by Russell Noga | Updated December 22nd, 2023

Who Qualifies for Medicare Supplement Insurance?

Navigating the world of healthcare insurance can be daunting, especially when it comes to Medicare and its various components. One aspect that often causes confusion is Medicare Supplement Insurance, or Medigap.

Navigating the world of healthcare insurance can be daunting, especially when it comes to Medicare and its various components. One aspect that often causes confusion is Medicare Supplement Insurance, or Medigap.

In this post, we’ll delve into the intricacies of who qualifies for Medicare Supplement Insurance, providing you with the knowledge you need to make informed decisions about your healthcare coverage.

Key Takeaways

- Medicare Supplement Insurance is a type of health insurance designed to fill gaps in Original Medicare coverage.

- Eligibility criteria for Medicare Supplement Plans include being 65 years or older and enrolled in both Part A and B of Medicare.

- During the six-month Open Enrollment Period, individuals turning 65 are eligible to enroll without penalty. Pre-existing conditions may be subject to waiting periods or additional costs depending on the insurer.

Understanding Medicare Supplement Insurance

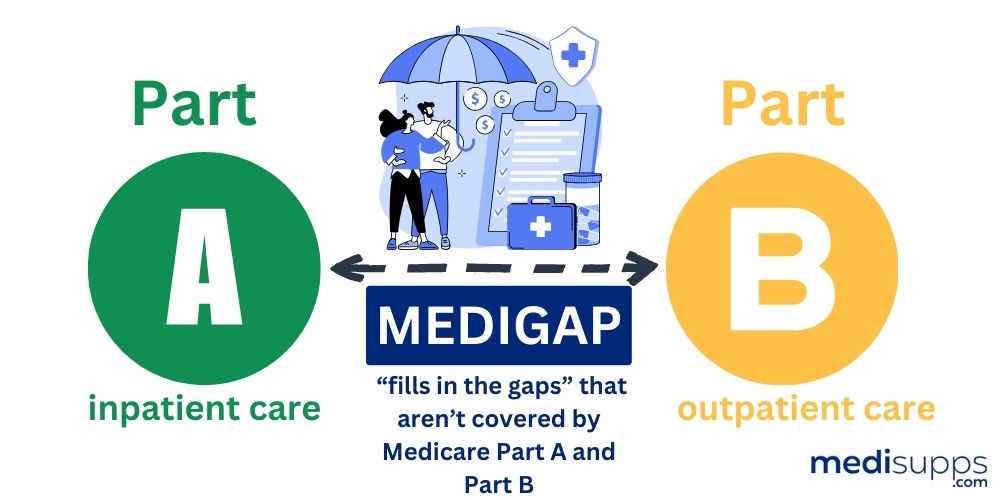

Medicare Supplement Insurance, commonly known as Medigap, is designed to help fill the gaps in Original Medicare coverage.

Sold by private insurance companies, Medigap policies can assist in covering certain healthcare costs not included in the Original Medicare Plan, providing additional coverage for eligible beneficiaries.

One option to consider is a Medicare Supplement Insurance Plan, which offers various levels of coverage depending on individual needs. It’s essential to explore different medicare supplement policies, including a suitable medicare supplement policy, to find the best fit for your healthcare requirements.

A Medicare Supplement plan requires enrolment in both Medicare Part A and Part B, coupled with the fulfillment of specific age criteria.

Notably, the Open Enrollment Period prevents insurance companies from denying coverage or levying higher Medicare Part B premiums based on health status.

What are Medigap Plans?

Medigap plans are designed to work in conjunction with Original Medicare. Offered by private insurance companies, such as a Medigap insurance company, these plans supplement the out-of-pocket costs not covered by Medicare Part A and Part B.

If you’re considering to buy a Medigap policy, there are 10 standardized Medigap plans available, designated:

Each plan has distinct benefits and coverage options.

The standardized Medigap plans typically help pay for one’s share of costs for services that are covered by Original Medicare (Part A and Part B).

While the benefits provided by Medigap plans may differ, they usually include Medigap coverage for:

- Coinsurance for hospital stays

- Coverage for skilled nursing facility care coinsurance

- Coverage for Part A deductible

- Coverage for Part B coinsurance or copayment

- Coverage for excess charges.

Keep in mind that Medigap plans exclude coverage for long-term care, dental care, vision care, hearing aids, eyeglasses, or private-duty nursing.

How do Medicare Supplement Plans differ from Medicare Advantage?

While both Medicare Supplement and Medicare Advantage plans aim to provide additional healthcare coverage, they serve different purposes.

Medicare Advantage plans offer an alternate method of obtaining Original Medicare coverage, whereas a Medigap policy functions in conjunction with your Original Medicare benefits to cover expenses.

The expenses of a Medicare Advantage plan can vary depending on the plan and the individual’s needs, as they may entail:

- Monthly premiums

- Deductibles

- Copayments

- Coinsurance

On the other hand, Medicare Supplement Plans have fixed monthly premiums that may fluctuate from year to year.

In terms of coverage, Medicare Advantage plans supplant Original Medicare and provide further advantages like prescription drugs, vision, and dental coverage, while Medicare Supplement plans offer coverage in addition to Original Medicare and assist in bridging the gaps in coverage.

