by Russell Noga | Updated May 30th, 2023

Your dental health gets more important as you age. Getting regular checkups and cleanings ensures you put off the risk of losing your teeth.

If you experience dental health issues such as cavities, compaction, and other problems, you need prompt treatment to ensure you don’t exacerbate these issues.

With the rising cost of healthcare in the United States, many seniors put off visiting their dentist for routine care. As a result, they require crowns, dentures, and root canal surgeries.

Dipping into your retirement savings to fund the cost of dental care hurts your financial planning, but it’s an essential cost.

Original Medicare

Medicare Parts A & B help you manage healthcare costs but don’t cover your dental expenses. Many seniors take a supplemental Medigap policy to help cope with the out-of-pocket costs left behind by Original Medicare.

But what about Dental insurance and Medicare?

This post looks at how you can get supplemental dental insurance to bolster your Medicare and Medigap policies, giving you the dental coverage you need for a healthy smile in your senior years.

Does Medicare Cover Dental?

Unfortunately, Original Medicare doesn’t offer dental coverage. Medicare is a Federally-funded healthcare program that doesn’t include any coverage for dental, vision, or hearing expenses.

So, you don’t have coverage for routine dental care, supplies, or dental procedures.

Medicare beneficiaries themselves are responsible for covering the full cost of fillings, cleanings, extractions, root canals, crowns, and dentures.

Medicare Part A, which covers inpatient hospital care, will sometimes cover the costs of dental procedures during a stay in the hospital, depending on the circumstances.

For instance, if you’re involved in a vehicle accident and experience a traumatic injury to your jaw or teeth, Medicare covers the cost of surgeries required to recover from the damage.

One of the reasons Medicare doesn’t offer dental coverage is the American Dental Association consistently opposes the proposal for adding dental coverage into Original Medicare policies, citing low reimbursement rates for dental services rendered to beneficiaries.

Understanding Medicare and Dental Coverage

Original Medicare, comprising Part A (hospital insurance) and Part B (medical insurance), primarily focuses on providing coverage for hospital stays, doctor visits, and medically necessary procedures.

Unfortunately, routine dental care, such as check-ups, cleanings, and fillings, is not covered under Original Medicare, leaving beneficiaries responsible for dental expenses.

The Importance of Dental Insurance

Maintaining good oral health goes beyond having a bright smile. Dental problems can lead to various health issues, including gum disease, tooth loss, and even systemic conditions like heart disease and diabetes.

Regular dental visits allow for early detection and prevention of oral health problems, ensuring better overall health and quality of life.

Dental Insurance to Supplement Medicare

While Original Medicare may not cover routine dental care, individuals can explore several dental plan options to supplement their Medicare coverage and receive comprehensive dental benefits.

Here are some common dental plans available:

Standalone Dental Insurance:

Private insurance companies offer standalone dental plans that provide coverage for routine dental services, including check-ups, cleanings, fillings, and more.

These plans usually have a network of dentists and offer various levels of coverage and premium options to meet individual needs.

Medicare Advantage Plans:

Medicare Advantage plans, also known as Part C plans, are comprehensive private health plans that combine Medicare Part A, Part B, and often Part D (prescription drug coverage) into a single plan.

Medicare Advantage Plan Dental Benefits

A Medicare Advantage plan may also include dental benefits, offering benefits like preventive care, basic procedures, and sometimes even major.

Dental insurance and coverage varies:

Dental discount plans, often known as dental savings plans, provide discounted rates for dental services when individuals visit participating dentists.

While not insurance plans, these can be an affordable option for individuals looking to reduce their out-of-pocket dental expenses.

Call us today at 1-888-891-0229 to review several different options for Dental insurance plans.

Employer-Sponsored Dental insurance:

Retirees who had employer-sponsored dental coverage during their working years may have the option to continue that coverage through a retiree dental plan.

These plans can provide comprehensive dental benefits and often have a wider network of dentists.

Do Medigap Plans Cover Dental Care?

Medicare supplement plans, also known as “Medigap” policies, assist with covering the 20% of out-of-pocket costs involved with Medicare Parts A & B. However, like Original Medicare, standardized Medigap plans don’t cover dental services.

What Does Medigap Cover?

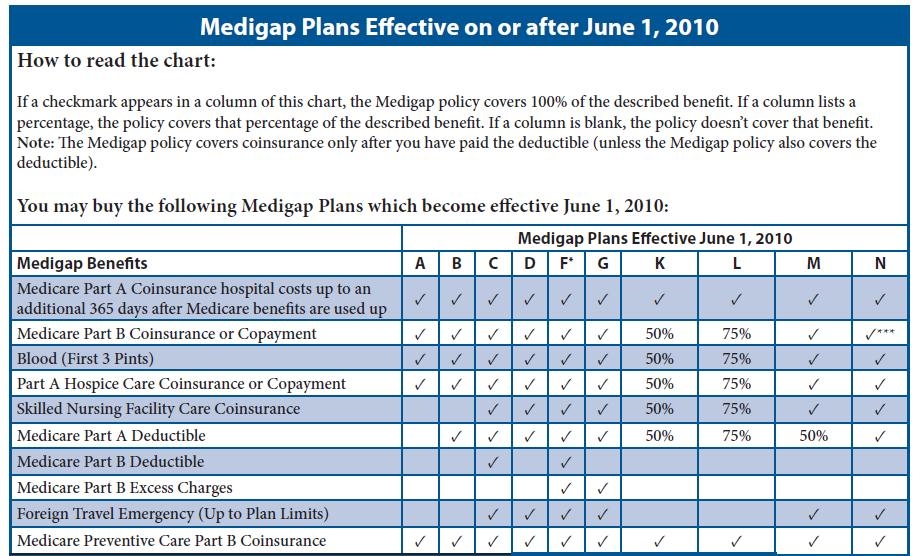

Medigap plans come in ten versions, Plans A, B, C, D, F, G K, L, M, &N. These plans aim to bolster your Original Medicare Parts A & B policies.

