by Russell Noga | Updated July 10th, 2023

Do you want to cancel your Medicare supplement insurance plan?

Do you want to cancel your Medicare supplement insurance plan?

You can cancel your Medigap policy anytime by calling your insurer or using your licensed Medigap agent. However, there are a few things you need to know before you do so.

- You may have to undergo medical underwriting, involving a health screening, before enrolling in another Medigap plan with an insurer.

- You might have to pay higher premiums with another provider or if you take a different plan.

- Other insurers might offer the same plans, but premiums can vary widely in cost.

This brief guide gives you everything you need to know on how to cancel Medicare supplement insurance policies.

Compare 2024 Plans & Rates

Enter Zip Code

What Medicare Expenses Do Medigap Plans Cover?

Original Medicare Parts A & B partially cover your inpatient (hospital) and outpatient (medical) expenses. They’re valuable policies to help seniors cope with the rising healthcare costs as they age. Medicare supplement plans (Medigap) differ in coverage, with ten plans available.

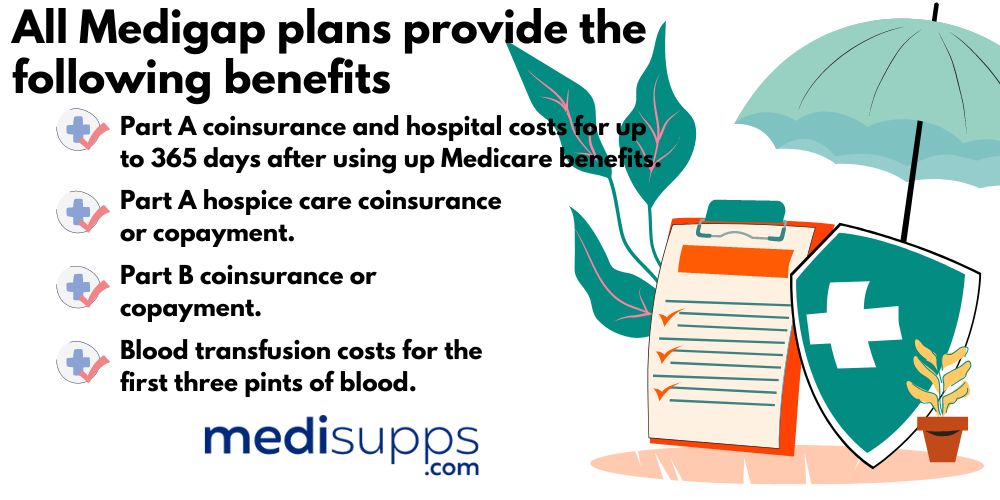

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

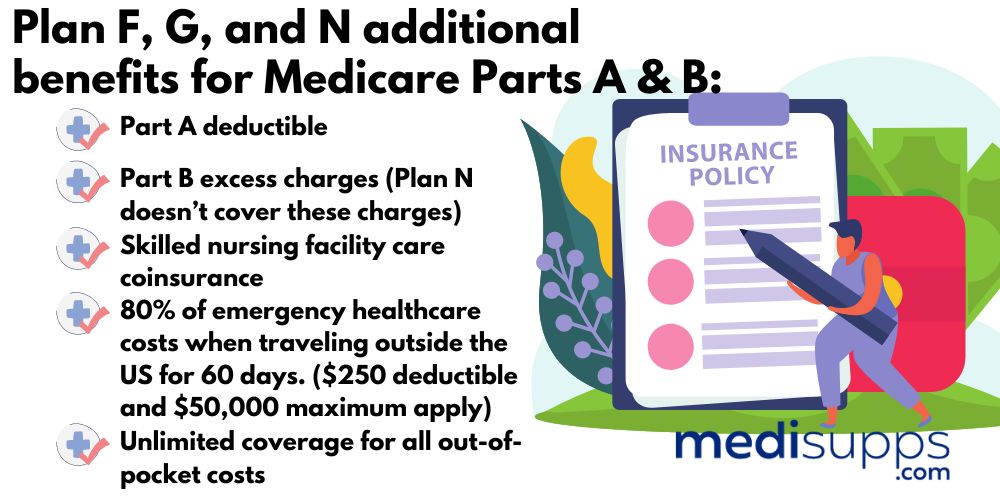

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*You’ll need to be eligible for Medicare before January 1, 2020, to qualify for Plan F. If you are eligible for enrollment after this cut-off date, you’ll need to go with Plan G instead.

