by Russell Noga | Updated October 3rd, 2024

Medicare Plan G in Georgia

Imagine you’re a Georgia resident nearing retirement, and you’re faced with the task of finding the right Medicare supplement plan to fit your needs.

With so many options available, it can be overwhelming to navigate this important decision. In this blog post, we’ll guide you through understanding Medicare Plan G in Georgia, comparing providers, costs, and how it stacks up against other popular Medigap plans for 2025.

By the end, you’ll be well-equipped to make an informed choice that aligns with your healthcare requirements and budget.

Short Summary

- Understanding Medicare Plan G in Georgia and comparing various providers is important for making an informed decision.

- Factors to consider when choosing a provider include pricing, reputation, customer service, and additional benefits.

Resources such as the State Health Insurance Assistance Program (SHIP) and Area Agencies on Aging can help individuals select the best plan for their needs.

Understanding Medicare Plan G in Georgia

Medicare Plan G is a popular Medigap plan in Georgia, known for its comprehensive coverage of most out-of-pocket expenses, excluding the Part B deductible.

This makes it an attractive option for those looking to minimize healthcare costs while maintaining a high level of coverage.

To better understand Plan G, let’s dive into the specifics of what it covers and who is eligible for enrollment.

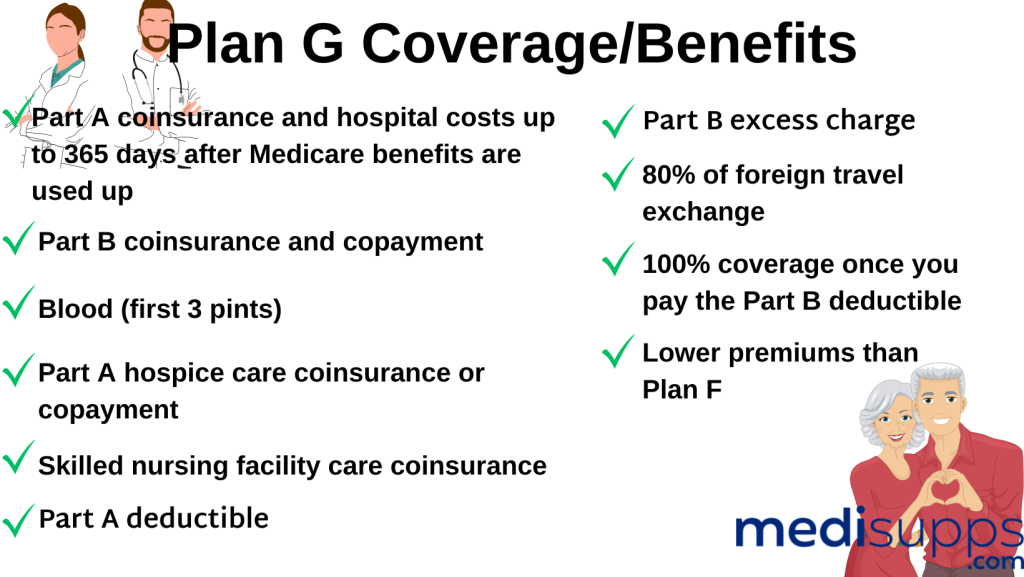

What Does Plan G Cover?

Plan G offers an extensive range of coverage, including Part A deductible and coinsurance, Part B coinsurance, and foreign travel emergency coverage.

With this medical insurance, beneficiaries can enjoy peace of mind knowing that most of their healthcare expenses will be covered, leaving only the Part B deductible as an out-of-pocket cost.

It is worth noting, however, that Plan G does not include prescription drug coverage, so you may need to enroll in a separate Medicare Part D plan or consider a Medicare Advantage Plan for that.

In comparison to other Medigap plans, Plan G stands out for its most comprehensive coverage, making it an attractive choice for those who prioritize both financial security and access to a wide range of medical services.

However, it’s essential to consider your individual healthcare needs and weigh the benefits of Plan G against other available options.

View Rates for 2025

Enter Zip Code

Who is Eligible for Plan G?

Georgia residents who are enrolled in Medicare Parts A and B are eligible for Plan G, regardless of their age or health status.

This means that if you have both Medicare Part A and Part B, you can enjoy the comprehensive coverage offered by Plan G.

Keep in mind, though, that Plan G does not include prescription drug coverage, so you may need to enroll in a separate Medicare Part D plan for that.

