by Russell Noga | Updated November 26th, 2023

What Will be the Medicare Premium for 2024?

As 2024 approaches, understanding the Medicare premiums and coverage changes becomes more critical than ever.

As 2024 approaches, understanding the Medicare premiums and coverage changes becomes more critical than ever.

With the ever-evolving healthcare landscape, being informed about Medicare options can save both time and money. So, why not stay ahead of the curve and dive into the projected “what will be the Medicare premium for 2024?”

This blog post will provide insights into the expected premiums for Part B and Part D, the impact of legislative changes, and tips on choosing the right Medicare plan in 2024.

In the sections to follow, we will discuss the factors affecting Medicare premiums, changes in Medicare coverage due to the Inflation Reduction Act, cost-sharing initiatives, and the reliability of Medicare Trustees projections. By the end, you will be well-equipped to make informed decisions about your Medicare coverage for 2024 and beyond.

Short Summary

- The standard Medicare Part B premium for 2024 is $174.70 per month

- The Inflation Reduction Act and other reforms will reduce the average total Part D beneficiary premium by 1.8% in 2024, as well as provide a cap on out-of-pocket drug spending for enrollees in Medicare Part D plans.

- During open enrollment, it is important to review your current coverage, compare available plans, and make any necessary changes before December 7th, 2023.

Projected Medicare Premiums for 2024

Although Medicare premiums for 2024 are subject to change, this overview of projected Part B and Part D premiums is based on current trends and legislation, as well as information from Medicaid services. It is essential to understand these projections to make informed decisions about your healthcare coverage in 2024.

Keep in mind that these projections are not set in stone, and staying informed about potential changes is crucial. The following sections will provide an in-depth look at the projected Medicare Part B and Part D premiums for 2024, along with the factors influencing their estimates.

Medicare Part B Premiums

In 2024, Part B premiums will be influenced by factors such as:

- inflation,

- healthcare costs,

- and legislative changes.

The standard monthly Part B premium is $174.70, while the base beneficiary premium for Part D and the average supplemental premium will also be affected.

As a Medicare beneficiary, being aware of these factors and the national average monthly bid can help you prepare for potential changes in your healthcare costs.

It is also important to note that 100% of insulin-related supplies are not covered by Medicare Part B.

It is also important to note that 100% of insulin-related supplies are not covered by Medicare Part B.

However, other initiatives are in place to lower prescription drug costs, such as the cost-sharing limit for insulin under Medicare Part B, which is set at $35 per month as of July 1, 2023.

Medicare Part D Premiums

Part D premiums for 2024 are expected to be affected by the Inflation Reduction Act and other reforms, leading to a lower average total premium.

The average total Part D beneficiary premium is projected to decrease by 1.8%, amounting to $55.50, which includes the Part D premium as the average basic premium. Understanding the potential changes to Part D premiums and coverage is essential to making informed decisions about your healthcare in 2024.

In addition to the anticipated decrease in the average total Part D beneficiary premium, the Inflation Reduction Act will impose a cap on out-of-pocket drug spending for enrollees in Medicare Part D plans.

This cap may provide relief for beneficiaries with high prescription drug costs, further emphasizing the importance of staying informed about changes to Medicare Part D coverage in 2024.

Rates for Medicare Premiums 2024

Enter Zip Code

Changes to Medicare Coverage in 2024

The Inflation Reduction Act and other changes to Medicare coverage in 2024 will have a significant impact on beneficiaries.

This section will discuss the impact of the Inflation Reduction Act on premiums and coverage, as well as increased catastrophic phase coverage for Medicare Part D enrollees.

Understanding these changes is crucial for making informed decisions about your Medicare coverage in 2024. The following subsections will provide more details on the Inflation Reduction Act’s impact and the increased catastrophic phase coverage.

Inflation Reduction Act Impact

The Inflation Reduction Act, enacted in 2020, will bring several changes to Medicare in 2024, including adjustments to premiums and coverage.

One of the most significant changes is the elimination of the 5% coinsurance requirement in the catastrophic phase for Part D enrollees. This change will result in considerable savings for Part D enrollees without LIS who use high-cost medications covered by Part D.

Furthermore, the Inflation Reduction has been achieved. The act will impose a cap on out-of-pocket drug spending for enrollees in Medicare Part D plans, and set the catastrophic threshold for Part D enrollees in 2024 at $8,000.

