by Russell Noga | Updated March 23rd, 2025

In 2026, Medicare Supplement Plan G will see important updates aimed at improving coverage. These include the addition of anti-obesity medications and enhanced behavioral health services. If you are enrolled in Plan G or considering it, this article breaks down everything you need to know about Medicare Supplement Plan G 2026 and how these changes will benefit you.

Key Takeaways

- Medicare Supplement Plan G provides extensive coverage, including costs for coinsurance, copayments, and deductibles, filling most gaps left by Original Medicare.

- Significant changes in 2026 will be announced closer to the 2026 year.

- Plan G offers flexibility in choosing healthcare providers without network restrictions, along with predictable costs, making it a top option for Medicare beneficiaries.

Compare 2026 Plans & Rates

Enter Zip Code

What is Medicare Supplement Plan G?

Medicare Supplement Plan G is a popular choice among Medicare beneficiaries seeking to fill the gaps left by Original Medicare. Designed to cover expenses like coinsurance, copayments, and deductibles, Plan G offers extensive coverage that enhances financial security for its users. Among Medigap plans available to new enrollees, it offers the highest level of coverage, making it one of the top Medicare supplement plans.

One of the standout features of Plan G is its coverage of Medicare Part B excess charges. These charges occur when healthcare providers bill more than the Medicare-approved amount, and Plan G ensures that beneficiaries are not burdened with these additional costs. This makes it an attractive option for those who anticipate needing frequent medical care, as it mitigates unexpected healthcare expenses.

Furthermore, Plan G is widely available, with almost all insurance companies that sell Medigap policies offering it. This widespread availability means that Medicare enrollees can easily find a suitable Plan G policy, regardless of their location. For those looking for a robust and reliable Medigap plan, Plan G is a top contender.

Key Changes to Medicare Supplement Plan G in 2026

As we approach 2026, Medicare Supplement Plan G is set to undergo several important modifications aimed at enhancing coverage and improving access to healthcare services. One of the notable changes is the inclusion of anti-obesity medications. Starting in 2026, these medications will be covered under Plan G when prescribed specifically for treating obesity. This change aligns with the growing recognition of obesity as a significant health issue and the need for effective treatment options.

Another significant enhancement is the improved coverage for behavioral health services. Plan G will now offer more comprehensive coverage for mental health care, aligning cost-sharing with traditional Medicare. This change is part of a broader effort to promote equitable access to behavioral health care and ensure that beneficiaries receive the necessary support without facing financial barriers.

Additionally, new regulations will be introduced to reduce prior authorization burdens, making it easier for Plan G members to access necessary healthcare services. These adjustments aim to streamline the healthcare process and ensure that beneficiaries can receive timely care without unnecessary delays.

Overall, the changes to Plan G in 2026 are designed to enhance coverage and improve the overall healthcare experience for its users.

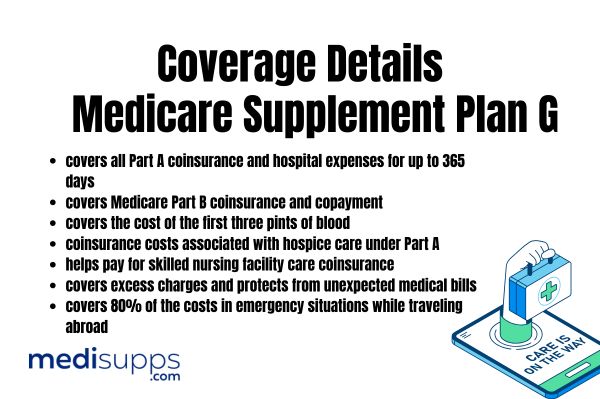

Coverage Details of Medicare Supplement Plan G 2026

Medicare Supplement Plan G offers a comprehensive range of coverage options that fill the gaps left by Original Medicare. One of the key benefits is the coverage of all Part A coinsurance and hospital expenses for up to 365 days after Medicare benefits are exhausted. This extended coverage ensures that beneficiaries are not left with substantial hospital bills if they require long-term care.

Plan G also includes coverage for Medicare Part B coinsurance or copayment, which is crucial for outpatient services. This means that beneficiaries can receive necessary medical treatments without worrying about high out-of-pocket costs. Additionally, Plan G covers the cost of the first three pints of blood needed for medical procedures, which can be a significant expense for those undergoing surgery or other treatments.

