by Russell Noga | Updated October 2, 2024

Are you looking for the best Medigap Plan G supplemental insurance provider in your state? You might want to look at Mutual of Omaha’s Rates for Plan G in 2025.

Are you looking for the best Medigap Plan G supplemental insurance provider in your state? You might want to look at Mutual of Omaha’s Rates for Plan G in 2025.

Medicare Plan G is now the most popular Medigap plan and for good reasons. Plan G offers great coverage with only one small out-of-pocket expense.

And Mutual of Omaha consistently has some of the lowest rates for Plan G, as we as a generous household discount.

Compare 2025 Plans & Rates

Enter Zip Code

Who Is Mutual of Omaha?

Headquartered in Omaha, Nebraska, Mutual of Omaha is one of America’s biggest healthcare insurers. Originally founded in 1909, the company started under the name “The Mutual Benefit Health & Accident Association” before changing it to the current moniker in 1950.

Mutual of Omaha sells Medicare Supplement Insurance plans and other insurance and financial products and services. The company services 49 states and Washington, D.C.

Unlike other companies offering “Medigap” policies, Mutual of Omaha doesn’t sell Original Medicare members Medicare Advantage or other health insurance options.

Mutual of Omaha is one of the best choices for your Medigap insurer. The company has an outstanding customer service department, receiving 60% fewer complaints than other companies competing in the same market.

Key Takeaways

- Mutual of Omaha has one of the best household discount programs. You get up to 12% savings on premiums for other household members that join you in making Mutual of Omaha your preferred Medigap provider.

- The company only offers Medigap Plan A, G, and N for new Medicare members.

Mutual Of Omaha Medicare Supplement Plan G Pros

- Mutual of Omaha has one of the best customer service departments in the industry, receiving 60% fewer complaints on average compared to other providers.

- Generous household discounts.

- Available in all states except Massachusetts.

- Some of the lowest premiums on Medigap Plan G countrywide.

- Options for standard and high-deductible Plan G.

Mutual Of Omaha Medicare Supplement Plan G Cons

- Limited options for Medigap plans. The company only provides plans A, G, and N. There’s no option for Plan D to cover prescriptions.

- Mutual of Omaha spends less than the industry average on member benefits and more on its overheads.

Compare Medicare Plans & Rates in Your Area

Mutual Of Omaha Medicare Supplement Plan G Coverage

Plan G Part A Deductible

Plan G Part A Deductible

Mutual of Omaha covers 100% of the $1,676 Part A deductible for Original Medicare in 2023.

Plan G Part B Deductible

Mutual of Omaha requires Plan G beneficiaries to cover the $257 Part B deductible in 2025.

Plan G Part B Coinsurance

Original Medicare covers 80% of the healthcare costs involved with visits to the doctor’s rooms. Plan G from Mutual of Omaha covers an additional 20% of the charges, up to 100% of the Original Medicare rate. This coverage extends to the cost of most outpatient hospital care and medical supplies.

Part B Excess Charges

Under Federal law, doctors who don’t accept “assignment” of the Medicare-approved amount can charge up to 15% more. Plan G absorbs this “excess” charge, covering you in full for your doctor’s visit at offices that charge more than the assigned rate.

Skilled Nursing Coinsurance

Skilled Nursing Coinsurance

Original Medicare covers the first 20 days of care in skilled nursing facilities. Plan G takes care of any additional days you spend in these facilities, with up to $200 per day for days 21-100.

Home Health Care

You’ll need home healthcare if you become injured or chronically sick. Plan G covers the 20% of costs involved with these services that Medicare Part B doesn’t.

365 Days of Hospital Stay

Medicare covers your first 60 days in the hospital. Plan G picks up the costs for any additional days you spend in the hospital.

Three Pints of Blood

Three Pints of Blood

Medicare covers from the fourth pint of blood onwards in transfusions. Plan G covers the costs of the first three pints.

Foreign Travel Emergency

Original Medicare covers 20% of your medical costs if you’re involved in an emergency when traveling outside the US. Plan G covers the 80% balance after you meet a $250 deductible.

