by Russell Noga | Updated July 7th, 2025

Wondering what Medicare Supplement Plans North Dakota 2026 can offer? This article explores your options to help you find a plan that suits your healthcare needs and financial situation.

Key Takeaways

- Medicare Supplement Plans in North Dakota are standardized, allowing beneficiaries to easily compare benefits across different insurers, thus reducing financial burdens from gaps left by Original Medicare.

- Choosing the right Medigap plan involves assessing various options like coverage levels and premiums, while also considering personal health needs and potential additional benefits such as dental and vision coverage.

- Medicare Supplement Plans do not cover prescription drugs, making it essential for beneficiaries to enroll in a separate Medicare Part D plan to ensure coverage for necessary medications.

Compare 2026 Plans & Rates

Enter Zip Code

Overview of Medicare Supplement Plans in North Dakota 2026

Medicare Supplement Plans in North Dakota are specifically designed to bridge the gaps in coverage that Original Medicare leaves behind. These gaps can include things like copayments, coinsurance, and deductibles, which can add up quickly and become a financial burden. Enrolling in a Medigap policy allows Medicare beneficiaries to enhance their coverage and reduce out-of-pocket expenses.

One of the key features of Medicare Supplement Plans is their standardization. This means that each plan, regardless of the insurer, offers the same set of benefits as long as it falls under the same letter designation. For example, Plan G from one provider will offer the same benefits as Plan G from another provider. This standardization simplifies the comparison process for beneficiaries and ensures a consistent level of coverage.

In North Dakota, as in other states, these standardized plans make it easier for Medicare beneficiaries to choose the coverage that best fits their needs without having to worry about variations in benefits across different insurers. This consistency is particularly beneficial for those who may feel overwhelmed by the myriad of options available.

Comparing Plan Options: Finding the Right Fit

Selecting the right Medicare Supplement Plan involves careful consideration of various factors. North Dakota offers several specific Medigap plans that vary significantly in coverage and costs. Understanding these differences is crucial for making an informed decision. Plan G, for example, is often recommended for its comprehensive coverage, including benefits like excess charges and emergency care abroad. On the other hand, Plan N might be a better fit if you prefer lower premiums and are willing to share some costs at the doctor’s office.

Comparing the benefits and premiums of different plans ensures they align with your healthcare needs. Reading reviews and experiences from current plan members can provide valuable insights into the quality of care offered by different insurers.

Additionally, knowing that you can apply for Medigap policies at any time of the year in North Dakota gives you flexibility, though benefits may vary based on the enrollment period.

Remember, some plans may impose medical underwriting, which means your acceptance could depend on your health status if you apply outside the initial enrollment period. Consulting with licensed agents who specialize in Medicare options can also assist in navigating the enrollment process and finding a plan that fits your specific needs.

Key Benefits of Medicare Supplement Plans

Medicare Supplement Plans offer numerous benefits that can significantly improve your financial and healthcare situation. One of the primary advantages is the reduction in out-of-pocket costs associated with Medicare services, which can be particularly high without supplemental coverage. Plans like Medigap also simplify the healthcare billing process, making it easier for beneficiaries to manage their medical expenses.

In addition to financial protection, Medigap policies may provide innovative benefits such as dental and vision coverage, enhancing care options beyond what Original Medicare offers. These additional benefits can be particularly valuable for those with specific health needs that aren’t fully covered by standard Medicare.

Furthermore, Medicare offers annual Wellness visits designed to help beneficiaries develop personalized plans for disease prevention. These visits include health risk assessments and reviews of medical history and prescriptions, ensuring that beneficiaries receive tailored preventive care based on their individual health and risk factors.

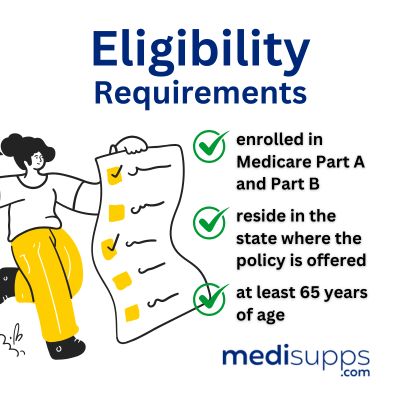

Eligibility and Enrollment Process

Eligibility for Medicare Supplement Plans generally requires enrollment in both Medicare Part A and Part B. This foundational requirement ensures that beneficiaries have basic hospital and medical coverage before adding a Medigap policy. Enrollment processes can vary by state, but in North Dakota, a significant percentage of traditional Medicare beneficiaries opt for these supplemental plans.

For the 2026 plan year, changes to the essential health benefits benchmark plan in North Dakota have been approved, impacting what is included in Medicare Supplement Plans. This means that state-required benefits for essential health coverage can vary, and it’s important to stay informed about these updates to understand how they might affect your coverage options.

The enrollment process itself is relatively straightforward. Beneficiaries can apply for a Medigap policy during their initial enrollment period when they first become eligible for Medicare or during open enrollment periods. In some cases, applying outside these periods may involve medical underwriting, where acceptance depends on health status. Keeping abreast of state-specific updates and consulting with licensed agents can simplify this process.

Compare Medicare Plans & Rates in Your Area

Premium Costs and Factors Affecting Rates

The cost of premiums for Medicare Supplement Plans in North Dakota can vary based on several factors. Geographic location, the insurer’s pricing methods, and the individual’s health status all play significant roles in determining premium rates. For example, beneficiaries in different parts of the state may face different premium costs due to varying healthcare costs in those areas.

