by Russell Noga | Updated May 23, 2023

Exploring the Benefits of Manhattan Life Medicare Supplement Plans

Navigating the world of Medicare Supplement plans can be daunting. But fear not, this comprehensive guide on Manhattan Life Medicare Supplement Plans will provide you with all the necessary information to make an informed decision.

We’ll cover the popular Medicare Supplement plans F, G, and N, factors affecting rates, additional insurance offerings, provider flexibility, financial strength, and discounts. Ready to dive in? Let’s get started!

Summary

- Manhattan Life Group offers Medicare Supplement plans, including Plan F, G, and N.

- Rates vary based on personal characteristics, location, and benefits included in the plan.

- Manhattan Life has a positive reputation with an A+ rating from BBB & 4.53 stars out of 5 from customer reviews. Discounts available for spousal/household coverage up to 12%.

Overview of Manhattan Life Medicare Supplement Plans

Manhattan Life Insurance Company, a reputable provider of life and health insurance solutions, offers a full range of Medicare Supplement plans tailored to meet individual needs and budgets. With their popular plans F, G, and N, you can choose the coverage that best suits your lifestyle and healthcare expenses.

Manhattan Life Group, comprising Central United Life and Western United Life Assurance, is dedicated to helping seniors secure the supplemental coverage they need to manage their healthcare costs effectively.

Medicare Plan F: High Coverage, Limited Eligibility

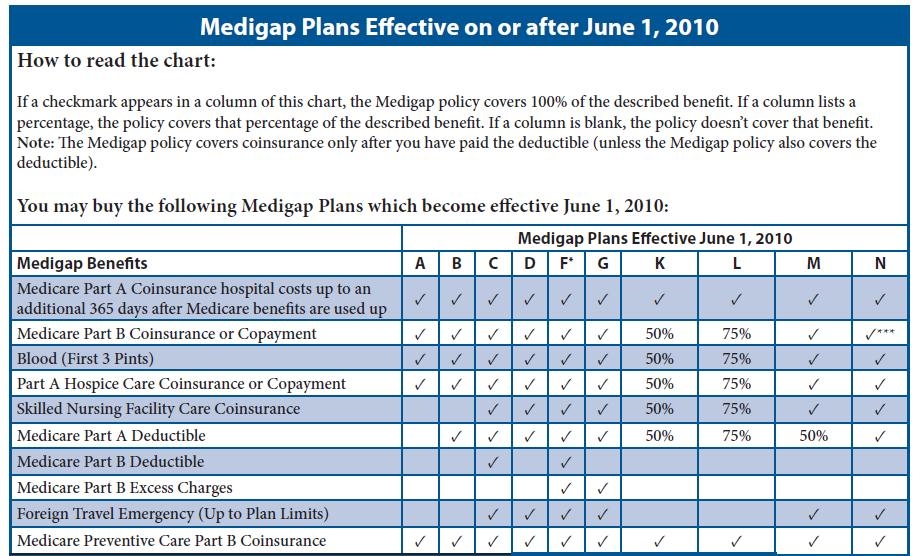

Manhattan Life Plan. F is the crème de la crème when it comes to Medicare Supplement plans, offering the most comprehensive coverage available. With Plan F, you’ll enjoy complete peace of mind as it covers 100% of all expenses not covered in full by Medicare.

However, there’s a catch: Plan F is only available to those who were eligible for Original Medicare benefits prior to January 1, 2020.

So, if you’re a new Medicare beneficiary after that date, you’ll have to consider other plans.

Medicare Plan G: Extensive Coverage, Lower Cost

For many, Plan G is the sweet spot of Manhattan Life’s Medicare Supplement offerings, providing extensive coverage at a competitive price. While it’s similar to Plan F, there’s one notable difference: Plan G includes an annual deductible of $226 in 2023.

However, once the deductible is met, you won’t have to worry about any additional payments for the remainder of the year for Medicare-approved services.

In essence, Plan G becomes comparable to Plan F once you’ve fulfilled the deductible.

Medicare Plan N: Affordable Option with Some Out-of-Pocket Costs

Manhattan Life Medicare Supplement Plan. N offers an affordable solution for those willing to shoulder some out-of-pocket costs. With Plan N, you’re responsible for your Medicare Part B deductible, co-pays for the doctor and emergency room, and your premium and Part B excess charges when applicable.

To avoid excess charges, ensure your provider accepts “Medicare Assignment”. While Plan N may require closer attention to your expenses, it can still help you manage your healthcare costs effectively.

