by Russell Noga | Updated October 2nd, 2024

If you’re approaching the age of 65, you’re likely planning on enrolling in Medicare. While the government-funded health insurance program does cover a lot, it doesn’t cover everything, and you’re responsible for the expenses it doesn’t pay for.

If you’re approaching the age of 65, you’re likely planning on enrolling in Medicare. While the government-funded health insurance program does cover a lot, it doesn’t cover everything, and you’re responsible for the expenses it doesn’t pay for.

For many, the gaps in coverage can cause financial hardship and uncertainty. Fortunately, Medicare Supplement Insurance can help to fill in those gaps.

A type of optional health insurance, Medicare Supplement plans are sold by private insurance companies. Many insurers offer these plans, including Blue Shield of California, and if you’re a resident of the state of California and you’re thinking about investing in a policy from this provider.

Compare 2025 Plans & Rates

Enter Zip Code

Before you do, however, it’s important to gather as much information as you can so that you can make the most informed decision. To help you make the right choice for your healthcare needs, in this guide, we provide an overview of Blue Shield of California Medicare Supplement Plans.

An Introduction to Medicare Supplement Insurance

Also known as Medigap, Medicare Supplement Insurance is private health insurance that is designed to fill in the gaps in Original Medicare coverage.

Original Medicare features two separate parts – Part A, which covers the costs related to inpatient medical care and services, and Part B, which covers the costs related to outpatient medical care and services – which combine to offer comprehensive health insurance coverage.

While Original Medicare does offer the most essential health benefits, it doesn’t cover all services and expenses, and beneficiaries are responsible for the services and expenses that aren’t covered; deductibles, copays, and coinsurance, for example.

Medicare Supplement Insurance fills in the gaps in coverage by paying for some of the out-of-pocket expenses and makes health insurance more affordable.

There are 10 Medigap plans, which are labeled with letters, and each lettered plan offers different levels of coverage. Policies are sold by private health insurance companies and while coverage may vary, all plans of the same letter must provide the same standard benefits, regardless of the provider or the location.

There are 10 Medigap plans, which are labeled with letters, and each lettered plan offers different levels of coverage. Policies are sold by private health insurance companies and while coverage may vary, all plans of the same letter must provide the same standard benefits, regardless of the provider or the location.

About Blue Shield of California

Blue Shield of California is one of the many insurance companies that offer Medicare Supplement Insurance policies. A mutual benefit corporation and health plan, the California Medical Association founded the not-for-profit organization in 1939. Headquartered in the city of Oakland, an estimated 4.5 million Californians receive their health insurance from this provider.

Blue Shield of California has been committed to providing residents of the Golden State with quality, easily accessible health insurance options for more than 80 years. To meet the unique needs of senior citizens who reside in California, the organization offers a collection of Medicare Supplement Insurance plans, which help to fill in the gaps in Original Medicare coverage and make health insurance more affordable.

What Medicare Supplement Plans Does Blue Shield of California Offer?

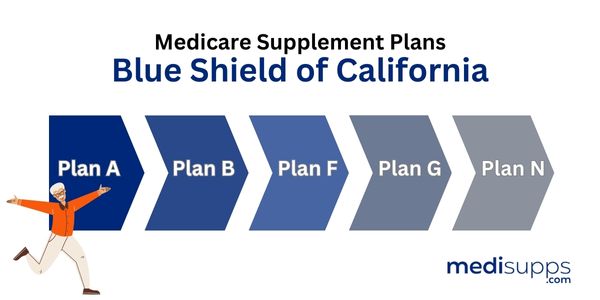

To help make the cost of healthcare more affordable and predictable for Medicare beneficiaries who reside in the Golden State, Blue Shield of California offers several Medicare Supplement Insurance plans. The Medigap plans the organization offers include the following:

- Plan A. This Medigap plan provides the most basic coverage and no extras.

- Plan C. This plan is considered the second-most comprehensive Medigap policy, as it covers the majority of the gaps in Original Medicare; however, it does not cover Part B excess charges. Additionally, not all Medicare beneficiaries can purchase Plan C. Individuals who became eligible for Medicare after January 1, 2020, cannot enroll in Plan C. If you had this plan before this date, however, you can keep it, and if you were eligible for benefits prior to this date, you can still purchase Plan C.

- Plan F. The most comprehensive of all Medigap policies, Plan F covers almost all of the expenses that aren’t covered by Original Medicare. It includes all of the benefits that Plan C offers, as well as coverage for Part B excess charges. Like Plan C, individuals who became eligible for Medicare benefits after January 1, 2020, cannot purchase Plan F; however, those who were eligible for Medicare before this date can still enroll and individuals who were already enrolled in Plan F can keep it.

