by Russell Noga | Updated December 21st, 2023

When Does Medicare Supplement Open Enrollment Take Place?

Navigating the world of Medicare can be a daunting task, especially when it comes to understanding the various enrollment periods and supplemental insurance options.

In this blog post, we’ll explore the Medicare Supplement Open Enrollment period, providing you with valuable information to make informed dec isions about your healthcare coverage.

isions about your healthcare coverage.

Let’s answer the question, “when does Medicare Supplement Open Enrollment take place?” and ensure you’re well-equipped to make the most of your Medicare Supplement Open Enrollment experience.

Key Takeaways

- Medicare Supplement Open Enrollment is a 6-month window offering individuals the opportunity to sign up for Medigap policies with maximum benefits and protection.

- Eligibility criteria include being enrolled in both Medicare Part A and Part B, which may differ depending on state of residence or age.

- Research options, submit an application within the open enrollment period, and consult with a licensed insurance agent to make an informed decision for best coverage.

Understanding Medicare Supplement Open Enrollment

Medicare Supplement Open Enrollment is a vital time for those who seek more coverage than Original Medicare provides.

This 6-month window allows you to enroll in a Medigap plan without undergoing medical underwriting. The purpose of this period is to provide you with the opportunity to sign up for multiple Medicare coverage options without penalty fees, medical underwriting, denial of coverage, and other potential costs.

Acquiring a Medigap policy during your open enrollment period offers maximum benefits. This time frame gives you guaranteed coverage and protection.

For individuals under 65 and enrolled in Medicare due to a disability or End-Stage Renal Disease (ESRD), it’s recommended to contact your state’s insurance department to determine your eligibility for Medicare Supplement insurance coverage.

View Medicare Supplement Plans for 2024

Enter Zip Code

The Timing of Medicare Supplement Open Enrollment

Your eligibility for Medicare Supplement Open Enrollment begins once you turn 65 and enroll in Medicare Part B, and lasts for six months.

This is the best time to purchase supplemental insurance without restrictions, as the 6-month open enrollment window begins the first month you are over 65 and enrolled in Medicare Part B.

This is the best time to purchase supplemental insurance without restrictions, as the 6-month open enrollment window begins the first month you are over 65 and enrolled in Medicare Part B.

Some states offer additional open enrollment periods, including those for individuals below 65. To explore the enrollment possibilities that may be applicable to you, it’s wise to contact your local Medicare office or a licensed insurance agent.

If you delay enrollment in Medicare Part B due to having creditable coverage through a large employer group plan, your Medicare Supplement Open Enrollment Period will begin upon losing group coverage and enrolling in Medicare Part B.

Key Dates to Remember

Medicare Supplement Open Enrollment spans a six-month period. It begins when you turn 65 and have enrolled in Medicare Part B.

This open enrollment window is crucial, as missing this period can limit your options for purchasing a Medigap policy and potentially result in higher premiums due to pre-existing conditions. Private insurance companies may also deny coverage based on these conditions.

Some states have regulations known as birthday rules, which allow individuals to enroll in Medigap without being subject to health questions at certain times, such as on a specific day of the month.

Be sure to explore these unique rules and take advantage of them to secure the best possible coverage for your needs.

Eligibility Criteria for Medicare Supplement Open Enrollment

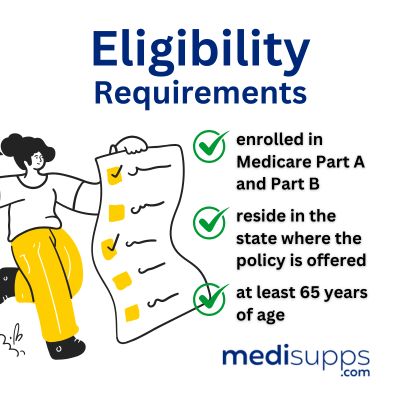

You must be enrolled in both Medicare Part A and Part B to qualify for Medicare Supplement Open Enrollment.

Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care, while Medicare Part B covers physician visits, outpatient services, preventive care, and medical supplies.

In addition to being enrolled in both parts of Original Medicare, certain states provide coverage for individuals under 65 who have disabilities.

Make sure to check your state’s specific eligibility requirements to ensure you’re taking advantage of all available coverage options.

Benefits of Enrolling During Medicare Supplement Open Enrollment

Joining during Medicare Supplement Open Enrollment brings numerous benefits like assured coverage, no medical underwriting, and stable premiums despite pre-existing conditions.

Guaranteed coverage means that insurance companies must offer you a Medigap policy at the most competitive rate, regardless of your health status. Moreover, the absence of medical underwriting allows individuals to enroll in a Medicare Supplement plan without undergoing a medical underwriting review.

If you miss the initial Medigap open enrollment period, you may face limited options for purchasing a Medigap policy and potentially higher premiums depending on your insurance provider, age, health status, and location.

Therefore, it’s crucial to take advantage of the open enrollment period to secure the best possible coverage and pricing.

Navigating Guaranteed Issue Rights

Guaranteed Issue Rights serve as a safeguard, protecting individuals from coverage denial or premium hikes due to health conditions after the open enrollment period.

These rights allow you to obtain specific Medigap policies, including medigap coverage, from an insurance company beyond the open enrollment period, ensuring you’re not left without the coverage you need in certain life events, such as losing employer coverage or moving out of your plan’s service area.

To demonstrate that your coverage has terminated, it’s important to retain any letters, notices, emails, or claim denials from your Medigap policy. This documentation will be essential in proving your eligibility for Guaranteed Issue Rights when applying for a new policy.

Comparing Medicare Supplement Plans

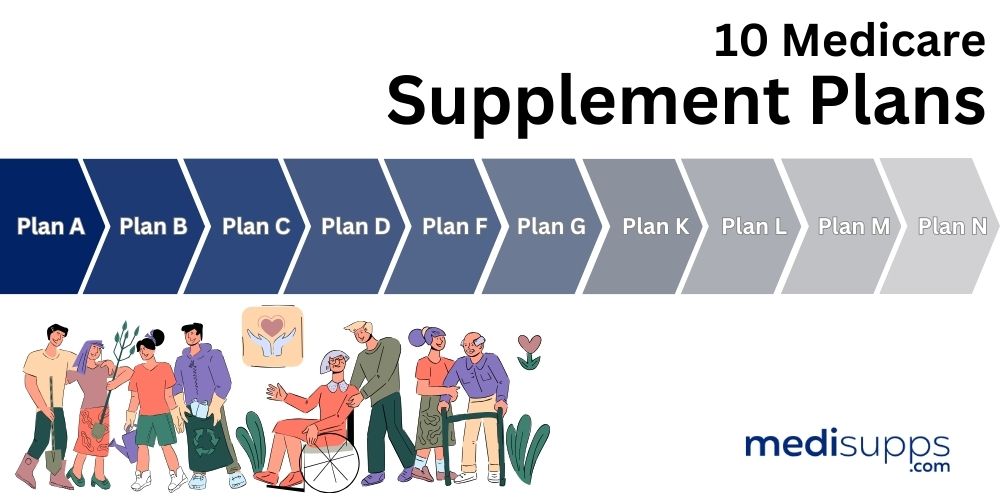

During Medicare Supplement Open Enrollment, it’s important to evaluate multiple Medicare Supplement plans to identify the most suitable coverage and pricing for your needs.

There are numerous websites that offer tools and resources to compare the benefits, costs, and coverage of different Medicare Supplement Plans, such as:

- Medicare.gov

- BoomerBenefits.com

- eHealthInsurance.com

- NerdWallet.com

- AARPMedicarePlans.com

- Humana.com

- Forbes.com

- Cigna.com

By carefully analyzing the advantages of each plan and considering your present and future healthcare requirements, you can make an informed decision that best suits your individual circumstances.