Hospice care is another area where Plan G provides valuable coverage. The plan pays for coinsurance costs associated with hospice care under Part A, ensuring that beneficiaries receive the compassionate care they need during difficult times. Moreover, Plan G helps pay for skilled nursing facility care coinsurance, which can be a significant financial burden for those requiring rehabilitation or long-term care.

Finally, Plan G covers excess charges that may occur when healthcare providers bill above Medicare-approved amounts. This feature provides peace of mind to beneficiaries, knowing that they are protected from unexpected medical bills. Additionally, in emergency situations while traveling abroad, Plan G offers coverage for up to 80% of the costs, subject to certain limits. This makes it an excellent choice for those who travel frequently and want to ensure they have adequate health coverage.

Benefits of Choosing Plan G

Choosing Medicare Supplement Plan G offers a multitude of benefits for Medicare beneficiaries. One of the primary advantages is its extensive coverage, which addresses almost all gaps in Medicare, with the exception of the Part B deductible. This comprehensive coverage provides financial security, allowing beneficiaries to manage their healthcare expenses more effectively and avoid unexpected medical bills. Additionally, Medicare supplement insurance can further enhance this coverage.

Another significant benefit of Plan G is the flexibility it offers in choosing healthcare providers. Unlike some Medicare Advantage plans, Plan G does not restrict beneficiaries to specific provider networks, allowing them to visit any doctor or specialist that accepts Medicare. This freedom ensures that beneficiaries can receive the best possible care without worrying about network limitations.

Plan G provides extensive coverage at a predictable cost, making it easier for beneficiaries to budget their healthcare expenses.

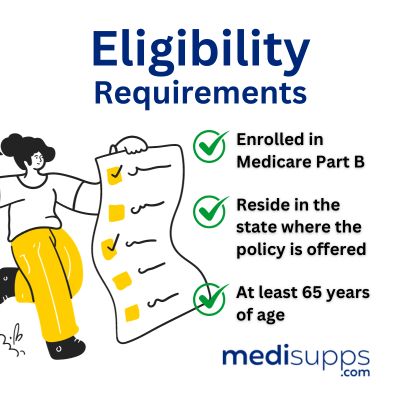

Eligibility and Enrollment

Eligibility for the Medicare Supplement Plan G requires enrollment in Medicare Part B. The Medicare Open Enrollment Period is six months long, starting from the first day of the month individuals turn 65 and are enrolled in Part B. During this period, beneficiaries can purchase a Medigap policy without undergoing medical underwriting, ensuring they receive coverage regardless of their health status.

In some states, there are specific laws that allow individuals under 65 to purchase a Medigap policy, providing more inclusive access to these valuable supplemental benefits. However, it’s important to note that insurance companies typically do not offer Medigap policies to individuals who have Medicaid.

When enrolling in a Medigap plan, individuals must continue to pay their Medicare Part B premium. Additionally, if switching from a Medicare SELECT policy or if their current Medigap policy is being dropped, there are specific time frames within which they must apply for a new Medigap policy to avoid a lapse in coverage. Applying for a Medigap policy at least 60 days before current coverage ends ensures a smooth transition and avoids potential late enrollment penalties.

Compare Medicare Plans & Rates in Your Area

Comparing Plan G with Other Medigap Plans

Medicare Supplement Plan G is often viewed as a successor to Plan F for new Medicare beneficiaries, offering broad coverage while being unavailable to those who qualify after January 1, 2020. One of the key differences between Plan G and other Medigap plans, such as Plan N, is that Plan G does not require beneficiaries to pay copayments for office visits and emergency room scenarios. This makes it a more attractive option for those who seek predictable healthcare costs without additional out-of-pocket expenses.

Unlike some Medicare Advantage plans, Plan G does not impose network restrictions, giving beneficiaries the freedom to choose their doctors and healthcare providers. This unrestricted access ensures that members of Plan G can receive care from hospitals and specialists across the U.S. without needing referrals. Additionally, Plan G covers Medicare Part B excess charges, which is not a feature of all Medigap plans.

Plan G stands out as a top choice for those valuing flexibility and comprehensive coverage, allowing beneficiaries to visit any healthcare provider that accepts Medicare.

How to Switch to Plan G

Switching to Medicare Supplement Plan G involves checking if it is available from an insurer in your area. Research is necessary as not all insurers offer Plan G.

After identifying an insurer, contact your current Medigap provider to cancel your existing policy. Ensuring a seamless transition is crucial to avoid gaps in coverage.

Apply for the new Plan G policy well in advance of your current policy’s expiration to allow sufficient time for processing and approval.

