by Russell Noga | Updated June 21st, 2023

Many people in the United States have a Health Savings Account (HSA) to assist them with paying for medical expenses when they retire. This can be funded by their employer, or themselves, or both.

Many people in the United States have a Health Savings Account (HSA) to assist them with paying for medical expenses when they retire. This can be funded by their employer, or themselves, or both.

When you reach retirement age, usually 65, you can enroll in Medicare Parts A & B to further assist with your healthcare expenses in your golden years.

Unfortunately, enrolling in Medicare makes contributing to your HSA a little more challenging.

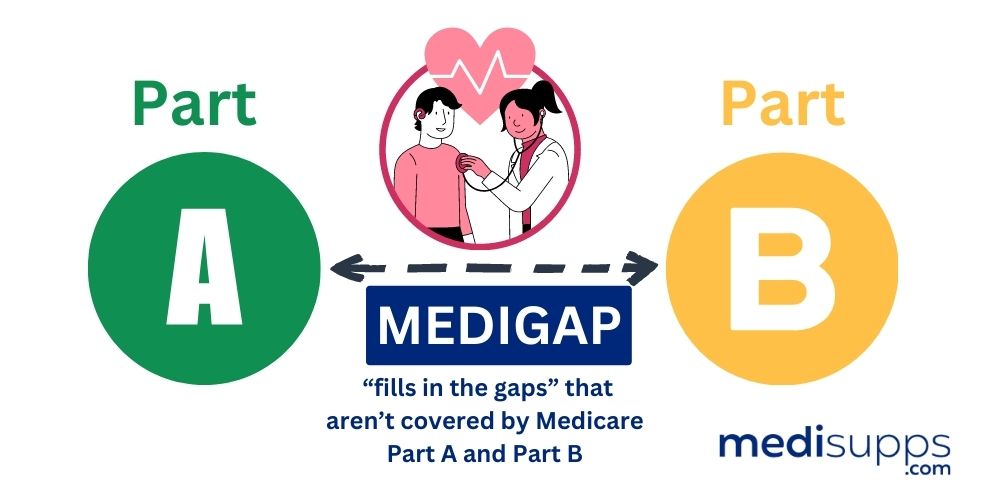

While Medicare beneficiaries can use their HSA savings to pay their Medicare premiums, they can’t continue to contribute to them after enrolling. To help make coverage offered by Original Medicare Parts A & B, many seniors choose to enroll in a Medicare supplement plan, aka “Medigap.”

Unfortunately, you may not use an HSA to pay Medicare supplement premiums. But there are many ways to save money and make sure you’re not overpaying for your coverage. This article unpacks everything you need to know about Medigap and HSA.

Compare 2024 Plans & Rates

Enter Zip Code

What Is a Health Savings Account (HSA)?

An HSA is an employment-based savings account where members can contribute pre-tax dollars from their salary to save for their medical expenses during retirement. While you can use funds from the HSA for medical expenses before retiring, you can also let it grow, receiving interest on this amount.

An HSA is an employment-based savings account where members can contribute pre-tax dollars from their salary to save for their medical expenses during retirement. While you can use funds from the HSA for medical expenses before retiring, you can also let it grow, receiving interest on this amount.

Technically, the HSA functions similarly to your 401k plan with your employer. All monetary contributions to your HSA reduce your annual taxable income, similar to tax-deferred 401(k) contributions. Provided you use the money you withdraw from your HSA on medical expenses when you aren’t retired, you won’t have to pay any tax on these withdrawals.

You can use your HSA for all qualifying medical expenses, such as paying Medicare Part B, C, and D premiums or deductibles. Or you can use the funds to pay for dental, vision, or hearing services and OTC medications.

Can You Use HSA To Pay Medicare Supplement Premiums?

The government allows you to use your HSA funds to pay for all qualifying medical expenses. Some examples include the following.

- Medicare Parts A & B deductibles.

- Medicare Part B, C, and D premiums.

- Dental expenses, since Medicare plans don’t cover the costs of dental, vision, and hearing services.

- Over-the-counter medications.

- Preventative treatments like podiatry, chiropractic, and physiotherapy.

- Private-duty nursing or stays at unskilled nursing facilities.

While you can use your HSA savings to pay for many of the above costs and even your Medicare premiums, you can’t use them to cover the costs of your Medigap premiums.

What Does Medigap Cover?

Medigap plans are regulated by the CMS, a Federal agency. This oversight ensures that all providers offer the same set of benefits in each Medigap plan, bringing consistency to the Medigap industry.

These plans are offered by private insurance companies such as Aetna, Mutual of Omaha, Allstate, Blue Cross, and more.

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

Medigap plans are essential for helping you handle the out-of-pocket costs not covered by Original Medicare. However, like Medicare, they don’t cover the costs of preventative treatments, hearing, vision, dental services, and prescriptions.

However, some providers offer coverage for hearing, vision, and dental services using an additional plan available at a marginal monthly cost. Or they offer discounted rates on these services if you use their in-network partners.

Qualifying Medicare Expenses for Payment with HSA Funds

Let’s unpack the Medicare expenses eligible for payment using your HSA savings. We’ll examine the Part A & B expenses qualifying for payment with HSA funds.

