by Russell Noga | Updated May 18th, 2023

For most people, the idea of losing their health insurance is scary to think of. After all, health insurance helps to make medical care more affordable; without it, a trip to the doctor or emergency room can be exorbitant, and the costs that you could face if you were diagnosed with an illness that required surgery and/or long-term care or if you were involved in a serious accident could end up leaving you bankrupt.

With that said, if you’re about to or you’re already enrolled in Medicare and you have or you’re planning on purchasing a Medigap plan to offset the out-of-pocket expenses that aren’t covered by Original Medicare, you might be asking the same question that so many other beneficiaries have, “ Can Medicare Supplement drop you?”

In other words, is there a chance that you could ever lose the additional health insurance that a Medigap policy provides?

How to Not Get Dropped

While Medicare Supplement Insurance does help to make the cost of healthcare more predictable and more affordable, there are intricacies involved that are important to be aware of so that you can make the appropriate plans.

In this guide, we’ll take a look at one of the most important intricacies associated with Medigap insurance: whether or not providers can drop their enrollees, and if so, the reasons why they could potentially drop your coverage.

An Introduction to Medicare Supplement Insurance

Before we discuss whether Medicare Supplement can drop you, it’s first important to have a basic understanding of what Medicare Supplement Insurance is and how it works.

Medicare Supplement Insurance is additional health insurance that is designed to fill in the gaps in Original Medicare coverage. Original Medicare consists of two parts: Part A, which covers the care and services you receive if you’re admitted to a facility, and Part B, which covers care and services you receive in outpatient settings.

Original Medicare does cover the essential components of health insurance, but it doesn’t cover everything, and you’re responsible for paying for the things that it doesn’t cover; copays, deductibles, and coinsurance, for instance.

Medicare Supplement Insurance – or Medigap – can help to cover the expenses that Medicare Part A and Part B leave behind. There are 10 Medigap policies, and they’re sold by private health insurance companies.

The benefits provided vary from plan to plan; however, all plans offer standardized benefits, meaning that all plans that fall under the same letter (Medigap policies are named for letters) have to provide the same coverage, no matter the provider or the location.

There are dozens of insurance companies that offer Medicare Supplement Insurance plans. Availability and eligibility vary from provider to provider and from state to state. In order to purchase any Medicare Supplement Insurance plan, you must be enrolled in both parts of Original Medicare; however, eligibility for some policies is limited to certain individuals. For example, Plan C and Plan F are only available to individuals who were eligible for Medicare before January 1, 2020.

If you became eligible for Medicare after this date, due to changes in Medicare Supplement Insurance, you cannot purchase these Medigap policies.

Can Medicare Supplement Drop You?

Yes, the insurer that provides your Medicare Supplement Insurance policy can drop your coverage. However, while insurance companies do reserve the right to either cancel policies, certain circumstances must apply. Additionally, regulations have been put in place by both federal and state governments to protect Medigap policyholders.

That said, the following are some of the reasons why your Medicare Supplement Insurance provider could potentially drop your coverage:

- Failure to pay. Because Medicare Supplement Insurance is separate insurance coverage, a separate monthly premium, in addition to the monthly premium for Original Medicare, must be paid. In the event that a policyholder fails to pay the monthly premiums, the insurance provider can drop their coverage. However, it should be noted that there are grace periods that have been put in place for missed payments, and insurers must adhere to these grade periods. In other words, if you were late with your payment one time, your carrier likely won’t drop your coverage. Additionally, in the event that you have missed several payments and your insurer does intend on dropping your coverage, they must provide you with advance notice.

- If you provided false information on your application for Medicare Supplement Insurance, your application was approved and you were granted coverage, but it was later revealed that you provided fraudulent information, your carrier can cancel your policy; for example, if you concealed a pre-existing health condition or provided the wrong date of birth. In this case, however, cancellation can only occur during the “free look” period, or the first few months of your coverage.

- Change in eligibility. In some cases, the eligibility of individuals who already have Medigap insurance can change. For example, if you decide to enroll in Medicare Advantage, or if you moved to a location that your insurer does not service, your eligibility would change and your policy could be terminated.