Costs Associated with Plan G

The premium costs for Medicare Supplement Plan G tend to be higher compared to other Medigap plans due to its extensive coverage. However, premiums can vary based on factors like the insurer, geographical location, age, and health status of the beneficiary. Shopping around and comparing rates from different insurance companies helps find the most cost-effective option.

Insurance companies may offer various discounts that can help reduce the premium costs for Medigap coverage policies. For example, some insurers provide discounts for non-smokers, couples, or those who pay their premiums annually instead of monthly. The cost of Medigap policies, including Plan G, typically increases annually, so budgeting for potential premium hikes over time is necessary.

While Plan G covers many medical expenses, it does not include the Medicare Part B deductible, which beneficiaries must pay out-of-pocket. Despite this, Plan G’s comprehensive coverage ensures predictable healthcare costs, simplifying expense management.

High Deductible Plan G Option

The High Deductible Plan G offers a cost-saving alternative for those anticipating lower healthcare expenses, featuring a reduced monthly premium compared to traditional plans. Choosing the high deductible option allows beneficiaries to save on monthly premiums while still enjoying Plan G’s extensive coverage.

The High Deductible Plan G activates coverage only after the calendar year deductible is fulfilled. As of 2026, this deductible is not set, but you can check back on this website for updated information. This means that beneficiaries will need to pay out-of-pocket for their medical expenses up to this amount before the plan’s coverage kicks in.

For those who do not anticipate high medical costs, this plan can be a cost-effective way to maintain comprehensive health coverage while managing expenses.

Prescription Drug Coverage and Plan G

While Medicare Supplement Plan G offers extensive coverage for various medical expenses, it does not include prescription drug coverage. This means that beneficiaries will need to purchase a separate Medicare Part D plan to cover their medication expenses. Medicare Part D plans are specifically designed to provide prescription drug coverage, ensuring that beneficiaries have access to the medications they need.

Carefully reviewing and selecting a Part D plan that covers specific medications is crucial, as not all plans cover the same drugs. Combining Plan G with a suitable Part D plan ensures comprehensive health coverage for both medical and prescription drug expenses.

Provider Networks and Plan G

A significant advantage of Plan G is the unrestricted access to healthcare providers, allowing beneficiaries to visit any provider that accepts Medicare without network restrictions. This flexibility benefits those who wish to receive care from specialists and hospitals across the U.S. without needing referrals.

In 2026, Medicare plans will enhance transparency in provider directories, making it easier for enrollees to access information about available healthcare providers. Improved transparency will help beneficiaries make informed healthcare decisions and ensure they receive the best possible care.

Future Outlook for Plan G

The future of Medicare Supplement Plan G looks promising, with several potential advancements on the horizon. Legislative changes and technological advancements, such as the increased use of artificial intelligence in healthcare, are expected to shape the coverage landscape of Plan G. These changes aim to improve access and efficiency in healthcare services, ensuring that beneficiaries receive timely and effective care.

As these advancements take effect, beneficiaries of Plan G can look forward to improved healthcare experiences and better outcomes. The ongoing efforts to enhance coverage and reduce barriers to care will continue to make Plan G a top choice for those seeking comprehensive health coverage.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

In summary, Medicare Supplement Plan G offers extensive coverage that fills the gaps left by Original Medicare, providing financial security and peace of mind for beneficiaries. The upcoming changes in 2026 further enhance its benefits, making it an even more attractive option for those seeking comprehensive health coverage.

With the flexibility to choose healthcare providers, predictable healthcare costs, and the option of a high deductible plan for cost savings, Plan G stands out as a top choice among Medigap plans. As you consider your healthcare options, Plan G provides a robust and reliable solution for managing your medical expenses and ensuring access to quality care.

Frequently Asked Questions

Does Medicare Supplement Plan G cover prescription drugs?

Medicare Supplement Plan G does not cover prescription drugs. You’ll need to enroll in a separate Medicare Part D plan for that coverage.

Can I switch to Plan G if I already have a different Medigap policy?

Yes, you can switch to Plan G from another Medigap policy, but ensure you check with insurers for availability and cancel your current policy appropriately.

What are the key changes to Medicare Supplement Plan G in 2026?

The changes for 2026 have not been announced yet. Please check back to this website for updated information.

How does Plan G compare to Plan F?

Plan G is generally viewed as a more affordable option compared to Plan F for new enrollees, as it does not cover the Part B deductible. However, Plan G still offers comprehensive coverage without network restrictions, allowing for greater flexibility in provider choices.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plan G 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.