Age is another crucial factor, with older beneficiaries typically facing higher premiums. Additionally, pre-existing health conditions can influence premiums, as insurers may charge higher rates for individuals with specific health risks. Evaluating your budget for premiums, deductibles, and out-of-pocket expenses is essential when selecting a plan.

Some insurers offer discounts for non-smokers, which can help lower premium costs. Assessing past premium increases can provide insights into cost stability, helping you choose a plan that offers both comprehensive coverage and financial predictability.

Prescription Drug Coverage and Medicare Part D

While Medicare Supplement Plans offer extensive coverage for many healthcare costs, they do not include prescription drug coverage. For this, Medicare beneficiaries must enroll in a Medicare Part D plan. Medicare Part D is essential for covering prescription drugs, and it’s crucial to ensure that the drugs you need are covered under the plan’s formulary.

One of the popular options for prescription drug coverage is the SilverScript Choice (PDP) plan, which offers coverage for covered drugs through more than 63,000 pharmacies nationwide. This broad network ensures that beneficiaries have easy access to their medications, regardless of where they live.

Understanding that Medigap policies can work alongside Medicare Part D plans but do not replace the need for a separate Part D plan is crucial. Enrolling in Medicare Part D is necessary to receive prescription drug benefits, and without it, beneficiaries may face significant out-of-pocket costs for their medications.

Network Restrictions and Provider Access

One of the significant advantages of Medicare Supplement Plans is the lack of network restrictions. Unlike Medicare Advantage Plans, which often limit enrollees to a network of healthcare providers, Medigap policies allow beneficiaries to use any provider that accepts Medicare. This flexibility is particularly beneficial for those who may need to see specialists or receive care outside a limited network.

For those considering Medicare Advantage Plans, it’s important to understand that while PPO plans allow for seeing providers outside the network, this usually comes with higher out-of-pocket costs. Weighing these factors can help beneficiaries decide whether the broader access provided by Medigap policies is worth the potentially higher premiums compared to network-restricted plans.

Additional Benefits to Consider

While the primary purpose of Medicare Supplement Plans is to fill gaps in Original Medicare coverage, some plans offer additional benefits that can be highly valuable. For instance, Aetna’s Medicare Supplement Plans may include services like dental, vision, and hearing coverage. These additional benefits go beyond standard Medicare coverage and can significantly enhance your healthcare experience.

Moreover, some plans include wellness services, providing further opportunities for maintaining good health and preventing illness. Considering these additional benefits when choosing a plan can ensure you receive comprehensive coverage that meets all of your healthcare needs.

Mental Health and Chronic Conditions Coverage

Mental health and chronic conditions are critical areas of concern for many Medicare beneficiaries. Approximately 20% of adults aged 65 and older report experiencing anxiety or depression, highlighting the need for comprehensive mental health coverage. Medicare Supplement Plans can provide coverage for mental health services, ensuring that beneficiaries have access to the care they need.

For those with chronic conditions, having a plan that offers extensive coverage for treatment and management is essential for those who are chronically ill and can help address potential health problems. Rural beneficiaries, in particular, may face greater challenges in accessing providers due to more restrictive networks compared to urban areas. Ensuring that your chosen plan covers the necessary services for managing chronic conditions can make a significant difference in your overall health and quality of life.

Tips for Choosing the Best Plan

Choosing the right Medicare Supplement Plan requires careful consideration of your personal health needs and financial situation. Consulting with a Personal Benefits Manager can provide valuable guidance in navigating the complexities of healthcare finance and the Medicare system. These licensed experts can help you compare different Medigap and Medicare Advantage Plans, ensuring that you make an informed decision.

Considering any additional services or benefits included in the plan can be crucial. Evaluating the coverage options, costs, and potential discounts can help you select a plan that offers the best balance of comprehensive coverage and affordability.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

In summary, Medicare Supplement Plans in North Dakota for 2026 offer valuable coverage options that can significantly enhance your healthcare experience. Understanding the differences between plans, evaluating the benefits, and considering your personal health needs are crucial steps in making an informed decision. Whether you prioritize comprehensive coverage, lower premiums, or additional benefits like dental and vision care, there’s a Medigap policy that can meet your needs.

As you navigate the complexities of Medicare, remember that consulting with licensed experts and staying informed about state-specific updates can simplify the process. By choosing the right plan, you can ensure financial protection and peace of mind, allowing you to focus on maintaining your health and well-being.

Frequently Asked Questions

What is the new rule for Medicare in 2025?

People with Medicare Part D plans will have a maximum out-of-pocket cost of $2,000 for prescription medications annually starting January 1, 2025. This change aims to provide financial relief for beneficiaries.

What are Medicare Supplement Plans, and why are they important?

Medicare Supplement Plans, or Medigap, are crucial as they cover the gaps in Original Medicare, thereby offering financial protection and minimizing out-of-pocket expenses for beneficiaries.

How do I compare different Medicare Supplement Plans?

To effectively compare different Medicare Supplement Plans, evaluate their benefits and premiums, read current member reviews, and consult with licensed agents who specialize in Medicare options. This comprehensive approach ensures you choose the best plan for your needs.

What additional benefits can Medicare Supplement Plans offer?

Medicare Supplement Plans can provide additional benefits such as dental, vision, and hearing coverage, along with wellness services, enhancing your overall healthcare experience.

Do Medicare Supplement Plans cover prescription drugs?

Medicare Supplement Plans do not cover prescription drugs; you need to enroll in a separate Medicare Part D plan for that coverage.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans North Dakota 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.