Since Original Medicare doesn’t offer any support for preventative treatments and services, such as dental costs, Medigap policies don’t make provisions to cover these services in their standardized offerings.

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

Some Medigap Providers Offer Dental Plans as a Perk or Additional Policy

The Federal government regulates the Medigap industry, ensuring all insurers offering Medigap plans have the same coverage for Part A & B out-of-pocket expenses.

So, you get consistency across all plan offerings from all providers.

While Medigap plans consist of standardized benefits, some insurers offer additional discounts, perks, and secondary benefits relating to healthcare expenses – such as dental costs.

There is no Federal oversight on these secondary offerings and perks; healthcare insurers use them to attract new beneficiaries to their Medigap scheme.

Choosing the Right Dental Plan

When considering dental plans to supplement Medicare, it’s essential to assess individual needs, budget, and dental health requirements.

Some key factors to consider include:

- Coverage and Benefits: Review the coverage provided by each plan, including preventive care, basic procedures, major services, and orthodontics, if needed.

- Network of Dentists: Determine if the plan has a network of dentists in your area and whether your preferred dentist is included.

- Costs and Premiums: Compare the costs, including premiums, deductibles, copayments, and coinsurance, to ensure the plan is affordable and aligns with your budget.

- Additional Benefits: Some plans offer coverage other than dental services, such as vision coverage or discounts on prescription drugs.

Evaluate these extras based on your individual needs.

Compare Plans & Rates

Enter Zip Code

Understanding Supplemental Dental Plans

A good example of a secondary add-on plan covering dental expenses comes from Blue Cross Blue Shield (BCBS). BCBS is a network of 34 healthcare insurers operating under the banner of BCBS.

BCBS offers its Medigap beneficiaries access to its “Plan G Plus” (Plan G+) program in selected states, such as Illinois, Montana, Oklahoma, New Mexico, and Texas.

The Plan G+ policy offers beneficiaries access to dental benefits included in their policy. For instance, if you sign up for a Plan G+ policy in a qualifying state, you get the following dental benefits included in your premiums.

- Two annual dental cleanings.

- Two annual dental exams.

- Coverage for one dental X-ray per year.

- 50% coverage for basic dental restorative services.

- 75% coverage for non-surgical extractions (if the beneficiary uses an in-network dentist)

While these benefits aren’t comprehensive by any means, they go a long way to assisting seniors with managing dental costs and making their treatments more affordable while reducing the need to pay a lump sum upfront for these services.

In return for the additional dental coverage, Plan G+ beneficiaries pay approximately $22 more per month over the standard Plan G policy offered by BCBS (rates differ by state and beneficiary).

Many other companies offer similar add-on dental plans covering these expenses. Speak to our team, and we’ll get you the best rate on a Medigap plan, including dental benefits in your state.

Frequently Asked Questions

Does Medicare provide dental coverage?

Original Medicare (Parts A and B) does not typically cover routine dental care, such as check-ups, cleanings, and fillings.

What dental coverage is offered by Medicare?

Medicare may cover dental services that are related to a covered medical procedure, such as dental exams before heart valve surgery or jaw reconstruction after an accident.

Are there dental plans available to supplement Medicare coverage?

Yes, there are dental plans available to supplement Medicare. These plans are offered by private insurance companies and can provide coverage for routine dental care.

What is a standalone dental insurance plan?

Standalone dental insurance is a private insurance plan that specifically covers dental care. These plans often include coverage for preventive services, basic procedures, and sometimes major dental treatments.

Can Medicare Advantage plans include dental coverage?

Yes, some Medicare Advantage plans (Part C) may offer dental coverage as part of their comprehensive benefits. The dental coverage can vary by plan, so it’s important to review the details.

What are dental discount plans?

Dental discount plans are not insurance plans but offer discounted rates for dental services at participating dentists. These plans can be an affordable option for reducing out-of-pocket expenses.

Are there dental plans available through employer-sponsored retiree plans?

Yes, some employers offer dental plans for retirees as part of their retiree benefits. These plans can provide comprehensive dental coverage for seniors.

Do Medicare supplemental plans (Medigap) include dental coverage?

No, Medigap plans do not typically include dental coverage. They are designed to help cover certain out-of-pocket costs related to Medicare Part A and Part B, but not dental services.

Can seniors purchase dental insurance on their own?

Yes, seniors can purchase standalone dental insurance plans directly from private insurance companies. These plans provide coverage for routine dental care and may have different coverage levels and premiums.

How can seniors choose the right dental plan for their needs?

Seniors should consider factors such as coverage options, a network of dentists, costs, and additional benefits when selecting a dental plan. It’s important to assess individual needs and budgets to find the most suitable option.

Contact Us to Discuss Dental Insurance Plans

If you need assistance finding a Dental insurance plan, or a Medigap plan, call us at 1-888-891-0229. Our fully licensed agents can help you find a provider in your state offering dental care benefits.

Call us today for help.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.