by Russell Noga | Updated September 19th, 2023

As the golden years approach, navigating the world of health insurance can be daunting. One insurance provider that stands out for its comprehensive coverage options and excellent customer service is Manhattan Life.

As the golden years approach, navigating the world of health insurance can be daunting. One insurance provider that stands out for its comprehensive coverage options and excellent customer service is Manhattan Life.

In this article, we will explore the benefits of Manhattan Life Medicare Supplement Plan F and its alternatives, helping you make an informed decision about your healthcare needs. So sit back, grab a cup of tea, and let’s dive into the world of Manhattan Life Medicare Supplement Plans.

Short Summary

- Manhattan Life Medicare Supplement Plan F offers comprehensive coverage and eligibility criteria.

- Alternatives, such as Plans G and N, should be compared in terms of cost, coverage and other factors to ensure the best rate is found.

- Manhattan Life has achieved high ratings from both A.M Best & Better Business Bureau with only 39 consumer complaints reported in last 3 years

Understanding Manhattan Life Medicare Supplement Plan F

Understanding Manhattan Life Medicare Supplement Plan F

Manhattan Life Medicare Supplement Plan F is designed to provide extensive coverage for out-of-pocket costs not covered by Original Medicare. This plan, being one of the medicare supplement insurance plans, has been a popular choice among beneficiaries due to its comprehensive benefits package, which complements the original medicare benefits.

To better understand this plan, we will discuss its coverage, eligibility criteria, and enrollment process.

Comprehensive Coverage

Manhattan Life Medicare Supplement Plan F offers a wide range of coverage, including:

- Medicare Part B excess charges

- Copayments

- Coinsurance

- Deductibles

This makes it a popular choice for those eligible. By covering these additional expenses, Plan F helps lift the financial burden off beneficiaries’ shoulders, enabling them to focus on their health and well-being.

This comprehensive coverage is one of the main reasons why Plan F has been favored by many Medicare beneficiaries. With a Manhattan Life Medicare Supplement Insurance Policy, you can rest assured knowing that the majority of your medical expenses will be covered, allowing you to access the healthcare services you need without worrying about the financial implications.

Eligibility Criteria

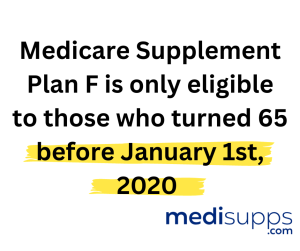

To be eligible for the Manhattan Life Medicare Supplement Plan F, you must have enrolled in Original Medicare before January 1, 2020, and meet other criteria such as being enrolled in both Medicare Part A and Part B and being 65 years or older.

It is essential to understand these eligibility requirements, as they ensure that you can take full advantage of the benefits offered by Plan F.

Enrollment Process

Enrolling in a Manhattan Life Medicare Supplement Plan involves comparing your options and working with an authorized agent. Licensed agents can assist you in reviewing your options and making an informed decision regarding your Medicare coverage, ensuring that you choose the plan that best suits your needs and budget.

It is crucial to enroll in a Manhattan Life Medicare Supplement Plan during your initial open enrollment period, which begins the year you turn 65 and lasts for six months. During this window, insurance companies cannot decline your application, even if you have unfavorable health conditions.

By enrolling during this period, you can secure the best possible coverage and rates for your Manhattan Life Medicare Supplement Plan.

Discover 2024 Plans & Rates

Enter Zip Code

Comparing Manhattan Life Medicare Supplement Plans

Manhattan Life offers various Medicare Supplement plans, including Plan G and Plan N, which are popular alternatives to Plan F. Comparing these Medigap plans can help you determine the best option for your healthcare needs, taking into consideration coverage, costs, and other factors.

When comparing plans, consider the coverage each plan offers. Plan G covers all of the same things.

Plan G vs. Plan F

Plan G vs. Plan F

Manhattan Life Medicare Supplement Plan G is another option to consider when comparing plans. Plan G offers similar coverage to Plan F, with the main difference being that Plan G policyholders must pay the Medicare Part B deductible themselves, while Plan F covers this deductible.

Despite this difference, Plan G can be a more affordable option for many individuals due to its lower monthly premium.

By opting for Plan G, you can still enjoy comprehensive coverage and potentially save on your monthly premiums. However, it is essential to weigh the costs and benefits of both Plan F and Plan G before making a decision, as your individual healthcare needs and financial situation will play a significant role in determining the best option for you.

