by Russell Noga | Updated November 9th, 2023

Blue Shield of California Medicare Plan G

Choosing the right Medicare Supplement plan can significantly impact your healthcare coverage and financial peace of mind.

Blue Shield of California offers comprehensive Medicare Supplement plans, including the popular Blue Shield of California Medicare Plan G and its enhanced counterpart, Plan G Inspire.

Both plans provide valuable benefits, but which one is right for you? In this blog post, we will explore the features of these plans, compare their benefits, and provide tips for choosing the best Medicare Supplement plan for your unique needs.

Short Summary

- Blue Shield of California offers two Medicare Supplement plans, Plan G and Plan G Inspire, with two pricing methods, Attained Age and Issue Age.

- Consider your healthcare needs when selecting a plan to ensure optimal coverage.

- Evaluate costs & benefits of each plan to select the best one that meets both your needs & budget.

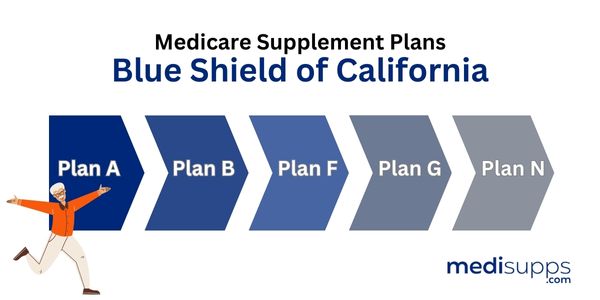

Blue Shield of California Medicare Supplement Plans

Medicare Supplement plans, also known as Medigap plans or Medicare Supplement Insurance, fill in the gaps left by Original Medicare, covering costs such as:

- Part A and Part B coinsurance

- Blood

- Hospice care coinsurance

- Skilled nursing facility care coinsurance

- And more

Blue Shield of California offers several Medicare Supplement plans, including Plan G and Plan G Inspire, which provide extensive benefits to help you manage your healthcare expenses.

Plan G is a popular choice among Medicare beneficiaries, as it offers comprehensive coverage for out-of-pocket costs not covered by Original Medicare, excluding the Medicare Part B deductible.

On the other hand, Plan G Inspire is an exclusive option available only in California, providing additional benefits like hearing, vision, and roadside assistance.

Both plans come with various savings programs offered by the Blue Shield Association, such as Welcome to Medicare rate savings, Household savings, AutoPay savings, and Dental savings.

Plan G: Comprehensive Coverage

Blue Shield Plan. G covers most out-of-pocket costs associated with Original Medicare, such as:

- Part A and Part B coinsurance

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B excess charges

The only exception is the Medicare Part B deductible, which is not covered by Plan G.

This plan offers a balance between comprehensive coverage and affordability, making it an attractive option for those who want to minimize their out-of-pocket healthcare expenses without paying for the more expensive Plan F, which covers the Part B deductible.

Plan G Inspire: Enhanced Benefits

For those seeking additional benefits beyond the standard Plan G coverage, Blue Shield offers Plan G Inspire. This unique plan includes hearing coverage, vision, and roadside assistance, distinguishing it from other Medigap plans.

Additionally, Plan G Inspire comes with a one-year new or renewal Classic AAA Membership, providing even more value to the policyholder.

To obtain a quote for Plan G Inspire or to find a plan that accepts Medicare, you can either get an instant quote online or call 800-930-7956 for assistance.

Get Quotes Now

Enter Zip Code

Comparing Blue Shield Medicare Supplement Plans

When comparing Blue Shield Medicare Supplement plans, it’s essential to consider the coverage, benefits, and pricing methods offered by each plan.

The primary difference between Plan G and Plan G Inspire lies in the additional benefits provided by Plan G Inspire, such as:

- hearing,

- vision,

- and roadside assistance.

Both plans offer comprehensive coverage, making it crucial to weigh the costs and additional benefits to determine which plan best suits your healthcare needs.

Blue Shield of California offers two pricing methods for their Medicare Supplement plans: Attained Age and Issue Age pricing.

