by Russell Noga | Updated July 12th, 2023

Medigap plans help you cope with the 20% of additional out-of-pocket expenses not covered by Original Medicare Parts A & B. You get coverage for several medical and hospital expenses, giving you less to pay for your annual healthcare.

Medigap plans help you cope with the 20% of additional out-of-pocket expenses not covered by Original Medicare Parts A & B. You get coverage for several medical and hospital expenses, giving you less to pay for your annual healthcare.

There are dozens of providers nationally, giving you several options to choose the best insurer for your policy. Mutual of Omaha is one of the best options, giving you some of the best monthly premiums across its range of plans and one of the best household discounts in the industry.

Who Is Mutual Of Omaha?

Mutual of Omaha is one of the most established healthcare insurers in the United States. Founded in 1909, Mutual of Omaha has over 1.4 million Medigap beneficiaries and a 10% market share. The company sells Medigap plans under the following subsidiaries.

- Mutual of Omaha Insurance Co.

- Omaha Insurance Co.

- United of Omaha Life Insurance Co.

- United World Life Insurance Co.

In 2020, Mutual of Omaha sold its Medicare Advantage business to Essence Healthcare, and the company no longer offers these plans.

Compare 2024 Plans & Rates

Enter Zip Code

Mutual Of Omaha Medicare Supplement Reviews at a Glance

As the country’s third-largest provider of Medigap plans, Mutual of Omaha has one of the biggest national footprints. It’s the ideal choice for cost-conscious seniors looking for the best deal on Medigap policies and is one of the few providers offering the high-deductible Plan G policy.

However, Mutual of Omaha isn’t the best option for additional benefits and perks or for those seeking less-popular plans in the Medigap range.

Mutual Of Omaha Medicare Supplement Reviews – Plans Offered

Mutual of Omaha has a select range of Medigap options, with the following plans available through its subsidiaries.

Medigap Plan A

The Federal government mandates all Medigap providers to offer Plan A. This is the most basic plan, offering you coverage for Part A and some Part B expenses.

Medigap Plan F

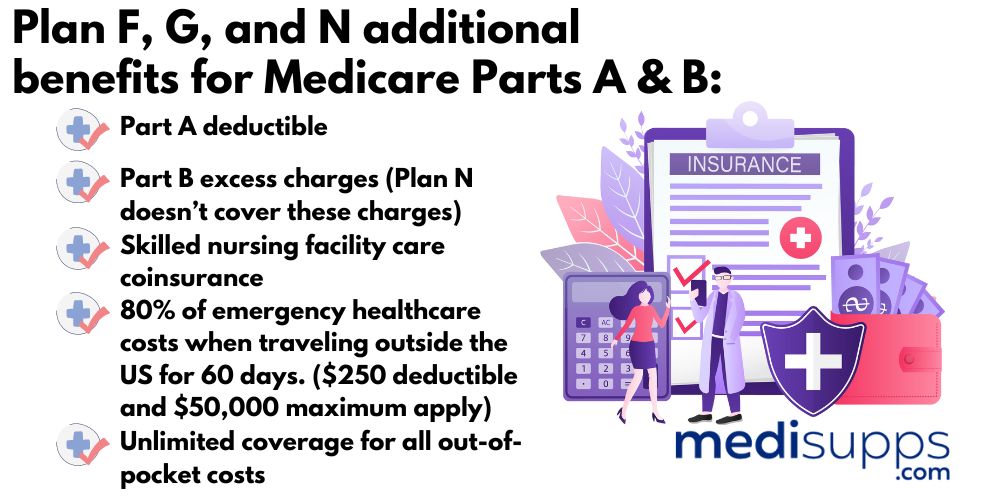

Medigap Plan F is the most comprehensive policy available. It’s the only plan covering the Part B deductible of $226 for 2023. However, it’s unavailable to seniors eligible for Medicare after January 1, 2020. If you were eligible before this date, you could still get Plan F, but you might have to undergo a medical underwriting.

Medigap Plan G

Plan G is the best option for newly eligible seniors. This policy covers everything that Plan F does except the Part B deductible. However, you get a significant discount on premiums compared to Plan F. These savings can help account for the Part B deductible.

Medigap High-Deductible Plan G

This plan offers all the same benefits as Plan G. However, you have your annual Part A deductible increased from $1,600 to $2,700. In exchange for the higher deductible, beneficiaries get lower premiums.

Medigap Plan N

Another popular option due to the low monthly premiums. Plan N requires payments of $20 at the doctor’s office and $50 at the emergency room if not admitted to the hospital. Plan N also doesn’t cover you for Part B excess charges when visiting practitioners that charge outside Medicare-approved rates. You can mitigate these costs by using doctors that charge Medicare Assignment rates.

Compare Medicare Plans & Rates in Your Area

What Coverage Do You Get with Mutual of Omaha Medicare Supplement Plans?

All Medigap plans from Mutual Of Omaha offer the following benefits to beneficiaries.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Along with these standardized benefits, beneficiaries receive vision and dental insurance for an additional fee, ranging between $27 and $53 per month. The company also offers Medicare Part D to cover your medication prescriptions for an additional monthly fee of between $25 and $84.

What Do Mutual Of Omaha Medicare Supplement Plans Cost?