Prescription drugs are generally covered in Medicare Advantage plans or through a separate Medicare Prescription Drug Plan (Part D), whereas Medicare Supplement Plans do not cover prescription drugs.

View Medicare Supplement Plans for 2024

Enter Zip Code

Eligibility Criteria for Medicare Supplement Plans

Eligibility for a Medicare Supplement plan necessitates meeting age requirements and being enrolled in both Medicare Part A and Part B.

The exact age requirements for Medicare Supplement Plans vary by state, but most require individuals to be 65 years of age or older.

Enrollment in Medicare Part A and Part B makes one eligible for Medicare Supplement Plans, and during the one-time Medigap Open Enrollment Period of 6 months, individuals have guaranteed issue rights, meaning insurance companies cannot deny coverage or charge higher premiums based on health status.

Age Requirements

The age requirements for Medicare Supplement Plans vary by state, with the majority requiring individuals to be age 65 or older.

However, some states offer exceptions for persons under the age of 65 who comply with particular criteria or have received Social Security Disability Insurance (SSDI) checks for at least 24 months.

Certain states, like Connecticut, Maine, Massachusetts, and New York, require Medigap insurers to offer policies to Medicare beneficiaries of all ages, irrespective of age.

The age requirement for Medicare Supplement Plans serves to ensure that the program is targeted towards the elderly population who are more likely to have healthcare needs, and federal law does not mandate all states to offer Medicare Supplement Plans to individuals under the age of 65.

Enrollment in Medicare Part A and B

Qualifying for a Medicare Supplement plan necessitates enrollment in both Medicare Part A and B.

Medicare Part A provides coverage for inpatient hospital care, skilled nursing facility care, hospice care, and home health care, while Medicare Part B covers medical services such as doctor visits, preventive care, and outpatient services. For comprehensive coverage, enrollment in both Part A and Part B is necessary.

To enroll in Medicare Part A and B, one may apply online if they already have Part A or contact Social Security at 1-800-772-1213.

Additionally, one may complete and mail the Application for Enrollment in Medicare Part B (CMS-40B) to the local office.

The general enrollment period for Medicare Part A and Part B is from January 1 to March 31, and penalties for late enrollment include 10% of the monthly premium for Part A and a 10% increase on the Medicare Part B premium for each full 12-month period during which an individual was not enrolled but eligible.

Medicare Supplement Plans for Individuals Under 65

Although Medicare Supplement plans are primarily designed for individuals aged 65 and older, some states do offer these plans to individuals under 65.

Although Medicare Supplement plans are primarily designed for individuals aged 65 and older, some states do offer these plans to individuals under 65.

However, options for these individuals may be limited, and costs can be higher due to an increased potential for claims.

State regulations determine the availability of Medicare Supplement plans for those aged under 65, with 34 states mandating Medigap insurers to provide at least one policy to individuals under 65 who are enrolled in Medicare.

However, federal law does not necessitate all states to offer Medicare Supplement plans to individuals under 65.

State Regulations

State regulations dictate the availability of Medicare Supplement plans for those under 65. While some states permit anyone with Medicare under 65 to procure a Medigap policy, others may impose additional restrictions or requirements.

States such as Connecticut, Massachusetts, New York, and Maine require Medigap insurers to offer policies to Medicare beneficiaries of all ages, irrespective of age.

However, not every state offers Medicare Supplement plans to individuals below 65 years of age, and the availability of these plans is contingent upon the respective state.

Cost Considerations

The cost of Medicare Supplement plans for individuals under 65 may be higher due to an increased potential for claims.

Insurance companies are aware that those on Medicare below 65 are likely to receive Social Security Disability (SSDI) benefits, and as individuals with qualifying disabilities are more likely to incur higher claims due to their need for consistent care, the cost of a Medicare Supplement plan is generally higher for people under 65.

The average cost of Medicare Supplement plans for individuals under 65 is estimated to be approximately $139 per month in 2023. The premiums for Medigap policies for individuals under 65, particularly for the disabled population, may reach up to $600 per month. This cost discrepancy is attributable to various factors, including age and health status.

Medicare Supplement Open Enrollment Period

The Medicare Supplement Open Enrollment Period is a crucial time for individuals looking to enroll in a Medigap plan, as it offers guaranteed issue rights.

This six-month period begins when an individual turns 65 and is enrolled in Medicare Part B, and during this time, insurance companies cannot deny coverage or charge higher premiums due to health conditions.

When does the Open Enrollment Period start?

The Open Enrollment Period commences when an individual reaches 65 and enrolls in Medicare Part B.

This is the optimal time to enroll in a Medigap policy, as it guarantees protection from denial of coverage or higher premiums due to health conditions by insurance companies.

Missing the Medicare Supplement Open Enrollment Period can result in:

- Higher costs for coverage

- Late enrollment penalties

- Fewer coverage options

- Increased premiums

Therefore, applying for a Medicare Supplement plan during the Open Enrollment Period is essential to evade these consequences.

