by Russell Noga | Updated December 28th, 2023

Does Medicare Cover Emergency Room Visits?

Every year, millions of Americans rely on Medicare to help cover the costs of their healthcare needs.

Every year, millions of Americans rely on Medicare to help cover the costs of their healthcare needs.

One critical aspect of healthcare coverage is understanding “Does Medicare cover emergency room visits?”

After all, emergencies can happen to anyone, and it’s essential to know what to expect when it comes to coverage and costs.

In this blog post, we will explore the various aspects of Medicare coverage for ER visits, including Original Medicare, Medicare Advantage, and Medigap plans, and how they can impact your out-of-pocket expenses.

By the end, you’ll have a comprehensive understanding of how Medicare covers emergency care and how to make informed decisions about your healthcare coverage.

Key Takeaways

- Original Medicare provides coverage for ER visits through Part A and B, with additional benefits offered by Medicare Advantage plans and Medigap plans.

- Costs associated with ER visits vary depending on the type of plan chosen. Out-of-pocket expenses are typically capped.

- When selecting a Medigap plan to cover emergency room expenses, it is important to consider factors such as costs, coverage options & supplemental insurance.

Understanding Medicare’s Coverage of Emergency Room Visits

Medicare, the federally-funded health insurance program, provides coverage for ER visits within the United States and its territories.

Part A of Medicare, also known as hospital insurance, provides insurance for inpatient hospital stays. Outpatient visits are covered by Part B.

Therefore, both components of Medicare play a role in covering ER visits, with Part A focusing on inpatient stays and Part B on outpatient visits.

You should be aware that costs linked to ER visits under Original Medicare can fluctuate based on the particular services received during the visit and your Medicare plan.

The upcoming sections will provide more detailed insights into the specifics of Original Medicare and ER visits, focusing on the differences between Part A and Part B coverage.

We will also examine how Medicare Advantage plans differ from Original Medicare in terms of ER coverage and the additional benefits they may offer.

Finally, we’ll explore Medicare’s coverage of ambulance transportation and non-emergency ER visits, as well as how Medicare Supplement (Medigap) plans can help with ER expenses.

Original Medicare and ER Visits: Part A vs. Part B

Original Medicare covers ER visits differently depending on whether you require inpatient or outpatient care. Medicare Part A covers inpatient hospital stays that require formal admission, including inpatient hospital costs, while Part B covers outpatient visits.

In other words, if you are admitted to the hospital for at least two nights of medically necessary care, your ER visit and inpatient stay will generally be covered under Part A.

In other words, if you are admitted to the hospital for at least two nights of medically necessary care, your ER visit and inpatient stay will generally be covered under Part A.

On the other hand, if your ER visit does not require a formal admission, and you are treated as an outpatient, Part B will cover the visit.

Understanding how outpatient hospital status affects the coverage provided by Original Medicare is important during an ER visit.

For example, being considered an “inpatient” or “outpatient” will determine whether Part A or Part B coverage applies. This distinction is vital as it can impact your out-of-pocket costs and the services covered during your ER visit.

Costs Associated with ER Visits Under Original Medicare

ER visits can be costly, and understanding the cost-sharing structure under Original Medicare is essential.

Depending on the specific services received during your ER visit, you may be responsible for deductibles, copayments, and coinsurance. The deductible for Medicare Part B is $226 for 2023.

Once you have satisfied your deductible, Medicare Part B usually pays for 80% of the amount approved by Medicare for doctor services. You will be responsible for the remaining 20%.

Bear in mind that there is a limit on out-of-pocket expenses for ER visits under Original Medicare.

However, the exact amount of the cap may vary depending on your specific Medicare plan and the services received during your ER visit.

To better understand your out-of-pocket costs for ER visits, it’s advised to review your Medicare plan documents or contact your Medicare provider for more information.

View Medicare Rates for 2024

Enter Zip Code

Medicare Advantage Plans and Emergency Room Coverage

Medicare Advantage plans, also known as Part C, are an alternative to Original Medicare and are offered by private insurance companies.

