by Russell Noga | Updated January 12th, 2024

Are you searching for an affordable Medigap plan with great benefits? If you qualify for Medicare before January 1, 2020, Plan F is an option for you. This fully comprehensive Medicare supplement plan offers you “first dollar coverage” on your healthcare expenses covered by Original Medicare Parts A & B.

Are you searching for an affordable Medigap plan with great benefits? If you qualify for Medicare before January 1, 2020, Plan F is an option for you. This fully comprehensive Medicare supplement plan offers you “first dollar coverage” on your healthcare expenses covered by Original Medicare Parts A & B.

Plan F is available in standard and “high-deductible” versions. What’s the difference between Medicare supplement high deductible Plan F and the standard option? This post unpacks everything you need to know about Plan F benefits, coverage, and premiums and how you can save money on your policy with the high-deductible version.

Compare 2024 Plans & Rates

Enter Zip Code

What Is Medicare Supplement Plan F High Deductible?

Medicare supplement Plan F high-deductible is a more affordable version of the standard Plan F. You get “first dollar coverage” for healthcare expenses relating to Part A (hospitalization) and Part B (medical treatments).

Plan F is the most popular option in the Medigap range due to the comprehensive level of coverage it offers beneficiaries. However, it’s also the most expensive policy.

Medigap High Deductible Plan F provides the most comprehensive benefits from Medicare supplemental plans. High-deductible Plan F is available from private healthcare insurers and is regulated by the CMS, a Federal agency. As a result, you get the same level of coverage and benefits, regardless of which company you use for your plan.

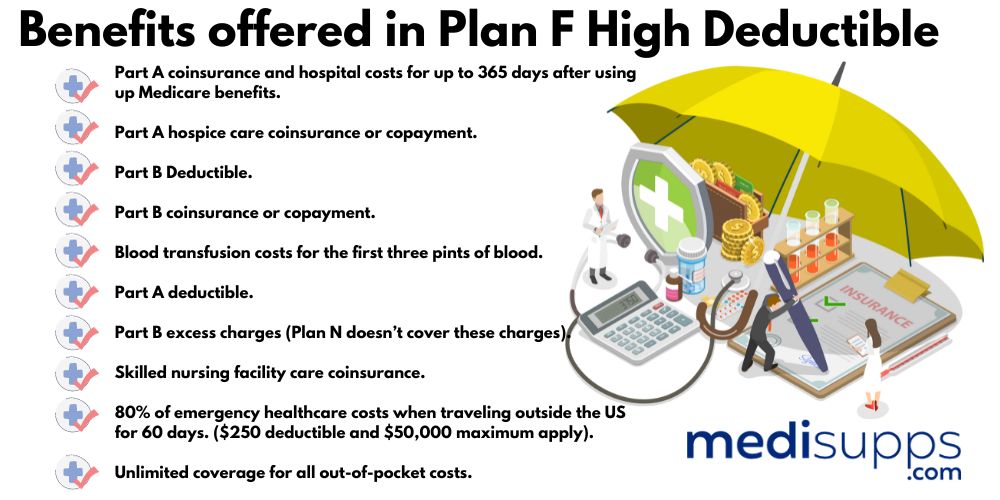

Here are the benefits offered in Plan F HD.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B Deductible.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*It’s important to note that not all healthcare insurers offer high-deductible Plan F. The policy might not be available in your state. Call our team for information on Plan F availability in your region.

Is There Anything Medicare Supplement High Deductible Plan F Doesn't Cover?

Medicare Plan F, like all Medicare Plans, doesn’t cover you for the cost of preventative treatments and healthcare services not associated with Medicare Parts A & B.

So, you don’t get coverage for maintenance treatments with the Chiropractor, acupuncturist, or physiotherapist. You also don’t have coverage for vision, hearing, and dental services. No Medigap plan offers coverage for prescription medications.

Differences Between Standard Plan F & Medicare Supplement High Deductible Plan F

There is no difference in the coverage offered by the standard or high-deductible Plan F. You get the same benefits with both plans, giving you “first dollar coverage” on your medical and hospitalization expenses associated with Original Medicare Parts A & B.

The difference between the benefits in the plans is that the High-Deductible plan F increases your Part A deductible from $1,600 to $2,700 in 2023. However, in return, you get a much lower monthly premium. The premiums for the HD plan can save you anywhere from 75% to 80% on the cost of the premiums for standard Plan F.

Compare Medicare Plans & Rates in Your Area

What Does Medicare Supplement High Deductible Plan F Cost?

HD Plan F is available from private healthcare insurers. Every provider offers the plan at a different rate, depending on the risk profile you present to its Medigap scheme. As a result, the price you get from one company for an HD Plan F policy might differ.

The plans also differ in price based on your location in the United States, health status, age, gender, and smoking status. On average, HD Plan F costs $230 per month across all providers. However, you could end up[ paying more, depending on your risk profile.

