by Russell Noga | Updated July 9th, 2025

Want to know what’s happening with Medicare Supplement Plans Ohio 2026? This article covers new plan options and important changes, so you can choose the best coverage.

Key Takeaways

- Medicare Supplement Plans in Ohio, known as Medigap, are essential for covering out-of-pocket costs not paid by Original Medicare and will undergo significant changes in 2026 with the introduction of the Next Generation MyCare plans.

- Popular Medicare Supplement Plans for 2026 include Plan G, Plan N, and the High-Deductible Plan G, each offering distinct benefits and tailored coverage options to suit various healthcare needs.

- Choosing the best Medicare Supplement Plan involves assessing personal health needs, budgeting for premiums and out-of-pocket costs, and consulting with Medicare providers for guidance throughout the enrollment process.

Compare 2026 Plans & Rates

Enter Zip Code

Overview of Medicare Supplement Plans in Ohio 2026

Medicare Supplement Plans in Ohio are designed to minimize out-of-pocket expenses for seniors by covering costs that Original Medicare does not. These plans, often referred to as Medigap, play a vital role in bridging the gap left by Original Medicare, ensuring that beneficiaries have comprehensive coverage.

As we look ahead to 2026, there are significant changes on the horizon for Medicare Supplement Plans in Ohio. The Ohio Department of Medicaid will implement updates that aim to enhance benefits and services for individuals eligible for both Medicare and Medicaid under the MyCare Ohio program. Understanding these changes is crucial for making the best choice for your healthcare needs.

What Are Medicare Supplement Plans?

Medicare Supplement Plans, commonly known as Medigap, are designed to help cover out-of-pocket costs that Original Medicare does not pay. These plans fill the coverage gaps left by Original Medicare, including expenses such as copayments, coinsurance, and deductibles. Medicare Supplement Plans reduce these expenses, offering beneficiaries additional financial security.

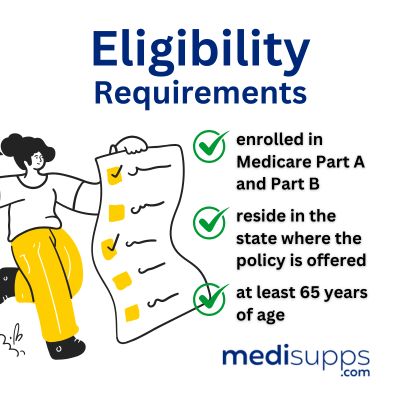

To enroll in a Medicare Supplement Plan, individuals typically need to have Original Medicare (Part A and Part B), as these plans are specifically designed to complement and enhance the coverage provided by Medicare. Ohio offers a variety of standardized Medigap plans, each providing different levels of coverage to meet diverse healthcare needs.

Key Changes for 2026

Starting in January 2026, there will be significant updates to Medicare Supplement Plans in Ohio. One of the major changes is the introduction of the Next Generation MyCare plans, which aim to provide enhanced benefits and services for individuals eligible for both Medicare and Medicaid. These plans will be managed by four organizations: Anthem Blue Cross and Blue Shield, Buckeye Health Plan, CareSource, and Molina HealthCare of Ohio.

Starting in 2026, coordination-only Dual Eligible Special Needs Plans (CO DSNP) will not be allowed. This change marks a significant shift in the eligibility of these plans. Current members of the MyCare Ohio program will not lose coverage when the new plans start, ensuring a smooth transition for all beneficiaries.

Top Medicare Supplement Plans Available in Ohio 2026

In 2026, several Medicare Supplement Plans will be available in Ohio, each offering distinct benefits and coverage options tailored to meet various healthcare needs. Among the most popular options are Plan G, Plan N, and the High-Deductible Plan G. Each of these plans offers unique advantages, making it essential to understand their differences to choose the best one for your situation.

Here are the specifics of these top Medicare Supplement Plans, beginning with Plan G.

