by Russell Noga | Updated August 14th, 2023

Medigap plans are available to beneficiaries enrolled in Original Medicare Parts A & B. There are ten plans available, A, B, C, D, F, G, K, L, M, and N, but Plan C & F have limitations around their enrollment.

Medigap plans are available to beneficiaries enrolled in Original Medicare Parts A & B. There are ten plans available, A, B, C, D, F, G, K, L, M, and N, but Plan C & F have limitations around their enrollment.

Plan F & C are only available to people eligible for Medicare before January 1, 2020.

Medigap plans help seniors and retirees aged 65 and older by covering the out-of-pocket costs involved with healthcare expenses. It’s also available for some individuals with disabilities and severe health conditions.

Original Medicare covers 80% of most inpatient and outpatient healthcare expenses, and your Medigap plan covers all or part of the balance. Each plan offers different levels of coverage for a monthly premium.

So, what are the different types of Medicare supplement plans, and what coverage do they offer?

This article unpacks everything you need to know about Medigap to make an informed decision on the right plan for you.

Get a Free Consultation with the Experts on Medigap Plans

If you need advice on choosing the right Medigap plan for your healthcare needs, get it from the experts. We offer a free consultation to help you with your decision.

Call us at 1-888-891-0229 for immediate assistance, or fill out the contact form, and we’ll have a fully licensed agent get back to you.

Our site also offers a free calculator for an automated quote on Medigap policy premiums in your state.

Call us, and we’ll help you find the lowest premium from health insurers in your area.

Find 2024 Rates Now

Enter Zip Code

Understanding the 10 Standard Medigap Plans

Medigap plans are available for private healthcare insurers in all 50 states. Not all providers operate in all states, and there are limitations on the availability of high-deductible plans in some states as well.

There are ten Medigap plans, and the Federal government regulates the benefits provided by each plan sold by insurers. As a result, there’s consistency in the plans available for all providers across the country.

Plan F & G have “high-deductible” options, giving you the opportunity to benefit from the comprehensive coverage they offer, but at a lower premium cost each month. Plans K, L, M, and N have cost-sharing components like copayments and coinsurance responsibilities.

Every insurer must offer Plan A, but it has the most basic level of coverage.

Basic Medigap Benefits Across All Plans

All Medigap plans provide some level of coverage for the following out-of-pocket medical expenses incurred by beneficiaries.

Medicare Part A – Hospitalization

Medigap covers the copayments required for hospitalization in inpatient care services from day 61 onwards until the end of the Medicare benefits period. It covers the Medicare Part A copayments for any hospital stay over the 90th day in the benefit period, up to an extra 60 days during your lifetime, otherwise known as your “inpatient reserve days.”

Beneficiaries can use these reserve days when they must spend more than 90 days in the hospital during any benefit period. When using a reserve day, it’s subtracted from the lifetime total.

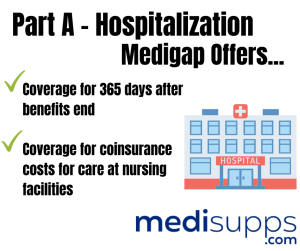

Medigap pays your Medicare Part A coinsurance and offers coverage for 365 days after your Medicare benefits end. Medigap also covers coinsurance costs for care at skilled nursing facilities.

Medicare Part A – Hospice Care

Medigap pays copayments for outpatient medications for pain control and inpatient respite care costs. Plan K & L contribute to these costs at different rates.

However, you must acquire a certificate of terminal illness from your doctor to meet the Medicare requirements for this coverage.

Part B – Medical Expenses

Part B – Medical Expenses

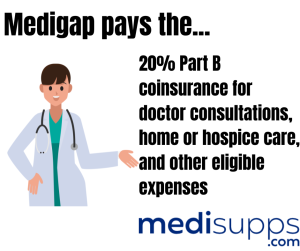

After meeting the Part B deductible of $226 for 2023, Medigap pays the 20% Part B coinsurance for your doctor consultations, home or hospital care, and other eligible expenses.

Plans K, L, & N require copayments for these services.

Blood

Medicare only plays for the fourth pint of blood onwards in procedures.

Medigap covers you for the first three pints under Parts A & B.

Part A & B Deductibles

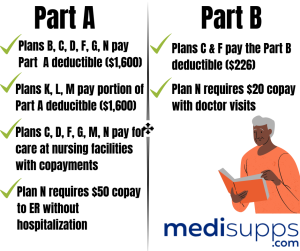

Plans B, C, D, F, G, & N pay the Part A deductible of $1,600 for 2023. Plans K, L, & M pay a portion of the Part A deductible.

K & L have out-of-pocket limits, while the rest of the plans have unlimited coverage for out-of-pocket expenses.

Plan N requires you to make a $20 copayment when visiting the doctor and a $50 copayment on trips to the emergency room that don’t result in hospitalization. Plans C & F are the only options for paying the $226 Part B deductible.

Plans C, D, F, G, M, & N pay for care at skilled nursing facilities with copayments from the 21st to the 100th day in your benefit period under Medicare Part A. This doesn’t qualify as custodial care.

Plans K & L pay portions of the cost until you meet your out-of-pocket limits. The plan then pays 100% of these costs.

Emergency Care During Foreign Travel

Medigap plans C, D, F, G, M & N pay for 80% of emergency care costs when traveling outside the US.

There’s a $250 deductible and a lifetime benefit maximum of $50,000.

Medicare Part B Excess Charges

Plans F & G pay excess doctor charges that Medicare doesn’t pay under Part B.

They cover 100% of excess fees, limited to 15% above Medicare-approved amounts.

Healthcare Services Not Covered by Medicare

Medigap doesn’t cover other healthcare costs not associated with inpatient and outpatient healthcare services. It doesn’t cover most long-term care facilities and only covers care provided in nursing homes.

Medigap doesn’t cover other healthcare costs not associated with inpatient and outpatient healthcare services. It doesn’t cover most long-term care facilities and only covers care provided in nursing homes.

The plans don’t cover the following.

- Homemaker services.

- Private-duty nursing.

- Dental care and dentures.

- Cosmetic surgery and foot care.

- Routine eye tests and eyeglasses (except after cataract surgery).

- Hearing tests and hearing aids.

Compare Medicare Plans & Rates in Your Area

What are the Premiums for Medigap Plans?

Medigap premiums vary in price, depending on which plan you take.

Plans F & G are the most expensive options due to the high level of care they offer. Plans K & L are the cheapest options, but you get limited coverage.

Plan N offers good emergency care but requires copayments for seeing the doctor and going to the emergency room, and it doesn’t cover excess charges.

Please speak to us about the right option for your healthcare needs.

Compare 2024 Plans & Rates

Enter Zip Code

Find the Right Medicare Plan for You

Searching for the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Contact us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.