These changes will help to reduce the financial burden on beneficiaries, making it essential for enrollees to understand the impact of the Inflation Reduction Act on their Medicare coverage.

Increased Catastrophic Phase Coverage

Catastrophic phase coverage for Medicare Part D will increase in 2024, providing supplemental protection for those who have achieved the out-of-pocket maximum for their Medicare Part D plan.

This increased coverage will benefit enrollees by reducing their out-of-pocket costs for prescription drugs.

Beginning in 2024, the catastrophic phase of the Part D program will no longer require a 5% coinsurance fee. This change will result in substantial savings for beneficiaries not on the Low Income Subsidy program who rely on expensive drugs paid for by the Part D program.

Understanding these changes to catastrophic phase coverage is essential for making informed decisions about your Medicare Part D plan in 2024.

Cost-Sharing and Lowering Prescription Drug Costs

Cost-sharing initiatives and efforts to lower prescription drug costs play a crucial role in making healthcare more affordable for Medicare beneficiaries.

This section will discuss federal government initiatives and Part D plan sponsors’ efforts to reduce out-of-pocket costs for enrollees.

Understanding these cost-sharing initiatives and efforts to lower prescription drug costs is essential for choosing the right Medicare plan and managing your healthcare expenses in 2024.

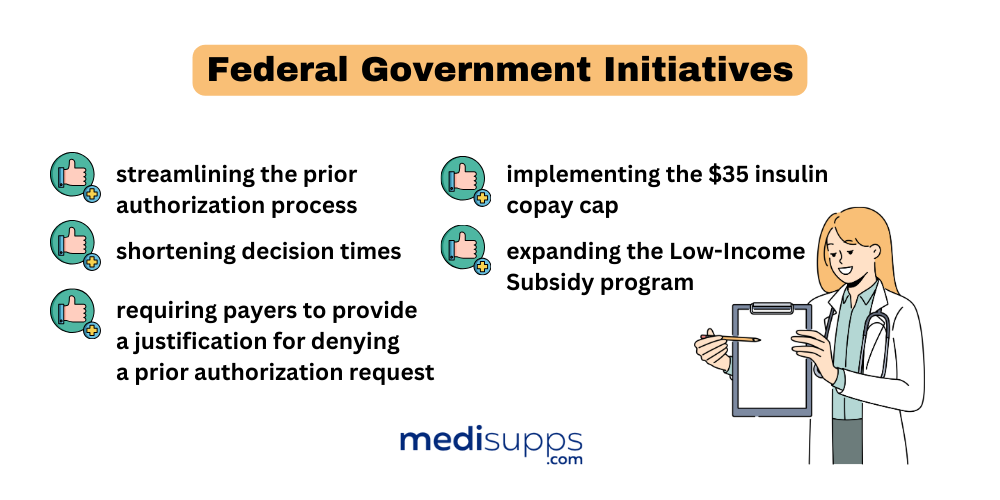

Federal Government Initiatives

The federal government has taken several initiatives to lower prescription drug costs, such as:

- streamlining the prior authorization process,

- shortening decision times,

- and requiring payers to provide a justification for denying a prior authorization request.

Additionally, the federal government has implemented the $35 insulin copay cap and expanded the Low-Income Subsidy program to assist Medicare beneficiaries with limited resources.

These federal government initiatives aim to reduce the financial burden on Medicare beneficiaries and ensure access to essential prescription medications.

Staying informed about these initiatives can help you make informed decisions about your prescription drug coverage and manage your healthcare expenses effectively.

Part D Plan Sponsors’ Efforts

Part D plan sponsors are working to reduce out-of-pocket costs for enrollees by providing the Extra Help program to assist with monthly premiums, annual deductibles, and co-payments associated with Medicare prescription drug coverage.

They have also set a limit of $35 per month for the maximum amount that Medicare Part D plans can charge for insulin products they cover.

These efforts by Part D plan sponsors help to lower prescription drug costs for enrollees and make healthcare more affordable for Medicare beneficiaries.

Being aware of these efforts and their impact on your healthcare expenses is crucial for choosing the right Medicare plan in 2024.

Understanding Medicare Trustees Projections

Medicare Trustees projections for 2024 premiums and coverage play a vital role in planning for your healthcare expenses in the coming year. This section will discuss the factors affecting these projections and their reliability.

By understanding the Medicare Trustees projections and the factors that influence them, you can make informed decisions about your Medicare coverage and better prepare for potential changes in 2024.

