by Russell Noga | Updated September 9th, 2025

Curious about Medicare Plan G reviews 2026? This article covers everything from plan benefits and costs to top-rated providers. Discover whether Plan G is the right choice for you.

Key Takeaways

- Medicare Supplement Plan G offers extensive coverage for out-of-pocket costs, making it a comprehensive choice for beneficiaries, especially those who travel often.

- Top providers for Plan G in 2026 include AARP/UnitedHealthcare, Mutual of Omaha, and Wellabe, known for their low complaint rates and customer satisfaction.

- The High-Deductible Plan G presents an affordable alternative for healthy individuals, providing the same benefits at a reduced premium after meeting a higher annual deductible.

Compare 2025 Plans & Rates

Enter Zip Code

Overview of Medicare Supplement Plan G

Medicare Supplement Plan G, commonly referred to as Plan G, is a Medigap plan policy that provides extensive coverage for costs not covered by Original Medicare. This includes copayments, coinsurance, and deductibles, making it a comprehensive option for Medicare beneficiaries seeking peace of mind. Plan G has emerged as the most comprehensive Medigap option for new Medicare members, often regarded as a replacement for Plan F, which is no longer available to new enrollees.

One of the standout features of Plan G is its coverage for hospital costs, including hospice care and emergency health services abroad. This makes it an attractive option for those who travel frequently or anticipate needing extensive medical care. Additionally, Plan G covers Part B excess charges, a unique benefit that applies if a provider charges more than the Medicare-approved amount.

However, new Medicare members cannot purchase plans that cover the Part B deductible as of 2020, making Plan G a crucial option in the Medigap landscape. Despite its extensive coverage, Medicare Supplement Plan G typically comes with higher premiums compared to other Medigap plans.

This trade-off comes with comprehensive benefits, including protection against unexpected medical expenses and the assurance that most out-of-pocket costs will be covered. For many, the peace of mind provided by Plan G outweighs the higher premiums, making it a popular choice among Medicare beneficiaries.

Top-Rated Medicare Supplement Plan G Providers in 2026

Choosing the right provider for Medicare Supplement Plan G is crucial, and in 2026, several companies stand out based on expert predictions and historical data. The top companies for Plan G include AARP/UnitedHealthcare, Mutual of Omaha, and Wellabe. These providers are evaluated based on factors such as premiums, discounts, complaint rates, extra perks, and online quote availability. Approximately two-thirds of Medigap beneficiaries are covered by these companies, reflecting their dominance in the market.

Evaluating complaints is crucial for determining the best providers, using a complaint index weighted by market shares to highlight providers with the lowest complaint rates and highest customer satisfaction.

The following sections detail the top-rated providers for 2026.

AARP/UnitedHealthcare

AARP/UnitedHealthcare is often considered the best overall provider for Medicare Supplement Plan G. One of the key reasons for this distinction is its remarkably low complaint rates compared to competitors. In fact, the complaint rate for AARP/UnitedHealthcare’s Plan G is far fewer than expected, which speaks volumes about its customer satisfaction and service quality.

AARP/UnitedHealthcare’s Plan G is available in all states, offering comprehensive coverage nationwide. This extensive availability, coupled with a low number of customer complaints, makes it a top choice for those seeking reliable Medicare Supplement insurance.

Mutual of Omaha

Mutual of Omaha is another top contender for Medicare Supplement Plan G, known for its broad availability and low complaint rates. The company’s commitment to customer satisfaction is evident in its lower-than-expected complaint rates, making it a reliable choice for Medicare beneficiaries.

Mutual of Omaha offers significant household discounts, leading to substantial savings for members. These discounts make Plan G more affordable and an attractive option for those looking to save on Medicare costs while enjoying comprehensive coverage.

Wellabe

Wellabe is recognized for offering some of the lowest prices on Medicare Supplement Plan G, making it a cost-effective option for budget-conscious beneficiaries. Operating in 28 states, Wellabe provides a significant coverage area for its customers, ensuring that many can benefit from its competitive pricing.

Wellabe’s NAIC complaint rate is close to expected, indicating satisfactory customer service. This balance of affordability and reliability makes Wellabe a noteworthy provider for those considering Medicare Supplement Plan G.

High-Deductible Plan G: An Affordable Alternative

The High-Deductible Plan G is an attractive alternative for those looking to save on premiums. Suited for healthy individuals, it offers the same benefits as the standard Plan G but at a reduced monthly premium, making it a cost-effective choice.

