by Russell Noga | Updated December 13th, 2023

Original Medicare Parts A & B don’t cover all your medical and hospital expenses. While you get 80% coverage for most Part A & B services, you must pay the remaining 20% of out-of-pocket costs. To reduce pressure on your financial planning during your senior year, consider enrolling in a Medicare supplement plan known as “Medigap.”

Original Medicare Parts A & B don’t cover all your medical and hospital expenses. While you get 80% coverage for most Part A & B services, you must pay the remaining 20% of out-of-pocket costs. To reduce pressure on your financial planning during your senior year, consider enrolling in a Medicare supplement plan known as “Medigap.”

Medigap plans come in ten variations, A, B, C, D, F, G, K, L, M, & N. Each plan has a different level of coverage. For example, Plans F & G are the most comprehensive options, Plan N is ideal for seniors who want good medical coverage in an emergency but low monthly premiums, and Plans J, K & L are the best for low-income seniors.

Medigap plans have many advantages and better predictability to your annual healthcare expenses. However, while there’s tremendous upside to owning a Medigap policy, they aren’t without disadvantages.

This post looks at the disadvantages of Medigap plans. We’ll give you the information to weigh the risk of taking a Medigap plan versus leaving it.

Compare 2024 Plans & Rates

Enter Zip Code

What Does Medigap Cover?

Medigap policies come with standardized Part A & B benefits regulated by the Federal government (CMS). You get the same benefits in your plan, regardless of the healthcare provider you use for your policy.

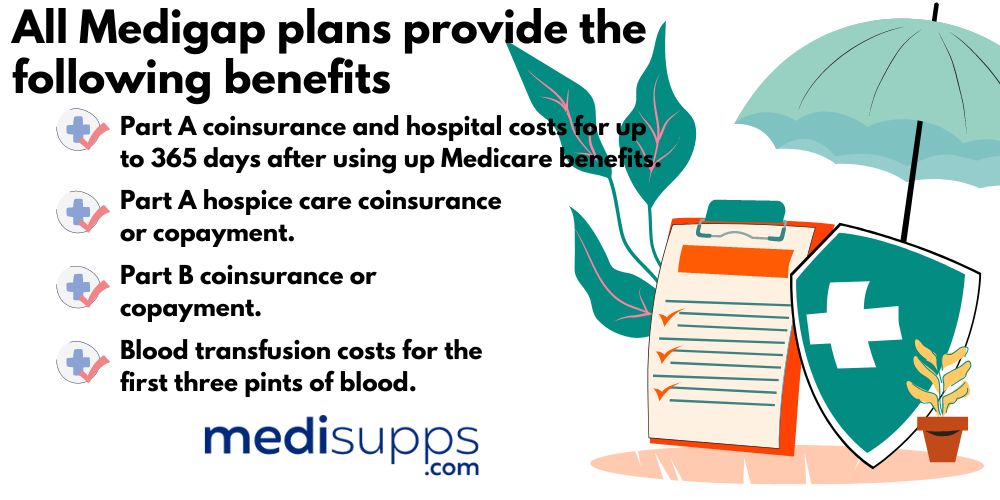

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply)

What are the Disadvantages of Medigap Plans?

So, Medigap plans look like they’re a good deal to help you deal with the out-of-pocket costs not covered by Original Medicare Parts A & B. So, what are the downsides to taking a policy? Let’s review the disadvantages of Medigap plans. We’ll give you what you need to decide whether it’s a policy you need for your healthcare in your senior years.

No Dental, Vision, or Hearing Coverage

The main issue seniors have with Medigap plans is that they don’t have dental, hearing, or vision services coverage. However, some companies offer these services as perks in their policy.

The main issue seniors have with Medigap plans is that they don’t have dental, hearing, or vision services coverage. However, some companies offer these services as perks in their policy.

Medigap providers compete with each other for your business. The more extras and perks they can add to your policy, the more attractive they seem over the competition. Some providers offer discounted rates on vision, dental, and hearing services if you use providers in their network.

Others offer add-on plans covering these services for between $20 to $40 a month. For example, Blue Cross Blue Shield subsidiaries offer “Plan G+” in some states. This plan includes vision, dental, and hearing services for a monthly average of $22 extra on top of the standard G plan.

No Part D Prescription Coverage

Medigap plans don’t offer any coverage for prescription drugs. You’ll need to enroll in a stand-alone Medicare Part D plan to cover the costs of your prescription drug coverage. Most providers offering Medigap plans also offer Part D.

Compare Medicare Plans & Rates in Your Area

No Coverage for Preventative Treatments

Medigap policies don’t cover the costs of preventative treatments such as foot care, chiropractic, physiotherapy, and acupuncture. However, some providers may offer these services as perks when you take a plan from them.

No Coverage for the Part B Deductible

Only Plan F covers the Part B deductible for Original Medicare Part B. However, Plan F is only available to seniors eligible for Medicare before January 1, 2020.

Underwriting when Switching Plans or Providers

You can switch Medigap plans or providers anytime during the year. However, doing so outside of the annual open enrollment period between October 15 and December 7 will result in the insurer wanting you to undergo medical underwriting.

You can switch Medigap plans or providers anytime during the year. However, doing so outside of the annual open enrollment period between October 15 and December 7 will result in the insurer wanting you to undergo medical underwriting.

