by Russell Noga | Updated November 24th, 2023

Original Medicare is a government-sponsored health insurance program that is intended for people aged 65 and over. It’s comprised of a variety of parts and the coverage and benefits that each part provides differ.

Original Medicare is a government-sponsored health insurance program that is intended for people aged 65 and over. It’s comprised of a variety of parts and the coverage and benefits that each part provides differ.

While Medicare can certainly be beneficial, it does have some distinct issues; namely, it doesn’t cover all of your health-related expenses. If you need coverage for services that Original Medicare doesn’t cover, you might be thinking about investing in a Medicare Supplement or a Medicare Advantage plan.

What’s the difference between Medicare Supplement and Medicare Advantage plans? To make the most informed decision for your healthcare coverage, keep on reading to learn more about these two private insurance options.

Compare 2024 Plans & Rates

Enter Zip Code

What’s Medicare Advantage?

Medicare Advantage – also known as Medicare Part C – bundles Original Medicare (Part A and Part B), and may also include the coverage that Medicare Part D provides (prescription drug coverage). In other words, Medicare Advantage plans aren’t an add-on for Original Medicare, but rather, they’re an alternative form of coverage.

Medicare Advantage – also known as Medicare Part C – bundles Original Medicare (Part A and Part B), and may also include the coverage that Medicare Part D provides (prescription drug coverage). In other words, Medicare Advantage plans aren’t an add-on for Original Medicare, but rather, they’re an alternative form of coverage.

Medicare Advantage plans are sold by Medicare-approved private insurance companies. These plans provide the same coverage as Part A and Part B, as well as additional benefits and perks that the insurance company you purchase the plan from offers; hearing, vision, and dental coverage, and even gym memberships, for example.

Types of Medicare Advantage Plans

- Health maintenance organization plans (HMOs). HMOs provide coverage for medical care and services that are offered by providers who operate within a specific network. If you receive are from an out-of-network provider, you’ll have to pay for a portion or all of the bill.

- Preferred provider organization plans (PPOs). You’ll pay less when you receive care and use services from providers within a specific network, and you can see out-of-network providers, but for a higher price.

- Private fee-for-service (PFFS) plans. PFFS plans can be based on a network of providers, but they may require out-of-network providers to accept reimbursement from Medicare, as well as the PFFS Medicare Advantage plan’s terms and conditions. These plans usually don’t include coverage for prescription drugs.

- Special needs plans (SNPs). SNPs are custom-designed to provide the medical needs of beneficiaries who have been diagnosed with chronic health conditions, such as diabetes or high blood pressure.

- Medical Savings Account (MSA) plans. These plans feature a dedicated savings account and a high deductible, and they do not offer coverage for prescription drugs. Funds for the medical care that beneficiaries require are placed into the account on a monthly basis.

- HMO Point-of-Service (HMO-POS) plans. These plans are a hybrid of HMO plans. They allow beneficiaries to see out-of-network providers for a fee. Deductibles are separate for in-network and out-of-network charges.

Benefits of Medicare Advantage

Medicare Advantage plans offer the same coverage that Medicare Part A and Part B offer, and most usually offer coverage for prescription drugs (Part D). These plans also provide coverage for expenses that Original Medicare doesn’t provide.

Medicare Advantage Eligibility

Typically, Medicare Advantage is available for people who are 65 and over. People who are younger than 65 and who have certain disabilities or who have end-stage renal failure may also qualify for Medicare Advantage. In order to enroll in a Medicare Advantage plan, you have to be enrolled in Medicare Part A and Part B.

Compare Medicare Plans & Rates in Your Area

What is Medicare Supplement?

Medicare Supplement plans (Medigap) are also sold by private insurance companies and are designed to cover the expense that Medicare Part A and Part B (Original Medicare) doesn’t cover. These plans work alongside Original Medicare and feature a separate premium.

Once you meet your premium, after Medicare covers the cost of the medical care and services you receive, Medigap will kick in and pay for the remainder of the expenses a specific plan covers.

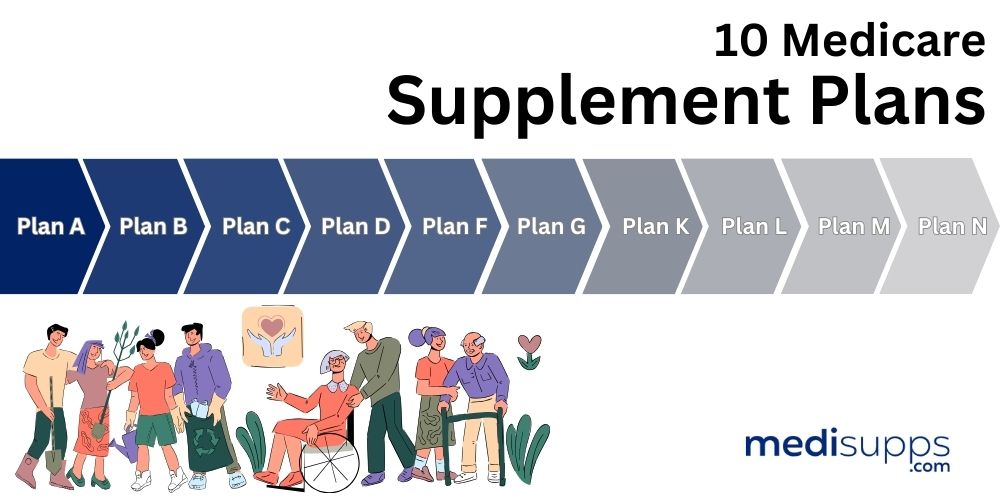

Types of Medicare Supplement Plans

There are a total of 10 Medicare Supplement plans. These plans are named for letters (A, B, C, D, F, G, L, M, and N) and all are standardized, meaning that Plan N must provide the same coverage, no matter where it’s purchased or what insurance company it’s purchased from.

