by Russell Noga | Updated August 23rd, 2023

Does Medicare Plan G Cover Emergency Room Visits?

Navigating the complex world of Medicare plans can be daunting, especially when it comes to understanding coverage for emergency room visits.

One question that often arises is, “Does Medicare Plan G cover emergency room visits?” G has emerged as a popular choice for many, but what does it truly offer in terms of emergency room coverage?

In this article, we’ll delve into the specifics of Medicare Plan G, compare it to other Medigap and Medicare Advantage plans, and provide guidance on choosing the right plan for your emergency room needs.

Short Summary

- Understanding Medicare Plan G is essential for making an informed decision about emergency room coverage.

- Medicare Plan G covers copayments and coinsurance related to emergency visits, though the Part B deductible must be covered by the individual.

- Comparing costs and benefits of Medicare plans is necessary in order to select a suitable plan that provides adequate coverage for unexpected healthcare events.

Understanding Medicare Plan G

Medicare Plan G is a Medigap plan designed to provide additional coverage for out-of-pocket expenses associated with Original Medicare, including emergency room visits.

Medicare Part B, which is considered hospital insurance, typically covers outpatient emergency room visits for injuries, sudden illnesses, or illnesses that quickly deteriorate.

However, even with Medicare Part B coverage, you may still be liable for some costs associated with emergency room visits, making medical insurance like Medicare Plan G a valuable addition.

It’s essential to understand the coverage offered by Medicare Plan G and how it compares to other Medigap plans to ensure you’re making an informed decision for your healthcare needs.

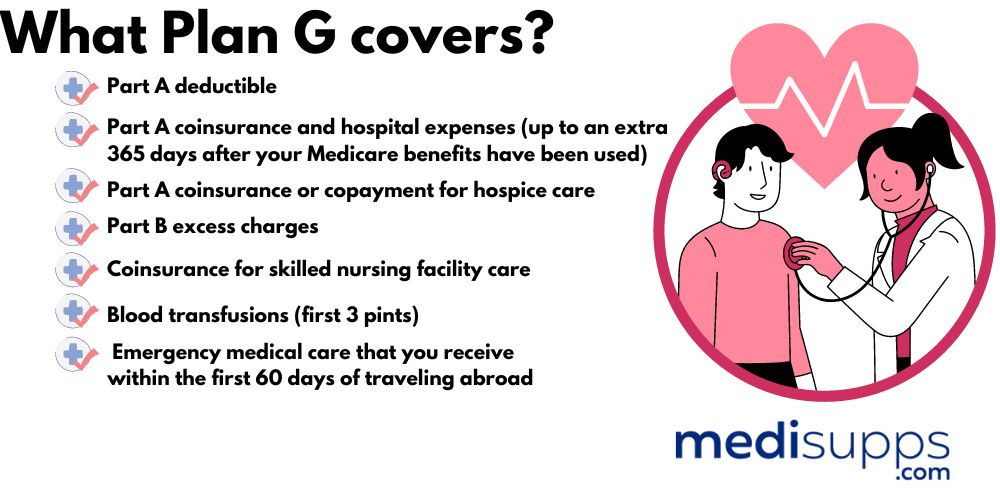

What does Medicare Plan G cover?

Medicare Plan G offers comprehensive Medicare coverage for services covered by Original Medicare (Part A and Part B). This includes coverage for:

- Part A and Part B coinsurance

- Part A deductible

- Part B excess charges

- Additional services that are Medicare-approved

However, it’s important to note that Medicare Plan G does not cover the Part B deductible.

In comparison to other Medigap plans, Medicare Plan G stands out for its coverage of Medicare Part B excess charges, which are not available with other plans.

Furthermore, while Plan G does not cover the Medicare Part B deductible, some other plans may cover it, making Plan G one of the most comprehensive Medicare plans available.

Comparing Medicare Plan G to other Medigap plans

When evaluating different Medicare plans for 2025, it’s important to compare Medicare Plan G to other Medicare plans to determine the most suitable coverage for your individual needs.

While Medicare Plan G is similar to other Medigap plans in terms of essential benefits coverage, the primary difference lies in the coverage of Medicare Part B excess charges and the Medicare Part B deductible.

Understanding these differences is crucial in making an informed decision about your healthcare coverage.

