by Russell Noga | Updated October 31st, 2023

Whether you are new to Medicare or you’ve been enrolled for a while, chances are you’ve heard of both Medicare Supplement Plan F and Plan G.

What you might not know is, only people enrolled in Medicare Part A and B prior to January 1st of 2020 may apply for Plan F. This is because it was removed from the lineup at that date, with Medicare Supplement Plan G taking its place as the most comprehensive Medicare Supplement Plan.

How Many Medicare Supplement Plans Are There?

There are a total of 10 Medicare Supplement plans. Each plan differs in terms of both coverage and rates. Medicare Plans F and G are two of the most comprehensive of all supplemental insurance options for Medicare.

If you’re one of many newly enrolled Medicare beneficiaries, you may be thinking about investing in supplemental insurance to offset the out-of-pocket expenses that Original Medicare doesn’t cover.

Because Medicare Supplement Plan F and Plan G offer the most comprehensive coverage, you might be trying to decide which one – if either – is right for you. Keep on reading to learn more so that you can determine if one of these Medicare Supplement policies is a good fit for you.

Medicare Supplement Plans Explained

Also known as Medigap plans, Medicare Supplement policies are designed to cover the gaps that Original Medicare – Part A and Part B – don’t cover. In other words, these insurance plans help to cover the out-of-pocket expenses that Original Medicare doesn’t cover, such as copays, deductibles, and coinsurance.

Medicare beneficiaries can purchase Medigap insurance through private insurance companies. There are a total of 10 subsidized Medigap plans that are named after letters: A, B, C, D, F, G, K, L, M, and N. All plans with the same letter must offer the same benefits; however, premiums may vary, as they are set by the individual insurance companies that sell the policies.

At the beginning of 2020, eligibility requirements for Medicare Supplement plans changed. With this change, new Medicare enrollees were no longer able to purchase Plan F; rather, it is only available to beneficiaries who were eligible for Medicare prior to New Year’s Day, 2020.

New Medicare enrollees can, however, purchase Medicare Supplement Plan G, which is similar to Plan F. In other words, if you were eligible for Medicare benefits prior to the beginning of 2020 and you purchased Plan F, you are permitted to keep it.

Similarly, if you were eligible for federally-sponsored healthcare prior to January 1, 2020, but you didn’t enroll at that time if you do sign up for Medicare, you may be able to purchase Medigap Plan F.

Medicare Supplement Plan F vs Plan G - the Main Differences

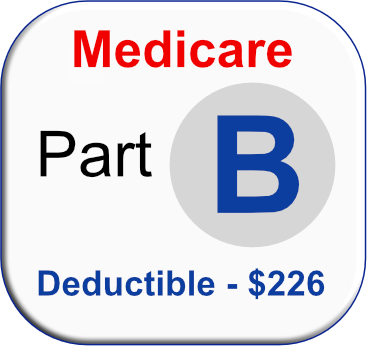

When analyzing the question of Medicare Plan F vs Plan G, it’s important to note that the coverage that Medigap Plan F and Medigap Plan G provide are virtually the same; however, there is one distinct difference: the Part B Deductible.

What Benefits Are the Same?

The following are the benefits Medicare Supplement Plan F and Plan G offer:

· Part A deductible

· Part A inpatient hospital and coinsurance costs, up to an extra 365 days past the point when a beneficiary’s benefits were used.

· Part A copayment and coinsurance for hospice care

· Part B copayment and coinsurance

· Part B excess charges for providers who do not participate in Medicare

· Coinsurance for skilled nursing facility care

· Blood transfusions for medical procedures; up to 3 pints

· Emergency healthcare that is deemed medically necessary within the first 60 days of traveling abroad (deductibles and limits do apply)

What Benefits Are Different?

The primary difference between Medicare Supplement Plan F and Plan G is that Plan F covers all of the above, as well as the deductible for Medicare Part B.

The primary difference between Medicare Supplement Plan F and Plan G is that Plan F covers all of the above, as well as the deductible for Medicare Part B.

Medicare Plan G does not cover this deductible.

No one who became eligible for Medicare Supplement benefits after January 1, 2020, can purchase a Medigap policy that will cover the cost of the deductible for Part B.

What is the Best Medicare Supplement Plan?

We’ll discuss why Medicare Plan F vs Plan G is still a hot debate, what you need to know about each plan, and how to choose the plan that fits your needs best.

The most popular Medicare Supplement Plans today are:

- Medicare Plan G

- Medicare Plan N

- Medicare Plan F

How Much Do Medicare Plan F and Plan G Cost?

Medigap Plan F costs more than Plan G, as Plan F offers more coverage. Because Medigap Plan F and Plan G offer the same benefits, the only exception being coverage for the Part B deductible, you might assume that difference in cost between these two plans would be minor.

While that may be the case in some instances (the monthly premium for Plan F might be $10 or $20 more than the monthly premium for Plan G, for example), sometimes, Plan F can cost significantly more than Plan G.

The private insurance companies that sell any Medicare Supplement Insurance plan set the premiums for the policies they sell. Health insurance companies take several factors into consideration when determining premiums for Medigap coverage.