Comparing Medicare Plan G Providers in Georgia

Now that you have a better understanding of Medicare Plan G, it’s time to explore the top insurance carriers offering this popular plan in Georgia.

By comparing providers and taking various factors into account, you can make a more informed decision and find the best Plan G option for you.

Top Insurance Carriers for Plan G

Leading insurance carriers offering Medicare Plan G in Georgia include:

- Allstate

- Cigna

- and Anthem.

It’s essential to research each carrier’s specific offerings, such as additional benefits, discounts, and unique programs, to ensure you find the best Plan G option for your needs.

Comparing providers will also help you make the most informed decision when it comes to pricing and overall value.

Factors to Consider When Choosing a Provider

When selecting a Plan G provider in Georgia, it’s important to consider factors such as:

- Pricing

- Reputation

- Customer service

- Additional benefits

As you evaluate each provider, keep in mind that the costs of Plan G can vary based on factors like your location, age, and the company you choose.

By taking the time to carefully weigh these factors and compare different providers, you’ll be better equipped to find the best Medicare Plan G option for your needs.

Costs of Medicare Plan G in Georgia

Understanding the costs associated with Medicare Plan G in Georgia is crucial to making an informed decision about your healthcare coverage.

In this section, we’ll explore the premiums and pricing factors for Plan G, as well as the average costs for this popular Medigap plan.

Premiums for Plan G vary depending on the age of the insured and the county in which they live.

Premiums and Pricing Factors

The cost of Medicare Plan G in Georgia can vary. Several factors, including:

- your location

- age

- the company and plan chosen may affect the final cost.

Other elements could also be relevant. Attained Age Rating and Issue Age Rating are two methods used to calculate the monthly premiums for Medicare Supplement plans in Georgia.

These approaches allow insurers to determine rates based on policyholder age and the age at which a policy was first purchased. Factors like age, discounts, and medical underwriting considerations can also impact the cost of Plan G.

It’s important to understand the pricing factors that can affect the cost of Plan G, as this knowledge will help you make an informed decision about which provider and plan are the best fit for your needs and budget.

Average Costs of Medicare Plan G in Georgia

The average monthly cost of Medigap Plan G in Georgia is $182.20, but this includes many older recipients.

The average monthly cost of Medigap Plan G in Georgia is $182.20, but this includes many older recipients.

Keep in mind that this figure can vary based on the insurance carrier and individual factors, such as:

- age

- gender

- and health status

By comparing the average costs of different providers, you can make a more informed decision about which Plan G option offers the best value for your needs.

View Plan G rates

Enter Zip Code

Enter your zip code above to view Plan G rates in your area.

Compare Medicare Plans & Rates in Your Area

Enrollment Process for Medicare Plan G in Georgia

Now that you have a better understanding of Medicare Plan G in Georgia, it’s time to explore the enrollment process. In this section, we’ll discuss the best time to enroll in Plan G and the steps to take for enrollment.

Enrolling in Medicare Plan G in Georgia is a straightforward process. You can enroll during the annual program.

When to Enroll in Plan G

The ideal enrollment period for Medicare Plan G in Georgia is during the Medigap Open Enrollment Period, which typically begins on the first day of the month in which you turn 65 and are enrolled in both Medicare Parts A and B.

This enrollment period lasts for six months, and it’s strongly recommended that you purchase a Medigap plan during this time to avoid potential premium increases or coverage denials based on your health status.

It is important to note that during this open enrollment period, you are guaranteed to be accepted.

How to Enroll in Plan G

To enroll in Medicare Plan G in Georgia, you’ll need to contact insurance carriers and compare plan options.

During your Medigap Open Enrollment period, which commences the first month you have Medicare Part B, and you are 65 years of age or older, you may enroll in Medicare Plan G in Georgia.

This enrollment period is valid for a period of six months, beginning with the month you turn 65.

It is strongly recommended that you purchase a Medigap plan during this time to ensure the best coverage and pricing options.

Medigap Plan G vs. Other Medicare Supplement Plans in Georgia

As you consider Medicare Plan G in Georgia, it’s helpful to compare its coverage and costs to other Medigap plans available in the state.

In this section, we’ll examine the differences between Plan G and other popular Medigap plans, such as Plans F and N, to help you determine the best option for your needs.

Plan G is one of the most impressive Medigap plans in Georgia. It offers an abundance of coverage options for seniors. It covers everything it covers.

