have absolutely nothing to lose by calling us to see if you can get approved at least. We have a very good idea of if you’ll get approved or not.

Even if we can’t move you to a different company today, we will certainly get your calendar for the date we think you can get approved.

Don’t keep paying your current high premium and wondering!

We know the underwriting guidelines of each company extremely well and have a very good idea of if you would get approved or not.

Again if you can’t get approved today we’ll put you on our calendar for when we think you can!

There are absolutely no downsides to inquiring or often even applying with an insurance carrier to try to save money!

If you’re moving from one Medicare supplement plan to another, or even coming off a Medicare advantage plan back to Original Medicare, you will have to through Medical underwriting with the new company you’re applying with.

We make it easy!

View the Plans

How Much Can You Save?

Now, to find out what the rates are for Medicare supplement plans and to learn more about all of this, just give us a call at 1-888-891-0229.

We could look up the rates in your area, see how much they cost.

Or if you currently have a Medicare supplement plan and it doesn’t matter what time of year you’re watching this, definitely give us a call.

Regardless of if you got a rate increase letter or not. Because we can shop the rates because we have access to all of the top companies.

Again like the Woman, I mentioned who called me, if you have had your current supplement for a year or more then I can almost guarantee you there’s a lower rate you could be paying.

We’re independent brokers, which makes all the difference. By having access to every company we can see the best rates all on one screen.

And because you’d pay the same whether you go direct or you let us help, it really makes sense to just give us a call at 1-888-891-0229

We can evaluate the coverage with the company you currently have, then compare the rates to see if we can save you money.

Or we can look at possibly changing your plan to match your own personal situation if it makes sense.

Take Action Today, You’re Not Alone!

So once again, to answer the question “Can I change Medicare supplement plans anytime?”, the answer is…

Absolutely! You certainly can.

Give us a call today and we’ll shop those rates for you. Regardless of if you have a supplement now, or if you’re just coming on to Medicare for the first time.

We’ll answer all of your questions to make the process as easy as possible.

We look forward to speaking with you soon!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.