Attained age pricing bases the premium on the individual’s current age, while Issue Age pricing is determined by the age of the insured when the policy is issued.

Understanding these pricing methods can help you make an informed decision when selecting a Blue Shield Medicare Supplement plan that provides the coverage you need at a price you can afford.

Attained Age vs. Issue Age Pricing

Attained Age pricing is a common method used to calculate Medicare Supplement plan premiums.

Under this pricing system, the premium is based on your current age, and as you grow older, the premium may increase accordingly.

On the other hand, Issue Age pricing bases the premium on your age at the time the policy is issued, which means your premium may be lower if you purchase the plan at a younger age.

When comparing Blue Shield Medicare Supplement plans, it’s essential to understand how these pricing methods affect your premiums, so you can choose a plan that fits your budget and provides the coverage you need.

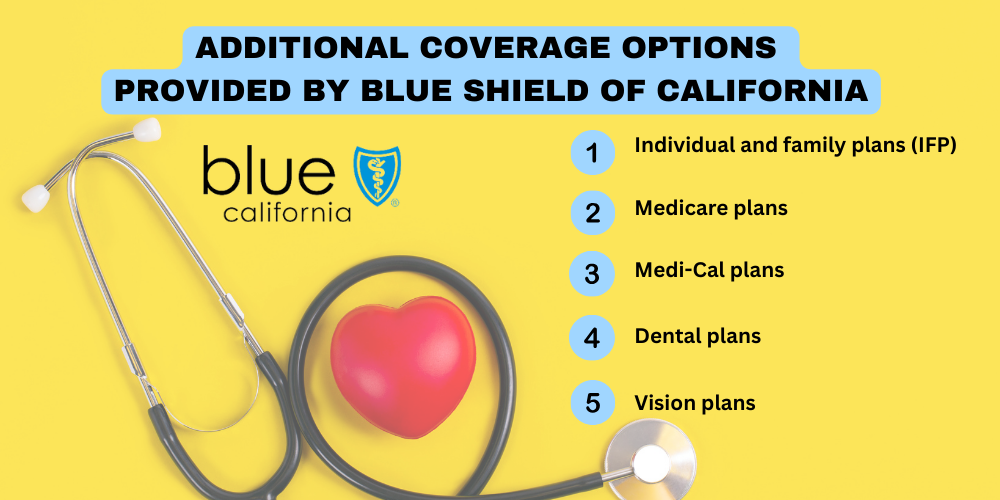

Additional Coverage Options

While Medicare Supplement plans like Plan G and Plan G Inspire offer comprehensive coverage for many healthcare expenses, they do not include coverage for prescription drugs, dental, or vision services.

To ensure you have complete coverage for all your healthcare needs, you may want to explore additional coverage options provided by Blue Shield of California, such as individual and family plans (IFP), Medicare plans, Medi-Cal plans, dental plans, and vision plans.

By adding prescription drug coverage or dental and vision plans to your Medicare Supplement plan, you can further minimize your out-of-pocket healthcare costs and enjoy comprehensive protection for all aspects of your health.

In the following sections, we will discuss options for adding these essential coverages to your Blue Shield Medicare Supplement plan.

Prescription Drug Coverage

Prescription Drug Coverage is a crucial component of any healthcare plan, as it helps to lower the cost of prescription medications, including cold and allergy medicines, and provides protection against higher costs.

Medicare Supplement plans do not include prescription drug coverage, so it’s essential to explore options for adding this vital coverage to your plan.

You can enroll in a standalone Medicare Part D plan or choose a Medicare Advantage plan that includes prescription drug coverage.

By adding Prescription Drug Coverage to your Medicare Supplement plan, you can ensure that your medications are more affordable and accessible when you need them.

Dental and Vision Plans

Dental and vision care are essential aspects of maintaining overall health, but Medicare Supplement plans do not typically provide coverage for these services.

Dental and vision care are essential aspects of maintaining overall health, but Medicare Supplement plans do not typically provide coverage for these services.