Guaranteed Issue Rights

Guaranteed issue rights allow individuals to purchase a Medicare Supplement plan without being denied coverage or charged more due to health conditions.

These rights are especially important during the Open Enrollment Period when insurance companies must offer certain Medigap policies and cannot deny coverage.

In situations wherein individuals are transitioning from a group health plan or during specific enrollment periods, guaranteed issue rights are also granted.

Being aware of these rights and the situations in which they apply is vital for making informed decisions about your healthcare coverage.

Factors That May Affect Medicare Supplement Eligibility

Several factors may impact an individual’s eligibility for a Medicare Supplement plan, such as pre-existing conditions and medical underwriting.

These factors can affect the availability and cost of Medigap plans, hence understanding their implications becomes crucial when evaluating your healthcare coverage options.

Pre-existing Conditions

Pre-existing conditions, which are health conditions or illnesses that one was diagnosed with or treated for prior to obtaining Medicare Supplement insurance, can affect a person’s eligibility for a Medigap plan.

Medicare Supplement plans may have a waiting period during which one may have to bear the out-of-pocket costs for the pre-existing condition before the plan begins covering those costs.

Following the waiting period, the Medicare Supplement plan may cover Medicare out-of-pocket costs associated with the pre-existing condition.

Certain insurance carriers may not provide coverage for pre-existing conditions during the initial six months of the policy, while others may require a waiting period before covering the associated costs.

Considering these factors is crucial when evaluating the cost of Medicare Supplement plans.

Medical Underwriting

Medical underwriting is the process of evaluating an individual’s health and medical history to ascertain their eligibility for a Medicare Supplement plan.

Insurance companies may employ medical underwriting to decide if an individual qualifies for a plan, and if so, what the cost of the plan will be.

Individuals may be questioned about their medical background, including any diagnoses, treatments, or prescribed medications received over the past five years during the medical underwriting process for Medicare Supplement plans.

Common health conditions that may be inquired about include:

- HIV/AIDS

- Alzheimer’s disease

- Cirrhosis

- Atrial fibrillation

- Kidney failure

How to Apply for a Medicare Supplement Plan

To apply for a Medicare Supplement plan, individuals should follow these steps:

- Compare the various plans available, assessing the pricing and availability for their area.

- Once an individual has decided on a plan, they should apply directly to the insurance company.

- Contact the insurance company or visit their website to complete the application process.

Comparing Plans

It’s vital to compare Medigap policies since costs can vary, despite the standardized Medigap policies offered by insurance companies having the same benefits.

The cost of Medicare Supplement Plans may vary depending on various factors, such as:

- the insurance company,

- the specific plan,

- and the location in which you reside.

Comparing the benefits and costs of each plan is crucial to determine which one aligns best with your needs and budget.

The premiums for Medigap policies can range from as low as $30-$40 per month for the least expensive plans for a 65-year-old, to more than $400 per month for some plans.

By comparing Medigap plans and understanding the different pricing methods, such as community-rated, issue-age-rated, and attained-age-rated, individuals can ensure they are obtaining the most advantageous value for their money.

Applying Directly to Insurance Companies

Applying directly to insurance companies for a Medicare Supplement plan ensures accurate information and premium costs.

To apply for the plan they desire, individuals should contact the plan directly to join, either by calling them or visiting their website. They can also complete the online application through the Social Security Administration’s website.

When submitting an application directly to insurance companies for a Medicare Supplement plan, the following information must be provided:

- Personal information

- Medicare information

- Current health insurance details

- Desired plan

- Potentially medical history

For accurate premium costs when applying directly to insurance companies for a Medicare Supplement plan, comparing premium costs from numerous insurers is advised to secure the most value for your money.

Summary

In conclusion, understanding the ins and outs of Medicare Supplement Insurance is essential for making informed decisions about your healthcare coverage.

From eligibility requirements and state regulations to comparing plans and applying directly to insurance companies, being well-informed about Medigap policies can help you navigate the complexities of healthcare insurance and ensure you receive the best coverage for your needs.

With the knowledge provided in this blog post, you are now better equipped to take control of your healthcare journey and make the most of your Medicare Supplement plan options.

Compare Rates Now for 2024!

Enter Zip Code

Frequently Asked Questions

What are the criteria for Medicare Supplement?

To be eligible for Medicare Supplement, you must be a U.S. citizen or legal resident for at least five years, enrolled in Medicare Part A and Part B, and reside in a state offering the desired plan.

Who would be most qualified for Medicare Supplement insurance?

If you are age 65 or older, or under 65 and receiving disability benefits, and enrolled in Original Medicare Part A and Part B (but not a Medicare Advantage plan), then you are most qualified for Medicare Supplement insurance.

Do most people get a Medicare Supplement?

Based on 2020 data, the majority of people with Medicare (86%) choose to supplement their coverage with a Medigap plan (36%).

What does an average person pay for Medicare with a supplement?

The average cost of a Medicare Supplement plan is $139 per month for 2023, with rates varying between about $50 to more than $400.

What is the purpose of Medigap policies?

Medigap policies provide additional coverage to assist individuals in paying for certain health care costs not included in the Original Medicare Plan.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know who qualifies for Medicare Supplement Insurance, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.