Plan N vs. Plan F

Plan N vs. Plan F

Another alternative to consider is Manhattan Life Medicare Supplement Plan N. Plan. N provides comprehensive coverage, similar to Plan F, but includes copayments for office and emergency room visits. This cost-sharing structure can make Plan N a more affordable option for those who do not frequently access healthcare services.

When comparing Plan N and Plan F, it is crucial to consider the potential out-of-pocket costs associated with each plan, such as copayments and deductibles. While Plan N may offer lower monthly premiums than Plan F, you may end up paying more in copayments and other out-of-pocket expenses if you require frequent medical care.

Ultimately, the best choice will depend on your individual healthcare needs and financial situation.

Manhattan Life Medicare Supplement Rates

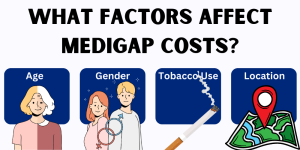

Manhattan Life Medicare Supplement rates can vary depending on factors such as:

- Age

- Gender

- Location

- Tobacco use

By understanding these factors and the available discounts and savings opportunities, you can ensure that you secure the best possible rates for your chosen plan.

It is important to compare rates from different providers to ensure that you are getting the best deal.

Factors Affecting Rates

Manhattan Life Medicare Supplement rates are influenced by a variety of personal factors, including:

- Age

- Gender

- Tobacco use

- Health status

Additionally, location-based factors, such as the cost of living and state regulations, can also impact your rates. Understanding these factors is crucial in determining the most suitable and affordable plan for your needs.

Working with a licensed agent can help you:

- Navigate these factors and find the best possible rates for your chosen Manhattan Life Medicare Supplement Plan

- Assist you in comparing options, taking into account your personal circumstances

- Ultimately help you make an informed decision about your healthcare coverage.

Discounts and Savings Opportunities

Manhattan Life, an insurance company, offers various discounts and savings opportunities for eligible beneficiaries, such as the household discount. This discount is available to married couples or two individuals cohabitating and aged 60 or above, providing a 7% reduction in premium costs.

It is essential to inquire about these discounts and savings opportunities when enrolling in a Manhattan Life Medicare Supplement Plan, as they can significantly reduce your monthly premiums and overall healthcare costs.

By taking advantage of these offers, you can secure comprehensive coverage at an affordable price, ensuring that you can access the healthcare services you need without financial strain.

Manhattan Life’s Additional Coverage Options

In addition to their Medicare Supplement plans, Manhattan Life also offers dental, vision, and hearing insurance options. These additional coverage options can further supplement your Medicare benefits and help mitigate the costs of services not covered by Original Medicare.

These plans can help you save money on routine dental care, vision exams, and eyeglasses.

Dental Insurance

Dental Insurance

Manhattan Life Dental Insurance offers guaranteed issue coverage with increasing benefits for preventive, basic, and major services. In the first year, the plan covers routine care, while the second year includes coverage for more extensive treatments such as dentures, bridges, and periodontal surgery.

By enrolling in Manhattan Life Dental Insurance, you can ensure that your oral health is well taken care of without incurring high out-of-pocket costs. With escalating benefits over time, this dental insurance plan can provide you with the peace of mind that your dental needs will be covered as you age.

Vision Insurance

Vision Insurance

Manhattan Life Vision. Insurance provides coverage for the following:

- Eye exams

- Refractions

- Glasses

- Contacts

The coverage for glasses and contacts has a waiting period of a minimum of six months to become effective. This ensures that you receive the care you need when you need it most.

Good vision is essential for maintaining independence and quality of life as we age. By enrolling in Manhattan Life Vision Insurance, you can rest assured that your vision needs will be taken care of, allowing you to see the world clearly and enjoy your golden years to the fullest.

Hearing Insurance

Hearing Insurance

Manhattan Life Hearing Manhattan Life Insurance offers coverage for exams and supplies, with a 12-month waiting period for new hearing aids and repairs. The coverage percentages increase over time, with 60% coverage in the first year, 70% in the second year, and 80% in the third year and thereafter.

Hearing loss can significantly impact an individual’s quality of life, making it crucial to address any hearing issues as soon as possible. With Manhattan Life Hearing Insurance, you can ensure that your hearing needs are met, allowing you to maintain your independence and enjoy life to the fullest.

Evaluating Manhattan Life’s Financial Strength and Customer Satisfaction

Manhattan Life’s financial strength and customer satisfaction are demonstrated through positive financial ratings and customer reviews. In the following sections, we will explore the company’s financial ratings and customer testimonials, providing you with a comprehensive understanding of Manhattan Life’s financial stability and reputation.