This will ensure you’re adequately covered and able to manage your healthcare expenses effectively.

Beyond Open Enrollment: Other Opportunities to Purchase Medicare Supplement Insurance

Although Medicare Supplement insurance can be bought at any time, finding coverage and avoiding premium increases can be more difficult after the open enrollment period.

Although Medicare Supplement insurance can be bought at any time, finding coverage and avoiding premium increases can be more difficult after the open enrollment period.

Medigap insurers may not be obligated to provide the desired plan and may charge higher premiums based on your location, health status, and age.

Certain states have unique rules for purchasing Medigap plans, such as allowing individuals under 65 with disabilities or End-Stage Renal Disease (ESRD) to acquire the desired Medigap policy until they reach the age of 65.

It’s essential to be aware of these rules and explore all available options for purchasing Medicare Supplement insurance outside of the open enrollment period.

Tips for a Successful Medicare Supplement Open Enrollment Experience

Maximize your Medicare Supplement Open Enrollment period by following these steps:

- Research your options and compare plans.

- Submit your application within the six-month window to secure the best coverage and pricing options tailored to your needs.

- When evaluating plans, consider the advantages of each and your present and future healthcare requirements.

- Make a well-informed decision based on your individual circumstances.

Don’t hesitate to consult with a licensed insurance agent or your local Medicare office for guidance and up-to-date information regarding your Medicare Supplement Open Enrollment options.

They can help you navigate the process and provide valuable insights into the best coverage for your unique situation.

Common Misconceptions about Medicare Supplement Open Enrollment

Differentiating between Medicare Supplement Open Enrollment and other enrollment periods like the Annual Enrollment Period is key to avoiding misunderstandings and missed coverage opportunities.

The Initial Enrollment Period, which occurs when an individual first becomes eligible for Medicare, is a crucial time to select a Medicare Advantage plan or Medicare Part D prescription drug plan.

Additionally, the Annual Enrollment Period, also known as the Medicare Annual Election Period, occurs annually from October 15 to December 7 and provides an opportunity for individuals to make changes to their existing plans.

By distinguishing between these enrollment periods and knowing the specific deadlines for each, you can ensure you’re taking full advantage of the opportunities available to you and securing the best possible healthcare coverage to meet your needs.

Summary

In conclusion, understanding the Medicare Supplement Open Enrollment period is essential for individuals seeking additional coverage beyond Original Medicare.

By knowing the timing, eligibility criteria, benefits, and potential pitfalls of this enrollment period, you can make informed decisions about your healthcare coverage and secure the best possible options for your needs.

Don’t miss the opportunity to make the most of your Medicare Supplement Open Enrollment experience, and remember to research, compare, and apply within the 6-month window to ensure comprehensive and affordable coverage.

Get Quotes for 2024 Now!

Enter Zip Code

Frequently Asked Questions

What is the enrollment period for a Medicare Supplement plan?

The enrollment period for a Medicare Supplement plan occurs annually from October 15 to December 7. During this time, individuals who are both 65 or older and enrolled in Medicare Part B can make changes to their health and drug coverage with guaranteed issue.

Which statement is true about Medicare Supplement open enrollment?

Medicare Supplement Open Enrollment is a 6 month period when consumers aged 65 and over are eligible to enroll in Medicare Part B.

What is the Medicare open enrollment period for 2023?

The Medicare Open Enrollment Period for 2023 takes place from October 15th to December 7th, 2023. Coverage changes will go into effect on January 1st, 2023.

What are Guaranteed Issue Rights?

Guaranteed Issue Rights provide individuals the right to obtain certain Medigap policies without being denied coverage or facing higher premiums due to pre-existing health conditions.

How can I compare different Medicare Supplement Plans during open enrollment?

Compare the benefits, costs, and coverage of different Medicare Supplement Plans during open enrollment by using websites like Medicare.gov, BoomerBenefits.com, eHealthInsurance.com, and NerdWallet.com.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know when Medicare Supplement Open Enrollment takes place, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.