by Russell Noga | Updated July 13th, 2023

Are you a senior aged 65? If so then you likely qualify for Original Medicare Parts A & B.

Are you a senior aged 65? If so then you likely qualify for Original Medicare Parts A & B.

These policies help reduce your healthcare expenses during your golden years. As a senior, you have to manage your finances prudently during your retirement, and healthcare costs can severely impact your financial planning if you don’t prepare for them.

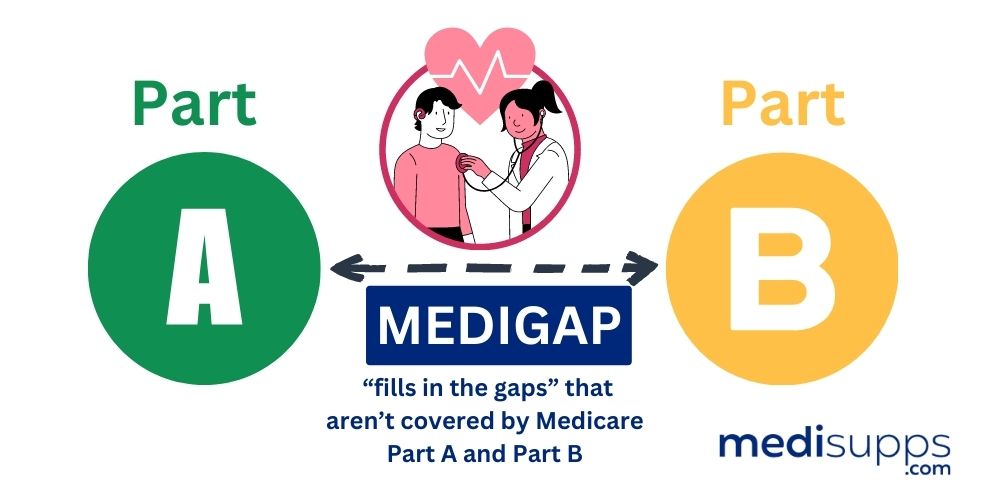

The issue with Medicare Parts A & B is that they only cover 80% of your total hospital and medical costs. You’re responsible for paying for the 20% balance. A Medigap policy helps you pay for the remaining out-of-pocket expenses not covered by Original Medicare.

Medigap plans come in ten options, A, B, C, D, F, G, K, L, M, & N. Each plan has different benefits, and some are more comprehensive than others. Understanding the various plans and how they work is central to choosing the right policy for your healthcare needs.

But how does Medicare supplement eligibility work? How can you enroll in a plan, and how do you start with Medigap?

Compare 2024 Plans & Rates

Enter Zip Code

How Does Medicare Supplement Insurance Work?

The Federal government standardizes the benefits offered in all Medigap plans. This regulation brings consistency to the industry, ensuring that you get the same level of benefits in each plan from any provider you sign up with for your Medigap policy.

So, what do Medigap policies cover? All Medigap plans offer the following benefits for Original Medicare Part A & B expenses.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F was phased out on January 1, 2020. It’s only available for people eligible for Medicare before this date. You can still buy a Plan F policy if you qualify for Medicare before this date, but terms and conditions apply. For newly eligible Medicare beneficiaries, the best option for near-comprehensive coverage is Plan G. Plan G has the same benefits as Plan F, but you don’t have coverage for the Part B deductible of $226.

Understanding Medicare Supplement Eligibility

The Open Enrollment Period

The “Open Enrollment” period for Medigap plans starts on the day of your 65th birthday, lasting six months from that date. During Open Enrollment, you can choose any Medigap plan and any provider for your insurer.

If you have pre-existing health conditions, the provider cannot use them to charge you higher-than-average premiums or deny you coverage. They must accept your application to join their scheme.

If you have pre-existing conditions and don’t have a history of at least six months of prior healthcare coverage before joining the scheme, the insurer can institute a three to six-month waiting period. During the waiting period, you pay premiums, but you don’t receive any Medigap benefits.

If you join after the Open Enrollment period ends, the insurer can make you complete “Medical underwriting.”

This process involves disclosing your pre-existing conditions in a questionnaire. If the insurer decides you’re a high-risk applicant, they can charge higher-than-average premiums or deny your application to join their scheme.

Federal law also imposes other protections for consumers when applying for Medigap policies. These include “guaranteed renewability,” meaning the insurer cannot cancel your policy if you continue paying your premiums.

Other protections are minimum medical loss ratios and rules stopping Medigap providers from selling policies to applicants with duplicate health coverage, such as a Medicare Advantage plan.

Special Guaranteed Issue Rights

Special guaranteed issue rights allow you to join a Medigap plan outside the Open Enrollment period without undergoing medical underwriting. Like the Open Enrollment period, the insurer must accept your application for a Medigap plan if you have special guaranteed issue rights.