Plan G

Plan G is one of the most sought-after Medigap options, providing comprehensive coverage for out-of-pocket expenses. This plan covers a wide range of services, including copayments, coinsurance, and deductibles, making it a favorite among Medicare beneficiaries. It is particularly beneficial for those who anticipate frequent hospital stays and doctor visits, as it covers hospital costs and skilled nursing care, except for the Part B deductible.

For those seeking extensive coverage without worrying about unexpected medical bills, Plan G is an excellent choice. It ensures that most out-of-pocket expenses are taken care of, providing peace of mind and financial stability.

Plan N

Plan N is another popular Medicare Supplement option in Ohio, known for offering lower premiums compared to some other plans while still covering many essential services. This plan typically covers 100% of Medicare Part A coinsurance and hospital costs, making it beneficial for hospital stays. However, beneficiaries may need to pay copayments for certain services, such as visits to specialists or emergency rooms.

Individuals choosing Plan N can expect to retain coverage while also maintaining some level of cost-sharing, which can lead to overall savings on healthcare expenses. This plan is designed to complement Original Medicare, providing additional coverage where Medicare may leave gaps.

High-Deductible Plan G

The High-Deductible Plan G is specifically available to those who became eligible for Medicare on or after January 1, 2020. For 2025, the annual deductible for this plan is set at $2,870, which must be met before benefits are paid. This deductible amount is adjusted annually based on the Consumer Price Index, reflecting changes in out-of-pocket expenses.

This plan is suitable for those who prefer to pay lower premiums in exchange for a higher deductible. Beneficiaries must meet the high deductible before the policy begins covering additional medical expenses, making it a budget-friendly option for those who do not anticipate frequent medical needs.

Compare Medicare Plans & Rates in Your Area

Comparing Medicare Supplement Plans with Medicare Advantage Plans

Deciding between Medicare Supplement Plans and Medicare Advantage Plans can be challenging. Each option has its own set of benefits and limitations, and the best choice depends on individual healthcare needs and financial considerations. Medicare Supplement Plans generally provide more comprehensive coverage and fewer restrictions than Medicare Advantage Plans.

In the following subsections, we’ll explore the key differences in coverage and costs between these two types of plans to help you make an informed decision.

Coverage Differences

Medicare Supplement Plans, also known as Medigap, provide coverage for out-of-pocket costs that Original Medicare does not cover. These plans are designed to fill the gaps in coverage left by Medicare, offering additional financial protection.

On the other hand, Medicare Advantage Plans are an alternative to Original Medicare and often include additional benefits like dental and vision coverage, which are typically not available through Medicare Supplemental Benefits Plans.

When selecting a plan, it’s essential to understand your personal health needs and compare the specific benefits and services offered by each plan. This will ensure that you choose the coverage that best fits your requirements.

Cost Considerations

Cost is a significant factor when deciding between Medicare Supplement Plans and Medicare Advantage Plans. Plan N, for instance, features lower monthly premiums compared to some other Medigap plans. However, it includes copayments for certain office visits and emergency room services.

Understanding the combination of premiums, out-of-pocket costs, and overall affordability is crucial for making a cost-effective choice. The right plan for you will depend on your financial situation and your anticipated healthcare needs.

How to Choose the Best Medicare Supplement Plan for Your Needs

Choosing the best Medicare Supplement Plan requires a thorough evaluation of your personal healthcare needs, budget, and the advice of professionals. Assessing your current and future health conditions, budgeting for premiums and out-of-pocket expenses, and consulting with Medicare providers and advisors are all critical steps in this process.

Let’s explore these steps in more detail to help you make an informed decision.

Assessing Your Health Care Needs

Evaluating your current and future health conditions is essential for choosing an appropriate Medicare Supplement Plan. Consider your current medical conditions, the frequency of doctor visits, and any ongoing treatments when determining your healthcare needs. Anticipating future health requirements, such as medications and preferred providers, is also crucial.

Knowledgeable Medicare providers and advisors can help clarify plan options and ensure informed choices based on individual circumstances. Their insights can be invaluable in navigating the complexities of available coverage options.