Coverage varies from plan to plan; however, most cover copays, coinsurance, and deductibles. It’s important to note that as of January 1, 2020, new Medicare enrollees can no longer purchase Medigap Plan F, which provides coverage for the Part B deductible; however, those who had Plan F before this date can keep it and those who were eligible for Medicare before this date but haven’t yet enrolled in Original Medicare may still be able to purchase it.

Benefits of Medicare Supplement Plans

Medicare Supplement plans make the out-of-pocket expenses for Original Medicare easier to predict and more manageable. The monthly premiums are fixed (though they can change each year). Additionally, unlike Medicare Advantage, there are no networks; with a Medicare Supplement plan, you can use any provider that accepts Medicare, and some plans will even cover your expenses if you see a provider that doesn’t accept Medicare.

Medicare Supplement Eligibility

Medicare Supplement Eligibility

In order to purchase a Medicare Supplement plan, you must be enrolled in Medicare Part A and Part B. You must also be 65 years of age or older; however, several states do offer Medigap for individuals with disabilities who are younger than 65. Additionally, you must live in the state the Medigap plan you are applying for is offered when you apply.

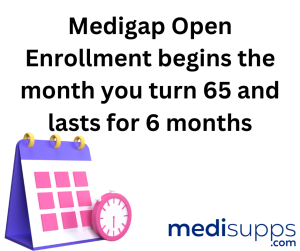

If you’re turning 65 and you are enrolling in Medicare, the ideal time to purchase a Medigap plan is during the Medicare Supplement Open Enrollment period. This 6-month period starts on the first day of the month you turn 65 and are enrolled in Part B.

During this period, you are not subjected to medical underwriting, so your medical history won’t affect your premium and you can’t be denied coverage. After this period, health insurance companies can impose medical underwriting when considering your application.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medicare Supplement and Medicare Advantage?

Medicare Supplement plans, also known as Medigap, are private insurance policies designed to work alongside Original Medicare (Medicare Part A and Part B) to cover certain out-of-pocket costs such as copayments, deductibles, and coinsurance.

Medicare Advantage plans (Medicare Part C) are comprehensive private health insurance plans that replace Original Medicare and offer all the benefits of Part A and Part B, along with additional coverage like prescription drugs, dental, and vision services.

How do Medicare Supplement and Medicare Advantage differ in coverage?

Medicare Supplement plans fill the gaps in Original Medicare coverage, providing more predictable healthcare costs. They do not typically cover additional benefits beyond what Original Medicare offers.

Medicare Advantage plans often include extra benefits such as prescription drug coverage, vision, dental, hearing, and fitness programs. These plans may have different cost-sharing structures and provider networks.

Are there differences in costs between the two types of plans?

Medicare Supplement plans generally have higher monthly premiums but lower out-of-pocket costs when healthcare services are needed.

Medicare Advantage plans may have lower monthly premiums, but they often have copayments and deductibles that vary depending on the plan and the services used.

Can beneficiaries keep their existing doctors with both plans?

With Medicare Supplement plans, beneficiaries can visit any healthcare provider who accepts Medicare patients, regardless of network restrictions.

Medicare Advantage plans usually have a network of providers, and beneficiaries may need to use in-network providers to receive the full benefits. Some plans may offer out-of-network coverage, but it may come with higher costs.

Can someone have both Medicare Supplement and Medicare Advantage plans?

No, beneficiaries cannot have both types of plans simultaneously. It is illegal for insurance companies to sell a Medicare Supplement plan to someone who already has a Medicare Advantage plan.

Are prescription drugs covered under both plans?

Medicare Supplement plans do not include prescription drug coverage. Beneficiaries can purchase a separate Medicare Part D plan for prescription drug coverage.

Medicare Advantage plans often include prescription drug coverage as part of their comprehensive benefits package.

Are there any restrictions on when someone can enroll in these plans?

Medicare Supplement plans have a six-month Open Enrollment Period that starts when someone is 65 or older and enrolled in Medicare Part B. During this period, they have guaranteed issue rights, meaning insurers cannot deny coverage or charge higher premiums due to pre-existing conditions.

Medicare Advantage plans can be joined during the Initial Enrollment Period when someone first becomes eligible for Medicare or during the Annual Enrollment Period from October 15 to December 7 each year.

Can beneficiaries switch between Medicare Supplement and Medicare Advantage?

Yes, beneficiaries can switch between the two types of plans during certain enrollment periods. For example, during the Annual Enrollment Period, they can switch from Medicare Advantage to Medicare Supplement or vice versa.

Do these plans cover medical expenses when traveling outside the U.S.?

Medicare Supplement plans may offer limited coverage for emergency medical care during foreign travel.

Some Medicare Advantage plans provide travel benefits for emergencies outside the plan’s service area, but the coverage may vary by plan.

Which plan is better for me?

The choice between Medicare Supplement and Medicare Advantage depends on individual healthcare needs, budget, and personal preferences. Some individuals prefer the simplicity and additional benefits of Medicare Advantage, while others prefer the freedom and flexibility of Medicare Supplement plans with Original Medicare. It’s essential to compare plans, consider healthcare needs, and assess potential out-of-pocket costs to make an informed decision.

How to Decide?

When you’re trying to decide between Medicare Advantage and Medicare Supplement, it’s important to compare quotes from several different insurance companies. By filling out the form to the right, you’ll receive quotes from the most reputable insurers in your area. If you prefer, you can call 1-888-891-0229 to speak with a licensed agent.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.