by Russell Noga | Updated August 7th, 2023

Navigating the world of healthcare can be a daunting task, especially when it comes to understanding Medicare and its supplemental insurance options.

Navigating the world of healthcare can be a daunting task, especially when it comes to understanding Medicare and its supplemental insurance options.

But fear not, we’re here to guide you through the ins and outs of Medicare Supplement insurance, ensuring you make informed decisions that best suit your healthcare needs and financial situation. To start, let’s discuss how to obtain a Medicare supplement insurance quote.

Short Summary

- Medicare Supplement Insurance, or Medigap, is a private insurance plan that helps to cover costs not covered by Original Medicare.

- Obtaining a Medicare Supplement quote can be done right here on this website! There’s no obligation to see the rates from top companies in your area.

- When selecting the best plan for individual needs it is important to consider healthcare needs, and the cost of coverage options including premiums & deductibles in order to balance cost with coverage.

Compare 2024 Plans & Rates

Enter Zip Code

Understanding Medicare Supplement Insurance

Medicare Supplement insurance, commonly referred to as Medigap, is a private insurance policy designed to offset expenses not included in Original Medicare. This includes Part A and Part B.

These plans are offered by private insurance companies to individuals enrolled in Original Medicare to assist in covering the gaps in that coverage.

The main advantage of Medicare Supplement plans is that they can help reduce the financial strain of out-of-pocket expenses not covered by Original Medicare.

These plans typically provide at least some of the following basic benefits: hospitalization, medical expenses, blood, hospice care coinsurance, and skilled nursing facility care coinsurance.

In addition, they may also offer the following additional benefits: foreign travel emergency and at-home recovery.

The Role of Medigap Plans

Medigap plans supplement the basic benefits of Medicare Parts A and B, allowing individuals to visit any healthcare provider who accepts Medicare assignment.

Some of the highest-rated Medicare Supplement providers include Humana Health Insurance Company, AARP/UnitedHealthcare, Mutual of Omaha, and State Farm.

The advantage of a Medigap plan is that you can visit any doctor, in or out of network, that takes Medicare. No need to worry about whether the provider accepts assignment from Medicare or not.

All Medigap plans offer the same basic benefits, but some plans offer additional benefits, such as coverage for foreign travel emergencies or at-home recovery.

Types of Medicare Supplement Plans

Ten Medigap plans (A-N) are available, each with varying levels of coverage and premiums. A wide range of options is available to suit the needs of different individuals. Plan F, G, and N are the most commonly selected Medicare Supplement plans. Each plan offers varying coverage for costs such as copayments, coinsurance, and deductibles not covered by Original Medicare.

While all Medigap plans provide the same basic benefits, premiums may vary depending on the insurance company and the rate-setting methodology they use. It’s essential to compare different plans and providers to find the one that best suits your healthcare needs and budget.

Compare Medicare Plans & Rates in Your Area

How to Get a Medicare Supplement Insurance Quote

Obtaining a Medicare Supplement insurance quote is the best way to compare providers and plan options. To gain a comprehensive understanding of Medicare Supplement insurance options, we recommend researching our website www.medisupps.com, as well as giving us a call today to get your questions answered.

Obtaining a Medicare Supplement insurance quote is the best way to compare providers and plan options. To gain a comprehensive understanding of Medicare Supplement insurance options, we recommend researching our website www.medisupps.com, as well as giving us a call today to get your questions answered.

Call 1-888-891-0229 for help.

Our website, Medisupps.com, offers a selection of Medigap plans from industry-leading Medicare insurance agencies. With this website, you can compare and choose the most suitable plan for yourself.

By entering your zip code and providing some information, you can begin your complimentary Medigap insurance quote and proceed with enrolling in the plan of your preference once you’ve made a decision.

Compare 2024 Plans & Rates

Enter Zip Code

Researching Medicare Supplement Providers

When researching Medicare Supplement providers, it’s important to consider factors such as ratings, customer reviews, and financial stability. Some of the highest-rated providers include Humana, Aetna, Mutual of Omaha, and Allstate.

