by Russell Noga | Updated July 25th, 2025

Curious about Medicare Supplement Plans Utah 2026? This article covers everything you need to know about Medigap options available in Utah for 2026. We’ll detail plan benefits, enrollment information, leading providers, and premium costs to help you make informed healthcare decisions.

Key Takeaways

- Medicare Supplement Plans, or Medigap, cover out-of-pocket expenses not fully addressed by Original Medicare, with various plans available in Utah for 2026 tailored to meet different healthcare needs.

- The top Medigap plans in Utah include Plan G for comprehensive coverage, Plan N for affordability with significant benefits, and High-Deductible Plan F for lower premiums with a higher deductible option.

- Premium rates for Medigap plans vary by age, location, and provider; it is essential to compare multiple providers and take advantage of the Annual Election Period to secure the best coverage and rates.

Compare 2026 Plans & Rates

Enter Zip Code

Understanding Medicare Supplement Plans in Utah

Medicare Supplement Plans, commonly referred to as Medigap, are designed to fill the financial gaps left by Original Medicare. These plans are sold by private insurance companies and can help cover costs that Medicare does not fully pay, such as deductibles and copayments. In Utah, residents will have access to several Medigap plans in 2026, each offering unique benefits tailored to meet different healthcare needs.

Medigap plans offer crucial financial protection for Medicare beneficiaries. It’s beneficial to understand the offerings of each plan to determine which best suits your needs.

Understanding the distinctions between Medigap plans and other Medicare options is key to making informed choices.

What Are Medigap Plans?

Medigap policies, offered by private insurers, are designed to supplement Original Medicare. To enroll in a Medigap plan, you must have both Medicare Part A and Part B. These plans help cover out-of-pocket expenses that Original Medicare does not fully address, such as deductibles, copayments, and coinsurance.

Medigap policies are standardized and labeled with letters, each offering different levels of coverage. These standardized plans ensure that no matter which insurance company you choose, the core benefits remain the same. This standardization makes it easier for Medicare beneficiaries to compare plans and choose the one that best meets their needs.

How Medigap Differs from Medicare Advantage

While both Medigap and Medicare Advantage plans offer additional benefits, they serve different purposes within the Medicare system. Medigap policies work alongside Original Medicare to cover additional out-of-pocket expenses. On the other hand, Medicare Advantage plans provide an alternative way to receive Medicare benefits through private insurers.

Medicare Advantage plans often include special supplemental benefits such as vision, hearing, and dental services, which are not typically covered by Medigap plans. Recognizing these differences helps beneficiaries choose the best Medicare Advantage plan for their healthcare requirements.

Eligibility and Enrollment

To qualify for a Medigap plan, individuals must be enrolled in both Medicare Parts A and B. The best time to purchase a Medigap policy is during the six-month Medigap Open Enrollment Period that starts when you turn 65 and are enrolled in Part B. During this period, you have the ability to enroll in any Medigap plan without medical underwriting, meaning you can’t be denied coverage based on pre-existing conditions.

Beneficiaries can also switch from Medicare Advantage to Original Medicare during the Annual Election Period, which may affect their eligibility for Medigap plans. Being aware of these enrollment periods and eligibility criteria ensures you secure the necessary coverage.

Top Medigap Plans Available in Utah for 2026

In Utah, there are ten different Medigap plans available to newly eligible Medicare beneficiaries. These plans range from those offering basic coverage to more comprehensive options, ensuring that there is a plan to meet the needs of every individual. The most sought-after Medigap plans in Utah for 2026 offer extensive benefits that fill the coverage gaps left by Medicare, providing peace of mind to beneficiaries.

Medigap plans in Utah often include supplemental benefits like vision, hearing, fitness, and dental services, aimed at improving overall health and wellness. With a variety of plans available, it’s important to understand the specifics of each to make an informed decision.

Here are some of the top Medigap plans available in Utah for 2026.

Plan G

Plan G is renowned for its comprehensive coverage, making it a popular choice among new Medicare enrollees. This plan covers full Medicare Part A and B co-pays, coinsurance, and hospice care, providing extensive health coverage and peace of mind for beneficiaries. Because of its robust coverage, Plan G is particularly popular among those who want to minimize their out-of-pocket expenses.

Cigna is recognized as the top provider for Medicare Supplement Plan G in Utah, noted for its affordable premiums and comprehensive benefits. Choosing a reliable provider like Cigna ensures you receive the best coverage and customer service.

Plan N

Plan N is gaining popularity among Medicare beneficiaries due to its balance of affordability and coverage. This plan offers lower premiums compared to some other Medigap plans, making it an attractive option for those looking to save on monthly costs. Plan N covers a wide range of services, although beneficiaries will have to pay some copayments when they visit a doctor’s office or use emergency services.

