by Russell Noga | Updated September 10th, 2026

Looking to compare the potential Medicare Advantage plans for 2026? This article simplifies the process, highlighting the available plan options and potential benefits, helping you choose the best option for your healthcare needs.

Key Takeaways

- Some Medicare Advantage plans may offer additional benefits that could go beyond Original Medicare, such as dental, vision, hearing services, and prescription drug coverage, likely promoting overall health and wellness.

- Cost considerations will likely be vital, such as the potential premiums and out-of-pocket expenses, possibly allowing beneficiaries to better manage their healthcare costs. Key enrollment periods, like the Initial Enrollment Period and Annual Election Period, are essential for accessing or switching Medicare Advantage plans, with provisions for Special Enrollment for qualifying life events.

Compare 2026 Plans & Rates

Enter Zip Code

Overview of Medicare Advantage Plans for 2026

Medicare Advantage plans, also known as Part C, could offer an alternative way for Medicare beneficiaries to receive their benefits through private insurance companies. These plans combine coverage for hospital services under Part A and medical services under Part B into a single plan. This potential integration may also include additional benefits that are not typically covered by Original Medicare, possibly making them an attractive option for beneficiaries.

Understanding the basics of how these plans work will likely set the foundation for exploring more specific details in the sections to follow.

Potential Benefits That May Go Beyond Original Medicare

Some Medicare Advantage plans might offer a range of additional benefits that could go beyond what is covered by Original Medicare. These additional benefits will likely be designed to enhance overall coverage and improve the health and well-being of beneficiaries. For instance, certain plans might include coverage for dental, vision, and hearing services.

By potentially offering a broad range of services, Medicare Advantage plans could potentially provide comprehensive care that might surpass what Original Medicare offers.

Prescription Drug Coverage in Medicare Advantage Plans

Prescription drug coverage will likely be an essential part of certain Medicare Advantage plans. This potential coverage might make certain drug costs more manageable, which may be especially beneficial for those with expensive or ongoing medication needs

Special needs plans (SNPs) may also provide Medicare Part D prescription drug coverage, possibly ensuring that eligible beneficiaries could have access to essential medications. The possibility of having prescription drug coverage incorporated into certain Medicare Advantage plans might make these plans a compelling option for members.

Comparing Provider Networks

Comparing provider networks may also be crucial when choosing a Medicare Advantage plan. Provider networks might vary significantly between plans, which could affect your access to primary care providers and specialists. Evaluate your healthcare provider preferences to ensure the plan you choose includes your preferred doctors and facilities.

Carefully comparing the available provider networks could help you select a provider network that suits your healthcare needs and lifestyle.

Star Ratings and Their Importance

Star Ratings could be crucial in evaluating Medicare Advantage plans. Determined by the Centers for Medicare & Medicaid Services (CMS), these ratings assess plan quality based on clinical outcomes and patient experiences.

Star Ratings could influence plan rankings and the quality bonus payments that Medicare Advantage plans receive. Higher-rated plans will likely be incentivized to improve their services and benefits, possibly making them more attractive to beneficiaries. Insurers may also prioritize enhancements to boost their ratings, ultimately benefiting members.

Paying attention to Star Ratings when comparing Medicare Advantage plans could help you make a reasonable expectation of an informed choice. Higher rate plans generally indicate better performance and member satisfaction, likely giving you greater confidence in your selection.

Possible Cost Considerations: Premiums, Deductibles, and Out-of-Pocket Maximums

Cost considerations will likely be crucial when choosing a Medicare Advantage plan. For instance, some plans may offer lower premiums compared to traditional Medicare, which could potentially reduce certain out-of-pocket expenses.

However, be sure to evaluate other out-of-pocket costs, such as deductibles and co-payments. Considering these various factors could help you choose a Medicare Advantage plan that provides the necessary coverage while minimizing applicable cost sharing and financial strain.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) will likely cater to individuals with unique healthcare needs, such as those who are chronically ill. They operate under the same regulatory framework as other Medicare Advantage plans but may have additional requirements for their specific populations. The three primary types of SNPs are Chronic Condition SNPs (C-SNPs), Dual Eligible SNPs (D-SNPs), and Institutional SNPs (I-SNPs), each addressing different healthcare needs.

Dual Eligible SNPs (D-SNPs) could provide integrated care for individuals eligible for both Medicare and Medicaid, possibly ensuring comprehensive coverage and support for dual eligible special needs.