To assess the financial stability of Medicare Supplement providers, consult ratings from independent rating agencies such as A.M. Best, Standard & Poor’s, and Moody’s.

To assess the financial stability of Medicare Supplement providers, consult ratings from independent rating agencies such as A.M. Best, Standard & Poor’s, and Moody’s.

Additionally, consider the provider’s customer service ratings to ensure they will be responsive and helpful should any issues arise with your coverage.

Comparing Plan Options

When comparing plan options, it’s crucial to look at benefits, premiums, and additional coverage options. Each Medicare Supplement plan provides different levels of coverage, so it’s essential to understand what services you need and how often you use them to make an informed decision.

Keep in mind that the cost of the same coverage can differ among insurance companies. By obtaining quotes from multiple providers, you can compare and find the best option for your healthcare needs and budget.

Factors Affecting Medicare Supplement Insurance Premiums

Medicare Supplement insurance premiums are affected by factors such as community-rated pricing, issue-age-rated pricing, and attained-age-rated pricing. Each pricing method has its own benefits and drawbacks, so it’s important to understand how they work to make the best decision for your healthcare needs and budget.

Knowing the distinctions between these pricing methods can help you make an informed decision when choosing a Medicare Supplement plan. Keep in mind that premiums may increase over time due to factors such as inflation, independent of the age of the policyholder.

Community-rated Pricing

Community-rated pricing is a health insurance pricing system wherein all individuals residing in the same geographic area are charged the same premium for the same type of policy, irrespective of age, gender, health status, occupation, or other factors. This method offers more affordable premiums for younger and healthier individuals, regardless of their age or health status.

Community-rated pricing is a health insurance pricing system wherein all individuals residing in the same geographic area are charged the same premium for the same type of policy, irrespective of age, gender, health status, occupation, or other factors. This method offers more affordable premiums for younger and healthier individuals, regardless of their age or health status.

However, the primary disadvantage of community-rated pricing is that individuals who are older or have pre-existing health conditions may be charged higher premiums than those who are younger and in better health. This pricing method establishes a uniform premium rate for all individuals residing within a specific geographic area, without considering age, gender, health status, occupation, or any other factors.

Issue-age-rated Pricing

Issue-age-rated pricing is a method for Medicare Supplement Insurance in which the premium rate is determined by the individual’s age at the time of application. Generally, individuals who apply at a younger age will receive a lower premium rate than those who wait until they are older.

The primary benefit of issue-age-rated pricing is that it can be more cost-effective for younger individuals. The primary drawback, however, is that the premium rate will increase with age.

When assessing issue-age-rated pricing in comparison to other pricing methods, it is imperative to take the age of the applicant into account.

Attained-age-rated Pricing

Attained-age-rated pricing is a method of pricing Medicare Supplement insurance in which premiums are determined according to the policyholder’s age at the time of enrollment. Initially, prices may be lower when the policy is first enrolled, however, they may increase as the policyholder ages.

Attained-age-rated pricing is a method of pricing Medicare Supplement insurance in which premiums are determined according to the policyholder’s age at the time of enrollment. Initially, prices may be lower when the policy is first enrolled, however, they may increase as the policyholder ages.

This pricing method differs from community-rated and issue-age-rated pricing in that premiums are determined based on the age of the policyholder when the policy is initially issued. As a result, attained-age-rated pricing may be more appealing to younger individuals due to its initially lower premiums.

Enrollment Periods and Eligibility for Medicare Supplement Insurance

Enrollment periods and eligibility for Medicare Supplement insurance include the Medigap Open Enrollment Period and Special Enrollment Periods. You must have Original Medicare Part A and Part B to be eligible for a Medicare Supplement plan. You cannot be enrolled in a Medicare Advantage plan.

Understanding these enrollment periods and eligibility requirements is crucial to ensure you can access the supplemental coverage you need without facing penalty fees or denial of coverage.