Financial ratings are an important indicator of a company’s financial strength. Manhattan Life has a Manhattan life.

Financial Ratings

Manhattan Life has a B++ (Good) rating from A.M. Best, indicating a strong history of paying customers on time. A.M. Best has been providing ratings on Manhattan Life since 1976, showcasing the company’s long-standing commitment to financial stability and customer satisfaction.

Furthermore, Manhattan Life Group, along with Central United Life, has been awarded an A+ rating by the Better Business Bureau, reflecting its dedication to providing excellent customer service and addressing any concerns or issues in a timely manner. These ratings serve as a testament to Manhattan Life’s financial strength and commitment to customer satisfaction.

Customer Reviews and Testimonials

Customer reviews and testimonials highlight high satisfaction with Manhattan Life’s Medicare Supplement plans and customer service. Beneficiaries often praise the company’s commitment to reducing healthcare costs and providing comprehensive coverage options.

In the past three years, only 39 consumer complaints have been reported to and addressed by the Better Business Bureau, demonstrating Manhattan Life’s dedication to resolving any issues promptly and efficiently.

These testimonials and reviews showcase the positive experiences of many Manhattan Life policyholders and serve as an endorsement of the company’s commitment to providing exceptional service and coverage options.

Compare Medicare Plans & Rates in Your Area

Summary

In conclusion, Manhattan Life Medicare Supplement Plan F and its alternatives offer comprehensive coverage options for beneficiaries seeking to supplement their Original Medicare benefits.

With a strong financial rating and a history of excellent customer satisfaction, Manhattan Life is a trustworthy and reliable choice for your healthcare needs.

By comparing plans, working with a licensed agent, and taking advantage of available discounts and savings opportunities, you can secure the coverage you need to enjoy a healthy, worry-free retirement.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Manhattan Life Medicare Supplement Plan F?

Manhattan Life Medicare Supplement Plan F is a health insurance plan designed to cover some of the expenses that Original Medicare (Part A and Part B) doesn’t fully cover. It helps policyholders pay for various out-of-pocket costs, such as deductibles, copayments, and coinsurance.

What does Manhattan Life Medicare Supplement Plan F cover?

Plan F typically covers the Medicare Part A deductible, Part B deductible, Part A and Part B coinsurance, Part B excess charges, and even foreign travel emergency expenses, making it one of the most comprehensive Medicare Supplement plans available.

Is Plan F still available for new enrollees?

As of January 1, 2020, Plan F is no longer available for new Medicare enrollees. Only those who were eligible for Medicare before this date can enroll in Plan F.

How does Manhattan Life Medicare Supplement Plan F differ from other plans?

Plan F offers the most comprehensive coverage among Medicare Supplement plans, covering nearly all out-of-pocket expenses. Other plans, like Plan G and Plan N, may have slightly different coverage options.

What is the cost of Manhattan Life Medicare Supplement Plan F?

The cost of Plan F varies depending on factors like your age, location, and any discounts available. It’s essential to get quotes from Manhattan Life or other insurance providers to determine the exact cost.

Can I keep my doctor with Manhattan Life Medicare Supplement Plan F?

Yes, you can generally keep your doctor as long as they accept Medicare patients. Manhattan Life Plan F doesn’t have a network of doctors, so you have the flexibility to choose any healthcare provider that accepts Medicare.

Are there any guaranteed issue rights for Manhattan Life Medicare Supplement Plan F?

Yes, there are guaranteed issue rights that allow you to enroll in Plan F without medical underwriting. This typically occurs during specific enrollment periods, such as when you lose other coverage or if you’re new to Medicare.

Does Manhattan Life offer any additional benefits with Plan F?

Some Medicare Supplement plans, including Plan F, may offer additional benefits like vision, dental, or fitness programs. It’s important to check with Manhattan Life for the specific benefits they provide.

Can I switch from another Medicare Supplement plan to Manhattan Life Plan F?

Yes, you can switch from one Medicare Supplement plan to another, including from one insurance company to Manhattan Life, if you meet the eligibility criteria and follow the enrollment rules.

How do I enroll in Manhattan Life Medicare Supplement Plan F?

To enroll in Manhattan Life Plan F or any Medicare Supplement plan, contact Manhattan Life directly or work with a licensed insurance agent. They can guide you through the application process and help you choose the right plan for your needs.

Find the Right Medicare Plan for You

Finding a Medicare plan for 2024 doesn’t have to be stressful. Whether it’s a Medigap plan or you have questions about Medicare Advantage or Medicare Part D, we can help.

Reach out today at 1-888-891-0229, and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.