A beneficiary’s geographic location, sex, age, whether or not they are married, and whether or not they use tobacco products are just some of the factors that insurance companies may consider when setting premiums.

Furthermore, whether a beneficiary opts for a standard policy or one that has a high deductible will also impact the cost of coverage.

Medicare Plan F and Plan G Eligibility Requirements

You are only eligible for Medigap Plan F if you were eligible for Medicare benefits prior to January 1, 2020. Anyone who became eligible for Medicare benefits after January 1, 2020, is not eligible for Plan F.

Anyone eligible for Medicare benefits, whether before January 1, 2020, or after, can purchase Medigap Plan G.

Which is Better: Plan F or Plan G?

One option isn’t better than the other, per se; rather, the plan that is right for you depends on your specific needs, including your budget. With that said, however, if you are interested in purchasing Plan F but you did not become eligible for Medicare benefits until after January 1, 2020, you will not be able to purchase this Medigap coverage. You can, however, purchase Medicare Supplement Plan G.

Do note that if Part B deductible coverage is important to you and you purchased Plan F prior to 2020, you can continue to keep the Medigap plan. While Plan G doesn’t cover the cost of the Part B deductible, because the premiums are lower, the amount you will save on this plan could offset the Part B deductible.

Medicare Supplement Plans are Standardized

It’s important to realize that when it comes to buying a Medigap plan, each insurance company has the exact same plans with the same benefits. They will all pay out of pocket costs the exact same way, and Medigap Plans from Mutual of Omaha for example, are the exact same as plans offered by Aetna or any other company.

The rates from each company can and often do vary widely, however. You might find Medigap Plan G for $120/month with one company, and the same Plan G could be $175 with another

It’s important to allow us to help you shop for Medicare coverage from all the top insurance companies to make sure you’re with the right plan, and you don’t overpay.

Top 10 Most Asked Questions about Medicare Plan F vs Plan G

What are the differences between Medicare Plan F and Plan G?

The main difference between Medicare Plan F and Plan G is that Medicare Plan F covers the cost of the Medicare Part B deductible, while Medicare Plan G does not. Also, Plan F cost more each month.

Which plan is more comprehensive: Plan F or Plan G?

Medicare Plan F is considered to be a more comprehensive plan, as it covers nearly all of the out-of-pocket expenses associated with Medicare. The difference is minimal, however, as it really only covers one small benefit that Plan G does not which is the annual Part B deductible.

Is Medicare Plan F going away?

No, Medicare Plan F is not going away for anyone enrolled in Medicare prior to January 1st of 2020. However, starting in 2020, new Medicare beneficiaries were no longer be able to enroll in this plan.

Which plan is less expensive: Plan F or Plan G?

Medicare Plan G is often considered to be a less expensive option when compared to Medicare Plan F. This is because Plan G does not cover the cost of the Medicare Part B premium.

Can I switch from Plan F to Plan G?

Yes, you can switch from Medicare Plan F to Plan G. However, it is important to carefully consider the pros and cons of each plan before making a decision. In most cases, you will need to go through medical underwriting to switch Medigap Plans.

What services are covered by Plan F and Plan G?

Both Medicare Plan F and Plan G are designed to provide coverage for many of the out-of-pocket expenses associated with Medicare, including copayments, coinsurance, and deductibles. Some of the services covered by both plans include hospitalization, medical equipment, and skilled nursing care.

What is not covered by Plan F and Plan G?

Both Medicare Plan F and Plan G do not cover the cost of long-term care, dental care, vision care, or hearing aids. Additionally, both plans do not cover the cost of prescription drugs.

How does Medicare Plan F vs Plan G compare to Medicare Advantage?

Medicare Advantage plans are another option for those who are looking to supplement their Medicare coverage. When compared to Medicare Plan F and Plan G, Medicare Advantage plans typically have a network you must adhere to, often require prior authorization for services, and can deny your claims if it’s coverage that Medicare Part A and B would not cover.

Medicare Advantage plans have more restrictions on the types of services that are covered and may limit the choice of healthcare providers.

How do I choose between Medicare Plan F and Plan G?

The decision to choose between Medicare Plan F and Plan G will depend on your individual needs and circumstances, as well as your budget. It is important to carefully consider the costs and benefits of each plan, as well as your overall health and financial situation.

We can help you decide which plan is best, and quite often most people would do better with Plan G than Plan F, simply because of the savings each month.

Can I enroll in Medicare Plan F or Plan G if I have pre-existing conditions?

You can apply for Medicare Plan F or Plan G even if you have pre-existing conditions. However, you may have to answer medical questions and go through underwriting to get approved.

If you are within your 6-month Medigap Open enrollment period, you are guaranteed coverage.

How to Find the Right Medicare Supplement Insurance

Medicare Supplement Insurance doesn’t have to be confusing or expensive. At Medisupps.com, our team of licensed agents will assist you with finding the right plan for you for the lowest price possible.

To start exploring quotes and learn which Medicare Supplement Plan is best for you, enter your zip code above or give us a call today!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.