Medigap Open Enrollment Period

The Medigap Open Enrollment Period is a six-month window that begins on the first day of the month in which an individual is both 65 years of age or older and enrolled in Medicare Part B. It is essential to enroll during this period to avoid potential penalties or denial of coverage.

If enrollment is attempted after the Medigap Open Enrollment Period has passed, it is possible that basic benefits may be denied or a higher premium may be charged based on medical history. Therefore, it’s crucial to be aware of this enrollment period and act accordingly.

Special Enrollment Periods

Special Enrollment Periods refer to the periods in which individuals can make modifications to their Medicare Advantage and Medicare prescription drug coverage due to specific life events, such as the loss of coverage, relocation to a new state, aging out of a parent’s plan, or having a baby.

These periods offer an opportunity to enroll in or change Medicare Supplement insurance plans outside of the standard enrollment periods. It’s important to be aware of these Special Enrollment Periods and the circumstances that may qualify you for them.

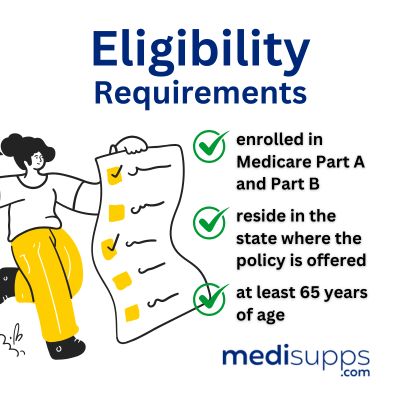

Eligibility Requirements

To be eligible for Medicare Supplement insurance, you must be enrolled in Medicare Part A and Part B, reside in the state where the policy is offered, and be at least 65 years of age.

Understanding these eligibility requirements is essential to ensure you can access the supplemental coverage you need. Keep in mind that if you are under 65 and have a disability or end-stage renal disease, you may still be eligible for Medicare Supplement insurance, but the availability and cost of coverage may vary by state.

Additional Coverage Options

In addition to Medicare Supplement insurance, there are other coverage options available to help you manage your healthcare needs. These include Medicare Part D for prescription drugs and dental and vision coverage.

It’s important to consider these additional coverage options when evaluating your overall healthcare needs and selecting the right plan for you.

Medicare Part D

Medicare Part D is a separate plan that offers prescription drug coverage. It is an optional benefit provided through private insurance companies approved by the federal government. Medicare Part D provides coverage for most outpatient prescription drugs and is administered by private insurance companies that have been approved by the federal government.

Enrolling in Medicare Part D can help you manage the cost of prescription medications, ensuring you have access to the medications you need without breaking the bank.

Dental and Vision Coverage

Dental and vision coverage are additional health insurance benefits that provide coverage for dental and vision care expenses. These benefits are not typically included in standard health insurance plans, and Original Medicare does not provide coverage for routine dental or vision care.

Supplemental insurance plans may be purchased from private insurance companies to provide additional coverage for dental and vision needs, in addition to your existing health insurance plan. Considering these additional coverage options can help you maintain good oral and visual health, contributing to your overall well-being.

Tips for Choosing the Right Medicare Supplement Plan

When it comes to choosing the right Medicare Supplement plan, it’s essential to assess your healthcare needs and find the right balance between cost and coverage. By taking the time to understand your healthcare requirements and comparing different plan options, you can make an informed decision that best suits your needs and budget.

When it comes to choosing the right Medicare Supplement plan, it’s essential to assess your healthcare needs and find the right balance between cost and coverage. By taking the time to understand your healthcare requirements and comparing different plan options, you can make an informed decision that best suits your needs and budget.

Keep in mind that the cost and coverage of Medicare Supplement plans are impacted by factors such as premiums, deductibles, copayments, and coinsurance, as well as the chosen pricing method. By considering these factors and weighing the options, you can choose the right plan that meets your healthcare needs and financial situation.

Assessing Your Healthcare Needs

When choosing a Medicare Supplement plan, it’s crucial to assess your healthcare needs and understand what services you require. This includes considering how often you use healthcare services, the types of services you need, and any pre-existing conditions that may require ongoing care.

