by Russell Noga | Updated April 22nd, 2023

The Worst Medicare Supplement Companies for 2025

Learning about Medicare Supplement plans can be a big task, especially when trying to avoid the worst Medicare supplement companies.

Learning about Medicare Supplement plans can be a big task, especially when trying to avoid the worst Medicare supplement companies.

But fear not! We’ve got your back with this comprehensive guide on identifying the right Medicare Supplement companies for you to consider. Because Medicare Supplement Plans are standardized, it makes finding the right insurance company a little easier.

Buckle up and get ready for an informative journey that’ll empower you to make the best decisions for your healthcare needs.

Key Takeaways

- Research and compare Medicare Supplement providers to find one that meets your needs.

- Seek professional guidance from our experienced insurance agents for help selecting a provider.

- Read reviews and testimonials of existing customers to ensure reliable coverage, excellent customer service, competitive pricing & additional benefits such as prescription drug coverage, dental care & vision care.

Identifying the Worst Medicare Supplement Companies

As the number of Medicare Supplement providers expands, discerning those who may not prioritize your needs becomes increasingly important.

Subpar insurance companies or those very new to the industry may have poor customer service, high premiums and rate increases.

But how can you spot these providers and avoid falling into their traps?

We’ll now examine the warning signs and red flags you should be wary of.

Poor Customer Service

Imagine needing urgent assistance with a billing issue or struggling to find an in-network provider, only to be met with unhelpful customer service representatives.

Poor customer service in Medicare supplement companies may manifest as:

- Difficulty in resolving billing and claims issues

- Extended wait times

- Inadequate communication

- Insufficient assistance navigating the Medicare and Medicaid services system.

The J.D. Power research suggests that communication in the industry is not always effective. Additionally, the results demonstrate that many people lack thoughtfulness when communicating with others.

Therefore, when comparing plans, evaluating providers’ communication strategies and weighing the advantages and disadvantages of each plan is of utmost importance.

Don’t let poor customer service be the Achilles’ heel of your Medicare Supplement experience.

High Premiums

Nothing can dampen your spirits like discovering you’re overpaying for your Medigap policy after you’ve already committed to a Medicare Supplement company.

High premiums refer to the monthly premium costs, while hidden costs can include deductibles and copayments that may not be immediately apparent or well explained prior to buying.

To steer clear of this financial pitfall, finding a Medicare Supplement plan that aligns with your needs is paramount, as is finding the right insurance agent to help you through the process year-after-year.

Be diligent when reviewing plan details and keep an eye out for additional costs like monthly premiums, annual deductibles, and out-of-pocket costs for services not covered by Medicare.

Remember, an informed decision now can save you from potential financial stress later.

View Medicare Supplement Rates for 2025

Enter Zip Code

Low-Quality Coverage and Limited Benefits

A Medicare Supplement plan is meant to protect your health and finances, but what if the coverage is insufficient?

Low-quality coverage and limited benefits suggest that the plan may not meet your healthcare needs. As you evaluate Medicare Supplement plans, it’s important to factor in potential issues like limited healthcare provider choices, preauthorization requirements, and higher out-of-pocket expenses.

Digging deeper into the plan details and understanding the limitations can help you avoid the worst Medicare Supplement plans and find one that caters to your specific requirements.

Don’t let low-quality coverage and limited benefits stand between you and the healthcare you deserve.

Red Flags to Watch Out for When Choosing a Medicare Supplement Company

With the knowledge of what contributes to subpar Medicare Supplement providers, you can now enhance your detective skills and become adept at identifying the red flags.

Being vigilant and identifying these warning signs can save you from potential pitfalls and ensure you choose a provider that offers the best value for your healthcare needs.

Inadequate Plan Offerings

When assessing Medicare Supplement providers, limited plan offerings can raise a red flag. Inadequate plan offerings may include:

- New to the industry

- High annual rate increases

- Elevated premiums

A comprehensive Medicare Supplement plan should provide comprehensive coverage for services included under Original Medicare (Part A and Part B) and assist in covering your share of costs such as deductibles, coinsurance, and copayments.

Inflexible and limited plan offerings can restrict your ability to receive the specific care you need, leading to higher out-of-pocket costs and dissatisfaction.