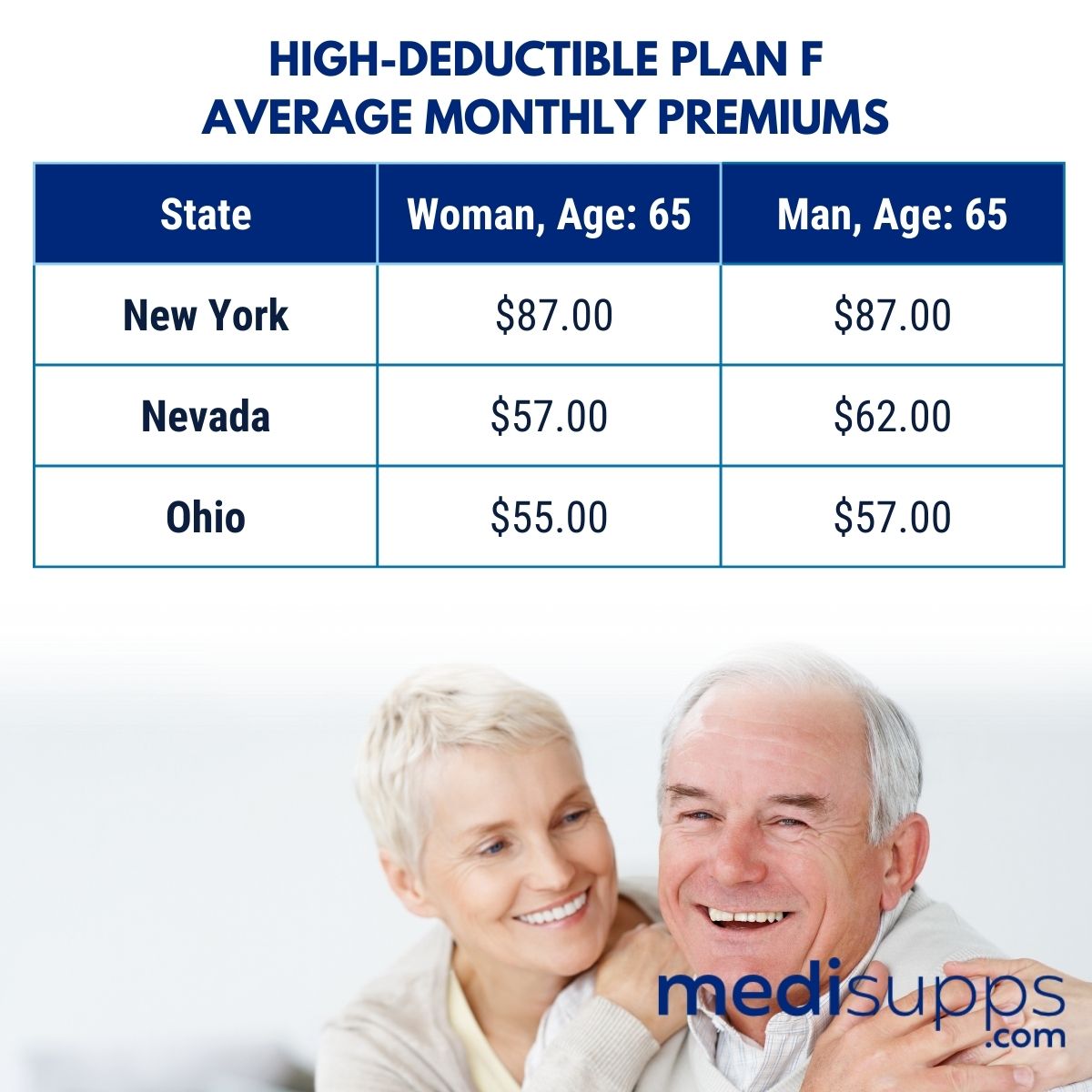

Here are a few examples of the price of HD Plan F in different states, based on a 65-year-old nonsmoking woman or man.

High-Deductible Plan F Average Monthly Premiums in New York

- Woman, Age: 65 $87.00

- Man, Age: 65 $87.00

High-Deductible Plan F Average Monthly Premium in Nevada

- Woman, Age: 65 $57.00

- Man, Age: 65 $62.00

High-Deductible Plan F Average Monthly Premium in Ohio

- Woman, Age: 65 $55.00

- Man, Age: 65 $57.00

Who Suits Medicare Supplement High Deductible Plan F?