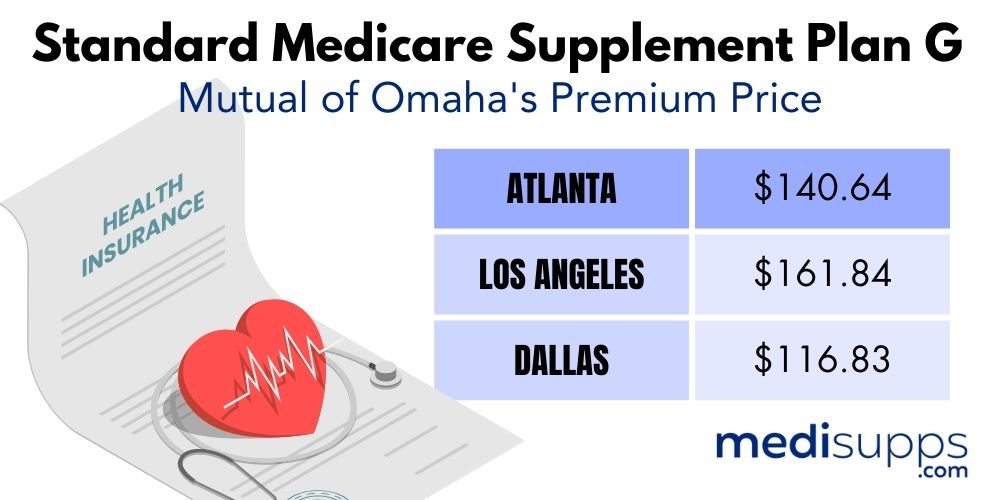

Mutual Of Omaha Medicare Supplement Plan G – Premiums

Every insurer offering Plan G sets a different rate, with some being more expensive than others in different states. We looked at the average costs for Plan G in three cities to assess the value it offers prospective beneficiaries.

- Atlanta: Average pricing.

- Los Angeles: More expensive pricing than average.

- Dallas: Less expensive pricing than average.

Standard Medicare Supplement Plan G

Mutual of Omaha’s average pricing for Plan G premiums was approximately 32% higher than the least expensive offering from other providers.

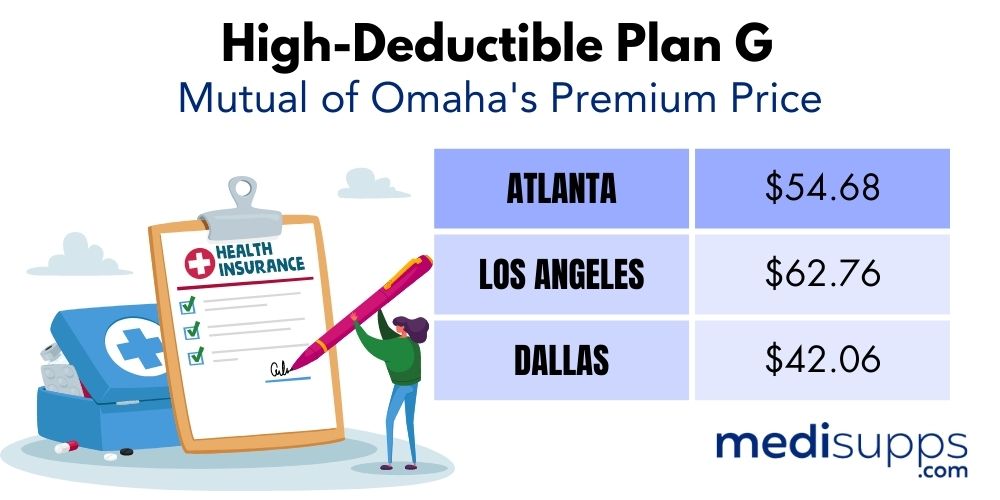

High-Deductible Plan G

Unlike other providers, Mutual of Omaha’s quote for its high-deductible version of Plan G was approximately 52% higher than the least-expensive insurer offering the high-deductible Plan G policy.

*It’s important to note that prices can vary by state and by your personal risk profile. When assessing premium costs, Mutual of Omaha requires basic information like age, location, gender, and smoking status. On average, men pay more in premiums than women.

Mutual Of Omaha Medicare Supplement Plan G Discounts

Mutual of Omaha offers some of the most generous discount programs on Medicare Supplement Insurance Plan G. Here are the discounts available when purchasing Plan G through this provider.

- Dental – Qualifying members purchasing Mutual of Omaha dental insurance within 30 days of procuring their Plan G policy can also receive up to a 15% discount on the premiums associated with their dental plan.

