by Russell Noga | Updated November 17th, 2023

Are you seeking a cost-effective Medicare supplement insurance plan that provides comprehensive coverage without breaking the bank? Look no further! High Deductible Plan G might be just what you need.

Are you seeking a cost-effective Medicare supplement insurance plan that provides comprehensive coverage without breaking the bank? Look no further! High Deductible Plan G might be just what you need.

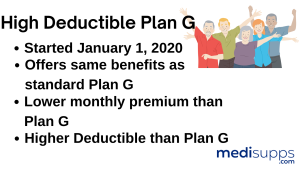

This plan offers the same coverage as the standard Plan G, but with a lower monthly premium, making it an attractive option for many Medicare beneficiaries.

In this article, we will dive into the details of High Deductible Plan G, its key components, and how it compares to its standard counterpart, helping you make an informed decision that best suits your healthcare needs and financial situation.

Navigating the world of Medicare supplement insurance can be overwhelming, but understanding your options is crucial for making the right choice. In this article, we will explore the ins and outs of High Deductible Plan G, its eligibility requirements, coverage and benefits, and the factors to consider when evaluating your healthcare needs.

Let’s begin our journey to better understand this cost-effective Medigap plan.

Short Summary

- High Deductible Medicare Plan G offers comprehensive coverage, a $2800 deductible for 2024, and eligibility requirements to cover Part A & B coinsurance.

- When considering this plan, it is important to evaluate one’s healthcare needs, anticipate medical expenses, and take into account financial situation.

- Comparing quotes from different carriers can help find the best combination of coverage, cost & customer service when shopping for a provider.

Understanding Medicare Supplement High Deductible Plan G

High Deductible G, often referred to simply as High Deductible Medicare Plan G, is a Medigap plan specifically designed for individuals who want comprehensive coverage but are willing to pay a higher deductible in exchange for lower monthly premiums. This plan is applicable to those who turned 65 or started their Medicare coverage on or after January 1, 2020.

High Deductible Plan G offers the same benefits as the standard Plan G, covering coinsurance and copayments for Medicare Part A and Part B, hospice care, skilled nursing facilities, deductibles for Medicare Part A, excess charges for Medicare Part B, and foreign travel emergency expenses.

Imagine two individuals, both 65 years old and living in the same city. One chooses the standard Plan G, while the other opts for the High Deductible Plan G.

Both plans provide the same level of coverage, but the person with the High Deductible Plan G pays a lower monthly premium. The trade-off, however, is that they must meet a higher deductible before they receive full coverage.

This cost-saving strategy can be beneficial for those who are relatively healthy and do not anticipate frequent medical visits, making the High Deductible Plan G an attractive option for many.

Discover 2025 Plans & Rates

Enter Zip Code

Key Components of Medicare Medigap Plan G

The key components of High Deductible Plan G include coverage and benefits, deductible amount, and eligibility requirements. In the following subsections, we will delve deeper into each component, providing you with a comprehensive understanding of this plan and how it can benefit you.

Coverage and benefits of this plan include Part A and Part B coinsurance, as well as coverage for the Part A and Part B deductibles. Additionally, it covers skilled nursing facility care coinsurance.

Coverage and Benefits

One of the most crucial aspects of any insurance plan is the coverage and benefits it offers. High Deductible Plan G provides the same benefits as the standard Plan G, with a few exceptions.

For instance, dental, vision, hearing, and prescription drug costs are not covered, apart from the Medicare Part B deductible. However, the plan covers coinsurance fees for inpatient hospital stays covered by Medicare Part A once the deductible is met, the first 3 pints of blood, and excess charges for Medicare Part B.

Travelers can also benefit from High Deductible Plan G’s foreign travel emergency coverage, which reimburses 80% of the billed charges after the annual deductible has been met.

This comprehensive coverage can be a game-changer for individuals who become eligible for Medicare benefits after January 1, 2020, making high-deductible Plan G a suitable alternative to Plan F benefits.

Deductible Amount

The deductible amount for High Deductible Plan G is $2,800 for 2024. This amount has been set and won’t change until further notice.

This means that before the plan covers any of the amounts not paid by Medicare (the 20%), you must first pay this deductible out of your own pocket.

It’s important to note that the cost of High Deductible Plan G varies depending on factors such as age, gender, location, and tobacco usage.

For example, a 65-year-old male might pay a different premium than a 75-year-old female, even if both individuals live in the same city and do not use tobacco products.

Understanding the deductible amount and how it impacts your overall healthcare costs is essential when considering High Deductible Plan G.

It’s crucial to weigh the lower monthly premiums against the higher deductible and determine if this plan is the most cost-effective option for your healthcare needs and financial situation.

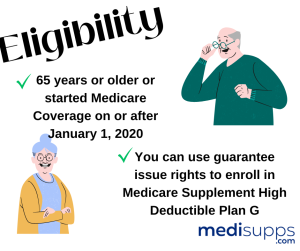

Eligibility Requirements

The eligibility requirements for High Deductible Plan G are equivalent to those for the standard versions of Medigap. However, it’s important to note that certain criteria must be met in order to be eligible for High Deductible Plan G.

