by Russell Noga | Updated May 13th, 2023

Navigating the world of Medicare coverage can be a daunting task, especially when it comes to understanding the ins and outs of Medicare Part D, the prescription drug coverage component.

But fear not!

This comprehensive guide will walk you through everything you need to know about Medicare Part D plans, from their basic structure to the financial assistance programs available to help you cover the costs.

So, let’s embark on this journey to demystify Medicare Part D and empower you to make informed decisions about your prescription drug coverage.

Short Summary

- Medicare Part D is a form of prescription drug coverage offered in two forms – Standalone Prescription Drug Plans (PDPs) and Medicare Advantage Plans with Drug Coverage.

- Understanding the associated costs such as premiums, deductibles, copays, coinsurance, and exceptions/appeals can help to manage expenses.

- Financial assistance programs are available for those who qualify to reduce or eliminate Part D costs.

Compare Plans & Rates

Enter Zip Code

What is Medicare Part D?

Medicare Part D is a vital component of Medicare that offers assistance with prescription drug coverage. It comes in two flavors: Standalone Prescription Drug Plans (PDPs) and Medicare Advantage Plans with Drug Coverage.

Medicare Part D is a vital component of Medicare that offers assistance with prescription drug coverage. It comes in two flavors: Standalone Prescription Drug Plans (PDPs) and Medicare Advantage Plans with Drug Coverage.

Standalone PDPs are offered by private insurance companies and vary in cost and coverage, while Medicare Advantage Plans are an alternative to Original Medicare, which includes prescription drug coverage in addition to the benefits provided by Part A and Part B.

The costs associated with Medicare Part D include premiums, deductibles, copayments, and the coverage gap (also known as the donut hole). But don’t worry, there are financial assistance programs available to help you manage these expenses.

In this section, we will discuss the two main types of Medicare Part D prescription drug insurance options: Standalone Prescription Drug Plans (PDPs) and Medicare Advantage Plans with Drug Coverage.

Understanding the differences between these options is crucial to making informed decisions about your prescription drug coverage

Standalone Prescription Drug Plans (PDPs)

Standalone prescription drug plans (PDPs) are offered by private insurance companies and can vary significantly in terms of cost and coverage.

To select the best plan for your needs, you should evaluate the available stand-alone plans in terms of their costs and coverage. PDPs provide improved benefits compared to the basic benefit design.

These can include a lower or no deductible, reduced cost sharing, and a higher initial coverage limit. In 2022, the average monthly premium for enhanced benefit PDPs was $51, while PDPs that did not require a deductible had an average monthly premium of $90. It’s important to note that the number of PDP options available in 2022 is significantly lower than the peak in 2007.

When considering a standalone PDP, it’s essential to understand the costs associated with each plan. For instance, the average weighted monthly PDP premium increased by $5 between 2021 and 2022, and 73% of Part D stand-alone plan enrollees experienced an increase in their monthly premium if they remained in their current plan.

Also, 35% of non-LIS enrollees were projected to pay monthly premiums of at least $60 if they remained in their current plans. In 2022, the average Medicare beneficiary had access to 23 stand-alone PDPs.

Medicare Advantage Plans with Drug Coverage

A Medicare Advantage Plan with Drug Coverage is a type of Medicare Advantage plan that includes prescription drug coverage (Part D) in addition to the benefits provided by Original Medicare (Part A and Part B).

Medicare Advantage is an alternative to Original Medicare offered by private insurance companies, which includes prescription drug coverage.

It is important to note that it is not typically possible to obtain a separate, stand-alone Medicare Part D plan when you have Medicare Advantage.

By choosing a Medicare Advantage Plan with Drug Coverage, you can simplify your healthcare coverage by consolidating your medical and prescription drug benefits under a single plan. This can make it easier to manage your healthcare expenses and ensure that all your healthcare needs are met.

Moreover, these plans often include additional benefits beyond Original Medicare, such as dental, vision, and hearing coverage, making them an attractive option for many beneficiaries.

Understanding Medicare Part D Coverage

Medicare Part D coverage is based on a formulary, which is a list of drugs that a Medicare drug plan or Medicare Advantage plan with prescription drug coverage covers.

Medicare Part D coverage is based on a formulary, which is a list of drugs that a Medicare drug plan or Medicare Advantage plan with prescription drug coverage covers.

