by Russell Noga | Updated October 2, 2024

Are you enrolled in Original Medicare Parts A & B? Do you realize these policies only cover 80% of your inpatient and outpatient healthcare expenses?

Are you enrolled in Original Medicare Parts A & B? Do you realize these policies only cover 80% of your inpatient and outpatient healthcare expenses?

You’ll have to pay the remaining balance out-of-pocket unless you have a Medigap plan.

Medicare supplement policies, known as “Medigap” plans, offer partial or full coverage for Medicare Part A & B out-of-pocket expenses.

There are ten plans, each offering a different level of coverage with many companies offering these plans. How do you choose a company?

Well, Allstate has recently acquired National General and they are offering incredible discounts of up to 25%, making them a leading company with some of the lowest premiums in the industry!

Our website shows you the rates from Allstate / National General Medicare Supplement plans in your area to see just how much you can save.

National General Medicare Supplement Plans at a Glance

- National General offers Medigap Plans A, F, HD F, G, & N in 23 states.

- It’s one of the few insurers providing HD Plan F but doesn’t offer HD Plan G.

- National General Medigap Plan premiums in 2025 are below the industry average in many states.

- The company offers dental and vision services through an add-on plan.

Compare 2025 Plans & Rates

Enter Zip Code

Who Is National General?

Founded in 1920, National General has headquarters in Winston-Salem, North Carolina. The company was originally the “GMAC Insurance Group” before rebranding to National General Insurance.

The Allstate Corporation acquired National General in 2021, rebranding the company to “Allstate Health Solutions” in 2022.

What Medicare Supplement Plans Does National General Offer?

National General has a niche Medigap offering, focusing on the most popular plans, F, G, & N. It’s also one of the few providers of the high-deductible plan F. All insurers must offer Plan A according to CMS guidelines.

Here’s a brief breakdown of each plan offering.

Plan A – You get basic benefits for Medicare Part A, no Medicare Part A or B deductible coverage, and coverage for Medicare Part B coinsurance and copayments. It’s the lowest-cost Medigap plan and ideal for seniors on a budget.

Plan F – This policy is the most comprehensive option in the Medigap range. You even have coverage for the Medicare Part B deductible.

High-Deductible Plan F – The HD version of Plan F offers the same benefits as the standard version of the policy.

However, you get up to an 80% reduction in policy premiums in exchange for a higher deductible of $2,700, compared to $2,600 for the standard Plan F.

Plan G – This policy offers near-comprehensive coverage of Medicare Part A & B expenses.

The only thing it doesn’t cover is the Medicare Part B deductible.

Plan N – Plan N offers low premiums in exchange for copays at the doctor and emergency room. The policy doesn’t cover Medicare Part B excess charges or the Part B deductible. If you visit doctors charging over Medicare-approved rates, you’re responsible for paying the excess charge.

National General Medicare Supplement Plans – Benefits & Coverage

All Medigap plans feature standardized benefits. The CMS regulates the industry, ensuring consistency between providers. So, the benefits available in National General Medicare supplement plans are the same as with any other healthcare insurer offering Medigap.

All Medigap plans offer the following benefits for Original Medicare Parts A & B.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F and HD Plan F are no longer available to seniors eligible for Medicare after January 1, 2020. If you qualify for Medicare before this date, you can still apply for a Plan F or HD Plan F policy. However, National General may require you to undergo medical underwriting unless you have guaranteed issue rights for your Medigap plan.

*Plan F and HD Plan F are no longer available to seniors eligible for Medicare after January 1, 2020. If you qualify for Medicare before this date, you can still apply for a Plan F or HD Plan F policy. However, National General may require you to undergo medical underwriting unless you have guaranteed issue rights for your Medigap plan.

Our team of Medigap experts can explain guaranteed issue rights to you and how they apply to your unique situation.

What National General Medicare Supplement Plans Don't Cover

National General Medigap plans won’t cover the costs of any medical services unrelated to Original Medicare Parts A & B.

You don’t have coverage for prescriptions, dental, hearing, or vision services. There’s no coverage for cosmetic procedures like teeth whitening or private-duty nursing and stays at unskilled nursing homes.

Medigap policies don’t cover the costs of preventative treatments, such as sessions with a chiropractor, podiatrist, acupuncturist, or physiotherapist. However, they may cover these services if deemed medically necessary by your doctor.

