by Russell Noga | Updated October 2, 2024

Original Medicare Parts A & B assist seniors with managing their healthcare expenses in their golden years. However, these policies only cover 80% of the costs of Medicare Part A & B services. So, the policyholder could face a stiff bill for medical services or a stay at the hospital.

Original Medicare Parts A & B assist seniors with managing their healthcare expenses in their golden years. However, these policies only cover 80% of the costs of Medicare Part A & B services. So, the policyholder could face a stiff bill for medical services or a stay at the hospital.

Medigap plans to add supplemental coverage to Medicare Parts A & B, partially or fully covering the out-of-pocket costs associated with their care and treatment. Medigap plans are available from private healthcare insurers like Medico.

You can sign up for a Medicare plan during the “Open Enrollment” period in the six months after your 65th birthday. During this time, the insurer must accept your application to join the Medigap scheme, even if you have pre-existing conditions. This post looks at Medico Medicare supplement policies’ plans, premiums, and benefits.

Medico Medicare Supplement Plans at a Glance

- Medico serves 27 states with Medigap policies.

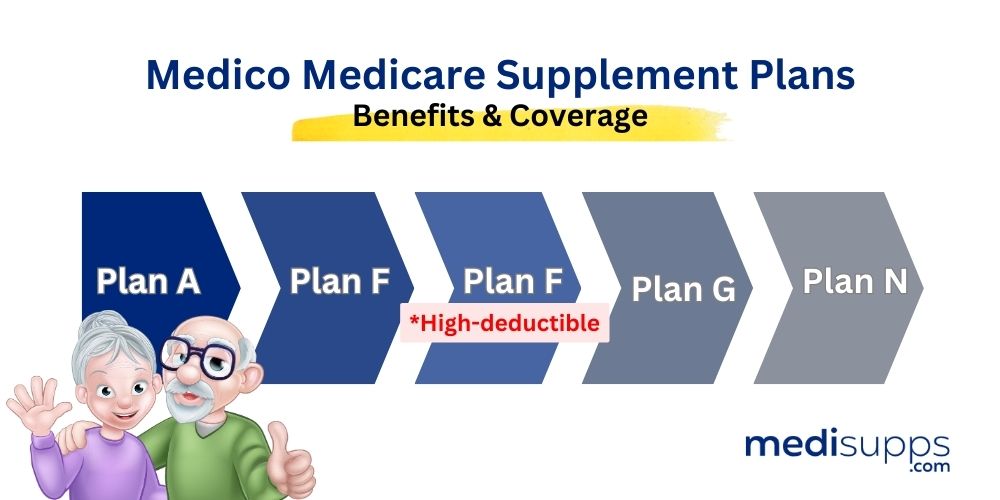

- Medico offers a niche range of popular Medigap plans, including Plans A, F, HD F, G, & N.

- Medico offers an add-on plan for dental coverage.

- Medico has one of the best household discounts in the Medigap industry.

Compare 2025 Plans & Rates

Enter Zip Code

Who Is Medico?

Founded in 1930, Medico has headquarters in Des Moines, Iowa. The company started issuing Medigap policies in 1973 and eventually merged with American Enterprise in 2012. The venture saw the founding of the Medico Corp in 2014. Medico offers Medicare supplement plans in 27 states.

What Medicare Supplement Plans Does Medico Offer?

Medico has a tight range of Medicare supplement plans. It sticks to offering the most popular options. All Medigap providers must offer Plan A, but Medico only offers four other plan options, F, High-Deductible F, G, & N.

Plan A – This policy offers you basic benefits. You get coverage for most Medicare Part A services, excluding the Medicare Part A deductible. There’s also coverage for Medicare Part B coinsurance and copayments. It’s the most affordable plan in the range from Medico.

Plan F – Plan F is the only Medigap policy offering “first dollar coverage.” You get full coverage for Medicare Part A & B benefits, and it’s the only plan in the Medigap range providing coverage for the Medicare Part B deductible.

Plan F HD – This “high-deductible” plan offers the same benefits as the standard Plan F. However, your Medicare Part A deductible increases from $1,600 to $2,700. In exchange for a higher deductible, you get up to an 80% reduction in monthly premiums.

Plan G – Plan G is the best alternative policy to Plan F. You get the same benefits as Plan F, excluding coverage for the Medicare Part B deductible.

Plan N – This policy requires copayments of $20 at the doctor’s office and $50 at the emergency room if not admitted into the hospital. There’s no coverage for the Medicare Part B deductible or excess charges. Excess charges are the additional fees doctors charge above the standard Medicare-approved rates.

Compare Medicare Plans & Rates in Your Area

Medico Medicare Supplement Plans – Benefits & Coverage

The CMS is a federal agency regulating the Medigap industry. They ensure all providers offer the same standardized benefits in Medigap plans. As a result, you’ll get the same Medicare Part A & B benefits in Medico plans as with any other Medigap provider.

All Medigap plans offer the following benefits for Original Medicare Parts A & B.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F & HD Plan F are only available to seniors qualifying for Medicare before January 1, 2020. The CMS is phasing out Plan F due to its Medicare Part B deductible coverage. If you were eligible for Medicare before the cut-off date, you can still apply for Plan F.

