by Russell Noga | Updated November 2nd, 2023

Are you looking into Medicare supplement plans? Medigap policies offer you coverage for the remaining 20% of out-of-pocket costs not covered by Original Medicare Parts A & B.

Are you looking into Medicare supplement plans? Medigap policies offer you coverage for the remaining 20% of out-of-pocket costs not covered by Original Medicare Parts A & B.

With Medigap, you get peace of mind knowing you have coverage for hospitalization and medical treatments in your senior years.

You can purchase a Medigap policy from approved healthcare insurers, with ten plans available.

But how do you know if you’re buying the right plan? What happens if you sign up for the wrong plan? Since Medigap policies are available for private healthcare providers, they charge different rates. Are you paying more than you should for your policy? Can you get it cheaper from another provider?

A Medicare supplement insurance agent can help you navigate the plans and providers, finding you the right policy at the best price.

Compare 2024 Plans & Rates

Enter Zip Code

What are the Benefits of Using a Medicare Supplement Insurance Agent?

Why would you use a Medigap agent to choose your plan if you can do it yourself? Don’t these companies charge you for their advice? No, not at all. Medigap agents don’t charge you a cent for using their services. You get free advice on Medigap plans and how they work.

A Medigap agent is essential for navigating the complicated world of Medicare supplement insurance. If you have trouble understanding how the deductibles work, your copayment and coinsurance responsibilities, and the scope of benefits, the Medigap agent is there to answer your questions.

Sure, you could get that information from the insurer, but they don’t have a dedicated focus on unpacking all the information for you. You’ll likely be tossed around between departments and waste a lot of time on the phone, becoming frustrated with your results. With a Medigap agent, you get everything you need to know from one source.

A Medicare Supplement Insurance Agent Helps You Choose Your Plan

A Medicare supplement agent can explain the difference between each Medigap plan. They’ll listen to your unique healthcare requirements and recommend the right plan for your situation. A Medigap agent is not interested in selling you the most expensive plan.

They want to keep you as a client, and they realize they can only do that by offering you an outstanding service experience. The last thing you want is to take a plan with more or less coverage than you need. The Medigap consultant ensures you get the insurance you need to reduce your out-of-pocket costs associated with Medicare Parts A & B.

A Medicare Supplement Insurance Agent Unpacks Your Benefits

Each of the ten Medigap plans has different benefits. Some offer near-comprehensive or comprehensive coverage. Others have cost-sharing models or provide limited benefits. Understanding the coverage provided in each plan is vital to prevent you from being under or over-insured.

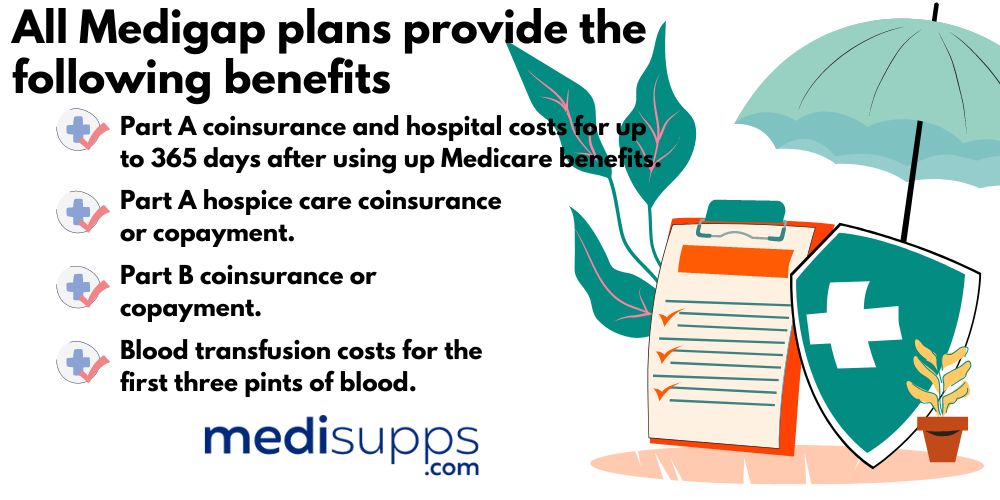

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

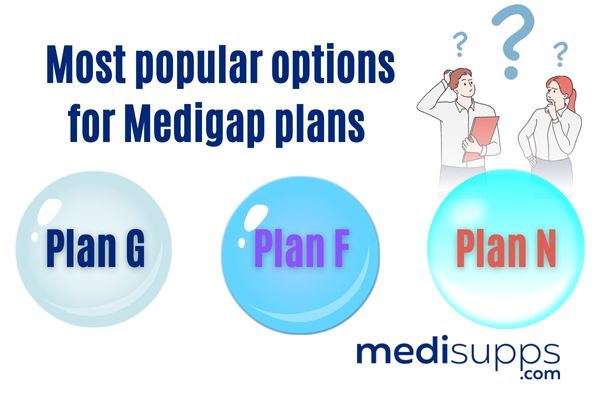

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

Medigap agents Help you understand each of the benefits, deductibles, coinsurance responsibilities, and copayments required with each plan. Many seniors find it confusing to navigate the specifics of each plan, and a Medigap agent gives you the information you need to make an informed decision on the right plan for you.