Manhattan Life Medicare Supplement Rates – What’s Involved

Several factors influence Manhattan Life Medicare Supplement rates, such as age, location, gender, tobacco use, and health. Additionally, the number of benefits included in your chosen plan may impact the cost. Keep in mind that rate increases may also occur due to inflation and the rising cost of healthcare.

Now, let’s delve deeper into how state variations, personal factors, and enrollment timing affect your rates.

Rates by State

Manhattan Life Medicare Supplement rates vary by state. In most states, rates are based on the age of the individual, while in others, like Georgia and Arizona, they are based on the age when the policy was issued.

For example, the average rate increase for Medigap plans offered by Manhattan Life in Arizona is 15.5%. It’s essential to consider state variations when comparing rates to ensure you’re getting the best value for your money.

Personal Factors

Personal factors, such as age, gender, tobacco use, and health, can significantly impact Manhattan Life Medicare Supplement rates. For instance, older individuals generally pay higher premiums, while women tend to pay lower rates than men. Tobacco users also face higher rates due to the associated health risks.

Understanding how these personal factors affect your rates can help you budget more effectively for your Medicare Supplement plan.

Best Time to Enroll

Timing is crucial when enrolling in a Manhattan Life Medicare Supplement plan. The optimal time to enroll is during the 6-month Medicare Supplement Open Enrollment Period, which starts on the first day of the month when you turn 65 or older and are enrolled in Part B. Enrolling during this period guarantees you coverage without having to answer health-related questions or undergo a medical underwriting.

Missing this window may result in higher premiums or even denial of coverage, so it’s essential to be proactive with your enrollment.

Compare 2025 Plans & Rates

Enter Zip Code

Eligibility and Enrollment for Manhattan Life Medicare Supplement Plans

To be eligible for Manhattan Life Supplement plans, you must be enrolled in Medicare Part A and B. It is recommended that you enroll during the Medicare Supplement Open Enrollment Period to secure the best rates and avoid any potential denial of coverage.

Enrolling after the Open Enrollment Period may require that you go through a simplified underwriting process. Moreover, you will be expected to answer health-related questions. Ensuring you’re eligible and enrolling at the right time can significantly impact your access to the supplemental coverage you need.

Customer Reviews and Ratings for Manhattan Life Medicare Supplement (Medigap) Plans

Manhattan Life’s Medicare Supplement (Medigap) plans have garnered consistently positive reviews and ratings, reflecting their commitment to providing high-quality coverage and customer service.

The company boasts an A+ rating from the Better Business Bureau and a rating of 4.53 stars out of 5 from 188 reviews on one website.

Manhattan Life’s relaxed underwriting also allows beneficiaries with less-than-perfect health to enroll, making their plans accessible to a broader range of individuals. With such impressive ratings, you can trust Manhattan Life to deliver reliable and comprehensive Medicare Supplement plans.

Additional Insurance Offerings from Manhattan Life

In addition to its Medicare Supplement plans, Manhattan Life provides dental, vision, and hearing insurance plans separately to supplement services not covered by Medicare. These additional insurance offerings can help you further manage your healthcare expenses and ensure you receive the comprehensive coverage you need.

Let’s explore each of these offerings in more detail.

Dental Coverage

Manhattan Life Dental insurance policy offers comprehensive coverage for preventive, basic, and major services. This includes routine checkups, cleanings, fillings, and even more complex procedures like root canals and crowns.

The 3-in-1 plan comes with a $100 annual deductible and a 12-month waiting period for major services. With Manhattan Life Dental coverage, you can maintain your oral health without breaking the bank.

Vision Coverage

Manhattan Life Vision insurance provides coverage for basic eye exams, eye refractions, glasses, and contacts. With the increasing prevalence of vision problems and the rising cost of eye care, having vision insurance can help you maintain good eye health and avoid costly out-of-pocket expenses.

By choosing Manhattan Life’s vision coverage, you can ensure that your eyes remain in tip-top shape while keeping your healthcare costs under control.

Hearing Coverage

Hearing coverage is another valuable benefit offered by Manhattan Life Medicare Supplement plans. The hearing coverage includes hearing exams and hearing aid supplies.

There is a 12-month waiting period for new hearing aids and repairs, but once that period is over, the coverage percentage for hearing aids increases from 60% in the first year to 80% in the third year and beyond (except for Ohio residents).

With Manhattan. With life’s hearing coverage, you can rest assured that your hearing needs are well taken care of.

Provider Flexibility with Manhattan Life Medicare Supplement Plans

Manhattan Life Medicare Supplement plans offer unparalleled provider flexibility, allowing you to choose any provider that accepts Medicare without any network restrictions. This means you can continue seeing your preferred healthcare providers or seek care from specialists across the country without worrying about network limitations.