*Plan F & HD Plan F are only available to seniors qualifying for Medicare before January 1, 2020. The CMS is phasing out Plan F due to its Medicare Part B deductible coverage. If you were eligible for Medicare before the cut-off date, you can still apply for Plan F.

However, your application might require medical underwriting if you don’t have guaranteed issue rights. Speak to our team, and we’ll advise you on enrolling in Plan F or recommend another plan based on your healthcare needs.

What Medico Medicare Supplement Plans Don't Cover

Medico Medigap plans don’t cover medical services not covered by Original Medicare Parts A & B. So, you don’t have coverage for preventative treatments at the chiropractor, physiotherapist, podiatrist, or acupuncturist.

There’s no coverage for dental, vision, and hearing services or prescriptions. Medigap plans don’t cover the costs of private-duty nursing or stays at unskilled nursing facilities.

Medico Medicare Supplement Plans – Premiums

Medico offers mid-tier pricing on Medigap premiums. Medico assesses your age, location, gender, and smoking status when setting your premiums. Our research indicates that the company offers the following average pricing on premiums in the following areas.

*Pricing based on a 65-year-old female nonsmoker. Your premium rates may vary.

Medico Medicare Supplement Plans – Additional Benefits

Medico offers a competitive household discount of up to 10%, depending on your location. They also provide discounts for paying your premiums using automatic bank payments. The company offers policyholders access to its easy online customer portal to manage their claims and account.

Medico doesn’t have a pre-existing clause. If you sign up for a policy during the Open Enrollment period and have a chronic health condition, the company won’t initiate a waiting period before activating your benefits.

While Medico doesn’t offer dental benefits included with its Medigap policies, you can buy an add-on plan for dental coverage. The Gold and Platinum Medico dental insurance plans cover basic dental healthcare services, including the following.

Medico Medicare Supplement Plans – Third-Party Ratings & Reviews

Medico has an A+ rating with the Better Business Bureau and an A- rating with AM Best for its financial strength.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Medico Medicare Supplement Plans?

Medico Medicare Supplement Plans, also known as Medigap plans, are private health insurance policies that work alongside Original Medicare to help cover out-of-pocket costs such as deductibles, copayments, and coinsurance. These plans are offered by Medico Insurance Company and provide additional coverage beyond what Original Medicare offers.

What are the benefits of Medico Medicare Supplement Plans?

The benefits of Medico Medicare Supplement Plans include helping to cover gaps in Original Medicare, providing predictable out-of-pocket costs, allowing you to choose any doctor or hospital that accepts Medicare, and coverage that travels with you throughout the United States.

What is the difference between Medico Medicare Plan G and Plan N?

Medico Medicare Plan G and Plan N both provide comprehensive coverage, but there are differences in cost-sharing. Plan G covers all Medicare Part A and B deductibles, excess charges, and skilled nursing facility coinsurance. Plan N requires cost-sharing in the form of copayments for certain services, such as office visits and emergency room visits.

Who is eligible for Medico Medicare Supplement Plans?

To be eligible for Medico Medicare Supplement Plans, you must be enrolled in Medicare Part A and Part B. The best time to enroll is during your Medigap Open Enrollment Period, which starts on the first day of the month in which you are 65 or older and enrolled in Medicare Part B.

When can I enroll in Medico Medicare Supplement Plans?

You can enroll in Medico Medicare Supplement Plans during your Medigap Open Enrollment Period. If you miss this period, you may still be able to enroll, but you could be subject to medical underwriting, which could affect your eligibility and premium rates.

What additional benefits does Medico offer with their Medicare Supplement Plans?

Medico offers additional benefits with their Medicare Supplement Plans, such as coverage for foreign travel emergencies, access to the SilverSneakers fitness program, and a 30-day “free look” period to review your plan and make sure it meets your needs.

Can I use any doctor or hospital with Medico Medicare Supplement Plans?

Yes, with Medico Medicare Supplement Plans, you can see any doctor or hospital that accepts Medicare. There are no network restrictions, giving you the freedom to choose healthcare providers that best suit your needs.

Do Medico Medicare Supplement Plans cover prescription drugs?

No, Medico Medicare Supplement Plans do not cover prescription drugs. However, you can enroll in a separate Medicare Part D prescription drug plan to add prescription drug coverage to your Medicare benefits.

Can I switch from another Medicare Supplement plan to Medico Medicare Supplement Plans?

Yes, you can switch from another Medicare Supplement plan to Medico Medicare Supplement Plans. However, depending on the timing and your specific circumstances, you may need to go through the underwriting process, which could impact your eligibility and premium rates.

Where can I get assistance in understanding and enrolling in Medico Medicare Supplement Plans?

To understand and enroll in Medico Medicare Supplement Plans, it’s recommended to consult with licensed insurance agents who specialize in Medicare. They can provide personalized guidance, help you compare plans, and assist you in finding the most suitable coverage for your healthcare needs.

Call Us for More Information on Medico Medicare Supplement Plans

Contact our team at 1-888-891-0229 for more information on Medico Medigap plans. We offer free consultations and quotes on any policy. If you can’t call us right now, leave your contact details, and we’ll get a Medigap expert to connect with you. Or you can use the free automated tool on our site for a complimentary quote.