These plans must provide the same coverage as Original Medicare (Part A and Part B), but they can have different rules, costs, and coverage restrictions. Medicare Advantage plans do offer coverage for emergency room visits.

However, the rules and out-of-pocket expenses can be different from Original Medicare.

The subsequent sections will contrast ER coverage among Medicare Advantage plans and elaborate on any extra benefits they might provide.

This information can help you determine if a Medicare Advantage plan is the right choice for your healthcare needs when it comes to emergency room coverage.

Comparing ER Coverage Between Medicare Advantage Plans

ER coverage varies among Medicare Advantage plans, with differences in deductibles, copayments, and coinsurance payments.

Original Medicare’s cost terms for ER visits may not be the same as those of a Medicare Advantage plan. Every plan sets its own rules and pricing.

For example, the Medicare Advantage PPO Plus Plan by Anthem Blue Cross requires beneficiaries to pay a $250 admission fee plus a 20% coinsurance payment for services, while the CignaHealthSpring Advantage HMO plan has a flat $90 copayment for Medicare-covered ER visits.

When selecting a Medicare Advantage plan, it’s important to analyze and contrast the benefits and costs of different plans to choose the one that best fits your needs and budget.

Understanding the various cost-sharing structures for ER visits under different Medicare Advantage plans can help you make an informed decision about your healthcare coverage.

Additional Benefits Offered by Medicare Advantage Plans

Some Medicare Advantage plans offer additional benefits for ER visits, such as:

- Reduced copayments or coinsurance

- Prescription drug coverage

- Vision coverage

- Hearing coverage

- Dental coverage

- Wellness coverage

An example of an additional benefit for ER visits is the waived copayment for hospital admissions within 24 hours of an ER visit. Some Medicare Advantage plans offer this benefit, which can help reduce out-of-pocket expenses during an emergency.

When considering a Medicare Advantage plan, it’s important to review the plan’s details and understand the additional benefits offered to ensure it meets your healthcare needs.

Ambulance Transportation and Medicare

In addition to covering ER visits, Medicare Part B also covers ambulance transportation to the hospital.

However, patients are responsible for 20% of the cost after meeting the deductible. As of 2023, the deductible for Medicare Part B is $226. This coverage can be crucial for patients who require immediate medical attention and cannot safely reach the hospital by other means.

However, patients are responsible for 20% of the cost after meeting the deductible. As of 2023, the deductible for Medicare Part B is $226. This coverage can be crucial for patients who require immediate medical attention and cannot safely reach the hospital by other means.

The upcoming sections will address Medicare’s coverage for ambulance transportation and the associated costs and copayments.

Understanding the coverage and costs associated with ambulance transportation under Medicare is vital for those who may require these services in an emergency.

When is Ambulance Transportation Covered by Medicare?

Ambulance transportation is covered by Medicare when it is deemed medically necessary and when other means of transportation could endanger the patient’s health.

Some examples of medical conditions that may necessitate an ambulance ride under Medicare include:

- Severe injuries or trauma

- Chest pain or suspected heart attack

- Stroke or suspected stroke

- Difficulty breathing or respiratory distress

- Uncontrolled bleeding

- Loss of consciousness

- Severe burns

- Suspected spinal injury

- Severe allergic reactions

- Any other conditions where immediate medical attention is essential.

To be eligible for Medicare coverage of ambulance transportation, the following documentation is typically required:

- A signed and dated Physician Certification Statement (PCS) from the patient’s attending physician

- Ambulance trip reports

- Documentation submitted with ambulance claims

Understanding the criteria for Medicare coverage of ambulance transportation is crucial for patients who may require emergency services in an emergency.

Costs and Copayments for Ambulance Services

The costs associated with ambulance services under Medicare include a deductible and 20% coinsurance, with potential additional charges for mileage and supplies. As of 2023, the deductible for Medicare Part B is $226.

After meeting the deductible, Medicare Part B typically covers 80% of the Medicare-approved amount for ambulance services, and the beneficiary is responsible for the remaining 20% of coinsurance.