For instance, you must be at least 65 years old or have started your Medicare coverage on or after January 1, 2020.

Additionally, if you’re not eligible to enroll in a first-dollar coverage plan, you can still use guaranteed issue rights to enroll in Medicare Supplement High Deductible Plan G.

It’s essential to understand eligibility requirements and limitations before committing to a High Deductible Plan G.

Ensuring that you meet these requirements and that the plan is suitable for your healthcare needs will prevent any unwanted surprises or difficulties down the line.

Comparing Costs: High Deductible Plan G vs. Standard Plan G

When choosing a Medigap plan, it’s important to compare the costs between different plans to determine which one is the most cost-effective option for you. In 2023, High Deductible Plan G had an average monthly premium of approximately $57. This was one of the lower-priced Medicare Supplemental Insurance plans.

To understand the cost-effectiveness of this plan, you should compare it to the costs of the standard Plan G, taking into account the lower monthly premiums and the higher deductible.

The key to determining whether High Deductible Plan G is more cost-effective than the standard Plan G is to weigh the savings from the reduced premiums against the additional costs of meeting the higher deductible.

By comparing the costs of both plans and considering your healthcare needs and financial situation, you can make an informed decision about which plan is the best fit for you.

Pros and Cons of Choosing High Deductible Medicare Plan G

Pros of High Deductible Plan G include lower premiums and cost-sharing when you need care. However, it is important to also keep in mind the cons, such as higher out-of-pocket costs if hospitalization or an extended illness occurs.

On the positive side, this plan offers reduced premiums compared to the standard Plan G, making it more affordable for many individuals. However, the trade-off is the increased deductible and out-of-pocket expenses that you must cover before the plan provides any coverage.

This means that if you anticipate frequent medical visits or have a higher risk of incurring significant medical expenses, High Deductible Plan G might not be the best choice for you.

It’s essential to weigh the advantages and disadvantages of choosing High Deductible Plan G against your healthcare needs and financial situation. By doing so, you can ensure that you’re making the most informed decision possible and selecting a plan that best suits your individual circumstances.

Evaluating Your Healthcare Needs

Before diving into the world of High Deductible Plan G, it’s crucial to evaluate your healthcare needs, including anticipated medical expenses, health condition, and financial situation.

In the following subsections, we will discuss each of these aspects in detail, helping you make an informed decision about whether High Deductible Plan G is the right choice for you.

Anticipated Medical Expenses

Anticipated Medical Expenses

Anticipating medical expenses is an essential step in evaluating your healthcare needs. These expenses may include monthly premiums, deductibles, co-pays, coinsurance, and other out-of-pocket expenses.

To anticipate medical expenses for High Deductible Plan G, you must consider the monthly premium, deductible, and the coverage that the plan offers, such as co-pays, coinsurance, and other out-of-pocket expenses.

For instance, if you’re relatively healthy and don’t anticipate many doctor visits or medical procedures, your annual healthcare costs might be lower with High Deductible Plan G compared to the standard Plan G.

On the other hand, if you have a chronic health condition or anticipate significant medical expenses, the savings from the lower premiums might not offset the higher deductible, making the standard Plan G a more cost-effective choice.

Health Condition and Risk Factors

Health Condition and Risk Factors

Your health condition and risk factors play a significant role in assessing your healthcare needs and determining the most suitable Medigap plan for you. Health condition refers to the state of your physical or mental health, while risk factors are characteristics or experiences that increase the likelihood of developing a certain disease or health condition.

For example, if you have a family history of heart disease or diabetes, you might be at a higher risk of developing these conditions and may require more frequent medical visits and treatments. In this case, the standard Plan G, with its lower deductible, might be a more cost-effective choice compared to the High Deductible Plan G.

On the other hand, if you’re in good health with few risk factors, High Deductible Plan G might be a more affordable option due to the lower monthly premiums.

Financial Situation

Financial Situation

Taking your financial situation into account is crucial when selecting a Medigap plan, including High Deductible Plan G. Factors to consider when appraising your financial situation include net worth, debt levels, liquidity, profitability, income, expenses, savings, assets, and financial goals.

Understanding your financial situation will help you determine the amount you can afford to spend on out-of-pocket medical expenses, including the deductible for High Deductible Plan G.

For example, if you have a limited budget and are looking to minimize your monthly healthcare expenses, High Deductible Plan G might be a more suitable choice due to the lower premiums. However, if you have a higher income and can afford to pay a higher monthly premium for the standard Plan G, you might prefer the added security of knowing that your deductible is lower in case of unexpected medical expenses.

Shopping for a High Deductible Medicare Plan G Provider

Once you have evaluated your healthcare needs and determined that High Deductible Plan G is the right choice for you, it’s time to shop for a provider.