For example, a company trying to push you into a high-deductible plan claiming it will save you money, while in the meantime trying to sell you additional policies.

That’s why it’s essential to choose the right Medicare supplement insurance agent to help ensure you get the most suitable coverage.

At Medisupps.com we’ve been helping people for 15 years with their Medigap coverage. We’re independent insurance agents, so we don’t work for insurance companies, we work for you!

Frequent or High Rate Increases

Frequent or high rate increases can be a sign of financial instability or poor management within a Medicare Supplement company.

It’s recommended to keep an eye on rate increase filings since insurance companies are obligated to file for these increases. It’s also important to note that rate increases can vary depending on factors such as location and plan type.

The average rate increase for Medicare Supplement plans is estimated to be between 6% and 10% annually, but this depends on the plan letter. We watch the rates every year for our clients to help save them money.

Poor Financial Ratings

Poor financial ratings can indicate potential issues with a company’s ability to pay claims and provide reliable coverage. Independent rating agencies such as:

- A.M. Best

- Fitch

- Kroll Bond Rating Agency (KBRA)

- Moody’s

- Standard & Poor’s

These companies use a comprehensive evaluation of factors, including balance sheet strength and operating performance, to determine financial ratings for Medicare Supplement companies.

In choosing a Medicare Supplement provider, taking their financial rating into account is crucial for the reliability and financial security of your choice.

Keep in mind that financial ratings are usually updated annually, so staying informed about the financial health of your chosen provider is an ongoing process.

Tips for Avoiding the Worst Medicare Supplement Companies

Armed with the knowledge of warning signs and red flags, you’re now better equipped to avoid the worst Medicare Supplement providers. But how can you ensure you find the best provider for your needs?

Don’t forget to research each company’s history, and customer reviews, and plan options to ensure they meet your individual needs.

By conducting thorough research and comparing providers, you’re more likely to find a provider that offers reliable coverage, excellent customer service, and competitive pricing.

Seek Professional Guidance

Navigating the world of Medicare Supplement providers can be overwhelming, but you don’t have to do it alone.

Our licensed insurance agents here at Medisupps.com can help you make sense of the selection process and find the best provider for your needs.

A licensed, independent insurance agent can provide expert knowledge and guidance on Medicare and the available plan options, answer your questions, and ensure that you meet the coverage requirements.

Remember, your decision will be more informed if you choose a reputable agent with experience in selling Medicare plans.

The Importance of Choosing the Right Medicare Supplement Plan

Selecting the right Medicare Supplement plan is of utmost importance, as it directly impacts your healthcare coverage and financial well-being.

Selecting the right Medicare Supplement plan is of utmost importance, as it directly impacts your healthcare coverage and financial well-being.

Your chosen plan should align with your healthcare requirements, preferences, and budget.

Let’s explore the key factors to consider when choosing a Medicare Supplement plan to ensure you make the best possible decision.

Plan Coverage and Benefits

In evaluating Medicare Supplement plans, the coverage and benefits they offer should be a primary consideration for Medicare beneficiaries.

As a Medicare beneficiary, it is important to choose a plan that provides coverage for services included under Original Medicare (Part A and Part B) and assists in covering your share of costs such as deductibles, coinsurance, and copayments.

Keep in mind that coverage may vary depending on the insurance company, the plan itself, and the region in which you reside.

Make sure to compare the benefits and costs of different plans to determine which one best meets your healthcare needs and preferences.

Cost and Affordability

When choosing a Medicare Supplement plan, cost and affordability stand as significant factors, given their substantial impact on your financial health.

Premiums for Medicare Supplement plans are set by private insurance companies using one of three methods:

- community-rated,

- issue-age-rated,

- or attained-age-rated.

When selecting a plan, be mindful of additional costs such as deductibles, copayments, and coinsurance.

By carefully reviewing plan details and understanding the factors that influence plan costs, you can make a more informed decision and choose a plan that offers the best value for your healthcare needs and budget.

Alternatives to the Worst Medicare Supplement Companies

If you’re still wary of the worst Medicare Supplement providers, fear not! There are alternatives that offer better coverage, customer service, and pricing.

