by Russell Noga | Updated September 29th, 2023

Medigap Plan N is a popular and cost-effective choice for many Medicare beneficiaries, offering comprehensive coverage for most out-of-pocket expenses. But what exactly does this plan entail, and what does Medigap Plan N not cover?

Medigap Plan N is a popular and cost-effective choice for many Medicare beneficiaries, offering comprehensive coverage for most out-of-pocket expenses. But what exactly does this plan entail, and what does Medigap Plan N not cover?

In this article, we’ll dive into the details of Medicare Supplement Plan N, its benefits, limitations, comparisons to other plans, and much more. Specifically, we will address the question: “What does Medigap Plan N not cover?” to ensure you have a thorough understanding of this insurance option.

Short Summary

- Medicare Supplement Plan N is a cost-effective plan that covers a wide range of medical costs, yet has certain restrictions.

- It is important to compare Medigap Plan N with other plans in order to determine which best meets an individual’s healthcare needs and financial goals.

- Reviews are key for customer satisfaction when selecting Medicare Supplement Plan N and its carriers, as it also offers foreign travel emergency coverage.

Understanding Medigap Plan N

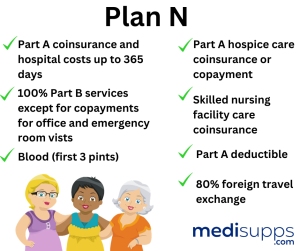

Medicare Supplement Plan N is designed to assist in the payment of out-of-pocket expenses not covered by Medicare Parts A and B. This plan covers a wide range of medical costs, including:

- Medicare Part A deductible

- Coinsurance for Parts A and B

- Three pints of blood

- 80% of medical costs incurred during foreign travel

Plan N is very attractive as it offers Medicare benefits which are similar to Medigap Plans C and F. Furthermore, premium costs for this plan are much lower. The average cost of Medicare Supplement Plan N is $152 per month.

This is the approximate amount most people in the United States spend on the plan. Moreover, there is a Medigap Plan N policies are standardized by law, meaning that regardless of the insurance company from which a Medicare supplement plan N is purchased, it must offer the same basic coverage.

Discover 2024 Plans & Rates

Enter Zip Code

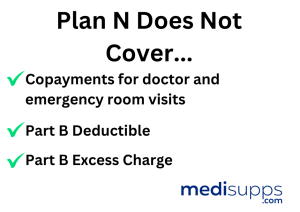

Limitations of Medicare Supplement Plan N

While Medicare Supplement Plan N does offer a wide array of benefits, there are certain limitations to its coverage. In the following subsections, we’ll discuss these limitations, which include the Medicare Part B deductible, Part B excess charges, and additional healthcare services not covered by Plan N.

The Medicare Part B deductible is the amount you must pay out-of-pocket before Medicare.

Medicare Part B Deductible

Medicare Part B Deductible

Medigap Plan N does not cover the annual Medicare Part B deductible, which beneficiaries must pay out-of-pocket. The Medicare Part B Deductible is $226 per annum, and this deductible must be paid before Original Medicare begins to cover medical services.

This additional expense should be taken into account when considering Plan N as a Medicare supplement option.

Medicare Part B Excess Charges

Another limitation of Plan N is its lack of coverage for Medicare Part B excess charges. These excess charges are fees above the amount approved by Medicare, charged by certain healthcare providers.

Failing to cover Medicare Part B excess charges could result in the beneficiary being liable for paying the entire excess charge.

Alternatives for covering these excess charges include Medicare Advantage plans, employer-sponsored health insurance, and other supplemental insurance plans.

Additional Healthcare Services

Medicare Supplement Plan N does not cover additional healthcare services like dental, vision, hearing, and prescription drug costs.

Beneficiaries seeking coverage for these services may need to explore other options, such as standalone dental, vision, and hearing plans or Medicare Advantage plans that include these benefits.

Comparing Medigap Plan N to Other Supplement Plans

Comparing Medigap Plan N to Other Supplement Plans

When considering Medicare Supplement Plan N, it’s essential to compare it to other popular Medigap plans for 2024, such as Plan G and Plan F. Plan N offers lower monthly premiums than Plan G, but it does require copays for physician office visits or trips to the ER that do not result in hospitalization, whereas Plan G does not require copays.

Plan F provides more comprehensive coverage than Plan N, covering Part A and B deductibles and coinsurance as well as Part B excess charges. However, Plan N is more budget-friendly and may be more suitable for those who don’t mind incurring some expenses for medical care.

When comparing Medigap plans, it’s crucial to weigh the differences in coverage and costs to determine the best fit for your healthcare needs and financial goals. Considering a Medigap policy can be an essential part of this process.

Costs Associated with Medicare Supplement Plan N

The premiums for Medicare Supplement Plan N can vary depending on factors such as:

- Location

- Age

- Gender

- Tobacco use

The average monthly cost ranges from $70 to $400. Monthly premiums for Plan N generally range from $100 to $350, with an average cost of approximately $150 per month.

It’s essential to consider the pricing method employed by the carrier when determining monthly premium rates for Medigap Plan N.

By researching different insurance providers and comparing their premiums and policies, you can make an informed decision about the best choice for your healthcare needs and budget.

Choosing the Right Medicare Supplement Plan

Selecting the best Medigap plan requires careful consideration of your individual healthcare requirements, such as any existing medical conditions, medications, and anticipated medical needs.

When evaluating Medigap plans, consider the coverage provided, the cost of the plan, and the provider network.