If the underwriting suggests you have pre-existing health issues, the insurer may increase your average premiums, institute a waiting period, or deny you coverage.

However, you can circumvent this issue by applying at the right time during the year. For instance, some states have a “Birthday Rule” allowing you to switch plans without underwriting. Contact our team if you want to change plans, and we’ll help you through the process.

Inconsistencies In Plans & Pricing Between Providers

Some insurers only offer a niche selection of Medigap plans. For instance, it’s common for some providers to only offer Plans A (mandated by the Federal government to be included in all plans offered by all providers), Plans F, G, & N. They don’t provide the others.

The cost of average premiums also differs by provider and by state. For instance, Aetna might be the lowest-cost provider for plan G in one state and the most expensive option in another. That’s why you need a licensed Medigap agent to assist you with finding the lowest-cost provider in your state for your chosen plan.

Why Choose a Medigap Plan?

While Medigap plans have their drawbacks, they’re essential for seniors. For example, Original Medicare will only cover your first 60 days in the hospital (assuming you’ve used up your “lifetime reserve days”). That means you have to pay for every day you spend in the hospital past day 60.

At between $00 to $800 per day, these costs can add up fast and cripple our financial planning./ Medigap covers this expense, ensuring you have nothing to pay out of pocket.

There are many advantages to Medigap; this example just scratches the surface. Reach out to our team, and we’ll walk you through all the benefits of Medigap and why you need one to bolster your Original Medicare policies.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Medigap Plans?

Medigap plans, also known as Medicare Supplement plans, are private insurance policies designed to cover certain costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

Who is eligible for Medigap Plans?

To be eligible for Medigap plans, individuals must be enrolled in Medicare Part A and Part B. The best time to enroll is during the Medigap Open Enrollment Period, which lasts for six months and begins when you are 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed issue rights, meaning insurance companies cannot deny you coverage or charge you more based on pre-existing conditions.

When can you enroll in Medigap Plans?

The Medigap Open Enrollment Period is the ideal time to enroll in a Medigap plan, as you have guaranteed access to coverage without medical underwriting. After this period, you can still enroll in Medigap plans, but insurers may consider your health status, and premiums could be higher.

What are the disadvantages of Medigap Plans?

Limited coverage for prescription drugs: Medigap plans do not cover prescription drugs. Beneficiaries may need to purchase a separate Medicare Part D plan to get prescription drug coverage.

Higher premiums: Medigap plans generally have higher monthly premiums compared to Medicare Advantage plans. However, beneficiaries may have fewer out-of-pocket expenses with Medigap plans.

No additional benefits: Medigap plans do not usually offer additional benefits like dental, vision, or fitness programs. Medicare Advantage plans may include such benefits.

Standalone coverage: Medigap plans work alongside Original Medicare, which means you need to manage separate coverage for medical services and prescription drugs. Medicare Advantage plans often combine medical and drug coverage into one plan.

What are the best Medicare Supplement plans?

The best Medicare Supplement plans for you depend on your individual healthcare needs and budget. Plan G and Plan N are popular choices due to their comprehensive coverage and competitive pricing.

What does Medicare Supplement Plan G cover?

Medicare Supplement Plan G covers most of the gaps in Original Medicare, including Part A and Part B coinsurance, hospice care coinsurance, and the first three pints of blood. It also covers skilled nursing facility care coinsurance, Part A deductible, and 80% of foreign travel emergency costs.

What does Medicare Supplement Plan N cover?

Medicare Supplement Plan N provides similar coverage to Plan G but requires beneficiaries to pay certain cost-sharing amounts, such as a copayment for doctor’s visits and emergency room visits. It does not cover the Part B excess charges.

What is the difference between Medicare Supplement Plans and Medicare Advantage?

Medicare Supplement plans work alongside Original Medicare and help pay for out-of-pocket expenses not covered by Medicare. Beneficiaries can see any healthcare provider that accepts Medicare.

Medicare Advantage plans, also known as Medicare Part C, are private health insurance plans that replace Original Medicare. They often include prescription drug coverage and may offer additional benefits like dental and vision. However, beneficiaries may need to use a network of providers and follow plan rules.

How to choose between Medigap Plans and Medicare Advantage?

When choosing between Medigap plans and Medicare Advantage, consider your healthcare needs, budget, preferred providers, and prescription drug coverage requirements. If you want more flexibility in provider choice and additional benefits, a Medicare Advantage plan might be a better fit. If you prefer the freedom to see any provider without referrals and want more predictable out-of-pocket costs, a Medigap plan could be a suitable option.

Can you switch from a Medigap plan to a Medicare Advantage plan?

Yes, you can switch from a Medigap plan to a Medicare Advantage plan during the Medicare Annual Enrollment Period, which occurs from October 15 to December 7 each year. Keep in mind that you may need to go through medical underwriting to join a Medicare Advantage plan outside of your initial eligibility period, and you will lose your Medigap coverage when you switch to a Medicare Advantage plan.

Get Professional Advice on Medigap Plans

If you need assistance choosing the right Medigap plan or deciding if you need one for your unique healthcare requirements, call us. Our fully licensed agents are available at 1-888-891-0229 for a free consultation and quote on Medigap policies.

If you can’t talk right now, leave your details on our contact form, and we’ll get a Medigap expert to return your call. Or you can use the tool on our site to get a free automated quote on any Medigap plan in your state.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.