by Russell Noga | Updated January 11th, 2024

What happens to my Medigap plan if I move out of state? Can the provider end my policy?

What happens to my Medigap plan if I move out of state? Can the provider end my policy?

Will I get Medigap coverage with another provider?

If you decide to move, you might be wondering about the changes you need to make to your Medigap coverage.

It depends on the type of plan and coverage you have.

Medigap Plans Offer Standardized Benefits Across All Carriers

Medigap plans come with standardized benefits regulated by the CMS, a federal agency. As a result, there’s complete consistency across all the plans offered by all providers.

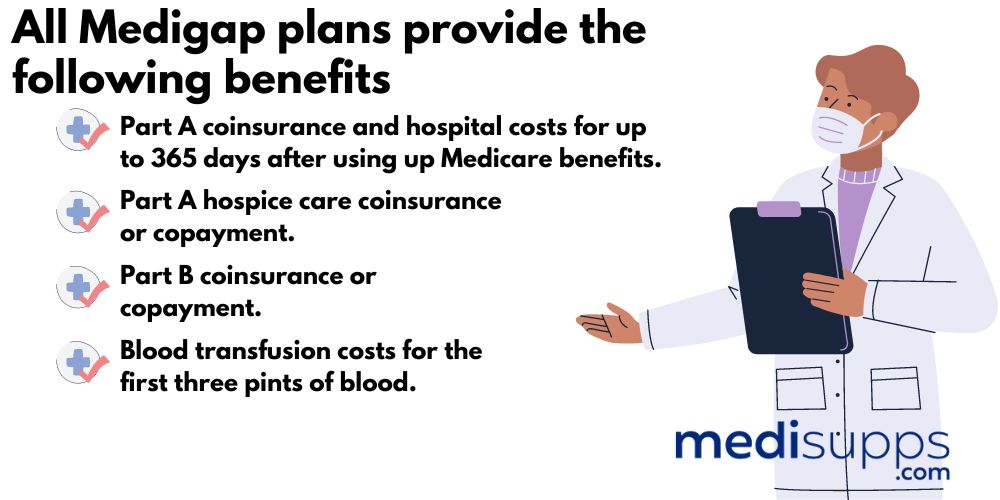

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

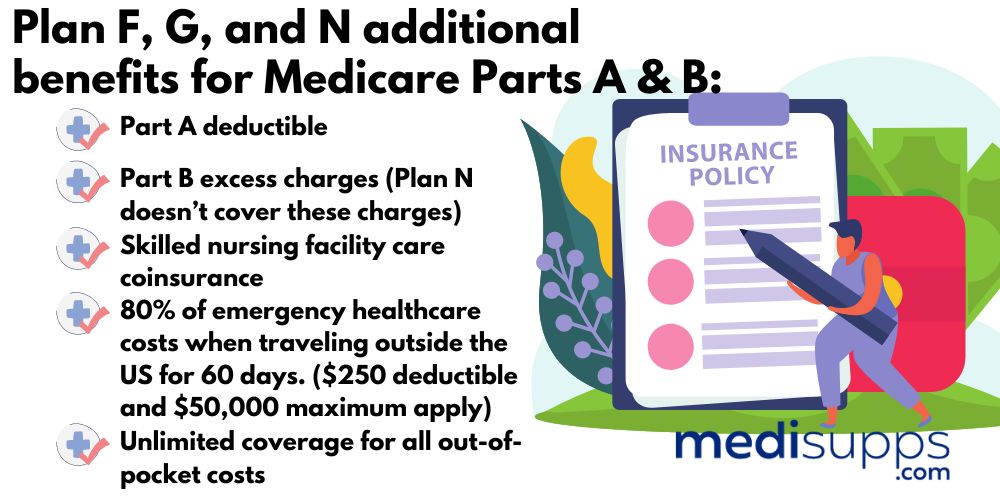

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F is the only policy offering coverage for the Part B deductible. However, you must be eligible for Medicare before January 1, 2020, to qualify for this plan. If you have a Medigap plan, you can change to Plan F, but you might have to undergo Medical Underwriting if you switch.

Medigap plans don’t cover the costs of healthcare services unrelated to Part A & B expenses. For instance, there’s no coverage for preventative care, prescription drugs, long-term nursing care, private-duty nursing, or vision, dental, or hearing services.

Compare 2024 Plans & Rates

Enter Zip Code

Can I Use my Medicare Part A & B Policies in Another State?

Which Medigap plan and the provider you use determines whether it carries over to your new state. Your Medicare Part A & B policies follow you to a new state.

