by Russell Noga | Updated October 2, 2024

If you receive your health insurance through Medicare, you might be thinking about purchasing a supplement insurance plan to help cover the out-of-pocket expenses.

If you receive your health insurance through Medicare, you might be thinking about purchasing a supplement insurance plan to help cover the out-of-pocket expenses.

While there are several insurance companies that sell these policies, and there are several plans to choose from, Mutual of Omaha Medicare Supplement Plan N is one of the most popular choices among Medicare beneficiaries.

This plan covers a lot of the expenses that Original Medicare doesn’t pay for, such as deductibles and coinsurance, and can really help to make your health insurance expenses more predictable and easier to manage.

If you’re considering Medigap insurance, read on to learn more about Mutual of Omaha Medicare Supplement Plan N to determine if it’s the right option for you.

Compare 2025 Plans & Rates

Enter Zip Code

About Mutual of Omaha

Founded in 1909, Mutual of Omaha is a financial services company that offers several financial and insurance products. This Fortune 500 company specializes in Medicare Supplement Insurance plans, and today, they’re one of the largest suppliers of these policies in the United States.

Medicare members that purchase Medigap supplement plans through Mutual of Omaha are very satisfied with the coverage and the services they receive. The plans the organization offers are among the most popular in the Medicare Supplemental Insurance industry.

If you’re an Original Medicare beneficiary and you’re looking for a reputable company that offers reliable Medigap insurance policies. Mutual of Omaha is an option that you might want to consider.

In addition to offering a variety of quality products that will help to protect both your health and your finances, this organization also has an impressive track record of success and has been a leader in the insurance industry in the United States for more than 100 years. In fact, today, millions of Medicare beneficiaries choose Mutual of Omaha to provide their Medicare Part A and Part B supplemental insurance.

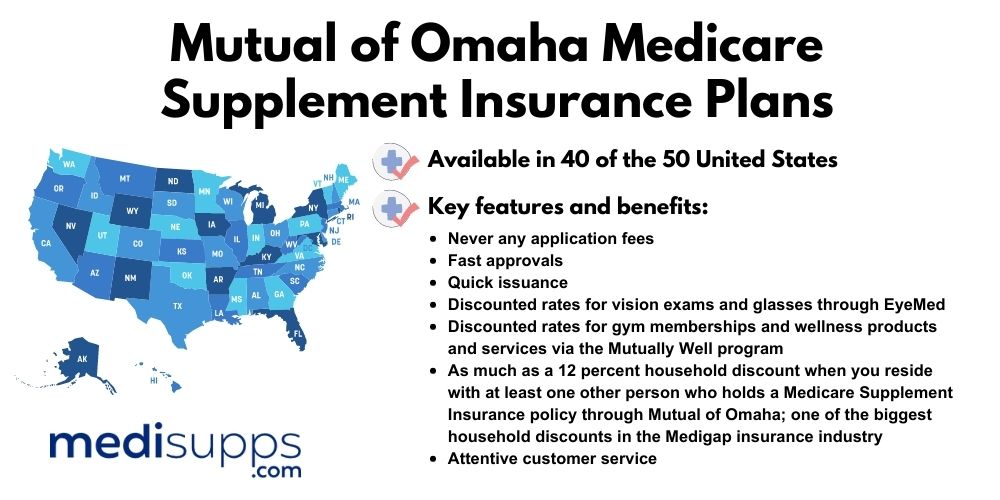

About Mutual of Omaha’s Medicare Supplement Insurance Plans

Mutual of Omaha’s Medigap plans are widely available. They can be purchased in 49 of the 50 United States (Massachusetts is the only exception), as well as the District of Columbia. In regard to supplemental insurance options, the firm offers a variety of high-quality options that are considered some of the best in the nation.

Not only do the Mutual of Omaha Supplement Insurance plans offer all of the standard benefits that Medicare requires, but the firm also offers several additional benefits to those who hold their supplemental policies with them.