The coverage of drugs under Medicare Part D plans is subject to certain federal standards, but plans may use tiered cost-sharing structures to encourage the use of generic and lower-cost brand-name drugs.

In this section, we will discuss formularies, tiers, and the processes for exceptions and appeals.

Understanding the different phases of Medicare Part D coverage is crucial for managing your prescription drug costs.

There are four distinct phases of Medicare Part D coverage, each with different out-of-pocket costs: the initial coverage phase, the coverage gap (donut hole) phase, the catastrophic coverage phase, and the end of the year phase.

It’s important to be aware of these phases and how your costs may change throughout the year.

Formularies and Tiers

A formulary is a list of drugs that a Medicare drug plan or Medicare Advantage plan with prescription drug coverage covers. Medicare Part D plans use formulary tiers to determine the cost of your prescription medication, with drugs in lower tiers generally being more cost-effective than those in higher tiers.

A formulary is a list of drugs that a Medicare drug plan or Medicare Advantage plan with prescription drug coverage covers. Medicare Part D plans use formulary tiers to determine the cost of your prescription medication, with drugs in lower tiers generally being more cost-effective than those in higher tiers.

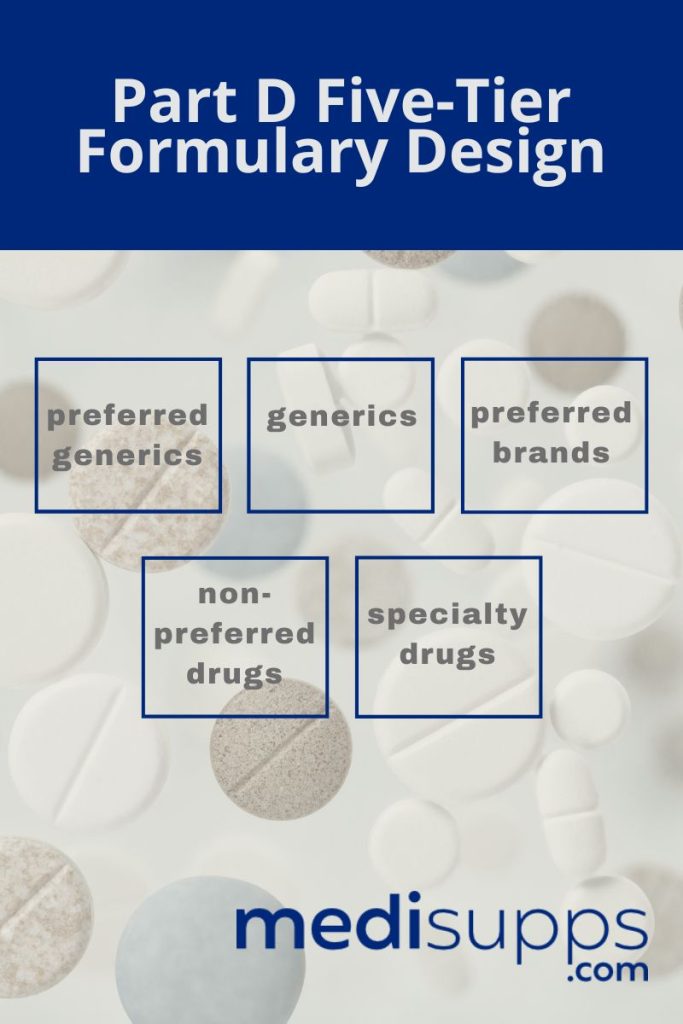

Part D typically follows a five-tier formulary design. These tiers include preferred generics, generics, preferred brands, non-preferred drugs, and specialty drugs.

Knowing the formulary tiers of your Medicare Part D plan is essential for managing your prescription drug costs.

In 2022, the median standard cost-sharing for preferred generics was $0, while for generics it was $5. In 12 of the 16 national PDPs for 2022, coinsurance amounts for non-preferred drugs ranged from 40% to 50%.

Additionally, in SilverScript Choice, the top PDP by enrollment, cost-sharing for preferred brands transitioned from a $35 flat copayment to a 17% coinsurance rate.

Being aware of these cost-sharing structures can help you make informed decisions about your prescription drug coverage and manage out-of-pocket expenses.

Exceptions and Appeals

Exceptions and appeals are processes that allow Medicare Part D plan enrollees to request coverage for a drug that is not on their plan’s formulary or to appeal a decision made by their plan.