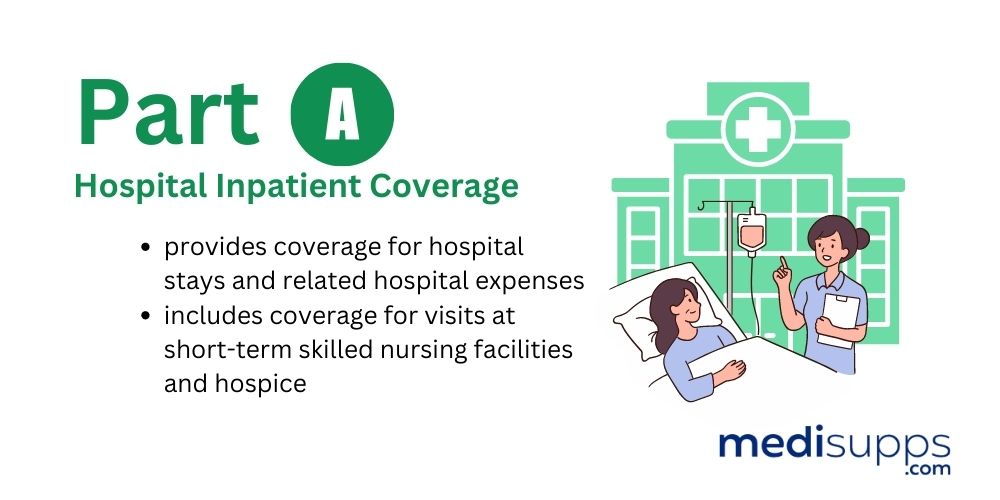

Part A (Hospital Inpatient Coverage)

When you first enroll in Medicare, you receive automatic enrollment into Part A. Medicare Part A provides coverage for hospital stays and related hospital expenses. It also includes coverage for visits at short-term skilled nursing facilities and hospices for rehabilitation and care.

You won’t pay premiums for Medicare Part A. However, you must pay the annual out-of-pocket deductible every year, which is $1,600 in 2023. You’ll also pay the coinsurance costs for stays at the hospital or rehabilitation facilities extending past 60 days.

To help you cope with the costs relating to extended stays at these facilities, you can take a Medigap plan. All Medigap plans cover you for any length of visit, ensuring you have no coinsurance responsibilities for these services.

However, it’s important to note that HSA funds are available to assist with payment for deductibles and coinsurance payments. They’re also eligible to pay for expenses related to hospitalization or rehabilitation.

Compare Medicare Plans & Rates in Your Area

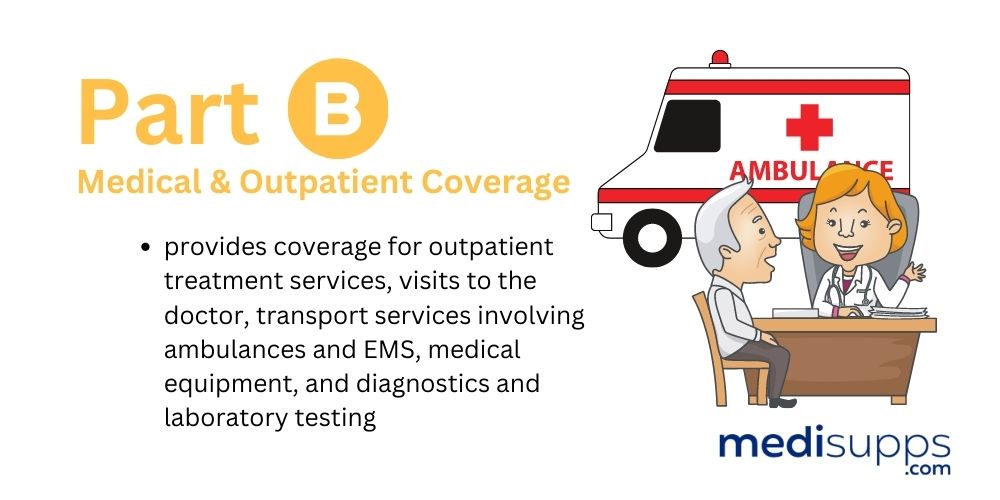

Medicare Part B (Medical & Outpatient Coverage)

Medicare Part B provides coverage for outpatient treatment services, visits to the doctor, transport services involving ambulances and EMS, medical equipment, and diagnostics and laboratory testing. Part B covers more individual medical expenses than Part A, so many people choose to delay their enrollment in this section of Medicare benefits if they have private healthcare insurance.

You’ll pay a monthly premium for your Part B policy, which is $164.90 for 2023, decreasing by $5.20 from $170.10 in 2022. The Part B premium is deducted from your Social Security benefit, along with the $226 Part B annual deductible and 20% coinsurance.

HSA funds qualify for use in covering your Medicare Part B premium, as well as the deductibles and coinsurance payments.

Part D (Prescription Medication Coverage)

If you want coverage for your prescriptions, you’ll need to enroll in Medicare Part D. Several stand-alone Part D plans are available from the same private healthcare insurers offering Medigap plans.

HSA funds can pay for your prescription co-pays. They also cover vitamins and supplement purchases, provided your doctor recommends these products as part of your healthcare planning for specific conditions.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

Can you use a Health Savings Account (HSA) to pay Medicare Supplement premiums?

Call Us for a Free Consultation on Medigap Plans

If you have any questions on Medigap plans and how they work, reach out to our team at 1-888-891-0229. We offer free consultations and quotes on any Medigap plan. Our team of fully licensed agents will source you the most affordable quotes on Medigap plans in your area.

If you can’t talk now, complete the contact form on this site, and we’ll get a Medigap expert to call you back. Or you can use the tool on our site to get a free automated quote on any Medigap plan.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.