Comparing Coverage and Costs

Plan G offers comprehensive coverage, but there are other Medigap plans in Georgia that you might also consider, such as Plans F and N.

Plan F covers:

- 100% of the costs not covered by Medicare Part A and Medicare Part B, providing essential Medicare benefits and comprehensive Medicare coverage

- deductibles

- copayments

- coinsurance

This leaves only the monthly premium as one of the out-of-pocket costs.

Plan N covers the full Medicare Part A deductible and coinsurance as well as Medicare Part B coinsurance. The individual is then responsible for the Medicare Part B deductible, $20 copayments at the doctor, $50 copayments at the ER, and excess charges when applicable.

Plan N covers the full Medicare Part A deductible and coinsurance as well as Medicare Part B coinsurance. The individual is then responsible for the Medicare Part B deductible, $20 copayments at the doctor, $50 copayments at the ER, and excess charges when applicable.

By comparing the coverage and costs of Plan G with other popular Medigap plans in Georgia, you can make a more informed decision about which plan best suits your healthcare needs and budget.

Choosing the Right Medigap Plan

To choose the right Medigap plan for your needs, consider factors such as coverage, cost, and your personal healthcare requirements.

By comparing Plan G with other popular Medigap plans in Georgia, such as Plans F and N, you can make an informed decision about which plan offers the best combination of coverage and affordability for your unique situation.

Additional Resources for Georgia Medicare Beneficiaries

If you’re still feeling uncertain about which Medicare supplement plan is right for you, there are additional resources available to help Georgia residents navigate the complexities of Medicare and Medigap plans.

In this section, we’ll introduce you to some valuable resources that can provide guidance and support throughout your decision-making process.

Georgia State Health Insurance Assistance Program (SHIP)

SHIP provides the following services:

- Complimentary, impartial counseling to help Medicare beneficiaries understand their options.

- Assistance in comparing plans.

- Support in making informed decisions about healthcare coverage.

By taking advantage of these services, you can gain a better understanding of the available Medicare supplement plans in Georgia and choose the one that best fits your needs, including options like Medicare Advantage and Medicare Advantage Plans, as well as Medicare supplement insurance plans.

Area Agencies on Aging

Area Agencies on Aging in Georgia can provide valuable guidance and support for seniors navigating Medicare and Medigap plans. These organizations offer a range of services, including:

- Information and assistance

- Health promotion

- Nutrition

- Caregiver support

These services help older adults maintain their independence and quality of life.

By reaching out to your local Area Agency on Aging, you can receive personalized assistance and advice on selecting the most suitable Medicare supplement plan, including Medicare supplement insurance options, for your needs.

Summary

In conclusion, finding the best Medicare Plan G in Georgia doesn’t have to be a daunting task.

By understanding the coverage and eligibility requirements, comparing providers and costs, and considering other available Medigap plans, you can make an informed decision that aligns with your healthcare needs and budget.

Don’t forget to take advantage of valuable resources, such as Georgia SHIP and Area Agencies on Aging, to help guide you through the process.

With the right knowledge and support, you can confidently choose the best Medicare Plan G in Georgia and enjoy peace of mind knowing that your healthcare needs are well taken care of.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

How much is a Plan G for Medicare in Georgia?

For Georgia residents, the average monthly premium for Medicare Plan G varies and the annual Part B Deductible of $257 for 2025.

Plan G also offers the highest coverage on foreign travel exchange at 80%.

What does Plan G pay for in Medicare?

Plan G in Medicare pays for 100% of the Medicare Part A and Part B co-pays and coinsurance, Skilled Nursing and rehab facility stays, Hospice care, and any other expenses related to your policy, such as the Part A deductible.

It does not cover the Part B deductible.

Is Medicare Plan G any good?

Medicare Plan G is an excellent plan, offering comprehensive coverage and giving Medicare beneficiaries complete peace of mind. It covers almost everything except the Part B deductible, which is $257 for 2025.

What is Medicare plan g?

Medicare Plan G is a supplemental policy that covers 100% of the Medicare Part A and Part B co-pays and coinsurance, Skilled Nursing facility stays, Hospice care and more.

It does not cover the Medicare Part B annual deductible, however.

Who is eligible for Medicare Plan G in Georgia?

Residents of Georgia who are enrolled in Medicare Parts A and B are eligible for Plan G, regardless of age or health.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2025 doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about the Medicare Plan G in Georgia, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!