by Russell Noga | Updated October 2nd, 2025

Looking to understand Medigap plans and their benefits? Medigap plans, or Medicare Supplement Insurance, cover out-of-pocket costs that Original Medicare doesn’t, such as deductibles and copayments. This article will explain how Medigap plans work, their benefits, associated costs, and tips for choosing the right plan.

Key Takeaways

- Medigap plans provide coverage for out-of-pocket costs not included in Original Medicare, with standardized options differing by state.

- Choosing the right Medigap plan involves comparing benefits, costs, and understanding the implications of enrollment periods on coverage options.

- When switching Medigap policies, be aware of potential underwriting challenges and the availability of original plans from your insurer.

Understanding Medigap Plans in 2026

Medigap plans, or Medigap Medicare Supplement Insurance, are designed to cover the out-of-pocket costs that Original Medicare (Parts A and B) does not cover, including supplemental coverage for coinsurance, copayments, and deductibles, which can add up quickly, especially for those with chronic conditions or frequent healthcare needs.

Medigap policies are standardized across most states, ensuring that a Plan G in one state offers the same benefits as a Plan G in another. However, certain medigap policies are not available in every area, and states like Massachusetts, Minnesota, and Wisconsin have different standardized plans.

As long as you pay, premiums are paid, Medigap policies renew annually, ensuring continuous coverage. Some plans also cover foreign travel emergency, allowing you to travel without concern for medical expenses abroad. These key features can aid in deciding if a Medigap plan suits your needs.

Comparing Medigap Plan Benefits

Medigap plans offer varying benefits; some cover basic needs like coinsurance for hospital stays and doctor visits, while others provide more comprehensive coverage. Comparing different plans can help you find one that aligns with your healthcare needs and budget.

Independent review sites can be valuable resources for compare medigap plans. These sites allow you to evaluate different plans based on factors such as coverage levels, premiums, and customer reviews. Since private insurance companies offer Medigap plans, availability and costs can differ based on your location and the insurer.

States like Massachusetts, Minnesota, and Wisconsin have unique standardized Medigap plans with different benefits from those in other states. Knowing the specific options in your area can help you make a better-informed decision.

Plan F vs. Plan G vs. Plan N

Plan F, Plan G, and Plan N are among the most popular Medigap plans, each offering varying coverage and costs. Understanding their differences can help you choose the best plan for your needs.

Plan F is known for its comprehensive coverage, including all out-of-pocket costs and the Part B deductible. Although ideal for those avoiding extra expenses, Plan F is no longer available to new Medicare beneficiaries as of 2020, but those eligible before then can still enroll.

Plan G is like Plan F but doesn’t cover the Part B deductible, often resulting in lower premiums. It’s popular for those seeking broad coverage at a slightly lower cost. Both Plan F and Plan G have high-deductible versions, requiring a specified out-of-pocket amount before coverage begins.

Plan N has lower premiums but requires copayments for some doctor visits and office visits, as well as emergency room visits. It can be a suitable option for those with lower healthcare needs or those looking to save on premiums while maintaining substantial coverage. Knowing these differences can help you choose the best plan for your needs and budget.

Costs Associated with Medigap Policies

The costs of Medigap policies vary widely based on factors like plan type, location, and the insurance company. Knowing these medigap costs is crucial for budgeting and making informed healthcare coverage decisions.

Medigap plans usually require upfront premiums, which vary based on coverage level and insurer. Premiums are influenced by pricing models such as:

- Community-rated: charge the same premium to all policyholders

- Issue-age rated: base premiums on your age at purchase

- Attained-age rated: increase premiums as you age

Some Medigap plans offer a high deductible version, requiring you to pay a specified amount before benefits begin. Additionally, some plans have deductibles that must be met before coverage starts, including the hospital deductible. Knowing these cost structures can help you select a plan that fits your budget and healthcare needs.

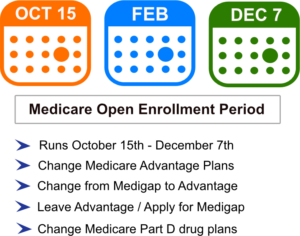

Enrollment Periods for Medigap

Enrolling in a Medigap policy at the right time is crucial. The six month period Medigap Open Enrollment Period is the best time, which:

- Starts when you first have Medicare Part B

- Requires you to be at least 65 years old

- Prevents insurers from denying coverage based on pre-existing conditions during this period.

Missing the Open Enrollment Period can limit your options for obtaining a Medigap policy and may result in higher premiums due to medical underwriting. Insurers can then consider your health status and potentially deny coverage or charge higher rates based on your conditions.

Certain situations, like losing other health coverage or moving out of a Medicare Advantage plan’s service area, may grant you guaranteed issue rights, allowing you to secure Medigap coverage outside of the Open Enrollment Period. Knowing these enrollment periods and their implications can help you make timely decisions about your coverage.