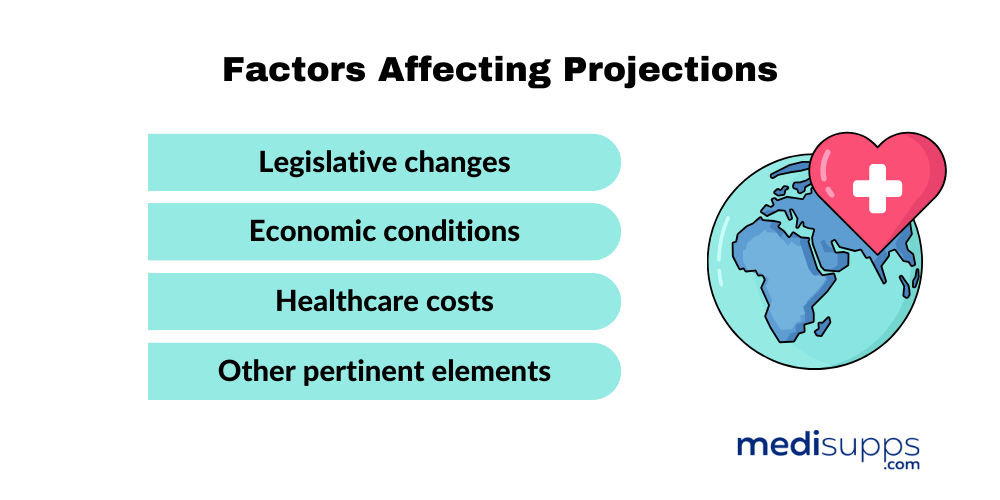

Factors Affecting Projections

The factors that influence Medicare Trustees projections include legislative changes, economic conditions, healthcare costs, and other pertinent elements.

These variables are taken into consideration when formulating the projections to provide the most accurate current estimate of future Medicare spending and premiums.

Periodic review by independent technical panels is conducted to ensure the accuracy of these projections. By understanding the factors that affect Medicare Trustees projections, you can be better prepared for potential changes in your healthcare expenses.

Reliability of Projections

The reliability of Medicare Trustees projections is generally considered high due to their annual review of Medicare-specific assumptions and the presence of a panel that evaluates the assumptions, projection methodology, and long-range growth assumptions.

However, it is important to remember that all projections into the future, especially in healthcare, are inherently uncertain. In fact, the medicare trustees projected outcomes may vary significantly depending on various factors.

Staying informed about potential changes and the factors that influence Medicare Trustees projections is essential for making informed decisions about your Medicare coverage and managing your healthcare expenses effectively.

Tips for Choosing the Right Medicare Plan in 2024

Choosing the right Medicare plan in 2024 is crucial for ensuring you have the coverage you need at a price you can afford. This section will provide tips for evaluating Part B options and comparing Part D plans, helping you make the best decision for your healthcare needs.

Choosing the right Medicare plan in 2024 is crucial for ensuring you have the coverage you need at a price you can afford. This section will provide tips for evaluating Part B options and comparing Part D plans, helping you make the best decision for your healthcare needs.

By following these tips and staying informed about the changing Medicare landscape, you can confidently choose the right Medicare plan in 2024 and enjoy peace of mind knowing you have the coverage you need.

Evaluating Part B Options

When evaluating Part B options for 2024, consider factors such as coverage benefits, your specific healthcare needs, the cost of the plan, the network of doctors and healthcare providers, additional benefits or services offered, the plan’s quality rating and customer satisfaction, and any prior authorization requirements or restrictions on medications or treatments.

When evaluating Part B options for 2024, consider factors such as coverage benefits, your specific healthcare needs, the cost of the plan, the network of doctors and healthcare providers, additional benefits or services offered, the plan’s quality rating and customer satisfaction, and any prior authorization requirements or restrictions on medications or treatments.

Assessing these factors will help you find a Part B plan that best suits your healthcare needs and budget. By carefully evaluating your options, you can ensure you have the coverage you need without breaking the bank.

Comparing Part D Plans

Comparing Part D plans for 2024 requires assessing factors such as drug coverage, premiums, and out-of-pocket costs. Use online tools like the Medicare Plan Finder at www.medicare.gov and the Medicare website at www.medicare.gov/plan-compare/ to input your current coverage, preferred medications, and pharmacies to evaluate plan costs. You can also contact Medicare at 1-800-MEDICARE to compare plans by phone.