With the High-Deductible Plan G, benefits activate once the insured pays a deductible of $2,870 annually. This plan is particularly appealing for those who expect to incur minimal healthcare expenses throughout the calendar year, as it provides a balance between coverage and affordability.

Healthy individuals who anticipate low medical utilization can save money with the High-Deductible Plan G while still maintaining robust coverage.

Compare Medicare Plans & Rates in Your Area

Comparing Costs and Coverage Options

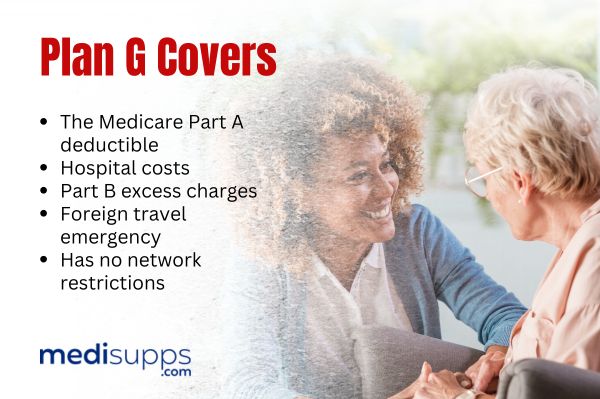

When it comes to Medicare Supplement Plan G, comparing costs and coverage options is essential. Plan G covers:

- The Medicare Part A deductible

- Hospital costs

- Part B excess charges

- Foreign travel emergency

- Has no network restrictions

However, premiums for Plan G can vary significantly based on factors such as age and location.

Regularly reviewing Medicare Supplement plans can help identify the most suitable coverage as health needs change. This annual review ensures you have the coverage that best meets your evolving requirements.

Premiums

Premiums for Medicare Supplement plans vary based on the insurer, location, and pricing model. Different insurance companies adopt varied pricing approaches, influencing overall consumer costs. For instance, Wellabe is known for some of the lowest average premiums for Medicare Supplement Plan G.

Providers may offer premium discounts for several factors such as:

- Annual payment

- Non-smoking

- Younger age enrollment

- Gender

- Payment method

Understanding these variations helps in choosing the plan that offers the best value for your circumstances.

Additional Benefits

Some insurers offering Medicare Supplement Plan G provide special benefits for their policyholders. One of the most valuable additional benefits is foreign travel emergency coverage, which can save insured individuals from high costs during international medical emergencies. This medicare coverage is particularly important for those who travel frequently, providing peace of mind and financial protection.

These additional perks enhance the value of Medicare Supplement Plan G, providing extra benefits and special supplemental benefits, as well as Medicare benefits and peace of mind. When choosing a plan, consider how these benefits align with your lifestyle and needs.

How to Choose the Best Medicare Supplement Plan G

Selecting the best Medicare Supplement Plan G involves considering your health status, budget, and expected medical needs. If you anticipate high medical expenses, opting for comprehensive coverage like Plan G may be beneficial. Evaluate your financial situation alongside your health needs and coverage options.

Evaluating insurance companies is equally important. Consider factors such as member satisfaction and pricing when choosing a Medicare Supplement plan. Regularly reviewing your plan ensures it continues to meet your evolving needs and budget. Understanding your options is key to making an informed decision for the best coverage.

Assessing Healthcare Needs

When evaluating health care needs, consider the following:

- The frequency of doctor visits as it influences premium costs and coverage requirements.

- Whether you require specialized treatments, as this affects your choice of Medicare Plan G.

- The likelihood of needing emergency room visits as it impact on overall healthcare planning.

Assessing your healthcare needs is crucial for choosing the best Medicare Plan G, ensuring adequate coverage tailored to your requirements. Understanding your health status and anticipated medical needs helps select a plan that balances coverage and cost.

Evaluating Insurance Company Ratings

Researching insurance company ratings is crucial when choosing a Medicare plan, ensuring reliable and efficient services. Key factors to consider include customer satisfaction, financial stability, and claim processing efficiency, providing insight into the insurer’s overall quality and reliability.

Insurance companies establish premiums based on their pricing strategies, leading to cost variations for similar plans. The only difference between Medigap policies from different insurers with the same plan letter is the premium amount. Carefully evaluating these ratings helps choose an insurer that offers the best combination of cost and service quality.