In addition to your healthcare needs, take into account the following factors when choosing an insurance provider:

- Your budget

- Out-of-pocket costs

- Potential savings

- Credibility of the insurance provider

- Customer service provided by the insurance provider

- Additional benefits offered by the insurance provider

Considering these factors will help you make an informed decision.

Enrollment Process for Medigap Plan N

Enrollment in Medicare Supplement Plan N typically occurs during the open enrollment period, which begins on the first day of the month you turn 65 and are covered under Medicare Part B and concludes six months after your birthday month.

This open enrollment period is crucial as it allows you to enroll in a Medigap plan without having to undergo medical underwriting, which could potentially result in increased premiums or denial of coverage due to your health.

If you miss the open enrollment period, you may still apply for Medigap Plan N, but you may be subject to medical underwriting and could face increased premiums or denial of coverage based on your health status.

Therefore, it’s important to be aware of the enrollment timelines and make a timely decision to secure the best possible coverage and rates.

Carriers Offering Medicare Supplement Plan N

Carriers Offering Medicare Supplement Plan N

Many private insurance companies, including some less-prominent ones, offer Medicare Supplement Plan N as well as Medicare Advantage Plan. Noteworthy carriers available in multiple states include:

- AARP/UnitedHealthcare

- Mutual of Omaha

- Aetna

- Blue Cross Blue Shield

- Cigna

These carriers provide various options for those seeking medicare supplement insurance, including Plan N, Medicare Advantage, and medicare supplement plans.

When evaluating potential options, it’s important to assess the provider’s credibility, customer service, and cost. Furthermore, ensure that the provider offers the required coverage.

Comparing carriers can help you find the best provider that meets your healthcare needs and aligns with your financial goals.

Copayments and Coinsurance with Medigap Plan N

Under Medicare Supplement Plan N, you will be responsible for a copay of $20 for certain doctor’s visits and a copay of $50 for emergency room visits that do not result in hospitalization.

These copayments and coinsurance costs can help cover out-of-pocket expenses associated with Plan N, including coinsurance and hospital costs.

It’s important to factor in these copayments when considering Medigap Plan N, as they may influence your healthcare costs and overall satisfaction with the plan.

Understanding these costs upfront can help you make an informed decision when selecting the right Medicare supplement plan for your needs.

Reviews and Customer Satisfaction for Medicare Supplement Plan N

Reviews and Customer Satisfaction for Medicare Supplement Plan N

Examining reviews for Medicare Supplement Plan N and its carriers is essential to guarantee customer satisfaction and maintain the stability of the company. For example, Aetna’s Medicare Supplement product has a customer complaint index score of 1.57, as reported by the National Association of Insurance Commissioners.

Opting for a carrier with good reviews is essential to guarantee customer satisfaction and maintain company stability.

Researching client and carrier reviews, as well as considering factors like company stability and customer service, can help you make an informed decision when selecting the right plan and provider for your healthcare needs.

Compare Medicare Plans & Rates in Your Area

Travel Benefits of Medigap Plan N

Medicare Supplement Plan N provides foreign travel emergency coverage, covering 80% of emergency medical costs abroad. This travel benefit can be especially important for retirees and older adults who enjoy traveling and want peace of mind knowing they have coverage in case of medical emergencies outside of the United States.

Although Medigap Plan works, it does not work. N does not provide travel benefits or coverage for emergency health care while traveling outside of the United States, the foreign travel emergency coverage included in Plan N can be a valuable addition for those who frequently travel abroad.

Always verify the specifics of your plan’s travel coverage to ensure you’re adequately protected during your trips.

Summary

In conclusion, Medicare Supplement Plan N is a popular and cost-effective choice for many Medicare beneficiaries, offering comprehensive coverage for most out-of-pocket expenses while maintaining lower premiums.

However, it’s essential to be aware of the plan’s limitations, including the lack of coverage for Medicare Part B deductible, excess charges, and additional healthcare services.

By carefully evaluating the benefits, costs, carriers, and customer satisfaction associated with Plan N, you can make an informed decision about the best Medicare supplement plan for your healthcare needs and financial goals.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medigap Plan N?

Medigap Plan N is a Medicare supplement insurance plan that helps cover some of the out-of-pocket costs associated with Original Medicare.

What healthcare costs does Medigap Plan N typically cover?

Medigap Plan N covers Medicare Part A coinsurance, hospital costs, and Part B coinsurance or copayments.

What does Medigap Plan N not cover?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges.

What is the Medicare Part B deductible?

The Medicare Part B deductible is an annual amount you must pay before Medicare starts covering your outpatient services.

What are Medicare Part B excess charges?

Excess charges are additional fees that some doctors may charge beyond what Medicare covers. Medigap Plan N does not cover these charges.

Are there any limitations on the coverage for skilled nursing facility care with Medigap Plan N?

Medigap Plan N covers skilled nursing facility care but may require a copayment after a specific number of days.

Does Medigap Plan N cover foreign travel emergency care?

Yes, Medigap Plan N covers foreign travel emergency care up to plan limits.

Can I see any doctor or specialist with Medigap Plan N?

Yes, you can see any doctor or specialist that accepts Medicare, and you are not restricted to a network of healthcare providers.

How do I pay for the Medicare Part B deductible and excess charges if I have Medigap Plan N?

You are responsible for paying the Part B deductible and any excess charges out of pocket if you have Medigap Plan N.

Are there any additional benefits included in Medigap Plan N?

Medigap Plan N may offer additional benefits like coverage for skilled nursing facility care coinsurance and foreign travel emergency care.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be difficult. Whether it’s a Medigap plan, or you have an inquiry about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.