*Plan F is available to beneficiaries of Original Medicare enrolling before January 1, 2020. If you qualify for Plan F, call a Medigap agent, and they’ll advise you on the best way to secure a Plan F policy. Or the agent will recommend a suitable alternative to Plan F that meets your healthcare requirements.

Compare Medicare Plans & Rates in Your Area

A Medicare Supplement Insurance Agent Deals with the Insurer

The Medigap agent deals with the insurer on your behalf. You only deal with them and direct all your Medigap enquires through the agent. The agent works with the insurer, reducing the hassle and frustration of talking to the carrier.

A Medicare Supplement Insurance Agent Gets You the Lowest Premiums

Medicare supplement plans are available through private healthcare insurers. While there are standardized benefits in all the plans, the premiums between insurers can vary widely. If you don’t know better, you could overpay for your policy.

The Medigap agent quotes you the best rates from leading healthcare insurers offering Medigap plans in your state. In some cases, you could save hundreds of dollars on your monthly premiums by using a Medigap agent to get your quotes.

For instance, UnitedHealthcare might be the cheapest option for Plan G in your state, but they could be the most expensive provider for Plan N. Don’t assume Medigap providers charge the same premiums, use a Medigap agent to get you the best rates on the plan you want.

A Medicare Supplement Insurance Agent Enrolls You in Your Plan

The Medigap agent advises when to join your insurer’s plan to avoid medical underwriting. Underwriting is a process where you must answer questions about your health status for the last several years. The insurer uses this information to set your premiums or deny you coverage.

The Medigap agent can advise you of your guaranteed issue rights for Medigap plans and how to join the plan at the best times of the year. If you qualify for guaranteed issue rights or enroll during a special enrollment period, you avoid underwriting and gain acceptance to any insurer’s Medigap scheme.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is a Medicare Supplement Insurance Agent?

A Medicare Supplement Insurance Agent is a licensed professional who specializes in helping individuals understand, compare, and enroll in Medicare Supplement plans. They have in-depth knowledge of the various plan options and can provide personalized guidance based on your specific needs.

What are the benefits of using a Medicare Supplement Insurance Agent?

Using a Medicare Supplement Insurance Agent offers several benefits, including expert guidance throughout the plan selection process, access to a wide range of plan options, assistance in comparing coverage and costs, and ongoing support to address any questions or concerns.

Can a Medicare Supplement Insurance Agent help me understand the differences between Plan G and Plan N?

Yes, a Medicare Supplement Insurance Agent can explain the differences between Plan G and Plan N. Plan G offers comprehensive coverage, including coverage for Medicare Part A and Part B deductibles, while Plan N has cost-sharing requirements for certain services. An agent can help you assess which plan aligns better with your healthcare needs.

How can a Medicare Supplement Insurance Agent assist me in selecting the right plan?

A Medicare Supplement Insurance Agent can assess your healthcare needs, budget, and preferences to recommend the most suitable plan options. They will guide you through the plan comparison process, explain the coverage details, and help you make an informed decision.

Are Medicare Supplement Insurance Agents independent or affiliated with specific insurance companies?

Medicare Supplement Insurance Agents can be either independent or affiliated with specific insurance companies. Independent agents work with multiple insurance carriers, offering a broader range of plan options, while affiliated agents represent a specific insurance company and focus on their plans.

Do Medicare Supplement Insurance Agents charge for their services?

Medicare Supplement Insurance Agents typically do not charge for their services. They are compensated by the insurance carriers with whom they work. It’s always a good idea to confirm any potential charges or fees with the agent before engaging their services.

Can a Medicare Supplement Insurance Agent help me during the enrollment process?

Yes, a Medicare Supplement Insurance Agent can assist you during the enrollment process. They will help you understand the enrollment periods, complete the necessary paperwork, and guide you through the application process to ensure a smooth and timely enrollment.

Can I switch Medicare Supplement plans with the help of a Medicare Supplement Insurance Agent?

Absolutely! A Medicare Supplement Insurance Agent can help you switch Medicare Supplement plans if you find a better option that suits your needs. They will assist you in comparing plans, evaluating the coverage and costs, and facilitating the plan switch process.

Will a Medicare Supplement Insurance Agent provide ongoing support after enrollment?

Yes, a Medicare Supplement Insurance Agent will provide ongoing support after enrollment. They can address any questions or concerns you have about your coverage, help you understand any changes or updates to your plan, and provide guidance when needed.

Where can I find a reputable Medicare Supplement Insurance Agent?

You can find reputable Medicare Supplement Insurance Agents through referrals from friends or family, online directories, or by contacting your local State Health Insurance Assistance Program (SHIP) for recommendations. It’s important to choose a licensed agent with a good reputation and experience in the Medicare field.

Get a Free Consultation from a Licensed Medicare Supplement Insurance Agent

If you have questions about Medigap policies, call our team of fully-licensed agents at 1-888-891-0229. We’ll advise you on the right plan for your healthcare requirements and get you the lowest rates on any plan from providers in your state.

Our consultations, advice, and quotes are free. If you can’t speak to us right now, complete the contact form on this site. We’ll get a Medicare supplement agent to call you back.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.