Exception requests are granted when a plan sponsor determines that a requested drug is medically necessary for an enrollee.

Additionally, appeals have five levels and can be requested if an enrollee disagrees with a decision made by their plan.

You or your healthcare provider may request an exception if they believe it is necessary for you to obtain a drug that is not covered by a Medicare Part D prescription drug plan.

Such an exception can help you get access to the medication that your plan does not cover. Likewise, if you disagree with a decision made by your plan, you may appeal the decision through the five-level appeals process.

Understanding these processes can help ensure that you receive the medically necessary drugs you need, even if they are not initially covered by your plan’s formulary.

Medicare Part D Costs

Medicare Part D costs can include premiums, deductibles, copayments, and coinsurance, depending on the chosen plan and coverage phase.

Medicare Part D costs can include premiums, deductibles, copayments, and coinsurance, depending on the chosen plan and coverage phase.

For example, the average national premium is $32.74 per month in 2023, and the Part D deductible is capped at a maximum of $505 per year.

In this section, we will discuss the various costs associated with Medicare Part D and how they may affect your healthcare expenses.

Understanding the different costs associated with Medicare Part D can help you make informed decisions about your prescription drug coverage and better manage your healthcare expenses.

By being aware of premiums, deductibles, copayments, and coinsurance, you can choose a plan that best meets your needs and budget.

Premiums and Deductibles

Premiums refer to the monthly payments made for a Medicare Part D plan, while deductibles refer to the amount that must be paid out-of-pocket before the plan begins covering drug costs.

Premiums refer to the monthly payments made for a Medicare Part D plan, while deductibles refer to the amount that must be paid out-of-pocket before the plan begins covering drug costs.

In 2023, the average premium for basic coverage for stand-alone Medicare Part D plans was $31.50 per month. On the other hand, the Part D deductible was $505.

By understanding the differences between premiums and deductibles, you can better manage your healthcare expenses and choose a Medicare Part D plan that aligns with your financial situation.

It’s important to keep in mind that lower premiums may be associated with higher deductibles, and vice versa. Therefore, it’s crucial to weigh the costs and benefits of each plan before making a decision.

Compare Medicare Plans & Rates in Your Area

Evaluating and Choosing a Medicare Part D Plan

When evaluating and choosing a Medicare Part D plan, it’s important to consider factors such as your priorities, cost, coverage, and convenience.

When evaluating and choosing a Medicare Part D plan, it’s important to consider factors such as your priorities, cost, coverage, and convenience.

To compare Part D plans in your area, you can use the Medicare Plan Finder online tool, which allows you to analyze costs, pharmacy, and star ratings.

In this section, we will discuss how to use the Medicare Plan Finder to compare and choose a Medicare Part D plan that best suits your needs.

By using the Medicare Plan Finder to compare plans, you can ensure that your designated medications are covered and that your chosen plan meets your healthcare needs and budget.

Additionally, being aware of any restrictions or exceptions that may apply to your plan can help you make informed decisions about your prescription drug coverage and avoid unexpected costs.

Using the Medicare Plan Finder

The Medicare Plan Finder is an online tool provided by the government that enables users to search and compare Medicare Part D plans.

With the Medicare Plan Finder, you can compare Part D plans in your zip code, ascertain costs, pharmacy, and star ratings.

Utilizing the Medicare Plan Finder can help you find a plan that meets your healthcare needs and budget.

By comparing plans based on factors such as cost, coverage, and convenience, you can make an informed decision about your Medicare Part D prescription drug coverage and ensure that your healthcare expenses are manageable.

Considerations for Choosing a Plan

There are several factors you should consider when selecting a Medicare Part D plan, including the plan’s ratings, costs, drugs covered, and whether your usual pharmacy is in-network.

Additionally, it’s important to consider the costs of deductibles and copays, as well as the plan’s covered drug list, as they differ between plans.

You should also be aware of any restrictions or exceptions that may apply to your plan, as they can impact your coverage and costs.

By considering these factors and using the Medicare Plan Finder to compare plans, you can make the best decision for your prescription drug coverage.

Taking the time to evaluate your options and understand the various aspects of each plan can help you find a Medicare Part D plan that meets your healthcare needs and financial situation.

Medicare Part D Enrollment Period

The Medicare Part D enrollment period is a crucial time to enroll in a prescription drug plan or Medicare Advantage plan with drug coverage.