Furthermore, Manhattan Life’s dental, vision, and hearing plans come with cash reimbursement options, giving you even more freedom in choosing your healthcare providers and services. With Manhattan Life, you’re in control of your healthcare decisions.

Financial Strength and Ratings of Manhattan Life Insurance

Manhattan Life Insurance’s financial strength reflects its commitment to providing reliable Medicare plans. With a B++ (Good) rating from A.M. Best and a Long-Term Issuer Credit Rating of “bbb” (Good), Manhattan Life has demonstrated its ability to meet its ongoing insurance obligations.

A.M. Best has been providing ratings on Manhattan Life since 1976, further attesting to the company’s stability and strong financial position. You can trust Manhattan Life to be a dependable partner in securing your healthcare coverage needs.

Discounts Offered by Manhattan Life

Manhattan Life offers Spousal and Household discounts for those enrolled in their Medigap Plans, with savings ranging from 7% to 12%. The Spousal Discount is available when both spouses are insured by Manhattan Life, while the Household Discount applies when multiple residents of a household are insured by the company.

These discounts can help you save on your premiums and make your Medicare Supplement plan even more cost-effective. With Manhattan Life, you don’t have to sacrifice quality for affordability.

Frequently Asked Questions

What is Medicare supplemental life insurance?

Medicare supplemental life insurance, commonly known as Medigap, is private health insurance that covers expenses not covered by Original Medicare. It helps pay deductibles, coinsurance, copayments, or other medical costs not covered by Original Medicare.

What is Manhattan Life’s A.M. Best rating?

A.M. Best has given ManhattanLife Insurance and Annuity Company a Financial Strength Rating of B++ (Good), demonstrating their commitment to financial security and stability.

This strong rating is a testament to the company’s reliability, making them a trusted partner for individuals seeking quality life insurance coverage.

What are Manhattan Life Medicare Supplement Plans?

Manhattan Life Medicare Supplement Plans, also known as Medigap plans, are health insurance policies provided by the Manhattan Life Insurance Company. These plans work alongside Original Medicare to help cover out-of-pocket costs like copayments, coinsurances, and deductibles.

What plans does Manhattan Life offer?

Manhattan Life offers several Medigap plans including Plan A, Plan C, Plan F, Plan G, and Plan N. However, offerings may vary by state and over time, so it’s best to check with Manhattan Life for current information.

What is Manhattan Life Plan F?

Manhattan Life Plan F is a comprehensive Medigap plan that covers all Medicare-approved expenses not covered by Original Medicare. However, it’s important to note that Plan F is no longer available to new Medicare beneficiaries as of 2020.

What is Manhattan Life Plan G?

Manhattan Life Plan G is similar to Plan F, but it does not cover the Medicare Part B deductible. It is often chosen for its broad coverage and typically lower premiums compared to Plan F.

What is Manhattan Life Plan N?

Manhattan Life Plan N covers most Medicare-approved costs, except the Part B deductible and some copayments. Plan N generally has lower premiums than Plan F or G.

How much do Manhattan Life Medicare Supplement Plans cost?

The cost of these plans can vary based on factors like your age, gender, location, and whether you use tobacco. To get a precise quote, just use our free online quote tool or call today at 1-888-891-0229

Are prescription drugs covered under Manhattan Life Medigap plans?

No, prescription drugs aren’t covered by these plans. For prescription drug coverage, you’ll need to enroll in a separate Medicare Part D plan.

Can I use my Manhattan Life Medigap plan with any doctor?

Yes, you can visit any doctor or healthcare provider that accepts Medicare.

When can I enroll in a Manhattan Life Medigap plan?

The best time to enroll is during your Medigap Open Enrollment Period, which starts the month you’re 65 and enrolled in Medicare Part B. During this period, you can’t be denied coverage or charged more due to health conditions.

Can I switch my Manhattan Life Medigap plan?

Yes, you can apply to switch at any time, but acceptance and premiums may be based on your health status unless you have guaranteed issue rights. Always consult Manhattan Life or a licensed insurance agent for specific information.

Summary

In conclusion, Manhattan Life Medicare Supplement Plans offer comprehensive coverage options, flexibility, and financial stability. With popular plans like F, G, and N, as well as dental, vision, and hearing insurance offerings, you can find the perfect plan to fit your healthcare needs and budget.

Positive customer reviews, strong financial ratings, and valuable discounts make Manhattan Life an excellent choice for your Medicare Supplement needs.

Don’t leave your healthcare to chance—call us today for more information about Manhattan Life Medicare Supplement plans today and secure the coverage and Medicare Benefits you deserve.