While Plan N does not cover the Medicare Part B deductible, it provides substantial coverage for other medical expenses, making it a cost-effective option for many beneficiaries. This plan is ideal for those who want significant coverage without the higher premiums associated with other plans.

High-Deductible Plan F

High-Deductible Plan F is a variation of the standard Plan F, designed for beneficiaries who want to pay lower premiums in exchange for a higher deductible before benefits kick in. This plan requires beneficiaries to meet a high deductible annually, meaning they must pay a specific amount out of pocket before coverage begins.

This plan can be particularly beneficial for healthy individuals who do not anticipate frequent medical services and prefer to save on monthly premiums. For those who can manage the high deductible, this plan can lead to significant savings compared to standard plans with higher monthly premiums.

Costs and Premiums for Medigap Plans in Utah

Premium rates for Medigap plans in Utah can vary widely based on several factors, including the specifics of the chosen plan and individual characteristics of the policyholder. For example, the high-deductible version of Plan F allows beneficiaries to maintain extensive coverage once the deductible is met while saving on monthly premiums. Understanding these cost dynamics is crucial for making informed decisions about your healthcare coverage.

We will examine the factors influencing Medigap premiums, average rates, and cost-saving tips to manage healthcare expenses effectively.

Factors Influencing Premiums

Several factors can influence the premiums for Medigap plans. Age is a significant factor, with older individuals typically facing higher costs. The geographic location of a policyholder also plays a role, as costs may differ between urban and rural areas.

Insurance companies may also consider gender and smoking status when determining premiums, with women generally offered lower rates and tobacco users potentially facing costs up to 10% higher than non-smokers. Knowing these factors aids in anticipating and managing healthcare expenses more effectively.

Average Premium Rates

For 2026, average premium rates for Medigap plans in Utah will differ depending on the plan coverage, with more comprehensive plans generally costing more. For instance, Plan N features lower premiums than many other Medigap plans while still offering significant benefits, making it attractive for budget-conscious enrollees.

Medigap plans that offer more extensive coverage, such as Plan G, typically have higher monthly premium costs compared to plans with limited benefits. Knowing the average premium rates helps in planning finances and selecting a budget-friendly plan.

Cost-Saving Tips

Shopping around during the open enrollment period can lead to significant cost savings on Medigap premiums. Reviewing multiple plans annually is essential as costs and benefits can change. Comparing providers allows you to evaluate premium rates and benefits side by side, ensuring you get the best value for your money.

Look for providers with competitive rates and additional benefits to maximize overall value. To make informed decisions, examine not only cost but also coverage details for each plan. Checking customer service ratings of providers can also impact satisfaction with Medigap plans.

Compare Medicare Plans & Rates in Your Area

Additional Benefits and Services

Certain Medigap plans in Utah offer additional benefits beyond standard coverage, enhancing the overall healthcare experience for beneficiaries. These benefits can include foreign travel emergency coverage and preventive care services, which are designed to promote early detection and maintenance of good health. These additional benefits can guide you in selecting a plan that covers medical expenses and supports overall well-being.

Here are some additional benefits and services, including foreign travel emergency coverage and preventive care.

Foreign Travel Emergency Coverage

Certain Medigap plans provide coverage for emergency medical services needed while traveling internationally, ensuring access to care outside the U.S. This coverage includes 80% of necessary medical expenses incurred abroad, subject to a $250 deductible, and is available for the first 60 days of travel.

Plan G, in particular, is recognized for its comprehensive coverage, including benefits for excess charges and foreign travel emergencies. This makes it an excellent choice for those who travel frequently and want to ensure they are covered in the event of a medical emergency abroad.

Preventive Care

Medigap plans typically cover a range of preventive services, promoting early detection and management of health conditions. These services can include routine check-ups, screenings, and immunizations, which are essential for maintaining good health and preventing serious illnesses.

The inclusion of preventive care services in Medigap plans supports overall health and helps beneficiaries manage their health proactively. By opting for a Medigap plan that includes preventive care, you can ensure that you receive timely medical attention and avoid potential health complications.

Comparing Providers

Comparing multiple insurance providers and their Medigap offerings can reveal significant differences in premiums and coverage options. By shopping around and evaluating different providers, you can find a plan that best meets your needs and offers the most value for your money.

Consider these factors when comparing providers: top ratings, customer service, and financial stability.

Top-Rated Providers

Some of the best-reviewed Medigap providers in Utah prioritize customer satisfaction and reliable service. Choosing a top-rated provider can significantly impact your healthcare experience and financial security, ensuring that you receive high-quality service and support when you need it.

Consider providers known for their excellent customer reviews and high ratings in service quality. Choosing a top-rated provider ensures your healthcare needs are well-managed.

Evaluating Customer Service

Customer satisfaction ratings from organizations like J.D. Power and the NCQA are crucial indicators of Medigap providers’ quality. Assessing customer service quality involves checking responsiveness, claims processing efficiency, and availability of support.