After meeting the deductible, Medicare Part B typically covers 80% of the Medicare-approved amount for ambulance services, and the beneficiary is responsible for the remaining 20% of coinsurance.

It is important to note that there is no surcharge for mileage in ambulance services that are covered by Medicare.

Additionally, Medicare does provide coverage for the cost of supplies utilized in ambulance transport.

Understanding the costs and copayments for ambulance services under Medicare can help patients prepare for potential expenses in the event of an emergency.

Non-Emergency ER Visits and Medicare

While Medicare coverage for emergency room visits is crucial, it is also essential to understand how non-emergency ER visits are covered.

Non-emergency ER visits are defined as visits to the emergency room for conditions that are not deemed a sudden illness, injury, or an aggravation of an existing illness. Medicare covers non-emergency ER visits but may have higher out-of-pocket costs, and may not cover all services provided during the visit.

The subsequent sections will discuss how to recognize non-emergency situations and explain Medicare’s coverage and costs for non-emergency ER visits.

Understanding the differences between emergency and non-emergency ER visits can help you make informed decisions about when to seek care and how to manage your healthcare expenses.

Identifying Non-Emergency Situations

Non-emergency situations include:

- Minor injuries or illnesses that can often be treated at urgent care centers or primary care providers

- Minor burns

- Earaches

- Pink eye

- Potential urinary tract infections

- Flu or fever

- Eye infections

- Sprains

These situations do not require an emergency room visit to the emergency room.

It is vital to differentiate between emergency and non-emergency situations in order to ensure appropriate care is administered.

In non-emergency situations, it may be more cost-effective and efficient to seek treatment at an urgent care center or primary care provider rather than an emergency room.

By understanding the difference between emergency and non-emergency care, you can make better decisions about when and where to seek treatment.

Medicare Coverage and Costs for Non-Emergency ER Visits

Medicare coverage for non-emergency ER visits depends on the specific services provided during the visit and your hospital status.

Medicare coverage for non-emergency ER visits depends on the specific services provided during the visit and your hospital status.

As mentioned earlier, Medicare Part B covers outpatient ER visits, which include non-emergency visits. The costs for non-emergency ER visits under Medicare include copayments, coinsurance, and deductibles, depending on the specific services provided.

It is important to be aware of the coverage limitations of Medicare as it may not cover all emergency room services completely.

Always check with your provider prior to receiving medical services to know what is covered and what is not.

To better understand the extent of your Medicare coverage, especially when it covers emergency room services for non-emergency ER visits, it is advised to consult with Medicare or your healthcare provider about the specific services received and your hospital status.

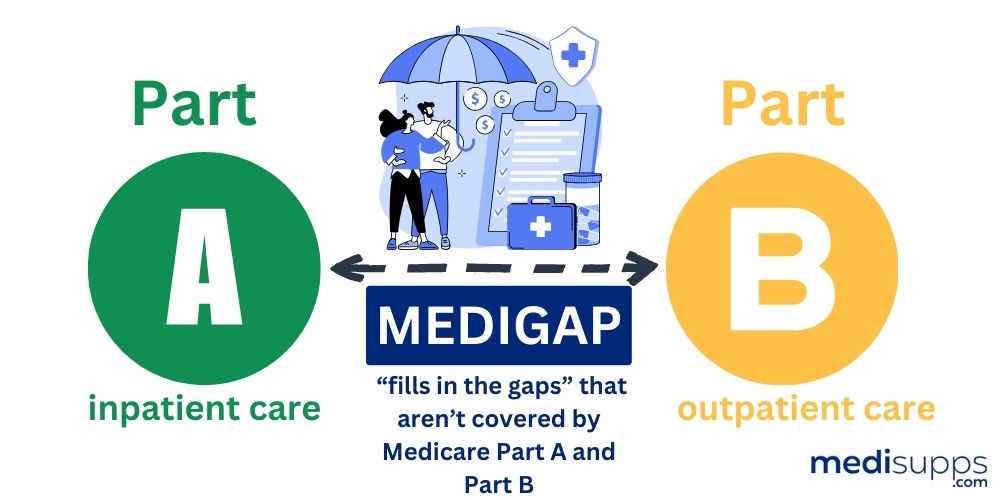

Medicare Supplement (Medigap) Plans and ER Costs

Medicare Supplement (Medigap) plans are private medical insurance plans that help cover some of the costs that Original Medicare does not cover, such as deductibles, copayments, and coinsurance.

