by Russell Noga | Updated April 22nd, 2024

Over the course of your entire working life, you have paid into Medicare. Now that you’re 65, you’re ready to take advantage of the federally-sponsored health insurance program that you’ve helped to fund. While Medicare does cover a large portion of health-related expenses, it doesn’t cover everything, and you’re required to pay for what it doesn’t cover. One of the out-of-pocket expenses that you’re responsible for is the deductible.

Over the course of your entire working life, you have paid into Medicare. Now that you’re 65, you’re ready to take advantage of the federally-sponsored health insurance program that you’ve helped to fund. While Medicare does cover a large portion of health-related expenses, it doesn’t cover everything, and you’re required to pay for what it doesn’t cover. One of the out-of-pocket expenses that you’re responsible for is the deductible.

Medigap insurance – supplemental insurance that you can purchase to cover the “gaps” in Medicare coverage – can help pay for some of the out-of-pocket expenses. There are a total of 10 Medicare Supplemental Insurance plans available. For new Medicare enrollees, Plan G is one of the most comprehensive, meaning that it provides the most coverage for the costs that Medicare doesn’t cover. But does it cover the deductible? Let’s take a closer look.

What is a Deductible?

Before your healthcare plan kicks in and covers the expenses that your insurance provides, you’ll need to pay a pre-determined amount of money yourself. That pre-determined amount of money is known as a deductible. All health insurance plans have a deductible, including Medicare.

To illustrate, if your annual deductible for Medicare is $100, you have to pay for the initial $100 for health-related services or products that you receive yourself. Once the deductible is paid, Medicare will pay for a percentage of the expenses that are related to the services and products that your plan provides for the remainder of the year.

What is the Medicare Deductible?

Both parts of Original Medicare – Part A and Part B – have a deductible. The following is an overview of this out-of-pocket expense for each part.

Medicare Part A Deductible

Part A of Original Medicare covers the cost of inpatient care that you receive, such as hospitals and skilled nursing facilities. The deductible for Part A is unique because, unlike deductibles for other health insurance plans (including other Medicare plans), it doesn’t operate on an annual basis; rather, it functions on the basis of a benefit period. This period starts on the day that you are admitted as an inpatient at a medical facility and it stops when 60 consecutive days that you have not received care in an inpatient setting have gone by.

Given the way the benefit period for Part A works, if you are admitted to a facility as an inpatient several times over the course of a year, you could potentially have several benefit periods. In that case, you would need to reach the full cost of the deductible for each new benefit period. The Part A per benefit period in 2023 is $1,600. If you were to receive treatment in a hospital as an inpatient, you would have to pay $1,600 out of your own pocket before Medicare Part A will kick in. If you are admitted to the hospital again a minimum of 60 days after the previous benefit period has concluded, a new benefit period will start and you would, again, need to pay another $1,600 before Medicare Part A will kick in

Medicare Part B Deductible

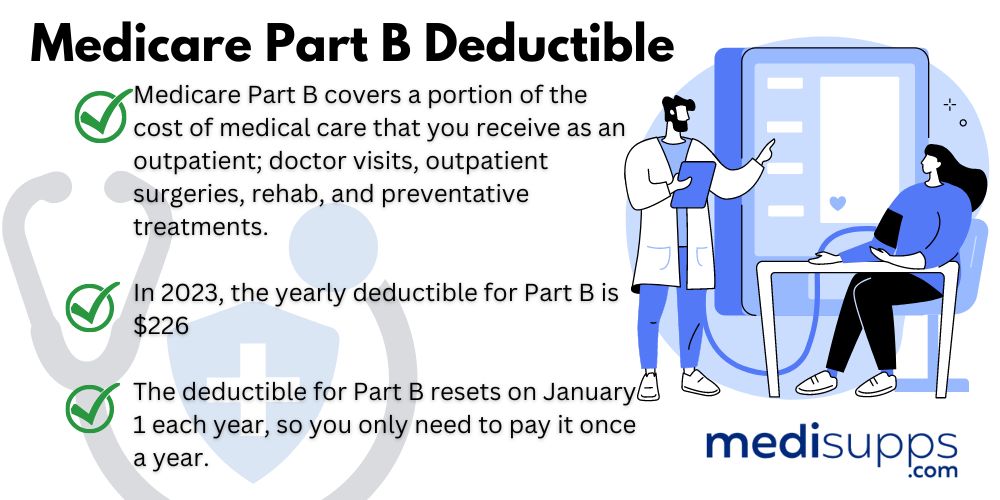

Medicare Part B covers a portion of the cost of medical care that you receive as an outpatient; doctor visits, outpatient surgeries, rehab, and preventative treatments, for example. Like Part A, Part B also has a deductible that you are responsible for paying before your coverage kicks in; however, the deductible for Part B resets on January 1 each year, so you only need to pay it once a year. Once you have met the Part B deductible, you will only be responsible for paying a 20 percent copay for any other covered services during the course of the year.