Why Do Beneficiaries Cancel Medicare Supplement Insurance Policies?

There are several reasons why beneficiaries decide to terminate their Medigap coverage. Some of the common reasons for canceling Medigap plans include the following.

- Moving to a part of the country where the Medigap provider doesn’t cover the area.

- The current Medigap plan leaves the beneficiary over or under-insured.

- Seniors in their retirement need to pay special attention to their finances. If you’re living on a fixed income, every penny counts and a change in Medigap premiums may make your coverage too expensive.

Canceling Medicare Supplement Insurance During the "Free Look" Period

You don’t have to cancel your current Medigap plan if you consider changing it to another option. For instance, if you’re enrolled in Plan G but want to change to Plan N, you can use the “free look period.” During this time, you have 30 days to evaluate Plan N and see if you prefer the coverage.

If you decide to make the change to Plan N, you mustn’t cancel your Plan G policy until your Plan N benefits are activated, or you’ll have no Medigap coverage. While you can utilize the free look period, there’s no guarantee the new insurer will accept you to its Medigap scheme unless you have a guaranteed issue right.

Additionally, the new insurer may require you to undergo medical underwriting to examine your risk profile. If they decide you’re a high risk to insure, they may increase your premiums, and you could end up paying more for Plan N than you were for Plan G.

Compare Medicare Plans & Rates in Your Area

Canceling or Changing Medigap Plans During the Open Enrollment Period

In most cases, Federal law dictates you don’t have the right to switch Medigap plans. However, you can switch plans if you have guaranteed-issue rights to buy a policy or if you’re in the 6-month window for the Open Enrollment Period in the six months after your 65th birthday.

In most cases, Federal law dictates you don’t have the right to switch Medigap plans. However, you can switch plans if you have guaranteed-issue rights to buy a policy or if you’re in the 6-month window for the Open Enrollment Period in the six months after your 65th birthday.

During your Medigap OEP, the insurer can’t deny you coverage based on medical underwriting results. They also can’t increase your premiums above your state’s average rate for that policy. However, the insurer can institute a three to six-month waiting period before activating your benefits.

During the Medicare Supplement Open Enrollment Period, you can buy a Medigap plan, change your mind, cancel it, and enroll in a different plan without incurring penalties. The guaranteed issue rights afforded by the Open Enrollment Period also extend to other circumstances.

For instance, if you leave an employer or union group healthcare plan. Or if you enroll in Medicare Advantage and decide to switch to Medicare and Medigap in the first year of coverage. Or if the insurer closes down in your state, goes bankrupt, or misleads you about the benefits of your plan.

How to Cancel Medicare Supplement Insurance Plans

You can cancel your Medigap plan anytime by calling your insurer and telling them you want to cancel. You must give them 30 days’ notice before they cancel your premiums. For instance, if you cancel in June, you’ll have to pay for July, and your coverage will cease in August.

You can cancel your Medigap plan anytime by calling your insurer and telling them you want to cancel. You must give them 30 days’ notice before they cancel your premiums. For instance, if you cancel in June, you’ll have to pay for July, and your coverage will cease in August.

Some insurers can cancel your policy over the phone, while others require you to email them with your notification to cancel. You can cancel your plan using your Medigap agent if you signed up for Medigap using their services.

Can the Insurer Cancel Your Medicare Supplement Plan?

Your insurer cannot cancel your Medigap policy if you keep paying your premiums. All Medigap plans from all insurers come with a “guaranteed renewable.” That means the insurer cannot cancel your plan because your health situation changes.

However, the insurer may cancel your plan if they go bankrupt. In this case, you would have a guaranteed issue right to join another provider’s Medigap scheme without undergoing medical underwriting. The insurer can cancel your Medigap plan if you lie or give false information on your application.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medicare Supplement Insurance?

Call Our Team for Advice on How to Cancel Medicare Supplement Insurance

Canceling your Medigap policy isn’t challenging; you can call our team at 1-888-891-0229 for assistance with the process. Our fully licensed Medigap agents can advise you on switching plans or insurers to get the best value for your policy.

We offer a free consultation and quote on Medigap plans. Our team can secure the best rate in your state, guide you through enrollment and advise you on your special guaranteed issue rights. If you can’t talk right now, complete the contact form on this site, and we’ll get a Medigap expert to call you back.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.