When it comes to Medigap plans, Medicare Part B Supplement Plan G tops the list as the most popular plan, and for good reason.

Medicare Supplement Plan G offers outstanding coverage for a relatively low cost, with just one small out-of-pocket expense to pay.

Why supplement Medicare Part B?

When it comes to Original Medicare, there are two main parts.

- Medicare Part A (Hospital coverage)

- Medicare Part B (Doctor’s services)

These two main parts of Medicare provide coverage, however, there are “gaps” within them. Gaps are expenses that you are required to pay.

Many people choose to enroll in a Medicare Supplement Plan (Also called Medigap), which helps pay most of these gaps for them. A Medicare Part B Supplement Plan G pays all of the gaps between Medicare Part A and B, except for one.

That one “gap” it does not pay, is the annual Medicare Part B deductible.

Compare Medicare Plan G rates now

Medicare Part B Deductible

Prior to Medicare paying any medical bills for you, you’ll need to pay the annual Medicare Part B deductible. In 2024, this deductible is $240 and it goes up or down slightly each year depending on economic factors.

Once you pay this deductible each year, Medicare Part B will pay 80% of your medical bills. Without a Medicare supplement plan, you are required to pay the remaining 20% of your bills as well as any other coinsurance, deductibles, and co-pays.

This is why many people enroll in a Medicare Part B supplement Plan G.

Medicare Supplement Plan G - Just One Deductible

While there are 10 different Medicare Supplement plans available, including two high-deductible versions of plans. most people enroll in just a few plans.

Medicare Supplement Plan G is now by far the most popular of all the Medigap plans for people new to Medicare.

This is because of Plan G’s great coverage, and relatively low cost.

One important thing to keep in mind is that every insurance company offers the exact same Plan G and benefits, but they all charge different rates for it. Therefore, it’s important to allow us to help compare all the top companies for you to make sure you don’t overpay for Medicare Supplement Plan G.

Our service to help you is entirely FREE!

Medicare Supplement Plan G Companies

Because each company offers the same thing, but they all charge different rates, it’s easy to overpay for your coverage. And calling each company on your own isn’t the solution, as they will all try to sell you their coverage without telling you what other companies charge.

Some of the top companies offering Medicare Plan G are:

- Mutual of Omaha

- Cigna

- Aetna

- United Healthcare

- Blue Cross Blue Shield

- Accendo

And several more.

We’re independent brokers working with all the top companies and we’ll shop them all for FREE to make sure you don’t overpay each year.

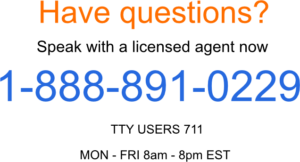

We’ve helped thousands of people over the last 15 years save money on Medicare Plan G. Just call us today at 1-888-891-0229.

Aetna Medicare Supplement Plan G

Aetna has long been an industry leader in providing Medigap insurance.

Consumers are likely to take advantage of Aetna’s competitive rates and household discounts as they enroll in Aetna’s Medicare Plan G this coming year. Aetna has several branches offering Medigap plans across the country.

- Aetna Health & Life

- Accendo

- American Continental

- Continental Life

Mutual of Omaha Medicare Plan G

Boasting more than a century of industry experience, Mutual of Omaha is set to remain one of the premier providers of Medicare Plan G in 2024.

This esteemed company will offer some of the most competitive premiums in various states, and households can save up to 12% with their exclusive discount – even if you don’t have a partner enrolled in the plan.

There are several divisions of Mutual of Omaha that have different company names, such as:

- Mutual of Omaha

- United of Omaha

- Omaha Insurance Company

- United World

Cigna Medicare Supplement Plan G

Cigna may not offer the lowest premiums across numerous states, however, certain locations may display competitive rates which they make come up best so it’s worth considering them. We can easily help you see if they’re a good option for you.

Cigna does also offer a household discount on their plans in several states, and they too have a few different company names.

- Cigna Health & Life

- American Retirement Life Insurance Company

- Loyal American

Accendo Medicare Supplement Plan G

Accendo is a division of Aetna and is owned by CVS. They’re a fantastic option for Medigap insurance as they consistently have some of the lowest premiums for Medicare Part B Supplement Plan G.

With low monthly rates and a huge 14% household discount in many areas, Accendo is most definitely a company to consider for Plan G.

How to Enroll in Medicare Supplement Plan G in 2024

The easiest way to get started and enroll in Medicare Plan G is to call us now at 1-888-891-0229.

We’ll check the rates of all the top companies in your area and answer any questions you might have. The application process takes less than 10 minutes by phone.

We’ll make sure you don’t overpay now or for years to come.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.