Preparing for Medicare Changes in 2026

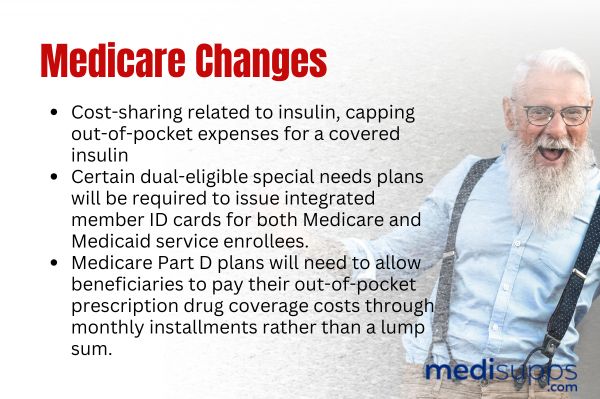

As we look ahead to 2026, several significant changes to Medicare are on the horizon. A new Medicare rule aims to enhance and modernize the Medicare Advantage plans and prescription drugs programs. One of the key provisions is that plans must now restrict the reopening of previously approved inpatient hospital admissions to cases of obvious error or fraud.

The final rule includes the following provisions:

- Cost-sharing related to insulin, capping out-of-pocket expenses for a covered insulin product at $35 per month.

- Certain dual-eligible special needs plans will be required to issue integrated member ID cards for both Medicare and Medicaid service enrollees.

- Medicare Part D plans will need to allow beneficiaries to pay their out-of-pocket prescription drug coverage costs through monthly installments rather than a lump sum.

Furthermore, Medicare plans will be required to ensure their network pharmacies participate in the Medicare Drug Price Negotiation Program, which aims to address rising drug prices. Potential changes under the ‘One Big Beautiful Bill Act’ could affect Medicare beneficiaries, including potential changes to Medicaid access and a 4% reduction in Medicare spending. Staying informed about these changes is crucial for making the best decisions for your healthcare needs.

Compare 2025 Plans & Rates

Enter Zip Code

Summary

Navigating the landscape of Medicare Supplement Plan G in 2026 requires a thorough understanding of the available options and upcoming changes. Plan G remains a cornerstone of comprehensive coverage for Medicare beneficiaries, offering extensive benefits that protect against unexpected medical expenses. Key providers such as AARP/UnitedHealthcare, Mutual of Omaha, and Wellabe have been highlighted for their reliability and customer satisfaction, each bringing unique advantages to the table.

For those looking to manage costs more effectively, the High-Deductible Plan G offers a viable alternative by balancing lower premiums with comprehensive coverage. Comparing costs and coverage options regularly ensures that your plan continues to meet your evolving healthcare needs. By assessing your healthcare requirements and evaluating insurance company ratings, you can make an informed decision that best suits your circumstances. As Medicare undergoes significant changes in 2026, staying informed and proactive will help you navigate these transitions smoothly and secure the best possible coverage for your needs.

Frequently Asked Questions

What makes Medicare Supplement Plan G the best Medigap plan for 2026?

Medicare Supplement Plan G stands out as the best Medigap plan for 2026 due to its comprehensive coverage of out-of-pocket costs like copayments, coinsurance, and deductibles not included in Original Medicare. This makes it an ideal choice for new Medicare members seeking extensive protection against medical expenses.

What are the top-rated providers for Medicare Supplement Plan G in 2026?

The top-rated providers for Medicare Supplement Plan G in 2026 are AARP/UnitedHealthcare, Mutual of Omaha, and Wellabe, recognized for their competitive premiums, discounts, and low complaint rates.

How does the High-Deductible Plan G differ from the standard Plan G?

The High-Deductible Plan G provides identical benefits to the standard Plan G, but with a lower monthly premium and an annual deductible of $2,870 that must be met before coverage begins. This makes it a cost-effective option for those who are generally healthy.

What factors should I consider when choosing a Medicare Supplement Plan G?

When choosing a Medicare Supplement Plan G, it’s crucial to consider your health status, budget, anticipated medical needs, and the insurance company’s reputation. These factors will guide you in selecting the most suitable plan for your situation.

What are the key changes to Medicare in 2026 that I should be aware of?

In 2026, key changes to Medicare will focus on modernizing the Medicare Advantage and prescription drug programs, implementing cost-sharing caps for insulin, providing integrated ID cards for dual eligible plans, and offering monthly installment options for out-of-pocket prescription costs under Medicare Part D. These updates are designed to improve accessibility and affordability for beneficiaries.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Plan G Reviews 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.