By comparing the costs and benefits of Medicare Plan G to other Medigap plans, you can ensure that you’re choosing the plan that best meets your needs and provides the necessary coverage for:

- Emergency room visits

- Hospital stays

- Doctor visits

- Prescription drugs

- Preventive care

Compare 2025 Plans & Rates

Enter Zip Code

Emergency Room Coverage Under Medicare Plan G

With Medicare Plan G, you can expect coverage for copayments and coinsurance related to emergency room visits, reducing your out-of-pocket costs.

However, it’s worth noting that while Medicare Part B typically covers emergency department services for injuries, sudden illnesses, or rapidly deteriorating illnesses, obtaining emergency room services outside of your Medicare plan’s network may result in higher costs.

Does Medicare cover emergency room visits? Yes, but it’s essential to be aware of the potential costs associated with out-of-network care.

It’s important to understand the coverage you have and the potential costs associated with emergency services.

Copayments and coinsurance

Copayments are a fixed amount that you’re required to pay out of pocket at the time of an emergency room visit, while coinsurance is a percentage of the total cost of the visit that you’re responsible for paying.

In 2023, the out-of-pocket costs for an emergency room visit under Original Medicare included a $226 deductible and a 20% coinsurance.

If you return to the hospital within 3 days of your emergency room visit for related treatment, you won’t be responsible for the coinsurance as Part A will cover the visit as an inpatient hospital stay, with out-of-pocket costs comprising a $1,676 deductible in 2025 for the first 60 days.

Medicare Plan G steps in to provide coverage for copayments and coinsurance for emergency room visits, helping to ease the financial burden associated with these unexpected healthcare events.

Deductibles for emergency room visits

An important aspect to consider when evaluating Medicare Plan G’s coverage for emergency room visits is the Part B deductible, which is not covered by the plan.

For the year 2025, the Part B deductible is $257. While Medicare Plan G covers copayments and coinsurance for emergency room visits, you’ll still be responsible for meeting the Part B deductible.

Deductibles for emergency room visits vary depending on the specific insurance plan. Generally, insurance companies will cover the cost of the visit to the ER, with the exception of deductibles or copays. The amount for deductibles is contingent upon the specific insurance plan.

Medicare Advantage Plans vs. Medicare Plan G for Emergency Room Coverage

Both Medicare Advantage plans and Medicare Plan G provide coverage for emergency room visits, although the specifics of coverage and costs may differ.

It’s important to compare these two options to ensure you’re choosing the plan that best meets your emergency room coverage needs.

When comparing the two plans, consider the cost of the plan, including emergency room costs, and the coverage for the emergency room.

Differences in coverage

Medicare Advantage plans, also known as Medicare Advantage plans, are required to provide coverage for emergency room visits, but the rules regarding coverage and out-of-pocket expenses may vary from those of Original Medicare.

The differences in coverage between Medicare Advantage plans and Medicare Plan G depends on individual plan details. To fully understand the disparities in coverage, it’s essential to review the particular benefits and coverage of each plan.

By examining the specific benefits and coverage of each plan, you’ll be able to make an informed decision regarding the best choice for your emergency room needs. It’s important to consider factors such as:

- Copayments

- Coinsurance

- Deductibles

- Any other services covered by the plan

Cost Comparison

When it comes to evaluating costs and coverage for emergency room visits, it’s important to compare Medicare Plan G with Medicare Advantage plans.

Medicare Part B provides coverage for emergency department services, but out-of-pocket costs such as deductibles, copayments, and coinsurance may still apply.

On the other hand, Medicare Advantage plans may also offer coverage for emergency room visits, but the specific costs and benefits will vary according to the individual plan.

To make an informed decision about your emergency room coverage, follow these steps:

- Review the details of each plan to cover emergency room visits.

- Compare the costs and benefits provided.

- Determine the most suitable option for your healthcare needs.

- Ensure that you’re prepared for any emergency room visits that may arise.

Additional Benefits of Medicare Plan G for Emergency Care

In addition to its coverage for emergency room visits, Medicare Plan G offers several other benefits for emergency care, including foreign travel emergency coverage and skilled nursing facility care coinsurance.

These additional benefits can provide valuable peace of mind and financial protection in the event of unexpected healthcare needs.

Foreign travel emergency coverage

One of the key benefits of Medicare Plan G is its foreign travel emergency coverage, which covers 80% of the cost of emergency care abroad.

This coverage can be invaluable for individuals who travel frequently or plan to spend time abroad, as it ensures that you’ll have access to emergency care if the need arises.

By including foreign travel emergency coverage in its offerings, Medicare Plan G provides a comprehensive plan for individuals seeking peace of mind while traveling.