Comparing Part D plans for 2024 requires assessing factors such as drug coverage, premiums, and out-of-pocket costs. Use online tools like the Medicare Plan Finder at www.medicare.gov and the Medicare website at www.medicare.gov/plan-compare/ to input your current coverage, preferred medications, and pharmacies to evaluate plan costs. You can also contact Medicare at 1-800-MEDICARE to compare plans by phone.

By carefully comparing Part D plans and considering the factors that impact your prescription drug costs, you can choose a plan that provides the coverage you need at a price you can afford.

Preparing for Open Enrollment

Preparing for open enrollment in 2024 is essential to ensure you have the best possible Medicare coverage for your needs. This section will discuss key dates, deadlines, and advice for reviewing your current coverage during open enrollment.

By staying informed about open enrollment and taking the time to review your current coverage, you can make the best possible decisions about your Medicare plan in 2024.

Key Dates and Deadlines

Open enrollment for Medicare Part B and Part D plans will commence on October 15, 2024, and conclude on December 7, 2024. It is crucial to be aware of these dates and deadlines to ensure you have ample time to review your current coverage, compare available plans, and make any necessary changes.

During open enrollment, be mindful of any alterations to your current plan regarding medications you may require, and carefully evaluate the drug coverage, copays, and coinsurance of potential new plans.

Reviewing Current Coverage

When reviewing your current coverage during open enrollment, consider any changes to your health needs, financial circumstances, and the coverage provided by your plan. Assess any modifications to premiums, coverage, and provider networks that may impact your healthcare expenses and access to necessary providers.

By thoroughly reviewing your current coverage and comparing it to available plans, you can make informed decisions about your Medicare coverage for 2024 and ensure you have the best possible plan for your needs.

Summary

In conclusion, understanding the projected Medicare premiums and coverage changes for 2024 is essential for making informed decisions about your healthcare.

By staying informed about the factors affecting Medicare premiums, changes in coverage due to the Inflation Reduction Act, cost-sharing initiatives, and the reliability of Medicare Trustees projections, you can confidently choose the right Medicare plan in 2024 and manage your healthcare expenses effectively.

As you prepare for open enrollment and consider your Medicare options, remember that knowledge is power. Stay informed, evaluate your options carefully, and choose the plan that best meets your healthcare needs and budget. After all, your health is your greatest wealth.

Get Quotes Now

Enter Zip Code

Frequently Asked Questions

Is the Medicare premium changing in 2023?

Yes, the Medicare premium is changing in 2023 with a decrease to the standard Part B premium and a decrease in the Part B deductible.

This change will help many seniors who are on a fixed income and struggling to make ends meet. It will also help those who are already enrolled in Medicare and are looking for ways to save money.

Is Part B going up in 2024?

It appears that the Part B premium will increase in 2024 from its current rate of $164.90 to around $179.80 per month, an increase of around $15 a month or 6%.

This is a significant increase for those on a fixed income, and it is important to plan ahead for this change. It is also important to consider other options for reducing the cost of Part B premiums, such as enrolling in a Medicare Advantage plan or a Medicare Supplement plan.

How will the Inflation Reduction Act impact Medicare coverage in 2024?

The Inflation Reduction. The Act will bring several changes to Medicare in 2024, including adjustments to premiums and coverage, the elimination of the 5% coinsurance requirement in the catastrophic phase for Part D enrollees, and the imposition of a cap on out-of-pocket drug spending for Medicare Part D plans.

This will have a positive impact on Medicare coverage in 2024.

What are some cost-sharing initiatives to lower prescription drug costs?

Cost-sharing initiatives like Extra Help, the Part D cap, and smoothing can help to lower prescription drug costs by covering monthly premiums, annual deductibles, co-payments, and out-of-pocket expenses.

These initiatives can help reduce the financial burden of prescription drugs for those who are eligible. They can also help to ensure that individuals have access to the medications they need.

It is important to understand the details of each cost-sharing initiative and how they can help to lower prescription drug costs. Knowing how to properly do this is important.

How can I compare Medicare Part D plans?

Compare Medicare Part D plans by using online tools such as the Medicare Plan Finder and Medicare website or contacting 1-800-MEDICARE.

Input your current coverage, preferred medications, and pharmacies to evaluate plan costs.

Find The Best Medicare Premium for 2024

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know more about Medicare Premium in 2024, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.