Medigap vs. Medicare Advantage Plans

Choosing between Medigap and Medicare Advantage plans can be challenging, as both have distinct pros and cons:

- Medicare Advantage plans often have lower upfront costs.

- They may include additional benefits like vision and dental coverage, along with medicare benefits.

- They typically come with network restrictions, limiting your choice of providers.

Medigap policies offer more flexibility in choosing healthcare providers without network limitations and provide more predictable expenses by covering out-of-pocket costs like deductibles and copayments. However, Medigap plans do not include prescription drugs coverage, so a separate Part D plan may be necessary.

Medicare Advantage plans can be appealing due to lower upfront costs and extra benefits, but may result in higher out-of-pocket expenses for chronic conditions due to cost-sharing requirements. In contrast, Medigap plans offer more comprehensive coverage and financial predictability, making them a better choice for those with higher healthcare needs.

Understanding these differences can help you choose the best option for your healthcare needs and budget.

Factors to Consider When Choosing a Medigap Policy

Selecting the right Medigap policy involves considering several factors, including your current and future healthcare needs, budget, and the specific benefits offered by each plan. Individuals who frequently use healthcare services may benefit more from a Medigap plan, as it helps cover out-of-pocket costs not included in standard Medicare.

Considering how your healthcare needs might change over time is important. Plans K and L, for instance, have defined out-of-pocket plan limits that, once met, allow for full coverage of covered services for the rest of the calendar year, providing peace of mind for those with higher healthcare needs or anticipating increased usage. Covered services are essential for those who require consistent care.

Understanding the financial implications of each plan is crucial. Some plans, like Plan N, may require copayments for specific services even after meeting the deductible. Evaluating your healthcare needs and budget can guide your decision, ensuring you choose a plan that provides the necessary coverage at an affordable cost, including hospital costs, while paying attention to overall expenses.

Switching Medigap Plans

Switching Medigap plans can be complex, especially outside the initial enrollment period. You may face underwriting questions and higher premiums based on your health status. Carefully consider if switching is necessary and weigh the potential benefits and costs.

If you switch plans, you can only revert to your original Medigap plan if it is still offered by the same insurance company. Additionally, not all plans may be available for reinstatement, depending on the insurer’s offerings. Knowing these factors can help you make an informed decision about switching.

Compare Medicare Plans & Rates in Your Area

How to Find the Best Medigap Insurance Company

Finding the best Medigap insurance company involves evaluating factors like:

- Consumer complaint rates: Lower complaint rates often indicate better customer service and satisfaction.

- Premium rates: Comparing premium rates for the same plan type across different insurance companies can help you find the most cost-effective option.

- Potential discounts.

Some Medigap insurance companies offer household discounts, potentially leading to significant savings if multiple members enroll. Working with a knowledgeable agent, such as those at Medisupps.com, can help you find the best coverage and the lowest premiums you qualify for.

Considering these factors can help you find a reliable insurance provider offering the best value for your Medigap policy.

Summary

Medigap plans in 2026 continue to offer valuable coverage for out-of-pocket costs that Medicare doesn’t cover, such as deductibles, coinsurance, hospice care coinsurance, and copayments. Understanding the different plans, their benefits, associated costs, and critical enrollment periods can help you make an informed decision about your healthcare coverage.

At Medisupps.com, we simplify the process of comparing Medigap options, helping you find the plan that fits your needs and budget. Call us today at 1-888-891-0229, and let our licensed agents guide you through your choices.

Frequently Asked Questions

What is the best time to enroll in a Medigap policy?

The optimal time to enroll in a Medigap policy is during the six-month Open Enrollment Period that commences when you first obtain Medicare Part B at age 65. Enrolling during this period ensures that you cannot be denied coverage due to pre-existing conditions.

Can I switch Medigap plans if I’m not satisfied with my current plan?

You can switch Medigap plans if you are not satisfied with your current one; however, be aware that this may involve underwriting questions and potentially higher premiums if it is outside your initial enrollment period.

How do Medigap and Medicare Advantage plans differ?

Medigap plans provide predictable expenses and greater flexibility with healthcare providers, whereas Medicare Advantage plans typically feature lower initial costs but may have network restrictions and potentially higher out-of-pocket expenses.

Are there any Medigap plans that cover prescription drugs?

Medigap plans do not cover prescription drugs; you must obtain a separate Medicare Part D plan for that coverage.

What factors should I consider when choosing a Medigap plan?

When choosing a Medigap plan, it is crucial to assess your healthcare needs, budget, and specific features like out-of-pocket limits and copayments. This evaluation will ensure you select a plan that offers necessary coverage within your financial means.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!