This period is held annually from October 15 to December 7. If you fail to sign up during the initial enrollment period, there will be significant, permanent penalties for enrolling at a later date.

In this section, we will discuss the various enrollment periods for Medicare Part D, including the initial enrollment period, special enrollment period, and late enrollment penalties.

By understanding the different enrollment periods and their implications, you can ensure that you enroll in a Medicare Part D plan or Medicare Advantage plan with drug coverage at the appropriate time.

This can help you avoid costly penalties and ensure that you have access to the prescription drug coverage you need.

Initial Enrollment Period

The Initial Enrollment Period for Medicare Part D is a seven-month period that commences three months before the month of your 65th birthday and concludes three months after the month of your 65th birthday.

This enrollment period is the optimal time to register for Medicare Part D coverage, as it can help you avoid late enrollment penalties.

By enrolling in a Medicare Part D plan during the initial enrollment period, you can ensure that you have prescription drug coverage when you need it most.

Whether you require a new prescription during this period or simply want to be prepared for future healthcare needs, enrolling in a Medicare Part D plan during the initial enrollment period can provide you with peace of mind and financial security.

Special Enrollment Period

The Special Enrollment Period is a two-month period that allows individuals to enroll in or change their Medicare Part D prescription drug plan if they have lost their current coverage, such as creditable prescription drug coverage from an employer.

The Special Enrollment Period is a two-month period that allows individuals to enroll in or change their Medicare Part D prescription drug plan if they have lost their current coverage, such as creditable prescription drug coverage from an employer.

This enrollment period is designed to provide Medicare beneficiaries with the opportunity to obtain prescription drug coverage without incurring late enrollment penalties.

If you experience a loss of coverage and qualify for a special enrollment period, you can enroll in a Medicare Part D plan to ensure that you have access to the prescription drug coverage you need.

By taking advantage of this special enrollment period, you can avoid costly penalties and maintain your access to vital medications.

Late Enrollment Penalties

The Late Enrollment Penalty is a fee assessed if you fail to enroll in a Medicare Part D plan during the initial enrollment period and do not have creditable prescription drug coverage.

This penalty is calculated as 1% per month for each month in which coverage should have been obtained. For example, if you delay enrollment in Medicare Part D for one year, you will incur an additional 12% monthly fee for the remainder of your life.

By enrolling in a Medicare Part D plan during the initial enrollment period or special enrollment period, you can avoid costly late enrollment penalties.

Understanding the consequences of late enrollment can help you make informed decisions about your prescription drug coverage and ensure that you have access to the medications you need.

Financial Assistance Programs for Medicare Part D

There are several financial assistance programs available to help Medicare beneficiaries with limited income and resources manage the costs associated with Medicare Part D.

These programs include the Extra Help program and State Pharmaceutical Assistance Programs.

In this section, we will discuss these financial assistance programs and their benefits. By taking advantage of financial assistance programs like the Extra Help program and State Pharmaceutical Assistance Programs, you can reduce or even eliminate some of the costs associated with Medicare Part D.

These programs can help ensure that you have access to the prescription drug coverage you need, regardless of your financial situation.

Extra Help Program

The Extra Help program is a government assistance program that assists Medicare beneficiaries with limited income and resources to reduce or eliminate Part D costs, including annual premiums, deductibles, and some copays and coinsurance costs.

To be eligible for the program, the annual income limit for an individual is $20,625, and for a married couple living together, the limit is $27,705.

To be eligible for the program, the annual income limit for an individual is $20,625, and for a married couple living together, the limit is $27,705.

In addition to helping with Part D costs, the Extra Help program provides an estimated annual savings of $5,100.

By taking advantage of the Extra Help program, you can reduce your out-of-pocket expenses and ensure that you have access to the prescription drug coverage you need.

State Pharmaceutical Assistance Programs

State Pharmaceutical Assistance Programs (SPAPs) are state-run programs that provide financial assistance to certain populations to help pay for prescriptions, though coverage varies significantly by state.

These programs offer supplemental assistance with prescription drug expenses for individuals who may not qualify for the Extra Help program or who need additional help with their prescription drug costs.

By taking advantage of State Pharmaceutical Assistance Programs, you can receive additional help with your prescription drug costs and ensure that you have access to the medications you need. It’s important to research the specific offerings of your state’s program to understand the benefits and eligibility requirements.