To complement your Medicare Supplement coverage, you can add dental and vision plans offered by Blue Shield of California or other providers. Some options include purchasing an Anthem dental-only plan or a combined dental and vision package.

Incorporating dental and vision coverage into your Medicare Supplement plan can help you save on dental and vision care while providing additional vision benefits for services not covered by Medicare.

Enrollment and Eligibility

When you’re ready to enroll in a Blue Shield of California Medicare Supplement plan, you can either enroll online or call 800-930-7956 for assistance.

Before enrolling in a Medicare Supplement plan, it’s crucial to ensure you’re eligible for coverage.

The first step is enrolling in Medicare Part A and Part B.

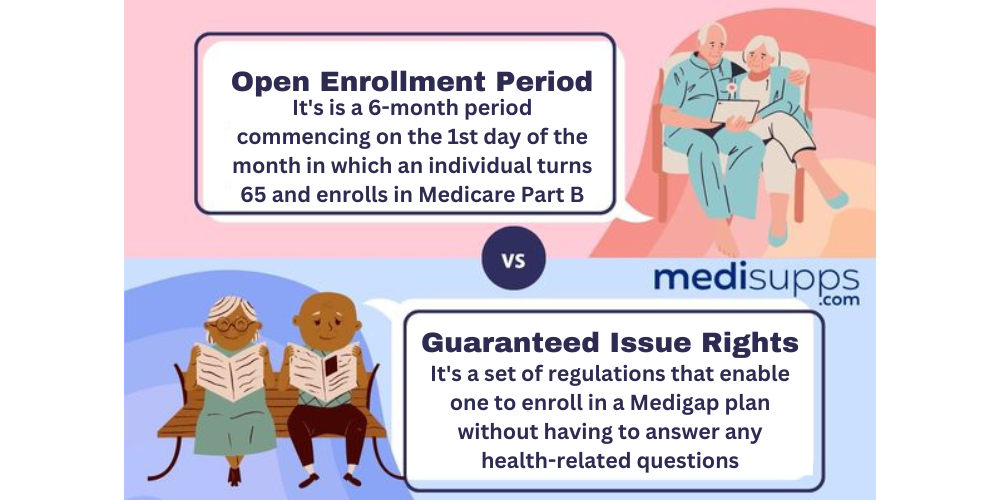

Once you have enrolled in Original Medicare, you can explore your Medicare Supplement plan options during your Initial Enrollment Period, which is a six-month window starting the first day of the month when you turn 65 or older and enroll in Part B.

During the Open Enrollment Period, you can purchase any Medicare Supplement plan available in your state without having to undergo medical underwriting or answer health questions.

After the Initial Enrollment Period, you may still be able to purchase a Medicare Supplement plan, but your options may be more limited, and you may face higher costs.

To ensure you secure the best plan for your needs, it’s essential to understand the enrollment and eligibility requirements for Medicare Supplement plans.

Open Enrollment Period

The Open Enrollment Period for Medicare Supplement plans is a critical time for securing the best coverage for your healthcare needs.

This 60-day window begins on the first day of your birth month and ends 60 days later, during which you can switch to an available plan of equal or lesser value without having to answer health inquiries or provide proof of insurability.

If you miss your Open Enrollment Period, you may still be able to purchase a Medicare Supplement plan, but your options may be more limited, and you may face higher costs due to medical underwriting.

By enrolling during the Open Enrollment Period, you ensure that you have the best possible coverage at the most affordable price.

Medigap Guaranteed Issue Rights

Medigap Guaranteed Issue Rights, also known as Medigap Protections, are situations where insurance companies are required to offer you a Medicare Supplement policy without denying coverage based on your health or medical history.

These rights ensure that you can obtain a Medigap policy regardless of any pre-existing conditions or health issues, providing peace of mind and financial protection when you need it most.

Understanding your Medigap Guaranteed Issue Rights can help you secure the best possible Medicare Supplement plan for your unique healthcare needs and budget.