- Plan G. For individuals who became eligible for Original Medicare after January 1, 2020, Medigap Plan G provides the most inclusive coverage. It includes all of the same benefits as Plan G, minus coverage for the Part B deductible.

- Plan N. Medicare Plan N also offers comprehensive coverage, though individuals who hold this policy do have to pay the Part B copayments (up to $20 per office visit and up to $50 per emergency room visit). In exchange for paying copays, however, .

Compare 2024 Plans & Rates

Enter Zip Code

Blue Shield of California Medicare Supplement Savings Programs

Blue Shield of California aims to charge fair and affordable rates. In addition to helping you save on your Medicare Supplement Insurance, if you enroll in a Medicare Supplement plan through Blue Shield of California, you will also be able to save on your monthly premiums through the savings program the organization offers. Examples of some of the available savings programs include:

Blue Shield of California aims to charge fair and affordable rates. In addition to helping you save on your Medicare Supplement Insurance, if you enroll in a Medicare Supplement plan through Blue Shield of California, you will also be able to save on your monthly premiums through the savings program the organization offers. Examples of some of the available savings programs include:

- Welcome to Medicare Rate Savings Program. Those who are new to Medicare Part B can enjoy a savings of $300 in their first year.

- Household Savings. When you and someone else who resides in your household enroll in the same Medigap plan, you’ll save 7 percent on your combined individual plan rates.

- Autopay Savings. When you enroll in AutoPay, you’ll save $3 per month, and your premiums will be deducted from your linked account automatically.

- Dental Savings. If you enroll in a Blue Shield of California dental plan and Medicare Supplement plan at the same time, you’ll save $3 a month for the first six months on your dental rates.

Compare Medicare Plans & Rates in Your Area

Frequently Asked Questions

What are Blue Shield of California Medicare Supplement Plans?

Blue Shield of California Medicare Supplement Plans are insurance policies that provide additional coverage to fill the gaps left by Original Medicare.

Who is eligible for Blue Shield of California Medicare Supplement Plans?

Individuals who are already enrolled in Medicare Part A and Part B are eligible for Blue Shield of California Medicare Supplement Plans.

When can I enroll in Blue Shield of California Medicare Supplement Plans for 2024?

You can enroll in Blue Shield of California Medicare Supplement Plans during your Medigap Open Enrollment Period, which starts when you are 65 years old and enrolled in Medicare Part B. However, you may also be eligible for a Special Enrollment Period under certain circumstances.

For those wishing to disenroll from a Medicare Advantage plan and enroll in a Medigap plan for 2024, you may do so starting in October of 2023.

What is the difference between Blue Shield of California Medicare Plan G and Plan N?

Blue Shield of California Medicare Plan G and Plan N are similar in coverage but differ in cost-sharing. Plan G offers more comprehensive coverage, including coverage for Medicare Part A and Part B deductibles and excess charges, while Plan N requires cost-sharing for certain services.

What types of coverage are included in Blue Shield of California Medicare Supplement Plans?

Blue Shield of California Medicare Supplement Plans cover costs such as Medicare Part A and Part B coinsurance, copayments, and deductibles, as well as coverage for excess charges.

Can I use any healthcare provider with Blue Shield of California Medicare Supplement Plans?

Yes, you can choose any healthcare provider who accepts Medicare with Blue Shield of California Medicare Supplement Plans.

How do I choose the right Blue Shield of California Medicare Supplement Plan for me?

Consider your individual healthcare needs, budget, and preferred level of coverage. Research and compare different plans offered by Blue Shield of California to find the one that best suits your requirements.

Are prescription drugs covered under Blue Shield of California Medicare Supplement Plans?

No, prescription drug coverage is not included in Blue Shield of California Medicare Supplement Plans. You would need to enroll in a standalone Medicare Part D prescription drug plan for prescription drug coverage.

What are the benefits of having Blue Shield of California Medicare Supplement Plans?

Benefits of Blue Shield of California Medicare Supplement Plans include reduced out-of-pocket expenses, flexibility in choosing healthcare providers, and the peace of mind that comes with comprehensive coverage.

Where can I find more information about Blue Shield of California Medicare Supplement Plans?

You can visit the official Blue Shield of California website, consult with licensed insurance agents specializing in Medicare coverage, or contact Blue Shield of California directly to request detailed information on Blue Shield of California Medicare Supplement Plans.

Contact Us for a Free Consultation on Medigap Plans

If you have questions about Medicare supplement plans, call our team at 1-888-891-0229. We offer professional advice on Medigap policies. Our fully licensed agents offer free consultations to give you all the information you need about Medigap.