Some of the key features and benefits that you’ll be able to take advantage of when you choose Mutual of Omaha for your Medicare Supplement Insurance include the following:

In addition to all of these benefits, you’ll also be able to enjoy peace of mind knowing that your supplemental insurance for Medicare Part A and Part B is being supplied by one of the most highly-regarded and well-respected insurers in the industry. More than 1.4 million Medicare beneficiaries choose Mutual of Omaha for their Medigap insurance.

Compare Medicare Plans & Rates in Your Area

Mutual of Omaha Medicare Supplement Plan N

As mentioned, Mutual of Omaha offers several of the lettered Medigap insurance plans. Of the different options they provide, Plan N is one of the most popular choices among policyholders. Medicare Supplement Plan N is made for people who are looking for lower monthly premiums in exchange for paying copays. Instead of paying for the entire Part B copayment like many other Medigap policies do, with Plan N, you’ll be responsible for paying the following copays yourself:

- Up to $20 per each office visit

- Up to $50 for each emergency room visit that doesn’t result in being admitted into the hospital for inpatient care

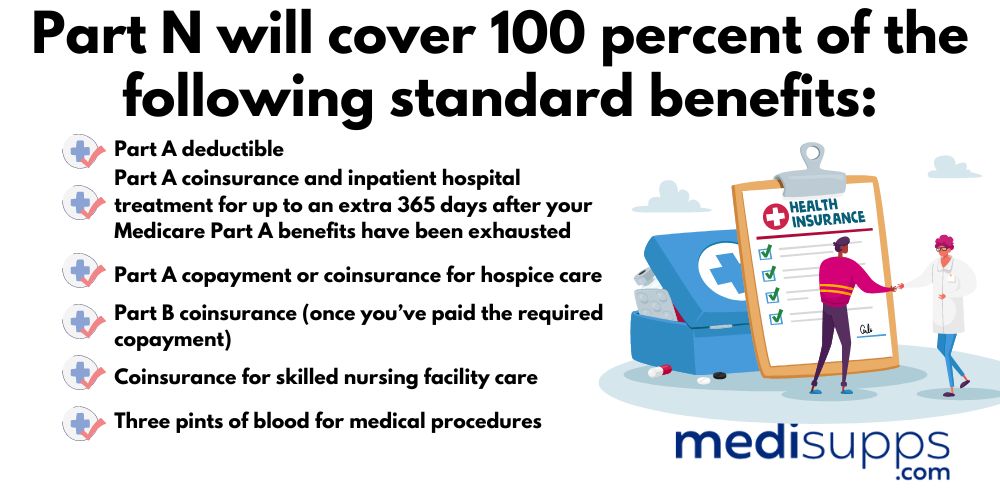

After you’ve paid these copays, your Mutual of Omaha Supplement Plan N policy will cover the rest of your Part B copay or coinsurance that remains. In addition, Part N will cover 100 percent of the following standard benefits:

Medicare Supplement Insurance Plan N also covers up to 80 percent of any emergency medical care that you receive while you’re traveling abroad, as long as the care is rendered within the first 60 days of travel; up to a $50,000 limit.

How Much Does Mutual of Omaha Medicare Supplement Plan N Cost?

Like all private insurance companies that offer Medicare Supplement Insurance, Mutual of Omaha sets their own rates for the policies they provide. The organization takes several factors into consideration when determining rates, such as where you are located and your sex. While rates do vary, generally speaking, Mutual of Omaha’s rates are very competitive; in fact, they charge some of the fairest prices for coverage in the Medicare Supplement Insurance industry.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Mutual of Omaha Medicare Supplement Plan N?

Mutual of Omaha Medicare Supplement Plan N is a standardized insurance plan that helps cover the gaps in Original Medicare (Part A and Part B) benefits. It offers a comprehensive range of coverage, including hospital coinsurance, Part B coinsurance or copayments, and skilled nursing facility coinsurance.

Who is eligible for Mutual of Omaha Medicare Supplement Plan N?