These specialized plans will likely offer various benefits and services that could significantly enhance the healthcare experience for eligible beneficiaries. Providing focused care and support, SNPs will likely play a crucial role in improving health outcomes for those with specific needs.

Compare Medicare Plans & Rates in Your Area

How to Choose the Right Medicare Advantage Plan

Choosing the right Medicare Advantage plan will likely require careful consideration of various factors. Start by:

- Evaluating your healthcare needs and preferences, such as prescription drug coverage and provider networks.

- Comparing plans to ensure they offer the benefits that best meet your needs.

State Health Insurance Assistance Programs (SHIP) offer free, one-on-one help to beneficiaries, providing valuable assistance in comparing plans and understanding changes. To enroll, use this website or call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

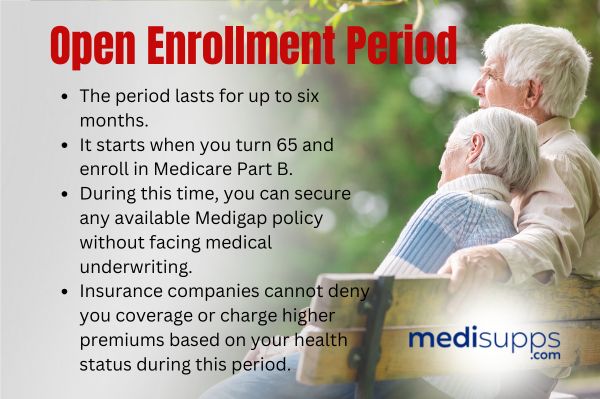

Enrollment Periods and Deadlines

Understanding enrollment periods and deadlines is vital to ensure you have the coverage you need. The Initial Enrollment Period begins three months before you become eligible for Medicare and ends three months after. The Open Enrollment Period, from October 15 to December 7, allows beneficiaries to enroll in, switch, or drop plans.

The Medicare Advantage Open Enrollment Period from January 1 to March 31 enables those already enrolled in a plan to switch to another or return to Original Medicare. Special Enrollment Periods also allow for enrollment changes based on specific life events, such as relocating or losing other coverage.

Resources for Comparing Plans

Several resources are available to help beneficiaries compare Medicare Advantage plans. Enter your zip code into the Plan Finder Tool on this website to:

- Compare different Medicare Advantage and Prescription Drug Plans

- Focus on drug coverage and costs to find the perfect fit for your healthcare needs

- Input your information and sort through a variety of plans

- Weigh the pros and cons of each based on your personal situation

Consulting with one of our licensed agents can provide valuable insights and help you navigate choices that best match your healthcare and financial needs. Local SHIP programs offer personalized help in comparing Medicare Advantage options, ensuring you make an informed decision.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

As we approach 2026, understanding the Medicare Advantage plans will likely be more important than ever. From the potential inclusion of prescription drug coverage to the importance of Star Ratings, this article has covered several aspects that beneficiaries need to know.

Medicare Advantage plans will likely offer a range of additional benefits that could go beyond Original Medicare, such as dental, vision, and hearing coverage. By comparing provider networks, evaluating Star Ratings, and considering the various cost factors, beneficiaries could select the right plan to meet their needs.

With the right information and resources, navigating the various Medicare Advantage plans for 2026 can be a smooth and informed process. Stay proactive, use the available tools, and consult with our agents to ensure you make the best decisions for your healthcare needs.

Frequently Asked Questions

What are the potential changes in Medicare Advantage Plans for 2026?

Unfortunately, the plan details for 2026 have not been released, but make sure to check back in to this article/website for updated information for the 2026 calendar year.

What additional benefits could Medicare Advantage plans offer beyond Original Medicare?

Some Medicare Advantage plans may provide additional benefits such as dental, vision, and hearing coverage, as well as prescription drug coverage, which may enhance your overall healthcare experience. This comprehensive approach could potentially improve your health and well-being.

What are Special Needs Plans (SNPs)?

Special Needs Plans (SNPs) are customized healthcare plans that will likely be designed for individuals with specific needs, including those who are dual eligibles, institutionalized, or have severe chronic conditions. These plans may provide specialized benefits and services to help support their unique healthcare requirements.

What resources are available for comparing Medicare Advantage plans?

To effectively compare Medicare Advantage plans, utilize the Plan Finder tool on this website, consult one of our licensed agents, or check your state’s SHIP program for personalized guidance.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare, Medicare Advantage and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know Compare Medicare Advantage Plans in 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs, and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.