We’ll look at some options that can guide you to find the perfect fit for your healthcare needs, steering clear of subpar providers.

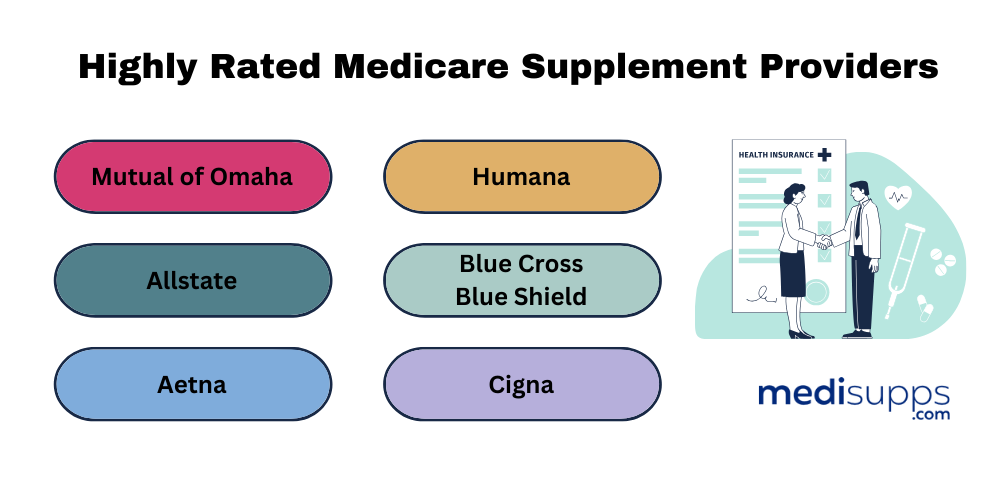

Highly Rated Medicare Supplement Providers

Just a few Highly rated Medicare Supplement providers include:

- Mutual of Omaha

- Allstate

- Aetna

- Humana

- Blue Cross Blue Shield

- Cigna

These private insurance companies offer reliable coverage, excellent customer service, and competitive pricing for Medigap plans. They have a proven track record of meeting beneficiaries’ healthcare needs and preferences.

When comparing providers, consider factors such as plan coverage, benefits, and pricing. By opting for a highly-rated provider, you can have peace of mind knowing that your healthcare coverage is in good hands and that you’re receiving the best value for your needs.

Summary

Navigating the world of Medicare Supplement providers can be challenging, but with the right knowledge and tools, you can confidently avoid the worst providers and find the best plan for your needs.

By identifying the red flags, researching providers, seeking professional guidance, and reading reviews and testimonials, you’re well-equipped to make an informed decision that aligns with your healthcare requirements and financial situation.

Remember, your health and well-being are worth the effort to find the perfect Medicare Supplement plan, so take charge and choose wisely.

View Rates Now

Enter Zip Code

Frequently Asked Questions

Which Medicare Supplement plan has the highest level of coverage?

Medicare Supplement Plan F is the highest level of coverage, covering all deductibles and copays as well as coinsurance, leaving you with no out-of-pocket costs.

While this makes it the most comprehensive Medicare Supplement plan available, it’s only offered to people who were enrolled in Medicare prior to January 1st of 2020. As well, it’s also the most expensive plan and in many cases Medicare Plan G can save you money over Plan F.

What is the best Medicare Supplement plan right now?

The best plan is the one that will fit your coverage needs and budget. The most popular Medigap plans are Plan G and Plan N, as they provide comprehensive coverage for relatively low premiums.

Who is the largest Medicare Supplement provider?

UnitedHealthcare, partnered with AARP, is the largest Medicare Supplement provider in the United States. The partnership covers over 43 million people in all 50 states and most U.S. territories, providing Medigap coverage to approximately 4.4 million U.S. adults.

What factors contribute to subpar Medicare Supplement providers?

Subpar Medicare Supplement providers are typically identified by their poor customer service, expensive premiums, and high annual rate increases.

How can I spot the red flags when choosing a Medicare Supplement company?

Be wary of red flags when selecting a Medicare Supplement company, such as inadequate plan offerings, frequent rate increases, and poor financial ratings.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2025 doesn’t have to be confusing. But fear not!

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!