When choosing a Medicare Supplement plan, it’s crucial to assess your healthcare needs and understand what services you require. This includes considering how often you use healthcare services, the types of services you need, and any pre-existing conditions that may require ongoing care.

By understanding your healthcare needs, you can better evaluate the different plan options and choose a plan that offers the right level of coverage for you.

Balancing Cost and Coverage

Balancing cost and coverage involves considering premiums, deductibles, copayments, and coinsurance. The higher the premium, the more coverage you will have. Conversely, higher deductibles, copayments, and coinsurance will result in lower premiums, though you will have to pay more out-of-pocket for services.

Balancing cost and coverage involves considering premiums, deductibles, copayments, and coinsurance. The higher the premium, the more coverage you will have. Conversely, higher deductibles, copayments, and coinsurance will result in lower premiums, though you will have to pay more out-of-pocket for services.

By comparing the costs and coverage of different Medicare Supplement plans, you can find the right balance that meets your healthcare needs without breaking the bank.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is the typical cost of Medicare supplemental?

The typical cost of a Medicare Supplement plan is approximately $139 per month for 2023. Your premiums may vary depending on your age, location and the plan you select, with prices ranging from around $50 to more than $400 per month.

What are the disadvantages of a Medicare Supplement plan?

A Medicare Supplement plan has a few drawbacks, including the potential for higher monthly premiums and a limited range of choices when selecting a doctor or hospital. Additionally, the plans typically don’t cover long-term care, vision, or dental services.

As a result, it’s important to assess your individual needs and understand the coverage and costs associated with the plan before making a commitment.

Which is cheaper Medicare Supplement or Medicare Advantage?

Remember, cheaper isn’t always “better”. Overall, Medicare Advantage tends to be more cost-effective than Medicare Supplement, but that is only if you remain relatively healthy.

Medicare Supplement plans offer the flexibility of seeing any doctor that accepts Medicare, and they cannot deny your claims. We recommend a Medicare Supplement plan in most cases.

Why should I get a Medicare Supplement Insurance Quote?

Getting a Medicare Supplement Insurance Quote allows you to compare costs and evaluate different plan options. It helps you understand the premium expenses associated with different Medicare Supplement plans and choose the one that fits your budget.

What factors are considered in a Medicare Supplement Insurance Quote?

The factors considered in a Medicare Supplement Insurance Quote may include your age, location, gender, tobacco use, and sometimes health status. These factors help determine the premium rate you would pay for the selected plan.

Is the premium cost the only factor to consider when choosing a Medicare Supplement plan?

No, the premium cost is not the only factor to consider when choosing a Medicare Supplement plan. It’s also important to consider the coverage benefits, cost-sharing requirements, provider networks, and overall value of the plan based on your specific healthcare needs.

Can I get a Medicare Supplement Insurance Quote online?

Yes, we offer FREE quotes online by entering your zip code above. This helps make it convenient to compare multiple plan options and premiums from the comfort of your home.

Can I negotiate the premium cost after receiving a Medicare Supplement Insurance Quote?

Generally, you cannot negotiate the premium cost of a Medicare Supplement plan. The premium rates are set by the insurance company and regulated by state authorities. However, we can help you compare quotes from different insurance providers to find the most competitive premium for the desired coverage.

Is a Medicare Supplement Insurance Quote binding or final?

No, a Medicare Supplement Insurance Quote is not binding or final. It provides an estimated premium cost based on the information provided, but the actual premium rate may vary when you officially apply for the plan. The final premium will be determined during the underwriting process.

Get a Free Consultation from a Licensed Medicare Supplement Insurance Agent

If you have questions about Medigap policies, call our team of fully-licensed agents at 1-888-891-0229. We’ll advise you on the right plan for your healthcare requirements and get you the lowest rates on any plan from providers in your state.

Our consultations, advice, and quotes are free. If you can’t speak to us right now, complete the contact form on this site. We’ll get a Medicare supplement agent to call you back.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.