- Household – If you live with your spouse, life partner, or other adults in the same household, the other people in your family can qualify for up to a 12% household discount if they take a Plan G policy from Mutual of Omaha.

*Discounts vary according to factors like how you apply for your policy, household status, and location in the United States.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Mutual of Omaha Medicare Supplement Plan G?

Mutual of Omaha Medicare Supplement Plan G is a standardized insurance plan that helps cover the gaps in Original Medicare (Part A and Part B) benefits. It offers a comprehensive range of coverage, including hospital coinsurance, Part B excess charges, and skilled nursing facility coinsurance.

Who is eligible for Mutual of Omaha Medicare Supplement Plan G?

Generally, individuals who are already enrolled in Medicare Part A and Part B are eligible to enroll in Mutual of Omaha Medicare Supplement Plan G. It is important to note that eligibility requirements can vary by state, so it is advisable to check with Mutual of Omaha or a licensed insurance agent for specific details.

When can I enroll in Mutual of Omaha Medicare Supplement Plan G?

You can typically enroll in Mutual of Omaha Medicare Supplement Plan G during your Medicare Supplement Open Enrollment Period, which is a six-month period that starts on the first day of the month you are both 65 or older and enrolled in Medicare Part B. There may be other enrollment periods available, such as guaranteed issue rights or special enrollment periods, in certain situations.

What is the difference between Mutual of Omaha Medicare Supplement Plan G and Plan N?

Mutual of Omaha Medicare Supplement Plan G and Medicare Plan N have some differences in coverage. Plan G provides more comprehensive coverage than Plan N. Plan G covers Medicare Part B excess charges, which Plan N does not cover. However, Plan N may have lower premiums compared to Plan G, but it requires copayments for certain services.

What does Mutual of Omaha Medicare Supplement Plan G cover?

Mutual of Omaha Medicare Supplement Plan G covers various out-of-pocket costs associated with Original Medicare, including Part A hospital coinsurance, Part B coinsurance or copayments, hospice care coinsurance or copayments, and the first three pints of blood. It also covers skilled nursing facility coinsurance, Part A deductible, and 80% of foreign travel emergency costs.

Does Mutual of Omaha Medicare Supplement Plan G cover prescription drugs?

No, Mutual of Omaha Medicare Supplement Plan G does not include coverage for prescription drugs. To get coverage for prescription drugs, you can enroll in a standalone Medicare Part D prescription drug plan or consider a Medicare Advantage plan that includes prescription drug coverage.

Can I go to any doctor or hospital with Mutual of Omaha Medicare Supplement Plan G?

Yes, with Mutual of Omaha Medicare Supplement Plan G, you have the freedom to choose any doctor or hospital that accepts Medicare patients. Since it is a Medicare Supplement plan, it works alongside Original Medicare, which means you have the flexibility to see any healthcare provider that accepts Medicare.

Can I keep my Mutual of Omaha Medicare Supplement Plan G if I move to a different state?

Yes, you can keep your Mutual of Omaha Medicare Supplement Plan G if you move to a different state. Medicare Supplement plans are standardized across most states, meaning the benefits of your plan remain the same even if you change your residence. However, it’s essential to notify Mutual of Omaha about your new address to ensure continued coverage and accurate premium billing.

What is the cost of Mutual of Omaha Medicare Supplement Plan G?

The cost of Mutual of Omaha Medicare Supplement Plan G can vary based on several factors, including your location, age, gender, and tobacco use. Insurance companies use different pricing methodologies, such as attained-age, issue-age, or community-rated pricing, which can impact the premiums. It’s advisable to compare quotes from Mutual of Omaha and other insurance providers to find the best rate for your circumstances.

Why should I choose Mutual of Omaha Medicare Supplement Plan G?

Mutual of Omaha is a reputable insurance company with a long-standing history of providing Medicare Supplement plans. Plan G offers comprehensive coverage and the flexibility to see any doctor or hospital that accepts Medicare. It provides peace of mind by helping to cover the out-of-pocket costs associated with Medicare, ensuring you have financial protection against unexpected healthcare expenses.

Find the Right Medicare Supplement Insurance Plan Today!

If you’re trying to determine which Medigap plan to purchase, comparing quotes from several different insurance companies is an important part of the process. To receive quotes from the top insurers in your area – including Mutual of Omaha – just fill out the form to the right of your screen. You can also call 1-888-891-0229 and one of our licensed agents will be more than happy to assist you with your needs.