- Insurer insolvency. On rare occasions, insurance companies can become insolvent, which would result in the policies they provide being canceled. In these cases, however, protections are in place to ensure policyholders can access new coverage without being penalized or can receive reimbursement.

How to Avoid the Risk

As you can see, there is a chance that your Medicare Supplement Insurance could be dropped; however, there are things that you can do to avoid this risk. Examples include:

- Make sure you thoroughly research the provider you are considering enrolling with before proceeding to learn about their history, financial status, and other pertinent information.

- Be sure to provide accurate information on your application.

- Ensure that your monthly premiums are paid on time and in full. Many insurers offer autopay, which would involve the funds for your premiums being withdrawn from your account automatically each month, which can help avoid the risk of missing payments.

Frequently Asked Questions

What is the function of a Medicare Supplement Plan?

A Medicare Supplement Plan, or Medigap, is an insurance policy sold by private insurance companies such as Mutual of Omaha, Allstate, Blue Cross, and many more. Its primary purpose is to cover some of the health care costs not catered to by Original Medicare (Part A and Part B), including copayments, coinsurance, and deductibles.

Can you explain how a Medicare Supplement Plan operates with Medicare Part A and Part B?

A Medicare Supplement Plan works in sync with your Original Medicare benefits. Firstly, Medicare Part A and Part B pay their portion for any covered healthcare services. Following this, your Medicare Supplement Plan takes effect, covering its share of the remaining costs.

How are claims paid through a Medicare Supplement Plan?

After Medicare pays its approved portion for your covered healthcare service, it forwards the leftover claim to your Medicare Supplement insurance company. This company then settles its share of the costs as dictated by your plan’s policy.

Do Medicare Supplement Plans feature out-of-pocket maximums?

Medicare Supplement Plans differ from Medicare Advantage Plans as they do not have out-of-pocket maximums. This means that while these plans cover a substantial part of your healthcare costs, there is no yearly limit on what you might have to pay out-of-pocket.

Could you outline what Medicare Part A covers and how a Supplement Plan aids this?

Medicare Part A primarily covers inpatient hospital care, skilled nursing facility care, hospice, and some home health care. If you possess a Medicare Supplement Plan, it can aid in covering the remaining costs after Medicare Part A has settled its share, like coinsurance and hospital cost up to an extra 365 days after Medicare benefits run out.

What services does Medicare Part B cover and how does a Supplement Plan support this?

Medicare Part B predominantly covers outpatient services, including doctors’ services, preventive services, and medical supplies. A Medicare Supplement Plan can provide support by covering the Part B coinsurance or copayment, and some plans even cover the Part B deductible.

Are prescription medications covered under Medicare Supplement Plans?

Typically, Medicare Supplement Plans do not cover prescription drugs. You would need to join a Medicare Prescription Drug Plan (Part D) to receive this type of coverage.

Can a Medicare Supplement Plan reject my application due to pre-existing conditions?

Yes, in some instances. If you apply for a Medicare Supplement Plan after your Medigap Open Enrollment Period, the insurance company can employ medical underwriting and may refuse your application based on your health or charge more for the policy.

Are Medicare Supplement Plans guaranteed renewable?

Yes, Medicare Supplement Plans are guaranteed renewable. This means your insurance company cannot cancel your Medigap policy as long as you continue to pay the premium, regardless of any health problems that may arise.

What could lead to the cancellation of a Medigap policy?

Generally, a Medigap policy could be canceled if the premiums are not paid on time. Additionally, if you were not truthful about your health history on your application, the company might have grounds for cancellation. However, under normal circumstances, and provided that the premiums are paid, the policy should remain in force.

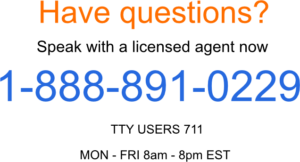

Contact Us for a Free Consultation on Medigap Plans

If you have questions about Medicare supplement plans, call our team at 1-888-891-0229. We offer professional advice on Medigap policies. Our fully licensed agents offer free consultations to give you all the information you need about Medigap. If you want someone to call you back, leave your details on our contact form, and we’ll get a Medigap expert to reach out to you.