Since they’re federally regulated plans, you’ll get the same coverage and the same Part B premiums in any state. Medicare doesn’t have coverage areas, and it serves all states.

However, you’ll have to update your mailing address with Medicare and let them know where you’re moving to ensure the continuation of your benefits.

What Happens to My Medigap Plan if I Move to Another State?

If you move to a new state, your plan will continue with no changes provided your healthcare insurer services that state and offers the same plan in that area.

If you move to a new state, your plan will continue with no changes provided your healthcare insurer services that state and offers the same plan in that area.

If you move, you might consider applying for a new Medigap policy, as the average rate for your plan premiums in the new state could be less. Or, they could be more.

For instance, if you have a Plan G policy with AARP in Arkansas and you move to California, you might have to pay a higher monthly premium on your Plan G policy, even if you stay with AARP.

If you’re moving to Minnesota, Wisconsin, or Massachusetts, it’s important to note that Medigap operates differently in these states. There is a difference in the standard benefits offered in Medigap plans and the structure of Medigap plans.

Call us today for help if you’re moving to a new state.

Compare Medicare Plans & Rates in Your Area

What States Allow You to Change Medigap Plans without Underwriting?

Some states allow you to change your Medigap policy without undergoing medical underwriting. The states allowing you to change your Medigap plan without undergoing medical underwriting include the following.

Some states allow you to change your Medigap policy without undergoing medical underwriting. The states allowing you to change your Medigap plan without undergoing medical underwriting include the following.

- Connecticut

- Maine

- Massachusetts

- Minnesota

- New York

- Oregon

- Rhode Island

- Vermont

It’s important to note that restrictions or conditions might apply to your situation when changing plans. For instance, you might only be able to change plans during the annual enrollment period between October 15 and December 7. Contact a Medigap agent, and they can walk you through everything you need to know to change your Medigap plan or provider in any state.

How to Change Medigap Plans If You're Moving Out of State

In most instances, you won’t have to change your Medigap plan or provider when you move states. However, you may decide to do so if another insurer offers a cheaper rate on your current plan. Enrolling in a new plan before dropping your existing coverage and provider is a good move. Failing to do so could see the new provider require you to undergo a medical underwriting.

If you don’t have guaranteed issue rights, any new provider might decide to subject you to medical underwriting. So, if you have a plan with Aetna, and they offer the same plan in your new location, it might be a better move to keep your current policy.

If you were to switch to the same plan with another provider, you might not get the same rate. You might have to pay more, even if the average premium pricing in that area is lower than what you currently play.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

Can I keep my Medigap Plan if I move to another state?

Yes, you can generally keep your Medigap Plan if you move to another state. However, your premium might change based on the new location’s pricing. This varies by company.

Is my coverage the same in the new state?

Yes, your coverage remains the same regardless of the state you move to. Medigap Plans are standardized, ensuring the benefits are consistent across states.

Will my premium change if I move?

Your premium might change due to regional pricing differences. Each state sets its own rules for Medigap pricing, which can affect your premium.

Do I need to notify my insurer about the move?

Yes, it’s important to notify your insurer about your move. They can guide you through any necessary steps and help ensure a smooth transition.

When should I inform my insurer about the move?

Notify your insurer about the move as soon as you have a new address. This helps avoid any coverage or premium issues down the line.

Will I have a new open enrollment period?

In most cases, you won’t get a new open enrollment period due to moving. However, some states have specific rules that might grant you additional rights.

Can I switch to a different Medigap Plan in the new state?

You can apply to switch to a different Medigap Plan in the new state, but you might need to go through medical underwriting. It’s best to explore this option by calling us today.

Are there any exceptions for moving to certain states?

If you move back to your old state within a year, some states might allow you to get back your old Medigap Plan. However, this depends on state regulations.

How does this apply to Plan G and Plan N?

Moving to another state doesn’t impact your Plan G or Plan N coverage, as these plans are standardized across states. However, premium adjustments might occur due to regional pricing differences.

Moving to another state with your Medigap coverage involves notifying your insurer, understanding potential premium changes, and exploring your options if you want to switch plans.

Call Our Team If You're Moving State & Need Advice on Medigap Plans

If you’re moving out of state, call our team at 1-888-891-0229 for free advice on your Medigap plan. Our fully licensed agents offer free consultations and quotes on a new plan from a new provider. If you can’t speak to us right now, leave your contact details on our web form. We’ll get a Medigap expert to call you back.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.