Summary

Understanding Medicare Part D and its various components, from the different types of plans to the enrollment periods and financial assistance programs, is crucial for managing your prescription drug costs and making informed decisions about your healthcare coverage.

By educating yourself on the ins and outs of Medicare Part D, you can confidently choose a plan that meets your healthcare needs and budget, ensuring that you have access to the prescription drug coverage you need throughout your golden years.

Compare Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are the two types of Medicare Part D plans?

There are two types of Medicare Part D plans: the private Medicare prescription drug plan (PDP) and the Medicare Advantage Plan with drug coverage (MAPD). With both, you have the ability to get coverage for many prescription drugs and access to a variety of formularies.

You can choose the plan that best fits your needs and budget. The PDP is a stand-alone plan that provides coverage for prescription drugs. The MAPD is a Medicare Advantage plan that includes drug coverage. Both plans have different costs and coverage.

How much does Medicare Part D Cost?

On average, the Medicare Part D cost for an individual is $32.74 per month. However, this amount may be affected by various factors such as a person’s income level and the company you might choose.

There are also different co-pays for each prescription, depending on what tier it falls in.

Therefore, the exact cost of Part D may vary depending on an individual’s circumstances.

Is Medicare Part D worth it?

For those without existing drug coverage, Medicare Part D is definitely worth considering. The prescription drug coverage offered by Part D plans can help make medications more affordable and even provide coverage for generic drugs for as little as $5 per month. Taking into account the potential savings on prescriptions, Part D may be a worthwhile addition to your health care coverage.

Part D plans are available from private insurance companies and are approved by Medicare. They offer a range of coverage options, including deductibles, copayments, and more.

What is Medicare Part D?

Medicare Part D is a federal program in the United States designed to assist eligible beneficiaries in covering the cost of prescription drugs. It’s an optional add-on to original Medicare (Parts A and B) and is offered by private insurance companies approved by Medicare.

What services are covered under Medicare Part D?

Medicare Part D covers prescription drugs. It includes both generic and brand-name drugs, which are categorized into tiers based on cost. The specific drugs covered can vary by plan, but each plan must meet the minimum standards set by Medicare.

How much does Medicare Part D cost?

The cost of Medicare Part D varies depending on the specific plan and the region in which you live. As of my knowledge cutoff in September 2021, the average premium was around $30-$40 per month. Additionally, there may be deductibles, copayments, and coinsurance.

What is a formulary in the context of Medicare Part D?

A formulary is a list of prescription drugs covered by a particular Medicare Part D plan. Formularies include both generic and brand-name drugs and are usually organized into cost tiers. Each Part D plan’s formulary must meet minimum standards set by Medicare, but the specific drugs covered

can vary from plan to plan.

When can I enroll in Medicare Part D?

Enrollment in Medicare Part D can be done during the Initial Enrollment Period, which is typically around your 65th birthday. Beyond that, there’s an Annual Election Period (October 15 – December 7 each year), during which you can join, switch, or drop a Medicare Part D plan. There are also Special Enrollment Periods based on certain situations like moving or losing other insurance.

Can I switch my Medicare Part D plan?

Yes, you can switch your Medicare Part D plan. The primary opportunity to do this is during the Annual Election Period (October 15 – December 7). During this period, you can switch from one Part D plan to another or drop your Part D coverage altogether.

Is Medicare Part D mandatory?

Medicare Part D is not mandatory. However, if you don’t sign up when you’re first eligible and you don’t have other creditable prescription drug coverage, you might pay a late enrollment penalty if you join a plan later.

What is the ‘donut hole’ in Medicare Part D?

The ‘donut hole’, or coverage gap, is a temporary limit on what a Medicare Part D plan will cover for prescription drugs. After you and your plan have spent a certain amount on covered drugs, you’re in the coverage gap. During this period, you’ll pay higher out-of-pocket costs for prescriptions.

Can I have both Medicare Part D and Medicaid?

Yes, you can have both Medicare Part D and Medicaid. Individuals who are eligible for both programs are known as ‘dual eligibles.’ If you’re dual eligible, most of your healthcare costs are likely covered.

What happens if I don’t enroll in Medicare Part D when I’m first eligible?

If you don’t enroll in Medicare Part D when you’re first eligible and you don’t have other creditable prescription drug coverage, you may have to pay a late enrollment penalty if you join a Part D plan later. The penalty is calculated based on how long you were without creditable coverage and could increase your monthly premium.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!