This additional coverage sets the plan apart from other Medicare options and makes it an attractive choice for those with a penchant for adventure.

Skilled nursing facility care coinsurance

Another additional benefit offered by Medicare Plan G is the coverage of skilled nursing facility care coinsurance, which reduces out-of-pocket costs for post-hospitalization care.

Under Medicare Plan G, the skilled nursing facility care coinsurance is based on the Medicare-approved amount, which is $185.50 per day for days 21 to 100 of each benefit period.

This coverage can be particularly helpful for individuals who require skilled nursing care following a hospital stay, as it alleviates some of the financial burden associated with these services.

With this benefit, Medicare Plan G offers a comprehensive solution for individuals seeking robust coverage for both emergency room visits and post-hospitalization care.

Compare Medicare Plans & Rates in Your Area

How to Choose the Right Medicare Plan for Your Emergency Room Needs

Choosing the right Medicare plan for your emergency room needs involves assessing your personal health risks and needs, as well as comparing the costs and benefits of various plans. By taking these factors into consideration, you can make an informed decision about your healthcare coverage and ensure that you’re prepared for any emergency room visits that may arise.

It is important to understand the differences between the various plans available, such as the deductibles.

Assessing personal health risks and needs

It’s essential to consider your current health status, any pre-existing conditions, and potential health risks that may require frequent emergency room visits when assessing your personal health risks and needs.

By understanding these factors, you can choose a Medicare plan that provides the coverage you need and offers peace of mind in the event of an unexpected healthcare event.

In addition to evaluating your health risks and needs, it’s important to review the coverage and benefits provided by each Medicare plan.

This will enable you to make an informed decision about the best plan for your emergency room needs, ensuring that you have access to the care you require when you need it most.

Comparing costs and benefits

When comparing the costs and benefits of different Medicare plans, it’s important to consider factors such as:

- Copayments

- Coinsurance

- Deductibles

- Any other services covered by the plan

By reviewing these details, you can determine the most suitable option for your healthcare needs and ensure that you’re prepared for any emergency room visits that may arise.

In addition to comparing the costs and benefits of Medicare Plan G to other Medigap and Medicare Advantage plans, it’s crucial to:

- Consult with your healthcare provider and insurance company to fully understand the coverage and costs associated with each plan

- Make an informed decision about your healthcare coverage

- Ensure that you have access to the care you need when you need it most.

Summary

In conclusion, Medicare Plan G offers comprehensive coverage for emergency room visits, with additional benefits such as foreign travel emergency coverage and skilled nursing facility care coinsurance.

By assessing personal health risks and needs and comparing the costs and benefits of various plans, individuals can make an informed decision about their emergency room coverage.

With the right Medicare plan in place, you can have peace of mind knowing that you’re prepared for any unexpected healthcare events that may arise.

Compare Plans & Rates

Enter Zip Code

Frequently Asked Questions

What plan G does not cover?

Plan G does not cover Part B deductible, dental care, vision, hearing, skilled nursing facility care, private-duty nursing or prescriptions, requiring a separate policy to be purchased for such needs.

This means that individuals who need these services must purchase a separate policy to cover them.

What does Medicare Plan G cover?

Medicare Plan G covers 100% of Medicare Part A and Part B copays and coinsurance, Skilled Nursing and rehab facility stays, and Hospice care, and also shields against balance billing.

It does not cover the Medicare Part B deductible, which must be paid out of pocket.

Does Medicare Plan G have a maximum out-of-pocket?

Medicare Plan G does not have a maximum out-of-pocket, as your only expense is the annual Part B deductible ($257 for 2025).

Other Medicare supplement plans, such as Plan K or Plan L do have out-of-pocket limits, so if this is something you are looking for, these may be a better fit.

Does Medicare Advantage cover emergencies?

Yes, Medicare Advantage Plans cover emergency and urgent care both physically and mentally without additional costs or coverage rules.

What factors should I consider when choosing the right Medicare plan for my emergency room needs?

When selecting a Medicare plan for your emergency room needs, consider your personal health risks and needs, as well as compare the costs and benefits of different plans to find the one best suited to you.

Take the time to research the different plans available and understand the coverage they provide. Consider the cost of premiums, deductibles, copayments, and coinsurance, as well as any additional benefits that may be included.

Find the Right Medicare Plan for You

Finding the right Medicare Supplement Plan doesn’t have to be confusing. Whether it’s a Medigap plan, you have questions or if you want to find out more about the Medicare Plan G Cover Emergency Room Visits, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!