Special guaranteed issue rights allow you to join a Medigap plan outside the Open Enrollment period without undergoing medical underwriting. Like the Open Enrollment period, the insurer must accept your application for a Medigap plan if you have special guaranteed issue rights.

28 states require insurers to issue plans to eligible beneficiaries if their employer changed their retiree healthcare benefits. Four states (CT, ME, MA, NY) require continuous or annual guaranteed issue protections for all Medigap beneficiaries in Original Medicare aged 65 and older, regardless of their pre-existing conditions and medical history.

Guaranteed issue protections stop insurers from denying Medigap plans to eligible applicants. If you recently lost your Medicare Advantage provider, you have a guaranteed issue right if you meet the following criteria.

Guaranteed issue protections stop insurers from denying Medigap plans to eligible applicants. If you recently lost your Medicare Advantage provider, you have a guaranteed issue right if you meet the following criteria.

- You no longer live in the service area for the Medicare Advantage plan.

- The company offering your Medicare Advantage plan lost its certification to sell plans.

- You canceled your Medicare Advantage plan within a year of enrolling in Original Medicare Part A.

For the following instances, you’re eligible for a guaranteed issue right for Medicare Supplement Plan A, Plan C, Plan D, Plan F, or High-Deductible Plan F.

- You canceled your Medicare Advantage plan because your insurer misled you or violated the contract.

- You canceled your enrollment in Medigap and enrolled in Medicare Advantage for the first time, then canceled the Medicare Advantage plan within the first year of coverage. (This condition applies to Plan N as well).

You also qualify for special guaranteed rights as a Medigap Plan A, C, D, F, or HD-F policyholder if you meet the following conditions.

- The company offering your Medicare supplement coverage goes bankrupt.

- You canceled your previous Medigap plan because it violated the contract.

- You canceled your Medigap plan for a Medicare Advantage plan, and within the first year, you switched back to your previous Medigap plan.

- These situations don’t apply to Medigap Plan N, G, or HD-G.

12 states offer guaranteed issue rights above and beyond the federal government requirements. These conditions apply to changing plans or the annual enrollment period.