These plans work in conjunction with Original Medicare (Part A and Part B) to help cover the costs of services that are covered by Original Medicare, including emergency room expenses.

The upcoming sections will explain how Medigap plans can cover emergency room expenses and offer advice on selecting the most suitable Medigap plan for emergency room coverage.

By understanding the role of Medigap plans in covering emergency room costs, you can make informed decisions about your healthcare coverage and potentially reduce your out-of-pocket expenses.

How Medigap Plans Can Help with ER Expenses

Medigap plans can help with ER expenses by covering costs not covered by Original Medicare, such as coinsurance and copayments.

For example, Medigap plans generally cover the 20% of expenses for emergency room visits that Medicare does not cover. This coverage can significantly reduce your out-of-pocket expenses during an emergency.

It is important to consult with your specific Medigap plan for coverage details, as the extent of coverage and out-of-pocket costs can vary between plans.

By understanding your Medigap plan’s coverage for ER visits, you can better prepare for potential expenses in the event of an emergency.

Choosing the Right Medigap Plan for ER Coverage

Choosing the right Medigap plan for ER coverage depends on your individual needs, including the frequency of ER visits and the desired level of coverage.

When selecting a Medigap plan, consider factors such as costs, coverage, supplemental insurance options, health needs, location, and additional benefits.

There are 10 different types of Medigap plans available for ER coverage, identified by letters A-D, F, G, and K-N.

By comparing the benefits and costs of different Medigap plans, you can select the plan that best suits your budget and healthcare needs.

Understanding the various Medigap plans and their coverage for ER visits will help you make an informed decision about your healthcare coverage.

Summary

In this blog post, we have explored the various aspects of Medicare coverage for ER visits, including Original Medicare, Medicare Advantage, and Medigap plans. We have discussed how each type of plan covers emergency care and the associated costs, as well as the differences between emergency and non-emergency ER visits.

By understanding the coverage and costs associated with ER visits under different Medicare plans, you can make informed decisions about your healthcare coverage and potentially reduce your out-of-pocket expenses.

Remember that circumstances and healthcare needs can change over time, so it’s essential to review your Medicare coverage periodically.

Stay informed, ask questions, and choose the right Medicare plan for your unique needs, so you can focus on living a healthy and fulfilling life.

Get Quotes for 2024 Now

Enter Zip Code

Frequently Asked Questions

What does Medicare consider emergency?

Medicare Part B covers emergency room visits for injuries, sudden illnesses or an illness that quickly gets worse. This includes coverage for ER visits regardless of the hospital or location, and does not require a referral or an in-network provider.

Is there a maximum out-of-pocket for Medicare?

Medicare Advantage plans have an out-of-pocket maximum, while Original Medicare does not.

These limits can vary between plans, so it is important to choose a plan with an out-of-pocket limit that fits your budget. Medigap plans can help reduce the burden of these out-of-pocket costs.

Does Medicare Part A cover lab work?

Yes, Medicare Part A covers lab work, including medically necessary blood tests ordered by a physician and certain tests on tissue specimens. The coverage may be limited in terms of frequency and amount paid.

How does Medicare Part A and Part B cover emergency room visits?

Medicare Part A covers inpatient hospital stays, while Part B covers outpatient visits relating to emergency room visits. Both components of Medicare cover ER visits, with Part A focusing on inpatient stays and Part B on outpatient visits.

Are there any additional benefits offered by Medicare Advantage plans for emergency room visits?

Medicare Advantage plans may offer additional benefits for ER visits, such as reduced copayments or coinsurance, as well as other benefits like prescription drug coverage, vision coverage, hearing coverage, dental coverage, and wellness coverage.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know if Medicare covers emergency room visits, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.