Tips for Choosing the Right Medicare Supplement Plan

Selecting the right Medicare Supplement plan is a crucial decision that can significantly impact your healthcare coverage and financial well-being.

To choose the best plan for your needs, it’s essential to consider:

- your healthcare needs,

- budget,

- and coverage options.

By evaluating the services, you require, the costs associated with each plan, and the network of doctors, hospitals, and pharmacies available through the plan, you can make an informed decision that best suits your unique healthcare needs.

In addition to considering your healthcare needs, it’s crucial to evaluate the costs and benefits of each Medicare Supplement plan. This includes assessing:

- The monthly premium

- The annual deductible

- The coinsurance associated with the plan

- The benefits provided by the policy, such as coverage for hospitalization, skilled nursing facility care, and hospice care

By carefully weighing the costs and benefits of each plan, you can select a Medicare Supplement plan that provides the coverage you need at a price you can afford.

Consider Your Healthcare Needs

When selecting a Medicare Supplement plan, it’s essential to consider your healthcare needs and ensure the plan covers the services you require. This includes evaluating the coverage for:

- Hospitalization

- Physician visits

- Preventive care

- Prescription drugs

You should also consider the costs for these services.

Additionally, it’s crucial to review the network of doctors, hospitals, and pharmacies available through the plan to ensure your preferred providers are included.

By considering your healthcare needs, you can choose a Medicare Supplement plan that provides the coverage and support you need to maintain your health and well-being.

Evaluate Costs and Benefits

To choose the best Medicare Supplement plan for your needs, it’s vital to evaluate the costs and benefits associated with each plan. This includes considering:

- The monthly premium

- The annual deductible

- The coinsurance

- The coverage provided by the policy, such as hospitalization, skilled nursing facility care, and hospice care.

By carefully weighing the costs and benefits of each plan, you can select a Medicare Supplement plan that provides the coverage you need at a price you can afford.

Remember that the cheapest plan may not always be the best option for your healthcare needs, so take the time to compare plans and make an informed decision.

Summary

In conclusion, selecting the right Medicare Supplement plan is essential for ensuring comprehensive healthcare coverage and financial protection.

Blue Shield of California offers a variety of Medicare Supplement plans, including the popular Plan G and Plan G Inspire, each with its unique benefits and pricing methods.

By considering your healthcare needs, evaluating costs and benefits, and understanding enrollment and eligibility requirements, you can make an informed decision and choose the best Medicare Supplement plan for your unique needs.

With the right plan in place, you can enjoy peace of mind knowing that your healthcare expenses are well-managed, allowing you to focus on living a healthy and fulfilling life.

View Rates for 2025

Enter Zip Code

Frequently Asked Questions

What does Medicare Plan G cover?

Medicare Plan G covers 100% of Medicare Part A and Part B co-pays and coinsurance, Skilled Nursing and rehab facility stays, Hospice care, and protects against balance billing.

It includes all the benefits of Medicare Supplement Plans A, B and C except for the Medicare Part B deductible.

What does Plan G not cover?

Plan G does not cover Part B deductibles, dental care, vision care, hearing care, skilled nursing facility care, private-duty nursing, or prescription drugs; separate policies are necessary for coverage of these needs.

These needs include, but are not limited to, Part B deductibles, dental care, vision care, hearing care, skilled nursing facility care, private-duty nursing, and prescription drugs.

What does Medicare G plan cost?

On average, Plan G costs $145 per month for those 65 and older. Price can vary based on factors like location, health, age, and gender.

What is the difference between Blue Shield Plan G and Plan G Inspire?

Plan G provides comprehensive coverage of out-of-pocket costs, while Plan G Inspire includes additional benefits like hearing, vision, and roadside assistance.

How do I enroll in a Blue Shield of California Medicare Supplement plan?

Enroll in a Blue Shield of California Medicare Supplement plan by visiting their website or calling 800-930-7956 for assistance.

Find The Best Blue Shield of California Medicare Plan G for 2024

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know more about Blue Shield of California Medicare Plan G, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!