Compare Medicare Plans & Rates in Your Area

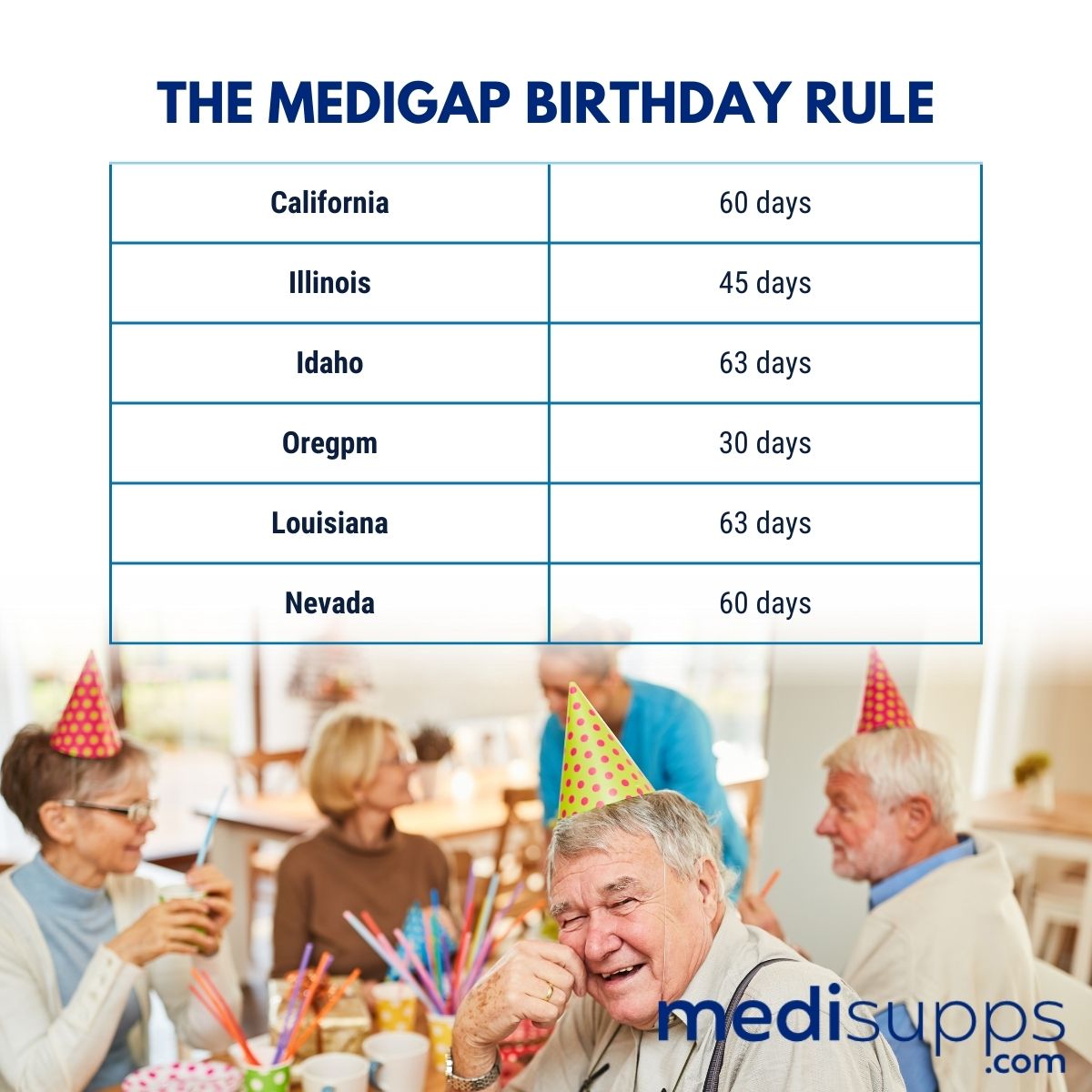

The Medigap Birthday Rule

Six states have a “birthday rule” where you can change Medigap plans or providers. The birthday rule says if you decide to change plans, you must change to a plan with the same or lesser benefits.

This period lasts a specific time before and after your birthday every year. Here are the birthday rules for each state.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

Who is eligible for Medicare Supplement plans?

To be eligible for Medicare Supplement plans, you must be enrolled in Original Medicare (Medicare Part A and Part B). Generally, you must be 65 years or older, or under 65 with certain disabilities, and reside in the plan’s service area.

When can I enroll in a Medicare Supplement plan?

The best time to enroll in a Medicare Supplement plan is during your Medigap Open Enrollment Period, which starts when you’re both 65 years old or older and enrolled in Medicare Part B. This period lasts for six months and guarantees you access to any Medigap plan with no medical underwriting.

What is the difference between Medicare Plan G and Plan N?

Medicare Plan G and Plan N are both Medigap plans that offer similar coverage, but they differ in cost-sharing. Plan G provides more comprehensive coverage, including coverage for Medicare Part A and Part B deductibles, while Plan N requires cost-sharing for certain services like copayments and excess charges.

Can I enroll in a Medicare Supplement plan if I have a pre-existing condition?

During your Medigap Open Enrollment Period, insurance companies cannot deny you a Medicare Supplement plan or charge you higher premiums due to pre-existing conditions. However, if you apply outside this period, insurance companies may impose medical underwriting and can refuse coverage or charge higher rates based on your health.

What happens if I miss the Medigap Open Enrollment Period?

If you miss your Medigap Open Enrollment Period, you may still be able to enroll in a Medicare Supplement plan, but insurance companies may subject you to medical underwriting. This means they can consider your health history and may charge higher premiums or deny coverage based on pre-existing conditions.

Can I switch Medicare Supplement plans later if I’m not satisfied?

Yes, you have the option to switch Medicare Supplement plans at any time. However, if you’ve passed your Medigap Open Enrollment Period, insurance companies may require medical underwriting, and acceptance into a new plan or lower premiums are not guaranteed.

Are there any restrictions on using Medicare Supplement plans with any healthcare provider?

With Medicare Supplement plans, you can generally use any healthcare provider nationwide who accepts Medicare. Medigap plans do not have provider networks, allowing you to receive care from any doctor or hospital that accepts Medicare patients.

Can I have both a Medicare Advantage plan and a Medicare Supplement plan?

No, it is not possible to have both a Medicare Advantage plan (Part C) and a Medicare Supplement plan (Medigap). These two types of plans cannot be used together to supplement your Medicare coverage.

Can I enroll in a Medicare Supplement plan outside of my Medigap Open Enrollment Period?

Yes, you can enroll in a Medicare Supplement plan outside your Medigap Open Enrollment Period. However, insurance companies may require medical underwriting, and acceptance into a new plan or lower premiums are not guaranteed.

Where can I find more information about Medicare Supplement eligibility and enrollment?

For more information about Medicare Supplement eligibility and enrollment, you can visit the official Medicare website, consult with licensed insurance agents specializing in Medicare, or contact your State Health Insurance Assistance Program (SHIP) for personalized assistance.

Call Us for Advice on Understanding Medicare Supplement Eligibility

If you need assistance understanding how to enroll in Medigap plans, call our team at 1-888-891-0229. We offer you a free consultation to discuss your Medigap options and how to register. We’ll answer our questions on special issue rights and show you the path for enrolling in the Medigap plan of your choosing.

Our team provides free quotes on Medigap plans, and we’ll secure you the best rate on premiums in your state. If you want our fully-licensed Medigap agents to call you back, leave your details on our contact form, and we’ll connect with you.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.