In 2023, the yearly deductible for Part B is $226, which is $7 less than the previous year. To reiterate, you are responsible for paying the full amount before Part B kicks in.

Compare Medicare Plans & Rates in Your Area

Does Medicap Plan G Cover Deductibles?

Medicare Supplement Insurance plans (also known as Medigap plans) are designed to help Medicare beneficiaries cover the out-of-pocket expenses that Part A and Part B don’t cover. These plans are sold by private insurance companies, and there are a total of 10. Plan G is one of the most comprehensive plans, as it helps to pay for the most gaps in Medicare coverage.

Deductibles are one of the expenses that Original Medicare doesn’t cover. Part G covers the deductible for Part A, but it doesn’t cover the deductible for Part B.

What Does Medigap Plan G Cover?

While Medigap plan G doesn’t cover the deductible for Part B, it does help to pay for many of the expenses that Original Medicare doesn’t cover, including the Part A deductible. Other out-of-pocket expenses that Plan G can help you pay for include:

- Part A copayment or coinsurance for hospice care

- Part A coinsurance and hospital-related expenses of up to an additional 365 days after Part A benefits have been used

- Part B copayment or coinsurance

- Part B excess charges

- Coinsurance for care provided in skilled nursing facilities

- Blood transfusions for medical procedures; up to 3 pints

- Emergency medical care received within the first 60 days while traveling abroad

What Doesn’t Medigap Plan G Cover?

While Plan G does cover a lot of the out-of-pocket expenses that Original Medicare doesn’t pay for, including the Part A deductible, it doesn’t cover everything. In addition to the deductible for Part B, Plan G won’t pay for the following:

- Long-term care; non-skilled care in nursing homes, for example

- Private-duty nursing care

- Prescription drugs

- Vision care

- Dental care

Are There Any Plans that Cover the Part B Deductible?

Plan F does cover the Part B deductible; however, since January 1, 2020, new Medicare enrollees can no longer purchase this plan. Those who were eligible for Medicare benefits prior to 2020 and purchased Plan F can hold onto it.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

Does Plan G Cover Medicare Deductible?

Medicare Supplement Plan G is a comprehensive Medigap plan designed to cover various out-of-pocket costs associated with Original Medicare. However, there’s an exception when it comes to the Medicare Part B deductible.

What does Plan G cover?

Plan G offers coverage for a wide range of healthcare costs, including Medicare Part A coinsurance and hospital costs, skilled nursing facility care coinsurance, Part A hospice care coinsurance, and more.

What about the Part B deductible?

Plan G does not cover the Medicare Part B deductible, which is an annual amount you must pay before Medicare Part B starts covering your outpatient services.

How much is the Part B deductible?

The Part B deductible amount can change annually. It’s important to check the current deductible amount each year. Medicare beneficiaries are responsible for paying this deductible themselves with Plan G.

What’s the benefit of Plan G despite the deductible?

Even though Plan G doesn’t cover the Part B deductible, it still offers substantial coverage for other Medicare-related expenses. It provides peace of mind by helping to cover many of the costs that can arise from medical treatments and hospital stays.

Can you still save money with Plan G?

Despite not covering the Part B deductible, Plan G can still offer significant cost savings. The monthly premiums for Plan G are often lower than for Plan F, and the difference in premiums can often be less than the Part B deductible.

How does Plan G compare to other plans?

Plan G is often considered a good compromise between comprehensive coverage and lower premiums. It covers nearly all of the gaps left by Original Medicare, except for the Part B deductible.

Can I switch to Plan G?

If you’re eligible for Medicare, you can switch to Plan G during your Medigap Open Enrollment Period or a Special Enrollment Period. However, if you already have another Medigap plan, you might need to go through medical underwriting.

Can I change from Plan G to another plan?

Yes, you can switch from Plan G to a different Medigap plan. Keep in mind that switching plans may involve medical underwriting and specific enrollment periods.

How do I decide if Plan G is right for me?

Consider your healthcare needs, budget, and whether you’re comfortable paying the Part B deductible out of pocket. If you want comprehensive coverage while keeping premiums relatively lower, Plan G could be a suitable option.

Secure the Best Medigap Rates with Compare Medicare Supplement Plans

With Medicare Supplement Plans, you’ll be able to find the most affordable rates on supplemental Medicare insurance, including Plan G. To start looking for quotes, simply fill out the form on this page or call 1-888-891-0229 and one of our licensed agents will be more than happy to assist you.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.