Budgeting for Premiums and Out-of-Pocket Costs

Budgeting for premiums and out-of-pocket expenses is a critical aspect of selecting the right Medicare Supplement Plan. It’s essential to evaluate the total cost of premiums alongside potential out-of-pocket expenses to create an effective budget.

Plans like the high-deductible version of Plan G allow policyholders to pay a lower premium but require meeting a higher deductible before coverage kicks in. This option can be budget-friendly for those who do not anticipate frequent medical needs.

Consulting Medicare Providers and Advisors

Consulting with Medicare providers and professional advisors is crucial for making informed decisions about coverage options. These experts can provide valuable insights and help you navigate your options effectively.

To facilitate a hassle-free enrollment process, it’s important to gather all necessary documentation and understand the terms of your chosen plan. Engaging with licensed Medicare brokers or local State Health Insurance Assistance Programs can provide personalized guidance in selecting a Medicare plan.

Enrollment Process for Medicare Supplement Plans in Ohio 2026

The enrollment process for Medicare Supplement Plans in Ohio requires beneficiaries to be aware of significant deadlines to ensure they do not miss their chance to enroll. Understanding specific deadlines and eligibility requirements is crucial for ensuring proper coverage.

Here is an overview of the initial enrollment period, special enrollment periods, and tips for a smooth enrollment process.

Initial Enrollment Period

The initial enrollment period for Medicare Supplement Plans is a crucial time frame when individuals can enroll without being subject to medical underwriting. This period typically begins during the first three months after an individual turns 65 and lasts for six months. Gathering all necessary documentation, such as Medicare cards and personal identification, can significantly ease the enrollment process.

Special Enrollment Periods

Special enrollment periods allow beneficiaries to enroll in Medicare Supplement Plans outside of the initial enrollment timeframe due to specific life events. Beneficiaries may qualify for these periods due to conditions such as losing other health coverage or experiencing specific life events.

Tips for a Smooth Enrollment

Gathering all necessary documentation and understanding the different plan options can help ensure a smooth enrollment experience.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

In summary, understanding the various Medicare Supplement Plans and the upcoming changes in 2026 is crucial for making informed healthcare decisions. Whether you choose Plan G, Plan N, or the High-Deductible Plan G, each option offers distinct benefits tailored to different needs. Assessing your healthcare needs, budgeting for costs, and consulting with professionals are vital steps in selecting the right plan.

As you navigate the enrollment process, remember to be mindful of deadlines and gather all necessary documentation to ensure a smooth experience. By staying informed and proactive, you can secure the coverage that best fits your needs and enjoy peace of mind in your healthcare journey.

Frequently Asked Questions

What are Medicare Supplement Plans, and how do they work?

Medicare Supplement Plans, or Medigap, are designed to cover out-of-pocket expenses that Original Medicare does not, including copayments, coinsurance, and deductibles. They work by filling the coverage gaps, allowing you to manage healthcare costs more effectively.

What changes are coming to Medicare Supplement Plans in Ohio in 2026?

The changes to Medicare Supplement plans for the 2026 year have not been announced yet. Please refer back to this website for updated information.

How does Plan G differ from other Medicare Supplement Plans?

Plan G offers extensive coverage for nearly all out-of-pocket medical expenses under Medicare, only excluding the Part B deductible, which distinguishes it from other Medicare Supplement Plans that may have different benefit structures. This makes Plan G a popular choice for those seeking maximum coverage.

What are the cost considerations when choosing between Medicare Supplement Plans and Medicare Advantage Plans?

When choosing between Medicare Supplement and Medicare Advantage Plans, it’s crucial to evaluate premiums, out-of-pocket expenses, and how these align with your personal healthcare needs. This assessment ensures you select a plan that offers both affordability and adequate coverage for your situation.

What is the significance of the initial enrollment period for Medicare Supplement Plans?

The initial enrollment period is crucial as it enables you to sign up for Medicare Supplement Plans without undergoing medical underwriting, typically starting three months after you turn 65 and lasting for six months. This period ensures you have access to coverage regardless of your health status.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans Ohio 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.