Compare Medicare Plans & Rates in Your Area

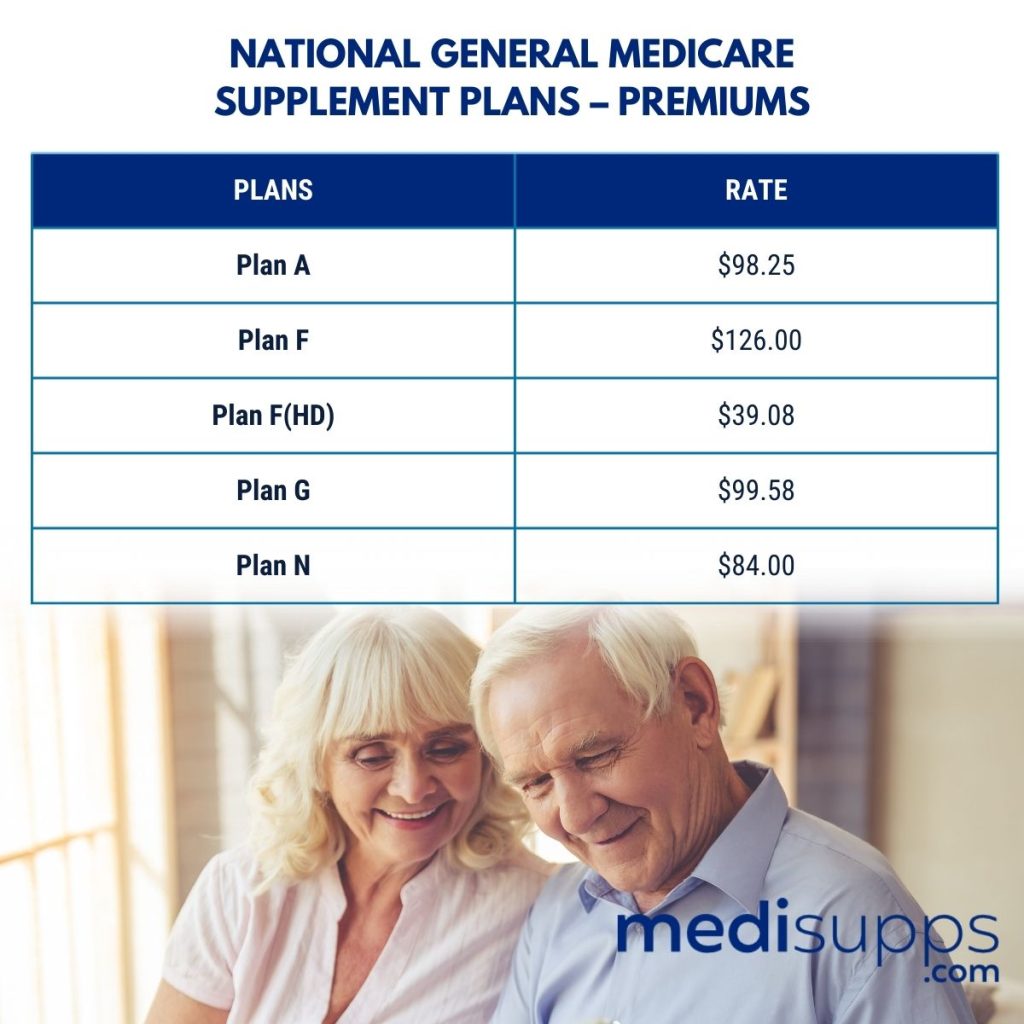

National General Medigap Plan Average Premiums

National General assesses your “risk profile” when you apply for coverage outside any enrollment period and need to go through medical underwriting.

They use this risk profile to set your premiums based on the coverage they think you’ll use while holding a Medigap policy. Factors included in your risk assessment are your age, smoking status, gender, and location in the United States.

National General has affordable rates on its Medigap plans. Here are the average premiums rates for a 65-year-old female nonsmoker in Oklahoma.

*Your premium rates will vary depending on your risk profile.

National General Medigap Plans – Additional Benefits

National General offer policyholders access to its easy E-Application platform for managing claims and their account. The company doesn’t include dental coverage within their Medigap plans, but you can buy add-on plans covering dental and vision services.

National General Dental Insurance covers preventive care dental treatments like examinations, surgeries, cleanings, X-rays, and more. The company offers three benefit plans with varying levels of coverage.

National General has two vision plans available. You get coverage for annual eye exams, eyeglass frames, lenses, or contacts. The Avēsis Vision network offers 98,000 locations across the United States.

National General Medicare Supplement Plans – Third-Party Ratings & Reviews

National General has an A- rating with AM Best for its financial strength and an A+ rating with the Better Business Bureau (BBB).

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are National General Medicare Supplement Plans?

Call Us for More Information on National General Medicare Supplement Plans

Reach out to our team at 1-888-891-0229 for more information on National General Medicare supplement plans. We offer a free consultation and quote on any plan with the best premium rates in your state.

If you can’t call us right now, leave our contact details on our web form, and we’ll get a Medigap expert to call you. Or you can use the free tool on our site to get an automated quote on any Medigap plan.