Look for responsiveness, clarity in communication, and the availability of support when assessing customer service from Medigap providers. The availability of live chat services on a provider’s website can significantly enhance customer support and accessibility.

Financial Stability

Choosing a financially stable Medigap provider ensures they can meet long-term obligations.

Providers with strong AM Best ratings indicate better financial health and reliability, which is important for long-term coverage assurance. By choosing a financially stable provider, you can be confident that your healthcare needs will be met consistently over time.

Navigating the Annual Election Period

The Annual Election Period (AEP) is a crucial time for beneficiaries to review and alter their Medicare coverage, impacting choices for Medigap plans. Effectively using the open enrollment period helps beneficiaries find better rates and coverage options.

Shopping around for different providers and comparing multiple Medigap plans during the open enrollment period can lead to significant savings on premiums. Understanding how to navigate this period is essential for making informed decisions about your healthcare coverage.

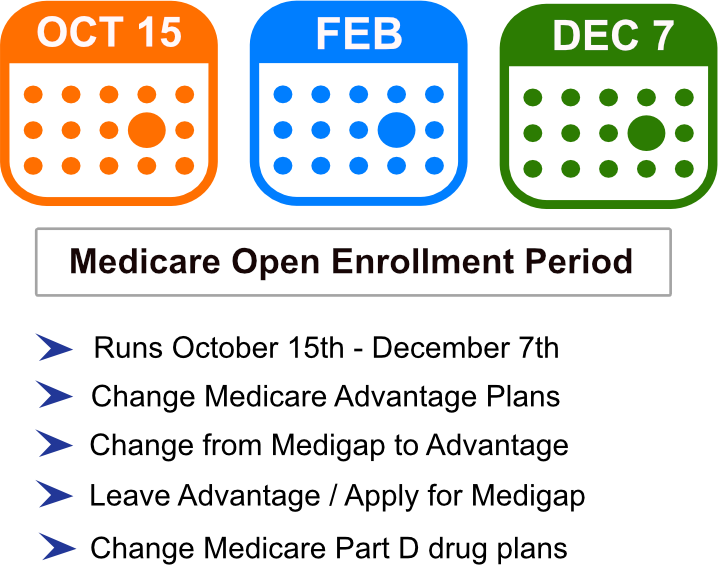

Key Dates and Deadlines

The Annual Election Period runs from October 15 to December 7, allowing beneficiaries to make changes effective January 1 of the following year. This period is the best time to review your current plan and make any necessary changes to ensure you have the best coverage for the upcoming year.

There is a Special Enrollment Period available for enrolling in a new Aetna plan. This period runs from December 8, 2024, to February 28, 2025. Keeping track of these key dates and deadlines is essential for making timely and informed decisions about your Medicare coverage options.

Making Changes to Your Plan

If you enroll in a new plan by December 31, 2024, your current benefits will remain active until that date. During the Annual Election Period, you can switch from Medicare Advantage to Original Medicare, which may affect your eligibility for Medigap plans.

Reviewing current coverage and understanding possible changes during the AEP ensures you have the best plan for your needs. Taking the time to compare different Medigap plans and providers can lead to better coverage and cost savings.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

In conclusion, understanding and choosing the right Medicare Supplement Plan in Utah for 2026 is crucial for ensuring comprehensive healthcare coverage. From exploring the differences between Medigap and Medicare Advantage plans to evaluating top-rated providers and managing costs, this guide has covered all the essential aspects you need to know.

By staying informed and proactive, you can make the best decisions for your healthcare needs. Remember to review your options during the Annual Election Period and choose a plan that offers the coverage and benefits that best suit your lifestyle. Here’s to a healthier and more secure future with the right Medicare Supplement Plan!

Frequently Asked Questions

What is a Medigap plan?

A Medigap plan is Medicare Supplement Insurance that provides additional coverage for out-of-pocket expenses not covered by Original Medicare, such as deductibles and copayments. It is offered by private insurers.

How does Medigap differ from Medicare Advantage?

Medigap supplements Original Medicare by covering additional out-of-pocket expenses, while Medicare Advantage offers a different way to receive Medicare benefits through private insurance plans.

When is the best time to enroll in a Medigap plan?

The best time to enroll in a Medigap plan is during the six-month Medigap Open Enrollment Period, which begins when you turn 65 and are enrolled in Medicare Part B. Taking advantage of this period ensures you receive the best coverage options without facing medical underwriting.

What factors influence Medigap premiums?

Medigap premiums are primarily influenced by age, geographic location, gender, and smoking status, with older individuals, urban residents, and smokers typically facing higher costs. Understanding these factors can help you better prepare for potential healthcare expenses.

What additional benefits do some Medigap plans offer?

Some Medigap plans provide extra benefits like foreign travel emergency coverage and preventive care services, enhancing your overall health management and protection while abroad.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans Utah 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.