Mutual of Omaha is one of the most competitively-priced Medicare providers in its service area. It’s one of the cheapest options for Plan F and has mid-ranged pricing compared to providers like AARP/ UnitedHealthcare, BlueCross BlueShield, and Cigna for Plans A, G, and N.

Across all Medigap plans, Mutual of Omaha offers an average monthly premium of between $87 and $161 for a nonsmoking female aged 65. Beneficiaries get access to its “Mutually Well” program for discounts on gym memberships and other wellness products and services with its partners. You’ll pay a $25 monthly fee to access the Mutually Well program.

Policyholders get vision discounts through its partner EyeMed, including eye exams for $50 and discounts on eyewear. Based on quotes for a 65-year-old female in Oregon, Mutual Of Omaha offers Medigap plans at the following rates.

These prices typically increase by 2% to 3% each year after 65. Mutual Of Omaha services Minnesota and Wisconsin. Most providers don’t offer coverage in these areas or Massachusetts due to the different Medigap rules that apply in these states.

However, residents of Minnesota have access to basic and extended Medigap plans for rates ranging between $255-$459. Residents of Wisconsin have options for the high-deductible Plan G and the standard plan, including extra coverage riders for between $50-$167.

Mutual of Omaha Supplement Plans Reviews – Third-Party Ratings

Mutual Of Omaha receives 4% fewer complaints than the industry average, according to data from the National Association of Insurance Commissioners (NAIC). The company has an A+ rating from the Better Business Bureau and an A+ (Superior) rating on its financial strength from AM Best.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are some key considerations when reading Mutual of Omaha Medicare Supplement reviews?

When reading Mutual of Omaha Medicare Supplement reviews, it’s important to consider factors such as overall customer satisfaction, the company’s reputation, claims processing efficiency, customer service quality, network coverage, and the range of available plans. Reviews can provide insights into others’ experiences, but it’s essential to balance them with your own research and priorities.

What are the benefits of choosing Mutual of Omaha Medicare Supplement plans?

Mutual of Omaha offers Medicare Supplement plans that provide various benefits, including standardized coverage, nationwide acceptance, the freedom to choose healthcare providers, no referrals required, and the option to keep your doctors. Additionally, Mutual of Omaha has a strong reputation for customer service and claims processing efficiency.

What is the difference between Mutual of Omaha Medicare Supplement Plan G and Plan N?

Mutual of Omaha Medicare Supplement Plan G and Plan N are two popular options. Plan G provides comprehensive coverage, including full coverage for Part A deductible, Part B excess charges, and skilled nursing facility coinsurance. Plan N offers similar coverage, but with some cost-sharing, such as a copayment for office visits and emergency room visits.

How do Mutual of Omaha Medicare Supplement reviews compare to other insurance providers?

Mutual of Omaha Medicare Supplement reviews are generally positive, reflecting the company’s commitment to customer service and efficient claims processing. However, it’s important to compare reviews across multiple insurance providers to get a comprehensive view. Factors such as regional variations, personal experiences, and individual needs can influence reviews, so it’s recommended to consider a range of opinions.

What are some common themes in Mutual of Omaha Medicare Supplement reviews?

Common themes in Mutual of Omaha Medicare Supplement reviews include praise for the company’s customer service, ease of claims processing, reliable coverage, and the availability of a wide range of plans. Customers often appreciate the company’s stability and reputation in the industry.

Are there any recurring concerns or drawbacks mentioned in Mutual of Omaha Medicare Supplement reviews?

While Mutual of Omaha Medicare Supplement reviews are generally positive, some recurring concerns might include premium increases over time, eligibility limitations, or specific issues related to claims processing. However, it’s essential to consider the overall pattern of reviews and weigh them against other factors when making a decision.

How can I find reliable Mutual of Omaha Medicare Supplement reviews?

To find reliable Mutual of Omaha Medicare Supplement reviews, you can visit trusted review websites, consult with independent insurance agents, and seek recommendations from friends, family, or healthcare professionals. It’s important to consider a variety of sources to form a balanced perspective.

Are there any alternatives to Mutual of Omaha Medicare Supplement plans with comparable reviews?

Several insurance providers offer Medicare Supplement plans with comparable reviews to Mutual of Omaha. Some well-regarded alternatives include Aetna, Cigna, Blue Cross Blue Shield, and UnitedHealthcare. It’s recommended to research and compare plans from different providers to find the one that best suits your needs.

How can I use Mutual of Omaha Medicare Supplement reviews to make an informed decision?

Mutual of Omaha Medicare Supplement reviews can provide valuable insights and help you make an informed decision. Look for patterns in the reviews, pay attention to specific features that are important to you, and consider your unique healthcare needs. It’s also beneficial to consult with a licensed insurance agent who can provide personalized advice based on your circumstances.

Can Mutual of Omaha Medicare Supplement reviews help me understand the claims process and customer service experience?

Yes, Mutual of Omaha Medicare Supplement reviews can give you insights into the claims process and customer service experience. Customers’ feedback can shed light on the company’s responsiveness, efficiency, and overall satisfaction. However, individual experiences may vary, so it’s important to consider reviews as part of your overall research.

Get a Free Consultation and Quote on Mutual of Omaha Medicare Supplement Plans

If you’re considering a Medigap policy, reach out to our team at 1-888-891-0229. We offer free consultations and quotes on any Medigap plan, and we’ll get you the best rate on any policy in your state. Or leave your details on our contact form, and one of our fully licensed agents will call you back.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.