Comparing quotes from different carriers can help you find the most competitive rates and ensure that you’re getting the best value for your money.

Remember to consider your healthcare needs, such as anticipated medical expenses, health condition, and financial situation, when shopping for a provider.

In addition to comparing quotes, it’s essential to research the various plans available and compare the costs and coverage of each plan. By doing so, you can ensure that you’re choosing a provider that offers the best combination of coverage, cost, and customer service, ultimately giving you peace of mind and confidence in your High Deductible Plan G choice.

Transitioning from High Deductible Plan F to Plan G

If you’re currently enrolled in High Deductible Plan F and are considering switching to High Deductible Plan G, there are a few steps you’ll need to take. First, you’ll need to submit a new application for High Deductible Plan G with your chosen provider.

Keep in mind that medical underwriting may be required when transitioning from High Deductible Plan F to standard Plan G, which could impact your eligibility for coverage.

Before making the switch, it’s important to consider your current health needs and financial situation and weigh the pros and cons of both plans.

By doing so, you can ensure that you’re making the most informed decision possible and selecting a plan that best suits your individual circumstances.

Compare Medicare Plans & Rates in Your Area

Cost of High Deductible Plan G

The cost of High Deductible Plan G varies depending on factors such as age, gender, location, and tobacco usage.

For example, a 65-year-old male living in Florida might pay a different premium than a 75-year-old female living in California, even if both individuals do not use tobacco products.

The deductible for Medicare High Deductible Plan G in 2024 is set at $2,800, as per the Medicare guidelines.

Understanding the factors that influence the cost of High Deductible Plan G can help you make an informed decision when choosing a provider and plan.

By comparing the costs of different carriers and taking your personal circumstances into account, you can find the most cost-effective option for your healthcare needs and financial situation.

Summary

In conclusion, High Deductible Plan G offers a cost-effective supplement insurance plan that provides comprehensive coverage for many Medicare beneficiaries.

By understanding the key components of this plan, such as coverage and benefits, deductible amount, and eligibility requirements, you can make an informed decision about whether High Deductible Plan G is the right choice for you.

Before committing to a provider, be sure to evaluate your healthcare needs, including anticipated medical expenses, health condition, and financial situation, and compare quotes from different carriers.

By doing so, you can ensure that you’re choosing the best High Deductible Plan G provider and plan for your unique circumstances, giving you peace of mind and confidence in your healthcare coverage.

Compare Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medicare High Deductible Plan G?

Medicare High Deductible Plan G is a health insurance plan that provides coverage for medical expenses beyond what Original Medicare offers. It features a higher deductible compared to regular Plan G, resulting in lower monthly premiums.

How does Medicare High Deductible Plan G work?

With Medicare High Deductible Plan G, you’re required to pay a higher deductible before the plan starts covering your medical costs. Once the deductible is met, the plan covers the same benefits as standard Plan G, including hospital stays, skilled nursing care, and more.

What are the advantages of choosing Medicare High Deductible Plan G?

Opting for Medicare High Deductible Plan G can lead to lower monthly premiums, making it a cost-effective option for individuals who are willing to pay a higher deductible when medical services are needed.

Are there any restrictions on the providers I can see with this plan?

No, Medicare High Deductible Plan G allows you to choose any healthcare provider that accepts Medicare patients, giving you the flexibility to see specialists or medical facilities of your choice.

What medical expenses are covered under Medicare High Deductible Plan G?

This plan covers a range of services, including hospitalization, doctor visits, preventive care, home health services, and hospice care. It also includes coverage for the first three pints of blood and up to 80% coverage for foreign travel emergencies.

How does the deductible work in this plan?

The deductible is the amount you must pay out of pocket before the plan starts covering your medical expenses. Once you reach the deductible limit, the plan pays for the covered services.

Can I switch from another Medicare plan to Medicare High Deductible Plan G?

Yes, you can switch from another Medicare plan to Medicare High Deductible Plan G during the annual Medicare Open Enrollment period. Certain conditions apply, so it’s wise to check with Medicare or a licensed insurance agent.

Is prescription drug coverage included in Medicare High Deductible Plan G?

No, prescription drug coverage isn’t included in Medicare High Deductible Plan G. If you want prescription drug coverage, you’ll need to enroll in a separate Medicare Part D plan.

Are there any additional costs beyond the deductible and premium?

Depending on your medical needs, you might incur costs like copayments or coinsurance even after meeting the deductible. It’s important to review the plan details to understand potential out-of-pocket expenses.

How can I determine if Medicare High Deductible Plan G is right for me?

Assess your healthcare needs, budget, and willingness to pay a higher deductible. If you anticipate relatively infrequent medical expenses and prefer lower monthly premiums, Medicare High Deductible Plan G could be a suitable choice. Consulting with a licensed insurance agent can provide personalized guidance.

Find the Right Medicare Plan for You

Finding the ideal Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Contact us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!