Generally, individuals who are already enrolled in Medicare Part A and Part B are eligible to enroll in Mutual of Omaha Medicare Supplement Plan N. It is important to note that eligibility requirements can vary by state, so it is advisable to check with Mutual of Omaha or a licensed insurance agent for specific details.

When can I enroll in Mutual of Omaha Medicare Supplement Plan N?

You can typically enroll in Mutual of Omaha Medicare Supplement Plan N during your Medicare Supplement Open Enrollment Period, which is a six-month period that starts on the first day of the month you are both 65 or older and enrolled in Medicare Part B. There may be other enrollment periods available, such as guaranteed issue rights or special enrollment periods, in certain situations.

What is the difference between Mutual of Omaha Medicare Supplement Plan N and Plan G?

Mutual of Omaha Medicare Supplement Plan N and Plan G have some differences in coverage. While both plans provide comprehensive coverage, Medigap Plan G offers more extensive coverage than Plan N. Plan G covers Medicare Part B excess charges, which Plan N does not cover. However, Plan N may have lower premiums compared to Plan G, but it requires copayments for certain services.

What does Mutual of Omaha Medicare Supplement Plan N cover?

Mutual of Omaha Medicare Supplement Plan N covers various out-of-pocket costs associated with Original Medicare, including Part A hospital coinsurance, Part B coinsurance or copayments, hospice care coinsurance or copayments, and the first three pints of blood. It also covers skilled nursing facility coinsurance and 80% of foreign travel emergency costs.

Does Mutual of Omaha Medicare Supplement Plan N cover the Part B deductible?

No, Mutual of Omaha Medicare Supplement Plan N does not cover the Part B deductible. You are responsible for paying the Part B deductible out of pocket. However, Plan N offers cost-sharing benefits, such as copayments for certain doctor visits and emergency room visits, which can help offset some of the costs.

Can I go to any doctor or hospital with Mutual of Omaha Medicare Supplement Plan N?

Yes, with Mutual of Omaha Medicare Supplement Plan N, you have the freedom to choose any doctor or hospital that accepts Medicare patients. Since it is a Medicare Supplement plan, it works alongside Original Medicare, which means you have the flexibility to see any healthcare provider that accepts Medicare.

Can I keep my Mutual of Omaha Medicare Supplement Plan N if I move to a different state?

Yes, you can keep your Mutual of Omaha Medicare Supplement Plan N if you move to a different state. Medicare Supplement plans are standardized across most states, meaning the benefits of your plan remain the same even if you change your residence. However, it’s essential to notify Mutual of Omaha about your new address to ensure continued coverage and accurate premium billing.

What is the cost of Mutual of Omaha Medicare Supplement Plan N?

The cost of Mutual of Omaha Medicare Supplement Plan N can vary based on several factors, including your location, age, gender, and tobacco use. Insurance companies use different pricing methodologies, such as attained-age, issue-age, or community-rated pricing, which can impact the premiums. It’s advisable to compare quotes from Mutual of Omaha and other insurance providers to find the best rate for your circumstances.

Why should I choose Mutual of Omaha Medicare Supplement Plan N?

Mutual of Omaha is a reputable insurance company with a long-standing history of providing Medicare Supplement plans. Plan N offers comprehensive coverage at a more affordable premium compared to some other plans. It provides peace of mind by helping to cover the out-of-pocket costs associated with Medicare, including hospital stays, doctor visits, and skilled nursing facility care.

How to Enroll in Mutual of Omaha Medicare Supplement Plan N

As with any other Medigap policy, the best time to enroll in Plan N with Mutual of Omaha is during the Medicare Supplement Open Enrollment period. During this 6 month period, which starts on the first day of the month that you turn 65 and you have Medicare Part B, you are guaranteed acceptance, meaning that your application won’t be subjected to medical underwriting.

If you’d like to start comparing quotes for Medicare Supplement Plan N from Mutual of Omaha and several other reputable insurance providers in your local area, complete and submit the form to the right or call 1-888-891-0229 today!