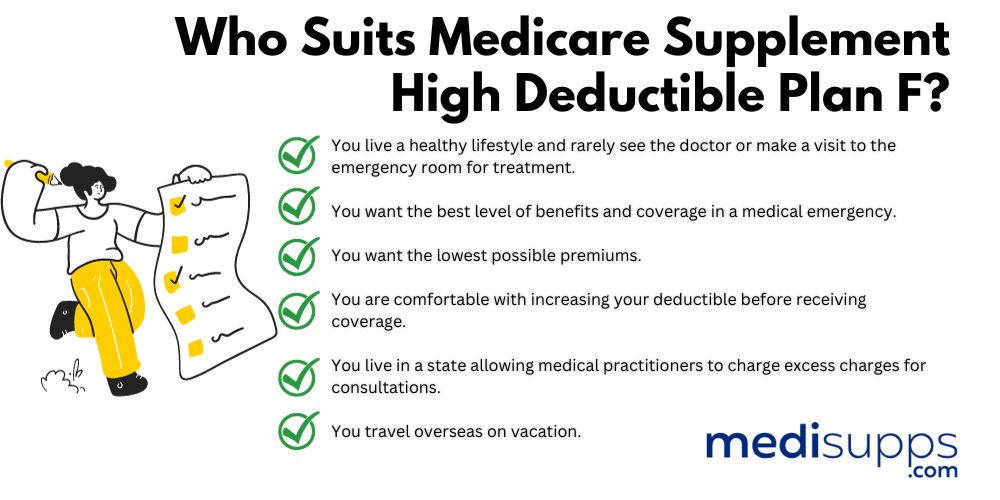

Plan F is a great choice for seniors who meet the following criteria.

- You live a healthy lifestyle and rarely see the doctor or make a visit to the emergency room for treatment.

- You want the best level of benefits and coverage in a medical emergency.

- You want the lowest possible premiums.

- You are comfortable with increasing your deductible before receiving coverage.

- You live in a state that allows medical practitioners to charge excess charges for consultations.

- You travel overseas on vacation.

Why Is Plan F No Longer Available for Some Seniors?

Plan F and HD Plan F are no longer available for seniors qualifying for Medicare after January 1, 2020. “The Medicare Access and CHIP Reauthorization Act of 2015” (MACRA) ended the approval of Medigap policies offering coverage for the Part B deductible.

Plan F and HD Plan F are no longer available for seniors qualifying for Medicare after January 1, 2020. “The Medicare Access and CHIP Reauthorization Act of 2015” (MACRA) ended the approval of Medigap policies offering coverage for the Part B deductible.

However, if you were eligible for Medicare before the cut-off date, you can still apply for Plan F or the HD version. It’s important to call our licensed Medigap agents before you apply for either policy. In some cases, you may have guaranteed issue rights; in others, you might have to undergo a medical underwriting process.

Medical underwriting involves the insurer asking about your health status and pre-existing conditions. If you have chronic health conditions, the insurer can use the underwriting process to charge you higher-than-average rates or to deny you coverage.

Compare Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medicare Supplement High Deductible Plan F?

Medicare Supplement High Deductible Plan F is a type of Medigap plan designed to provide coverage for the gaps in Original Medicare. It offers a high deductible option for beneficiaries who want to reduce their monthly premiums.

How does it work?

With High Deductible Plan F, you pay a higher deductible amount before the plan starts covering your healthcare costs. Once you meet the deductible, the plan covers your Medicare-approved expenses just like other Medigap plans.

What does it cover?

High Deductible Plan F covers the same benefits as the standard Plan F after you meet the deductible. This includes Medicare Part A and Part B deductibles, co-payments, coinsurance, and extended hospital stays.

Is it the same as regular Plan F?

The coverage provided by High Deductible Plan F is the same as regular Plan F, but the difference lies in how you reach the coverage. High Deductible Plan F has a higher initial out-of-pocket cost in the form of the deductible.

What’s the benefit of a high deductible plan?

The main benefit of High Deductible Plan F is its lower monthly premium compared to the standard Plan F. It can be a cost-effective choice for individuals who are generally healthy and don’t anticipate frequent medical expenses.

Can I switch to High Deductible Plan F?

If you’re eligible for Medicare, you can switch to High Deductible Plan F during your Medigap Open Enrollment Period or a Special Enrollment Period. However, if you already have another Medigap plan, you might need to pass medical underwriting.

How does it compare to other plans?

High Deductible Plan F offers similar comprehensive coverage as other Medigap plans. The difference is the initial out-of-pocket expense in the form of the deductible.

Can I change from High Deductible Plan F to another plan?

Yes, you can switch from High Deductible Plan F to a different Medigap plan. However, as with any plan change, you may need to go through medical underwriting and meet specific enrollment periods.

Who might benefit from this plan?

High Deductible Plan F can be beneficial for individuals who are in good health and want to keep their monthly premiums low while still having coverage for potential high medical costs.

Is High Deductible Plan F available for new enrollees?

No, High Deductible Plan F was discontinued for new Medicare beneficiaries after January 1, 2020. If you already had this plan before that date, you can keep it.

Understanding Medicare Supplement High Deductible Plan F is crucial for evaluating whether it aligns with your healthcare needs and financial situation. Consider your health status and budget before deciding on the right Medigap plan for you.

Call Us for More Information on Medicare Supplement High Deductible Plan F

If you need more information on high-deductible Plan F, call our fully licensed Medigap agents at 1-888-891-0229. We offer a free consultation and quote on your HD Plan F policy. We work with all providers offering this policy in your state and secure you the best monthly premiums.

If you can’t call us right now, leave your details on our contact form, and one of our consultants will reach out to you to answer our questions. Or you can use the tool on our site to see if Plan F HD is available in your state and get a free automated quote on your monthly premium.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.